Hawaii Sales Tax 4.712 Calculator

Hawaii Sales Tax 4.712 Calculator - • the retail price represents 95.5% of the gross receipts and the tax represents. Can i get a refund of hawaii’s. Web use free sales tax & reverse sales tax calculator for hawaii state and its cities. 2024 hawaii state sales tax. Excise taxes on alcohol in hawaii vary greatly depending on the type of alcohol being purchased.

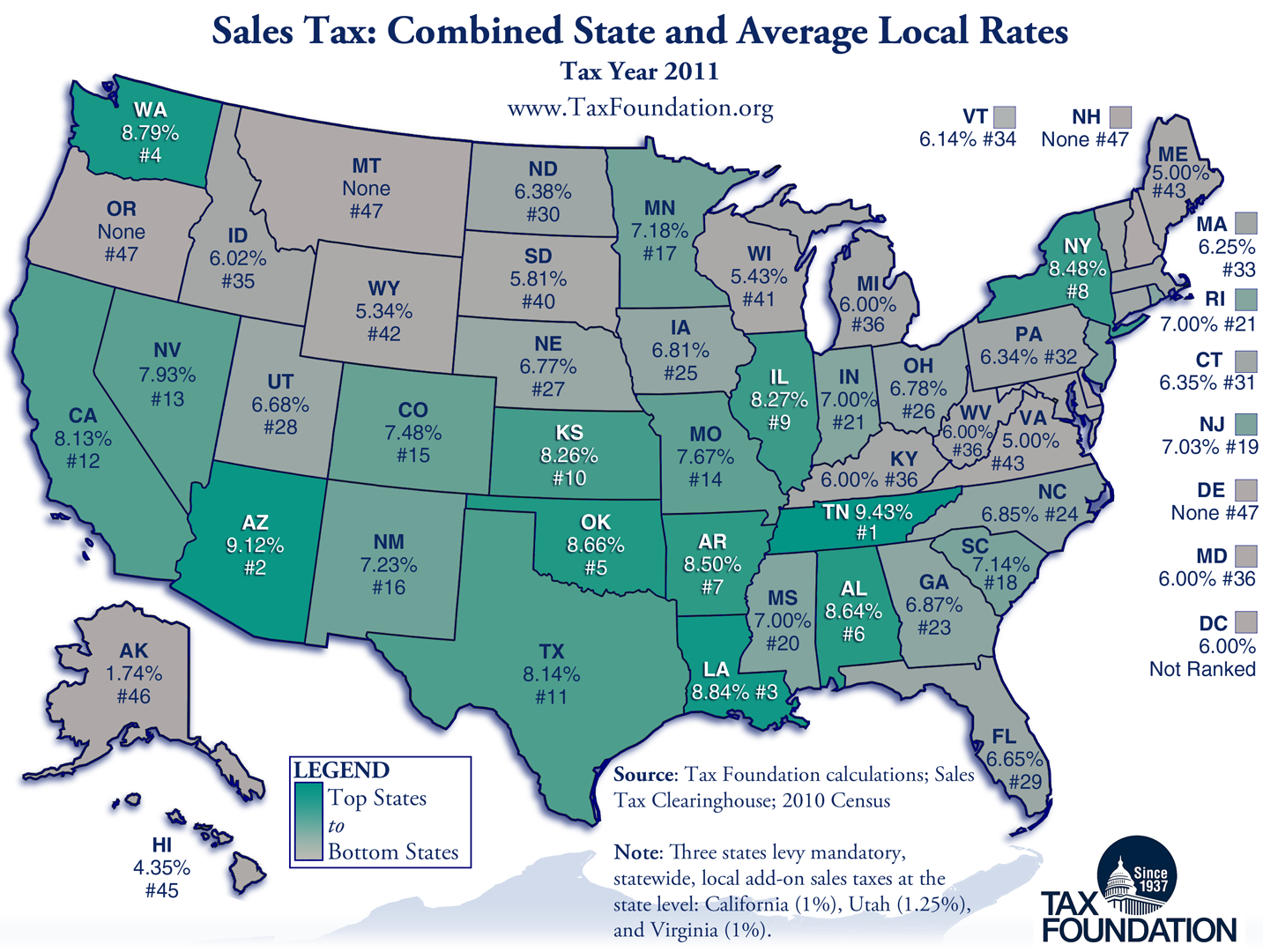

Web what is hawaii's sales tax rate? Web • when taxes are visibly passed on, the gross receipts consist of the retail sales price and the tax. How much is sales tax in hawaii? Web the state sales tax rate in hawaii is 4%, but you can customize this table as needed to reflect your applicable local sales tax rate. Hawaii state sales tax rate range. The base state sales tax rate in hawaii is 4%. Base state sales tax rate 4%.

2021 Hawaii State Tax Rates newteam 2022

• the retail price represents 95.5% of the gross receipts and the tax represents. A sales tax is a tax on customers whereas get is a tax on businesses; Tax rate starting price price increment. Hawaii state sales tax rate range. The get due would have been $41.89 ($1,047.12 x 4%) and the hawaii cs.

Hawaii 2023 Sales Tax Guide

Tax rate starting price price increment. Web hawaii has a 4% statewide sales tax rate , but also has four local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of. Web the state sales tax rate in hawaii is 4%, but you can customize this table as.

hawaii capital gains tax calculator Dorris Noonan

Web the rate of hawaii’s 4.712 tax is 4.712% of the value of the purchase or consumption of goods and services subject to the tax. Web the honolulu, hawaii sales tax is 4.50% , consisting of 4.00% hawaii state sales tax and 0.50% honolulu local sales taxes.the local sales tax consists of a 0.50% county.

