Fringe Benefits Calculator

Fringe Benefits Calculator - Enter the gross annual income, daily wage, vacation days, holidays,. Add up the total cost of all. Web how to calculate total wages and fringe benefits? The calculation would look like this: Web the fringe benefit tax is calculated separately from the paye calculations and filed on its on sheet in the p10 returns excel file.

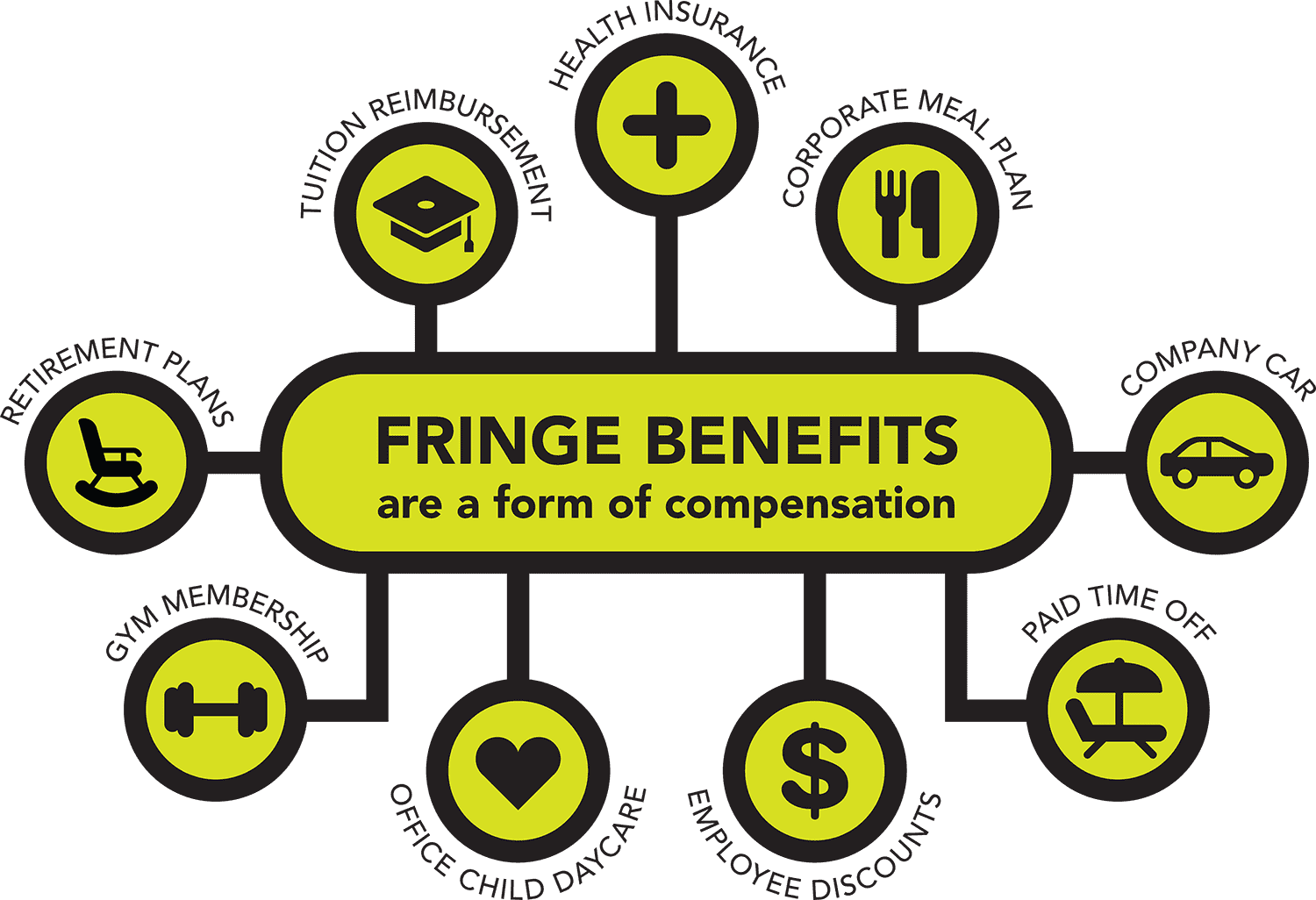

For example, you provide an employee with a fringe benefit when you allow. These terms are defined below. Web the fringe benefit tax is calculated separately from the paye calculations and filed on its on sheet in the p10 returns excel file. Next, determine the total salary ($). $10,000 / ([$25 x 40] x 52 weeks) $10,000 / (1000 x 52) $10,000 / 52,000 = 0.19 x 100 = 19% fringe benefit rate. Web the fringe benefit rate tells you how much you spend on fringe benefits beyond base salary. Fbt car calculator step 2:

Fringe Benefits Tax Business Fitness Help & Support

$10,000 / ([$25 x 40] x 52 weeks) $10,000 / (1000 x 52) $10,000 / 52,000 = 0.19 x 100 = 19% fringe benefit rate. Add up fringe benefits from. Web example, an employee has a taxable fringe benefit with a fair market value of $3.00 per day. If they work a total of 40.

How to Calculate Fringe Benefits HR University

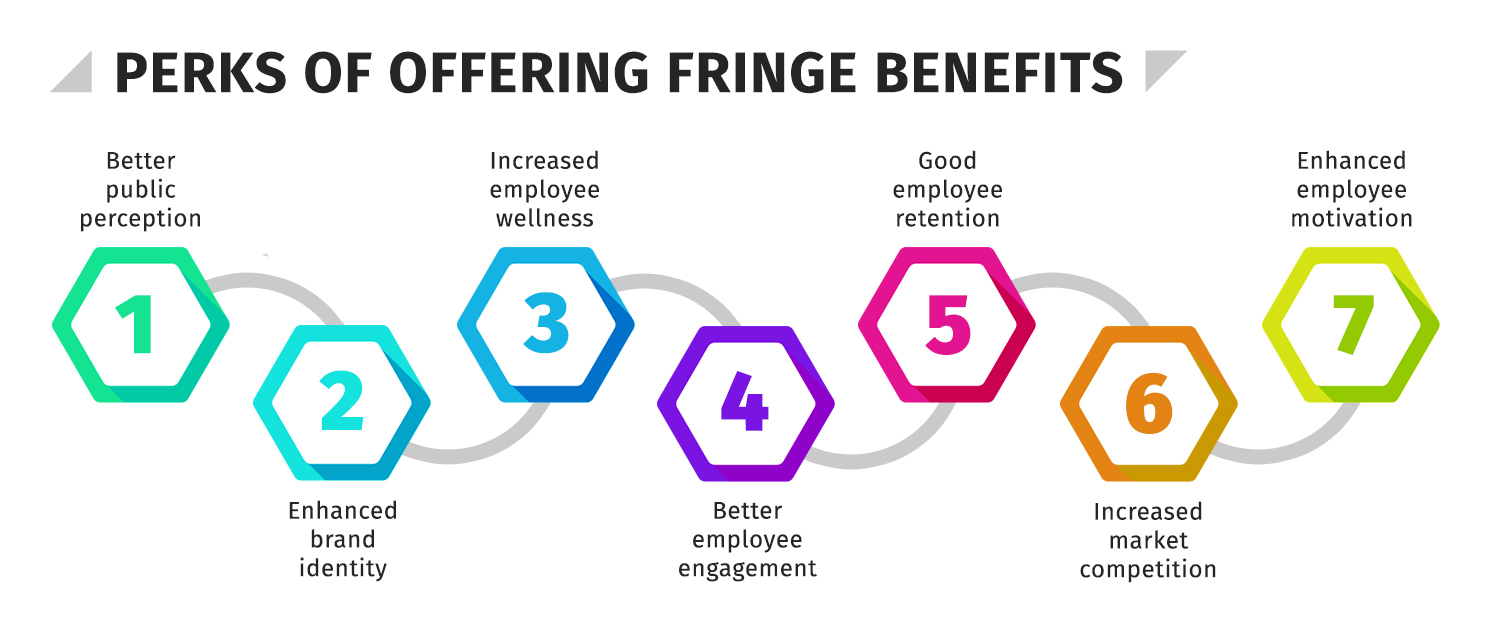

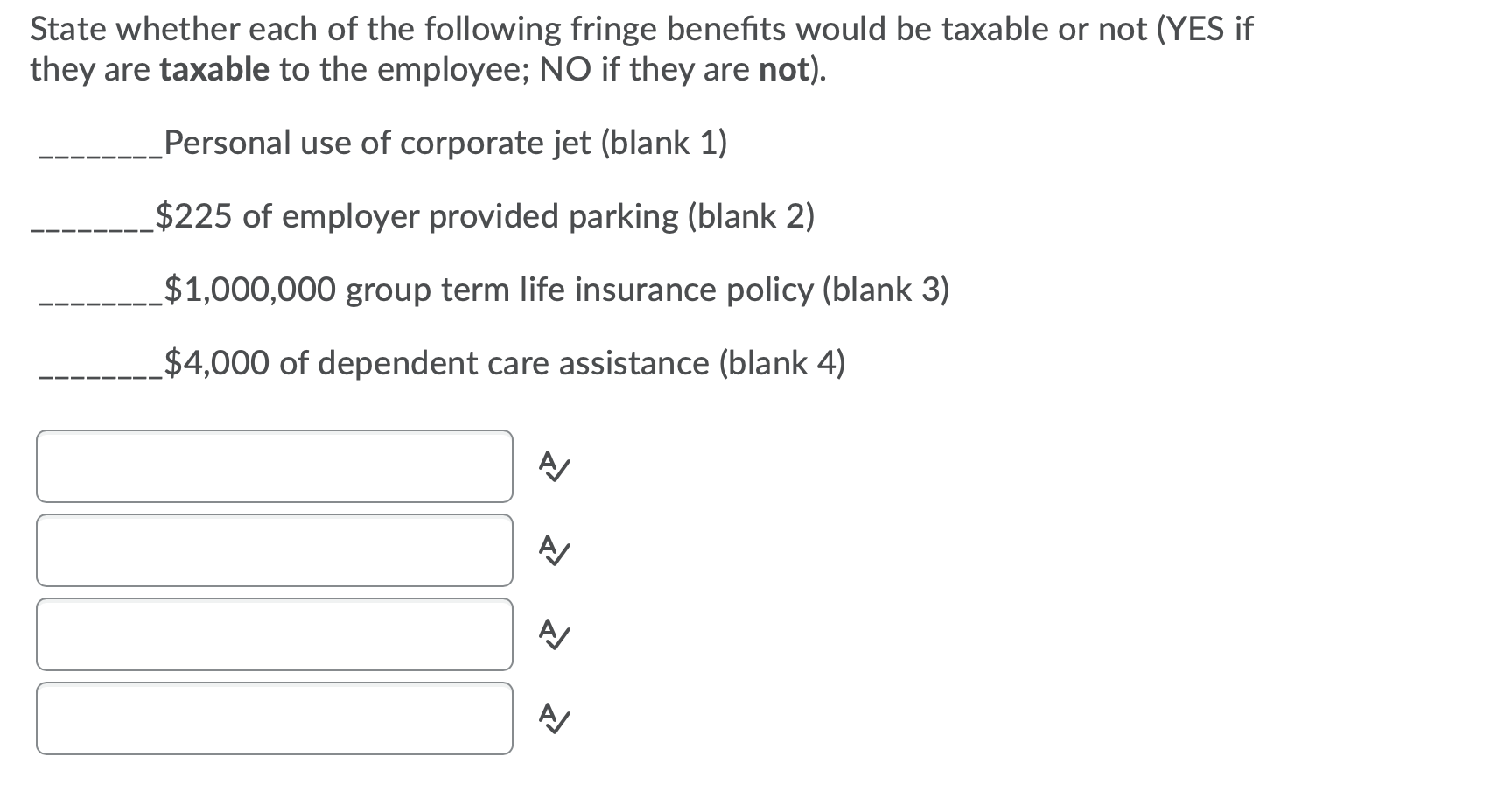

You must include in a recipient's pay the amount by which the value of a fringe benefit is more than the sum of the following amounts. $10,000 / ([$25 x 40] x 52 weeks) $10,000 / (1000 x 52) $10,000 / 52,000 = 0.19 x 100 = 19% fringe benefit rate. Web including taxable benefits.

The Comprehensive Guide to Fringe Benefits AttendanceBot

Web including taxable benefits in pay. Web how to calculate total wages and fringe benefits? Enter the gross annual income, daily wage, vacation days, holidays,. The total salary ($) is provided as: (2) $27.00 plus $14.00 in any combination of bona fide fringe benefits; Fbt car calculator step 2: Web the number of employees that.

