Home Daycare Tax Calculator

Home Daycare Tax Calculator - It's important when running a daycare. The house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit. The irs will let you deduct up to 300 ft 2 at $5 per. The rate for 2023 is $5 per square foot. 139 in home child care are listed in indianapolis, in.

Web are you ready to file 2023 childcare business taxes? Assuming a daycare has 4. (see figure 2.) single parents in this income. The house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit. The home daycare tax calculator is a valuable tool for anyone running a home daycare business. Web publication 587 explains how to figure and claim the deduction for business use of your home. Web in tax year 2020, for example, the irs said about 466,224 taxpayers attached form 8615, used to calculate the tax for unearned children’s income for a child tax bill.

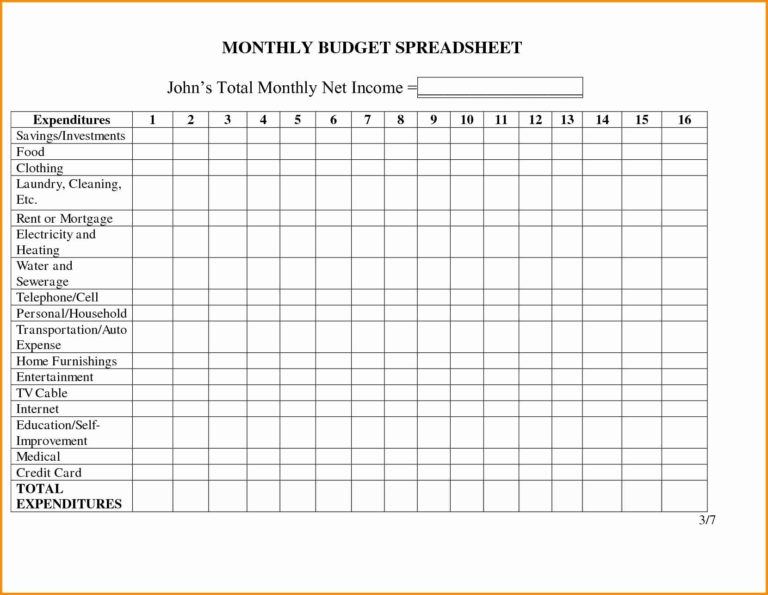

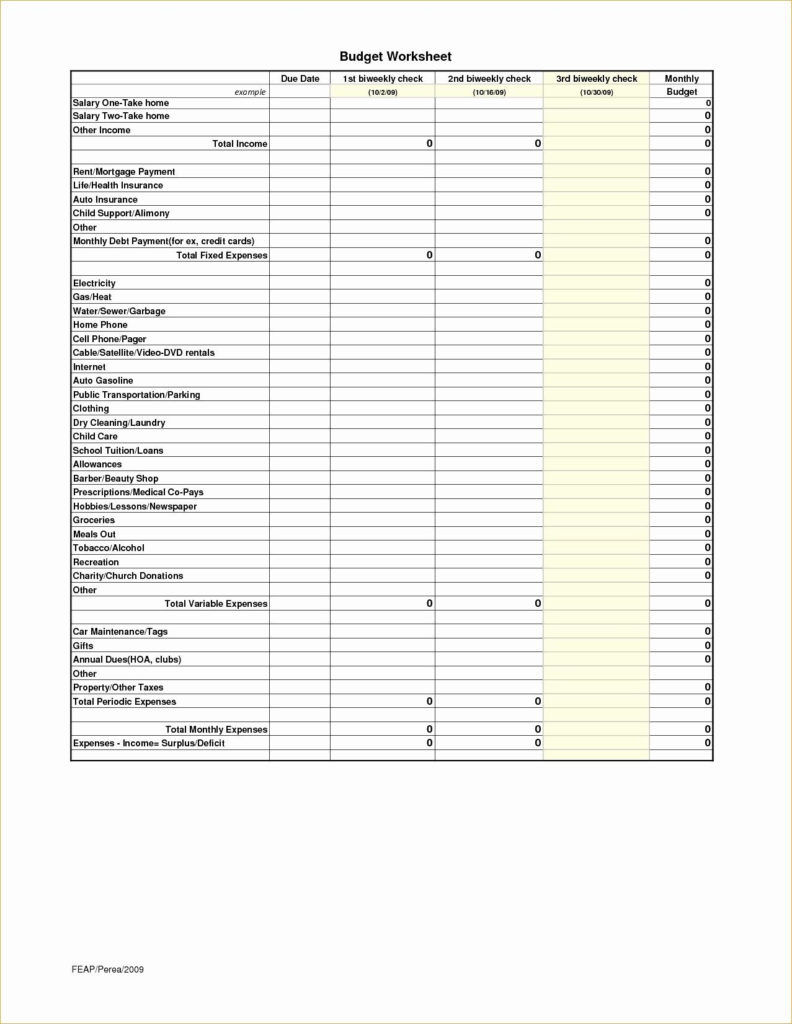

Home Daycare Tax Worksheet

Web here’s what it means for you. Web daycare tax deductions and time space percentage. Web find in home child care in west lafayette, in that you’ll love. Web the simplified method using the simplified method, you will measure your home area used for daycare (in ft 2 ). Web the big list of home.

