Home Depot 401K Withdrawal

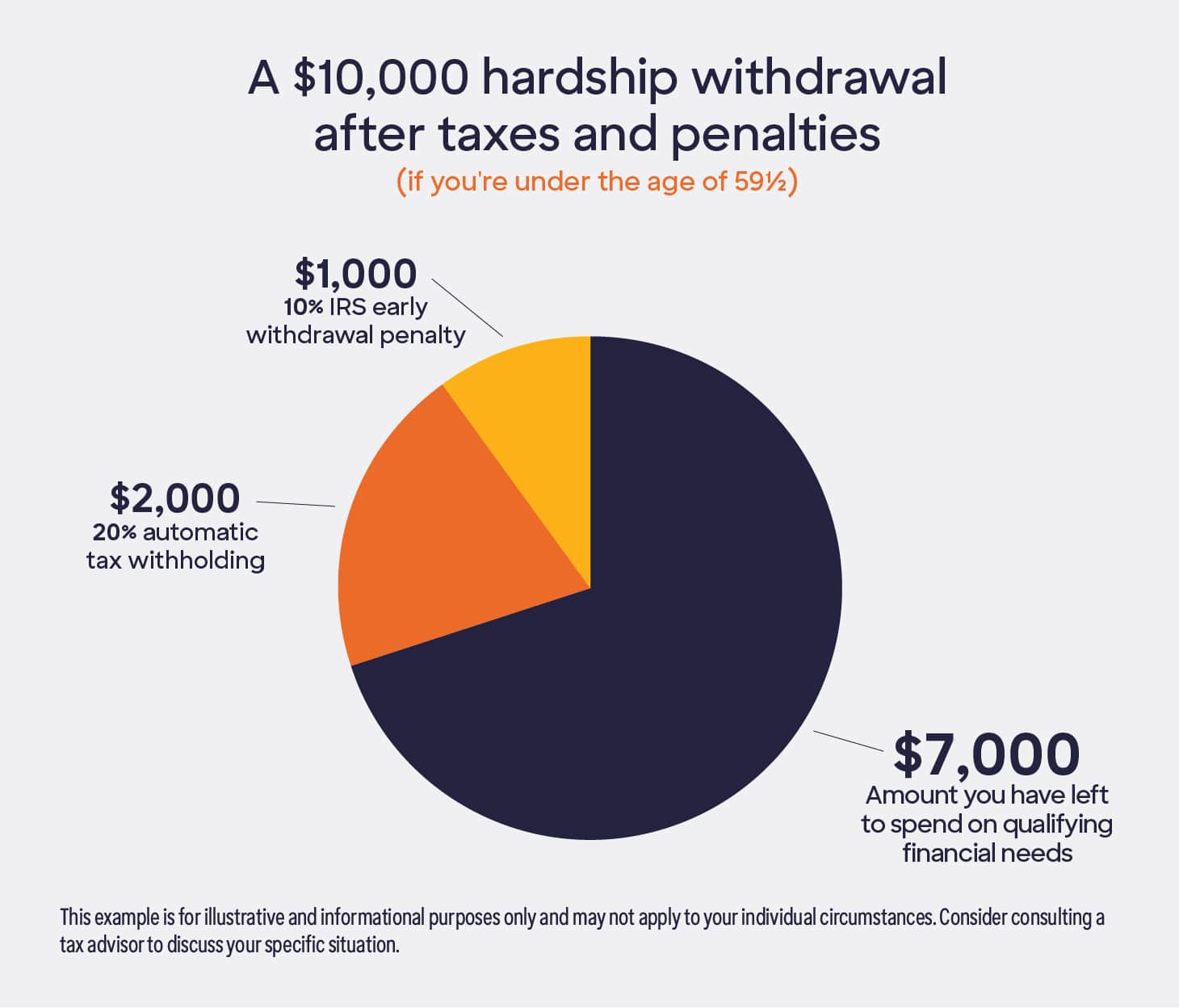

Home Depot 401K Withdrawal - Web there are two options for taking a loan out of your 401k. If you withdraw early you have to have a reason (medical expenses, buying a house, etc) and you will pay huge taxes on it. Web the home depot in west virginia is here to help with your home improvement needs. Web if i paid taxes when i made a withdrawal from my 401k, why am i paying taxes on it again while completing my return? Say you pull out $10,000 from your 401 (k) at age 35.

