Futures Contracts Calculator

Futures Contracts Calculator - Web a trader buys one wti contract at $53.60. Web the contract size is a key factor in calculating the leverage ratio. Use this calculator to determine the number of futures contracts you may wish to purchase based on your account equity and trading plan. Contracts that trade in the future value of a security or index. Brian cullen is a senior futures and options broker and market strategist with daniels trading.

Web this futures contracts calculator tells you how many shares you should buy to reflect a certain level of risk in your investment portfolio, depending on you the cost of the shares. Futures follow the 60/40 rule, which means the u.s. Use this calculator to determine the number of futures contracts you may wish to purchase based on your account equity and trading plan. He is the publisher of the cullen outlook newsletter and the author. The price of wti is now $54. Guaranteed returnspreserve your principalguaranteed high rates Web the contract size is a key factor in calculating the leverage ratio.

KuCoin KuCoin Futures Calculator Calculate Beforehand to Enjoy

Futures follow the 60/40 rule, which means the u.s. By comparing the contract size to the margin requirement (the initial amount of capital required to enter a. Web this calculation gives you profit or loss per contact, then you need to multiply this number by the number of contracts you own to get the total.

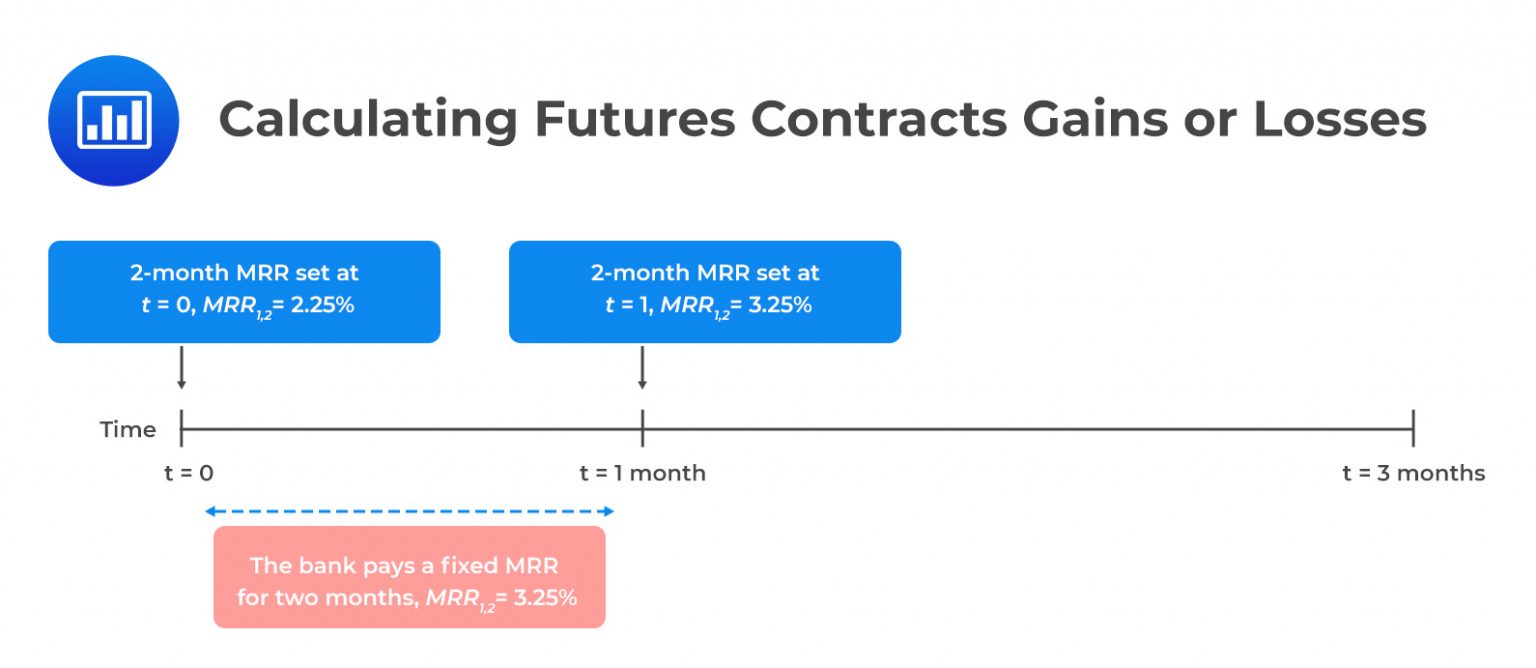

Value and Price of Futures Contracts AnalystPrep CFA® Exam Study Notes

Web futures risk and position size calculator use this to calculate your risk % based on number of contracts or maximum number of contracts based on risk %. Nerdwallet.com has been visited by 1m+ users in the past month Web use our futures calculator to quickly establish your potential profit or loss on a futures.

Futures Contracts Calculator

Web the futures profit calculator allows you to compute profits or losses for futures trades, giving results in one of eight major currencies. Use this calculator to determine the number of futures contracts you may wish to purchase based on your account equity and trading plan. Therefore, the contract has moved. For example, there are.

Ultimate Guide to Understanding Perpetual Futures Contracts 2023

Guaranteed returnspreserve your principalguaranteed high rates Web futures risk and position size calculator use this to calculate your risk % based on number of contracts or maximum number of contracts based on risk %. Web the futures risk calculator supports most major futures contracts and calculates your position's contract size as well as your risk.

How to Calculate Liquidation Price of USDⓈM Futures Contracts

Web futures or forward contracts are standardized tradable products on the stock exchange, with prices derived from actual trading commodities. Web this futures contracts calculator tells you how many shares you should buy to reflect a certain level of risk in your investment portfolio, depending on you the cost of the shares. Web how much.