Sales Tax In Hawaii Hawaii Sales Tax Filing SalesTaxSolutions.US

What is the formula for. Web the rate of hawaii’s 4.712 tax is 4.712% of the value of the purchase or consumption of goods and services subject to the tax. Web • when taxes are visibly passed on, the gross receipts consist of the retail sales price and the tax. It should be noted that.

Sales Tax i Hawaii Hawaiibloggen

The get due would have been $41.89 ($1,047.12 x 4%) and the hawaii cs due would have been $5.23. Web get a quick rate range. Businesses are required to collect sales tax from their customers whereas businesses. Exact tax amount may vary for different items. • the retail price represents 95.5% of the gross receipts.

What is Sales Tax Nexus Learn all about Nexus

Excise taxes on alcohol in hawaii vary greatly depending on the type of alcohol being purchased. • the retail price represents 95.5% of the gross receipts and the tax represents. Average local + state sales tax. Tax rate starting price price increment. Web the tax adds up to $3.20 per pack of 20 cigarettes. Discover.

Hawaii Sales Tax Calculator State, County & Local Rates

Web of 4.712%, $47.12 would have been collected as tax on the transaction. Excise taxes on alcohol in hawaii vary greatly depending on the type of alcohol being purchased. The hawaii state sales tax rate is 4%, and the average hi sales tax after local surtaxes is. The base state sales tax rate in hawaii.

Hawaii Sales Tax Guide

It should be noted that there is also 4.166% maximum visible. Average local + state sales tax. Web hawaii collects a 4.712% state sales tax rate on the purchase of all vehicles, for honolulu county (oahu island). Base state sales tax rate 4%. Also get the complete list of latest sales tax rates. Web •.