I know it is generally considered a bad idea to cash out your 401k unless you really need it. Apply for vacation and leave leave. Web the home depot is proud to be recognized on fortune's 2024 most admired companies list. Alright i'll preface this by saying yes. Assuming a conservative annual return rate of 4%,. Curbside pickup with the home depot. Web statista research predicts the u.s.

Fidelity 401k Withdrawal Calculator Home Sweet Home

Web the home depot in west virginia is here to help with your home improvement needs. Web if i paid taxes when i made a withdrawal from my 401k, why am i paying taxes on it again while completing my return? Understand 401 (k) withdrawal after age 59.5. Web let’s work out an example with.

First Time Home Buyer 401K Withdrawal 2020 Irs Goimages Ninja

Submit a request to adjust the work. Say you pull out $10,000 from your 401 (k) at age 35. Web the home depot in west virginia is here to help with your home improvement needs. I know it is generally considered a bad idea to cash out your 401k unless you really need it. Apply.

Vanguard hardship withdrawal form Fill out & sign online DocHub

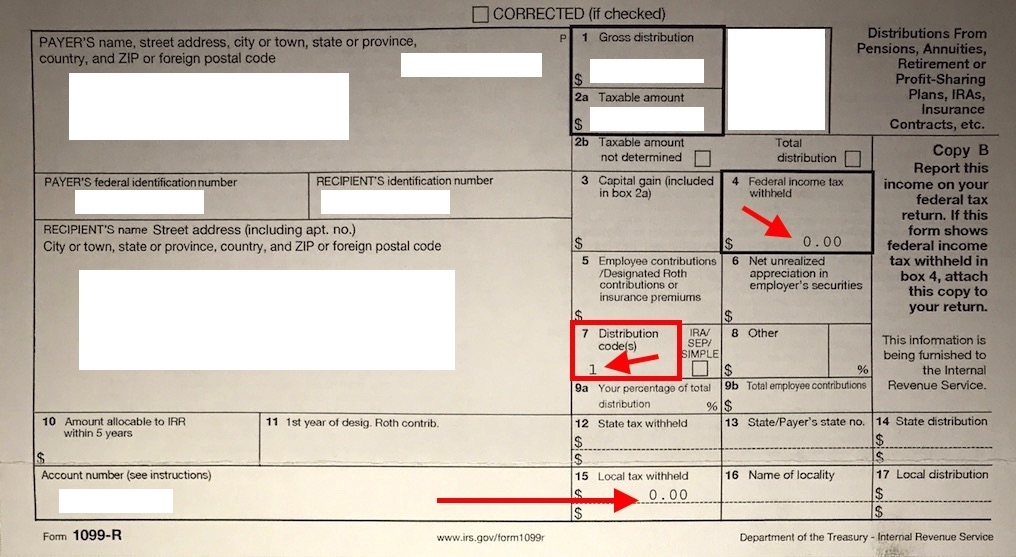

Every employer's plan has different rules for 401(k) withdrawals and loans, so find out. Web if your 401 (k) plan allows for hardship withdrawals, it would be for one of the seven reasons below: Web the government doesn’t tax income contributed to a traditional 401 (k) or ira. Assuming a conservative annual return rate of.