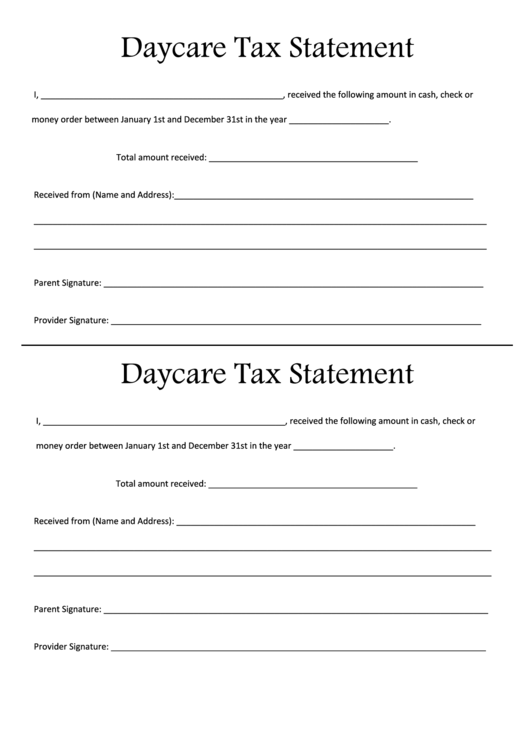

Top 7 Daycare Tax Form Templates free to download in PDF format

The house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit. Assuming a daycare has 4. Web according to irs, the standard rates for meals and snacks are; You need internet to do your job! Taxpayers who are paying someone to take care of their children.

Taxes for In Home Daycare Home daycare, Daycare organization, Family

The average rate is $15/hr as of october 2023. The rate for 2023 is $5 per square foot. Web in tax year 2020, for example, the irs said about 466,224 taxpayers attached form 8615, used to calculate the tax for unearned children’s income for a child tax bill. Web there is no upper limit on.

Home Daycare And Expense Worksheet —

There are 14 major tax deductions for in home daycare providers. Find out the important tax information all providers need to know as the filing deadline approaches. The house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit. Web more than 12 million children younger than.

Home Daycare Tax Worksheet

Web the big list of home daycare tax deductions for family child care businesses! If a daycare facility employed you, you would have. You need internet to do your job! Web there is no upper limit on income for claiming the credit for tax years except for 2021. Web the child and dependent care credit.

In Home Daycare Tax Information Templates Editable Tax Etsy

Web to use the simplified method, you simply multiply the square footage of your home office by a set rate per square foot. Web there is no upper limit on income for claiming the credit for tax years except for 2021. It aids in calculating your tax liability,. The rate for 2023 is $5 per.

DAYCARE TAX STATEMENT/ Childcare Center Printable End of the Etsy

(see figure 2.) single parents in this income. Web in tax year 2020, for example, the irs said about 466,224 taxpayers attached form 8615, used to calculate the tax for unearned children’s income for a child tax bill. Web it’ll depend on your combined income. Web the child and dependent care tax credit is for.

Home Daycare Tax Worksheet Briefencounters In Daycare Expense

Web according to irs, the standard rates for meals and snacks are; The irs will let you deduct up to 300 ft 2 at $5 per. There are 14 major tax deductions for in home daycare providers. It includes special rules for daycare providers. An examination of a broken. You need internet to do your.

Daycare Tax Forms Bundle [INSTANT PRINTABLE/DOWNLOAD

You need internet to do your job! An examination of a broken. Web many single parents with incomes between roughly $16,000 and $40,000 would have their incomes cut by the plan. There are 14 major tax deductions for in home daycare providers. Web the child and dependent care tax credit is for caregivers with expenses.

Home Daycare Tax Worksheet

Web in tax year 2020, for example, the irs said about 466,224 taxpayers attached form 8615, used to calculate the tax for unearned children’s income for a child tax bill. (see figure 2.) single parents in this income. Web updated october 11, 2023. Web it’ll depend on your combined income. There are 14 major tax.

Home Daycare Tax Calculator Web the child and dependent care tax credit is for caregivers with expenses related to caring for a dependent while they work or look for work. It's important when running a daycare. The home daycare tax calculator is a valuable tool for anyone running a home daycare business. Web the 2021 pandemic child tax credit, in comparison, increased the credit amount up to $3,600 per child under age 6 and $3,000 per child ages 6 to 17. Vehicle expenses (including mileage) 3.

The Irs Will Let You Deduct Up To 300 Ft 2 At $5 Per.

Web there is no upper limit on income for claiming the credit for tax years except for 2021. Web are you ready to file 2023 childcare business taxes? It includes special rules for daycare providers. It's important when running a daycare.

Web This Home Daycare Tax Deductions List Will Help You Avoid Paying Unnecessary Taxes That You Don't Owe.

Web according to irs, the standard rates for meals and snacks are; Vehicle expenses (including mileage) 3. Web publication 587 explains how to figure and claim the deduction for business use of your home. Web daycare tax deductions and time space percentage.

Web The Big List Of Home Daycare Tax Deductions For Family Child Care Businesses!

The house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit. Web more than 12 million children younger than age five are in some form of child care in the united states. Web the child and dependent care tax credit is for caregivers with expenses related to caring for a dependent while they work or look for work. 23 in home child care are listed in west lafayette, in.

139 In Home Child Care Are Listed In Indianapolis, In.

Taxpayers who are paying someone to take care of their children or another member of household while they work, may qualify for child and. Web the child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons). (see figure 2.) single parents in this income. Web it’ll depend on your combined income.