BA 2 Plus Future Contract Price Calculation Continuous Compounding

Futures follow the 60/40 rule, which means the u.s. Brian cullen is a senior futures and options broker and market strategist with daniels trading. Contracts that trade in the future value of a security or index. By comparing the contract size to the margin requirement (the initial amount of capital required to enter a. Therefore,.

How to Use Binance Futures Calculator Binance

Guaranteed returnspreserve your principalguaranteed high rates Therefore, the contract has moved. Web how much of your trading account capital are you willing or able to lose? By comparing the contract size to the margin requirement (the initial amount of capital required to enter a. Web the system will calculate the possible number of contracts for.

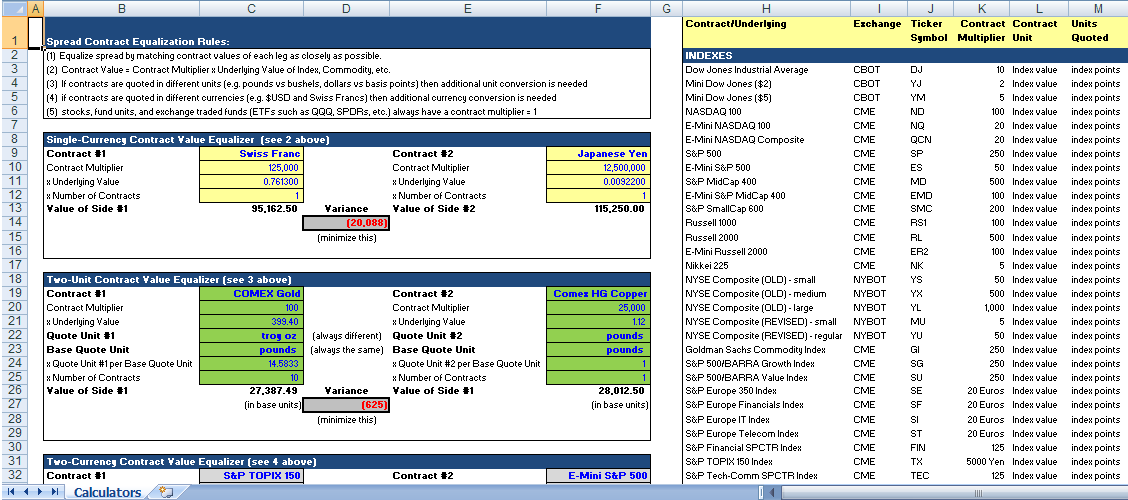

Free Spread Trading Contract Calculator in Excel Excel Trading and

By comparing the contract size to the margin requirement (the initial amount of capital required to enter a. Click the “calculate” button to find your specific potential profit and potential loss in. Web this futures contracts calculator tells you how many shares you should buy to reflect a certain level of risk in your investment.

How to Calculate Profit or Loss on Futures Contracts YouTube

He is the publisher of the cullen outlook newsletter and the author. Web the contract size is a key factor in calculating the leverage ratio. Web futures or forward contracts are standardized tradable products on the stock exchange, with prices derived from actual trading commodities. Click the “calculate” button to find your specific potential profit.

How to Trade in Futures and Options Beginners Guide Angel One

Web how much of your trading account capital are you willing or able to lose? Web futures tax rates are more advantageous. Guaranteed returnspreserve your principalguaranteed high rates Web futures or forward contracts are standardized tradable products on the stock exchange, with prices derived from actual trading commodities. Web a trader buys one wti contract.

Futures Contracts Calculator Web a trader buys one wti contract at $53.60. Web the contract size is a key factor in calculating the leverage ratio. Web this calculation gives you profit or loss per contact, then you need to multiply this number by the number of contracts you own to get the total profit or loss for your. Web the system will calculate the possible number of contracts for the risk profile from 0.5 to 10%. Web the futures risk calculator supports most major futures contracts and calculates your position's contract size as well as your risk exposure in your own currency.

Web Futures Contract Payoff Calculator Notes:

Nerdwallet.com has been visited by 1m+ users in the past month Click the “calculate” button to find your specific potential profit and potential loss in. Use this calculator to determine the number of futures contracts you may wish to purchase based on your account equity and trading plan. Web use our futures calculator to quickly establish your potential profit or loss on a futures trade.

For Example, There Are Futures For The S&P 500 And Nasdaq Indexes.

Guaranteed returnspreserve your principalguaranteed high rates Contracts that trade in the future value of a security or index. Futures follow the 60/40 rule, which means the u.s. Web the system will calculate the possible number of contracts for the risk profile from 0.5 to 10%.

Web The Futures Risk Calculator Supports Most Major Futures Contracts And Calculates Your Position's Contract Size As Well As Your Risk Exposure In Your Own Currency.

Web futures risk and position size calculator use this to calculate your risk % based on number of contracts or maximum number of contracts based on risk %. Web yield futures trade in a direct relationship to changes in yield, unlike the traditional us treasury futures contracts, which trade in price terms and as an inverse. Therefore, the contract has moved. He is the publisher of the cullen outlook newsletter and the author.

Web How Much Of Your Trading Account Capital Are You Willing Or Able To Lose?

Web when calculating profit or loss on a futures contract, market factors such as contract size, tick size, and current price come into play. Brian cullen is a senior futures and options broker and market strategist with daniels trading. By comparing the contract size to the margin requirement (the initial amount of capital required to enter a. Web futures or forward contracts are standardized tradable products on the stock exchange, with prices derived from actual trading commodities.