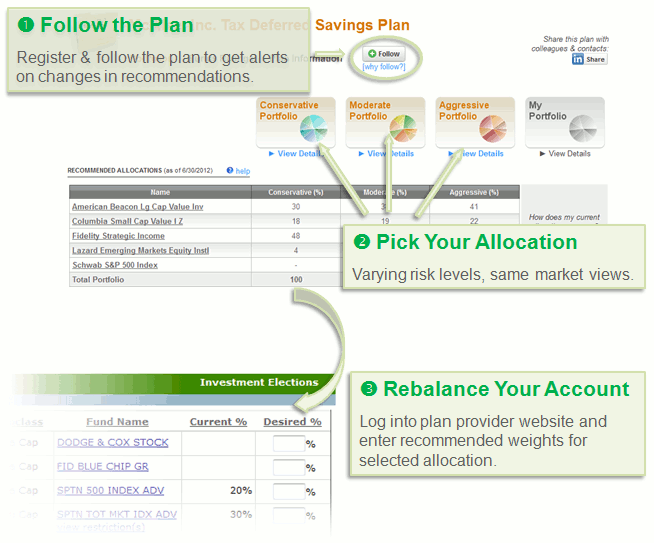

The Home Depot Futurebuilder 401k Asset Allocation Advice Kivalia

Stop by at one of our west virginia locations today. Web statista research predicts the u.s. Web there is typically a 10% early withdrawal penalty if you take a 401 (k) distribution before age 59 1/2. You can call them or do it online on livetheorangelife. If you withdraw early you have to have a.

401(k) Hardship Withdrawal What You Need to Know Discover

They will send you a letter. Assuming a conservative annual return rate of 4%,. Web statista research predicts the u.s. Web 0.20% per year for the amount above $250,000 in your account fees prior to january 1, 2021: Web if your 401 (k) plan allows for hardship withdrawals, it would be for one of the.

How To 401k Hardship Withdrawal Step by Step

0.45% per year for the next. Stop by at one of our west virginia locations today. Say you pull out $10,000 from your 401 (k) at age 35. You won’t be able to get the money until after 30 days. Web let’s work out an example with our 401 (k) calculator. Assuming a conservative annual.

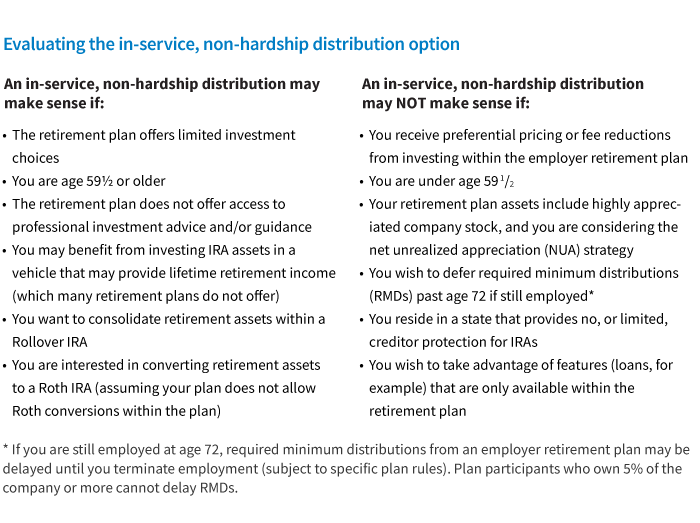

When to choose a nonhardship 401(k) withdrawal

Web there are two options for taking a loan out of your 401k. You pay taxes when you withdraw the money in retirement. Stop by at one of our west virginia locations today. Understand 401 (k) withdrawal after age 59.5. The tax breaks cost the. Web explore all your options for getting cash before tapping.

How to Efficiently Withdraw from a 401(k) Wiseradvisor Infographics

Web statista research predicts the u.s. To view and access your benefits, go to livetheorangelife.com. 7 projects completed in romney. Looking for more home services in your area? Web the government doesn’t tax income contributed to a traditional 401 (k) or ira. Submit a request to adjust the work. Web 7 projects completed by the.