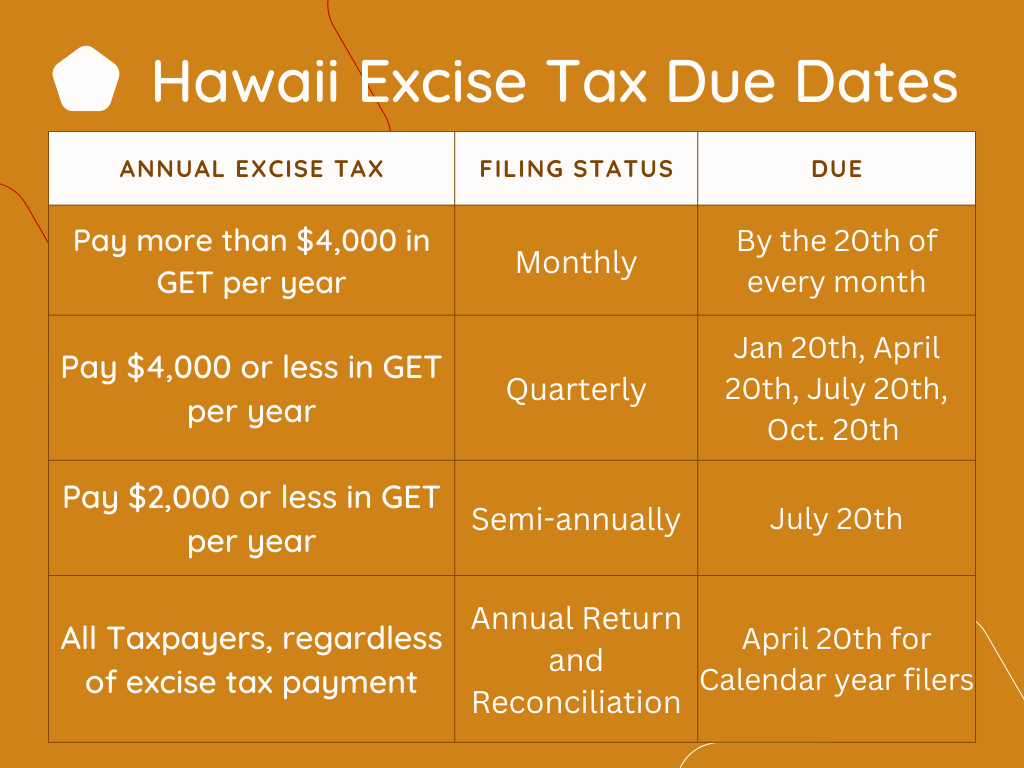

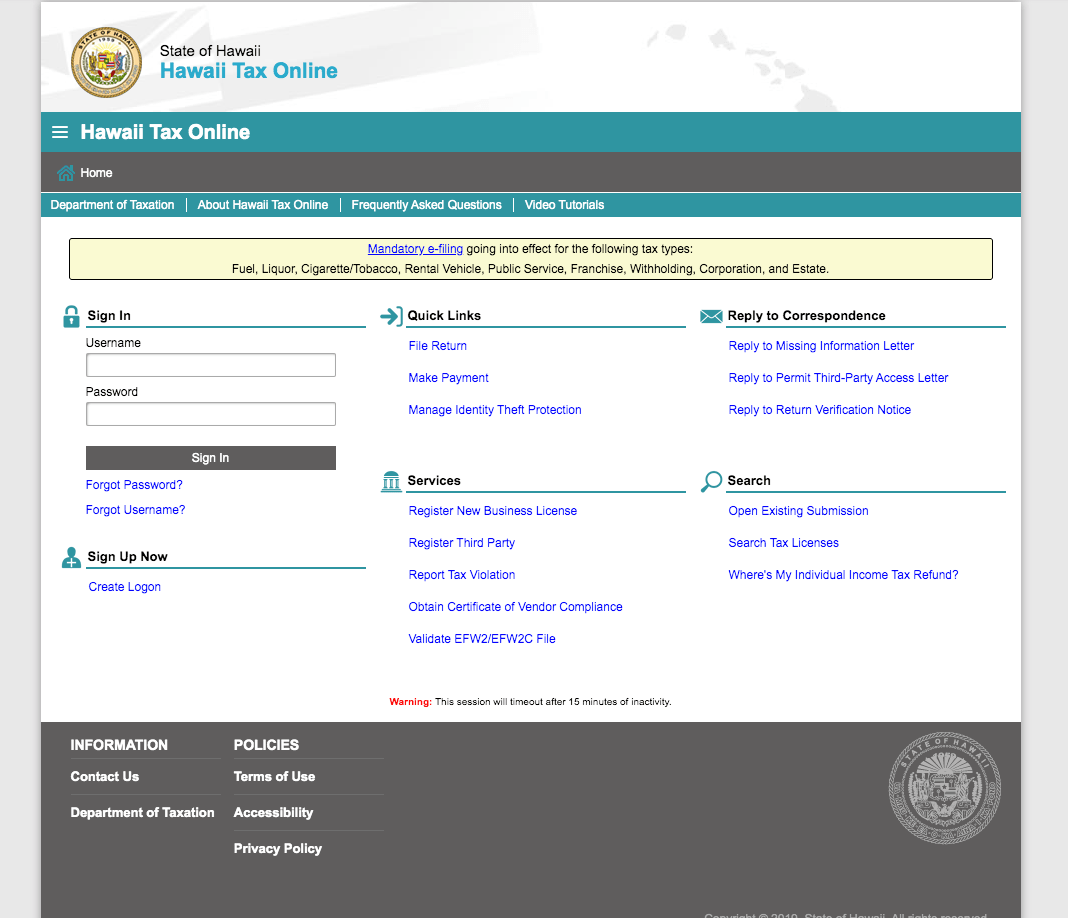

How to File and Pay Sales Tax in Hawaii TaxValet

Web get a quick rate range. Web the honolulu, hawaii sales tax is 4.50% , consisting of 4.00% hawaii state sales tax and 0.50% honolulu local sales taxes.the local sales tax consists of a 0.50% county sales. What is the formula for. Web the rate of hawaii’s 4.712 tax is 4.712% of the value of.

Hawaii Sales Tax Rate Step By Step Business

The base state sales tax rate in hawaii is 4%. Web of 4.712%, $47.12 would have been collected as tax on the transaction. Exact tax amount may vary for different items. Web what is hawaii's sales tax rate? Base state sales tax rate 4%. *due to varying local sales. Web 1040.00 what is the sales.

Hawaii Sales Tax 4.712 Calculator Hawaii state sales tax rate range. Tax rates are provided by avalara and updated monthly. Local tax rates in hawaii range from 0% to 0.5%,. Web the state sales tax rate in hawaii is 4%, but you can customize this table as needed to reflect your applicable local sales tax rate. It should be noted that there is also 4.166% maximum visible.

Web Get A Quick Rate Range.

Web of 4.712%, $47.12 would have been collected as tax on the transaction. Base state sales tax rate 4%. It should be noted that there is also 4.166% maximum visible. Tax rate starting price price increment.

Also Get The Complete List Of Latest Sales Tax Rates.

Web use free sales tax & reverse sales tax calculator for hawaii state and its cities. What is the formula for calculating penalty? Web the honolulu, hawaii sales tax is 4.50% , consisting of 4.00% hawaii state sales tax and 0.50% honolulu local sales taxes.the local sales tax consists of a 0.50% county sales. Can i get a refund of hawaii’s.

Web The Get Rate In Hawaii Is 4% On Retail Sales, With An Additional 0.5% Local Sales Tax Added In Oahu County, Kauai County, And Hawaii County In The Form Of A County Surcharge.

A sales tax is a tax on customers whereas get is a tax on businesses; Excise taxes on alcohol in hawaii vary greatly depending on the type of alcohol being purchased. Web the tax adds up to $3.20 per pack of 20 cigarettes. The hawaii state sales tax rate is 4%, and the average hi sales tax after local surtaxes is.

Tax Rates Are Provided By Avalara And Updated Monthly.

Web the last rates update has been made on january 2024. How much is sales tax in hawaii? Web hawaii collects a 4.712% state sales tax rate on the purchase of all vehicles, for honolulu county (oahu island). Web • when taxes are visibly passed on, the gross receipts consist of the retail sales price and the tax.