How to Calculate Fringe Benefits HR University

To calculate it, follow these steps: If they work a total of 40 hours per week for the entire year, you can calculate the fringe benefit rate. Enter the gross annual income, daily wage, vacation days, holidays,. (2) $27.00 plus $14.00 in any combination of bona fide fringe benefits; Get ready to navigate through. Web.

How To Calculate Fringe Benefits Per Hour

To calculate it, follow these steps: Add up fringe benefits from. If they work a total of 40 hours per week for the entire year, you can calculate the fringe benefit rate. A fringe benefit is a form of pay for the performance of services. Next, determine the total salary ($). To calculate your total.

4 Ways to Calculate Fringe Benefits wikiHow

Web how to calculate total wages and fringe benefits? Web fringe benefits $14.00 total prevailing wage obligation $41.00 (1) $41.00 in cash wages; Web the fringe rate calculator is a useful tool for calculating fringe benefits or costs associated with an employee’s salary. Web if you provided car fringe benefits, you can use the fbt.

4 Ways to Calculate Fringe Benefits wikiHow

In this presentation you’ll learn: Web the fringe benefit rate tells you how much you spend on fringe benefits beyond base salary. (2) $27.00 plus $14.00 in any combination of bona fide fringe benefits; For example, you provide an employee with a fringe benefit when you allow. Get ready to navigate through. If they work.

How to Calculate Fringe Benefits YouTube

To calculate your total hourly compensation rate, you add the ‘hourly rate’ equivalent of your benefits to the. These terms are defined below. Web the fringe benefit tax is calculated separately from the paye calculations and filed on its on sheet in the p10 returns excel file. Web the fringe rate calculator is a useful.

4 Ways to Calculate Fringe Benefits wikiHow

$10,000 / ([$25 x 40] x 52 weeks) $10,000 / (1000 x 52) $10,000 / 52,000 = 0.19 x 100 = 19% fringe benefit rate. These terms are defined below. Web example, an employee has a taxable fringe benefit with a fair market value of $3.00 per day. Web the fringe benefit rate tells you.

How To Determine Fringe Benefits

Add up the total cost of all. Web the fringe benefits tax (fbt) car calculator is designed to help employers calculate the taxable value and fbt payable of a car fringe benefit using either the. Web the fringe rate calculator is a useful tool for calculating fringe benefits or costs associated with an employee’s salary..

Fringe Benefits Calculator Web so grab your calculators and let's dive right in to demystify the world of fringe benefits calculation for prevailing wage! Fringe benefits can include expenses. Web the fringe rate calculator is a useful tool for calculating fringe benefits or costs associated with an employee’s salary. $10,000 / ([$25 x 40] x 52 weeks) $10,000 / (1000 x 52) $10,000 / 52,000 = 0.19 x 100 = 19% fringe benefit rate. To calculate your total hourly compensation rate, you add the ‘hourly rate’ equivalent of your benefits to the.

If They Work A Total Of 40 Hours Per Week For The Entire Year, You Can Calculate The Fringe Benefit Rate.

Web including taxable benefits in pay. Web the total fringe benefits ($) is given as: To calculate a salaried employee’s fringe benefit rate, the. Web calculate the total compensation package for your employees, including salary, benefits, and other payments.

Fbt Car Calculator Step 2:

Web for the most current versions of fringe benefit calculators, click the + next to fringe benefits on the office of fiscal planning and analysis budget tools. The calculation would look like this: Web fringe benefits $14.00 total prevailing wage obligation $41.00 (1) $41.00 in cash wages; Web the fringe benefit rate tells you how much you spend on fringe benefits beyond base salary.

The Fringe Benefit Portion In Dollars Of The Work Per Hour.

Web the fringe benefit tax is calculated separately from the paye calculations and filed on its on sheet in the p10 returns excel file. The total salary ($) is provided as: Web how to calculate total wages and fringe benefits? Add up the total cost of all.

$10,000 / ([$25 X 40] X 52 Weeks) $10,000 / (1000 X 52) $10,000 / 52,000 = 0.19 X 100 = 19% Fringe Benefit Rate.

(2) $27.00 plus $14.00 in any combination of bona fide fringe benefits; Enter the gross annual income, daily wage, vacation days, holidays,. To calculate your total hourly compensation rate, you add the ‘hourly rate’ equivalent of your benefits to the. Web the number of employees that are doing prevailing wage work.