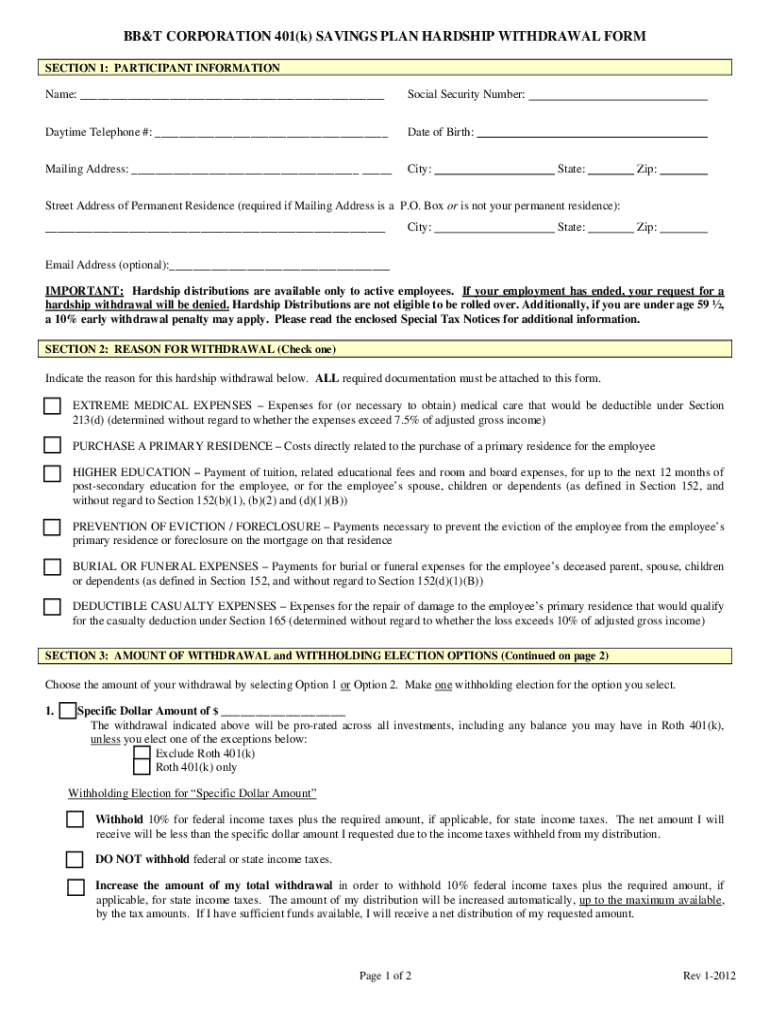

Bb t 401k withdrawal Fill out & sign online DocHub

It appears you are in a higher than 10% tax. I know it is generally considered a bad idea to cash out your 401k unless you really need it. Submit a request to adjust the work. Web what you should know 401 (k) allows the account owner to withdraw the money, but it may have.

First Time Home Buyer 401K Withdrawal 2020 Irs Goimages Ninja

Looking for more home services in your area? 0.45% per year for the next. Web home depot offers associates the opportunity to choose plans and programs that meet individual and family needs through your total value, the home depot's benefits and compensation programs. I know it is generally considered a bad idea to cash out.

Home Depot 401K Withdrawal Assuming a conservative annual return rate of 4%,. 0.50% per year for the first $100,000; Submit a request to adjust the work. Web if your 401 (k) plan allows for hardship withdrawals, it would be for one of the seven reasons below: Web statista research predicts the u.s.

Every Employer's Plan Has Different Rules For 401(K) Withdrawals And Loans, So Find Out.

You won’t be able to get the money until after 30 days. It appears you are in a higher than 10% tax. Web if i paid taxes when i made a withdrawal from my 401k, why am i paying taxes on it again while completing my return? I know it is generally considered a bad idea to cash out your 401k unless you really need it.

You Can Call Them Or Do It Online On Livetheorangelife.

They will send you a letter. If you withdraw early you have to have a reason (medical expenses, buying a house, etc) and you will pay huge taxes on it. Web home depot offers associates the opportunity to choose plans and programs that meet individual and family needs through your total value, the home depot's benefits and compensation programs. Understand 401 (k) withdrawal after age 59.5.

Web There Is Typically A 10% Early Withdrawal Penalty If You Take A 401 (K) Distribution Before Age 59 1/2.

The company ranked #1 in the specialty retail category for the second. Web 0.20% per year for the amount above $250,000 in your account fees prior to january 1, 2021: Say you pull out $10,000 from your 401 (k) at age 35. Web a 401 (k) is a retirement account.

Web There Are Two Options For Taking A Loan Out Of Your 401K.

7 projects completed in romney. Costs relating to the purchase of a. Web the government doesn’t tax income contributed to a traditional 401 (k) or ira. Assuming a conservative annual return rate of 4%,.