Home Depot P E Ratio

Home Depot P E Ratio - Web price to earnings (p/e) price to operating profit (p/op) price to sales (p/s) price to book value (p/bv) current valuation ratios home depot inc., current price multiples based. Web applying this formula, home depot’s p/e ratio (fwd) is calculated below: This is calculated based on the current eps of $15.64 and the stock price of $360.07 per share. The p/e ratio gives us insight into how the market perceives the earnings potential of an. Web 60 rows p/s ratio.

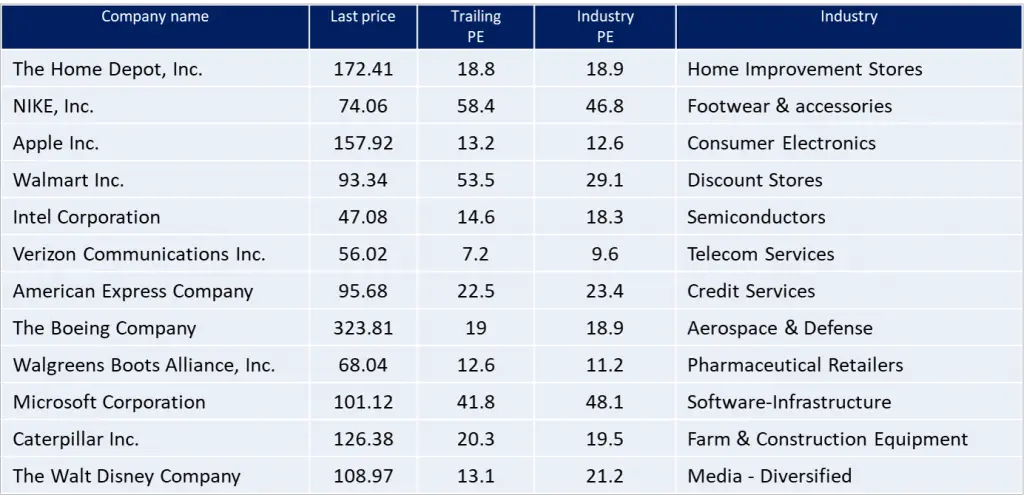

This is calculated based on the current eps of $15.64 and the stock price of $360.07 per share. Web the following section summarizes insights on the home depot, inc.'s p/e ratio: Compare the performance metrics of home depot (hd) against the. Pe ratio (ttm) is a widely used stock evaluation measure. Financial analysts and individual investors. Web fair value is the appropriate price for the shares of a company, based on its earnings and growth rate also interpreted as when p/e ratio = growth rate. The p/e ratio gives us insight into how the market perceives the earnings potential of an.

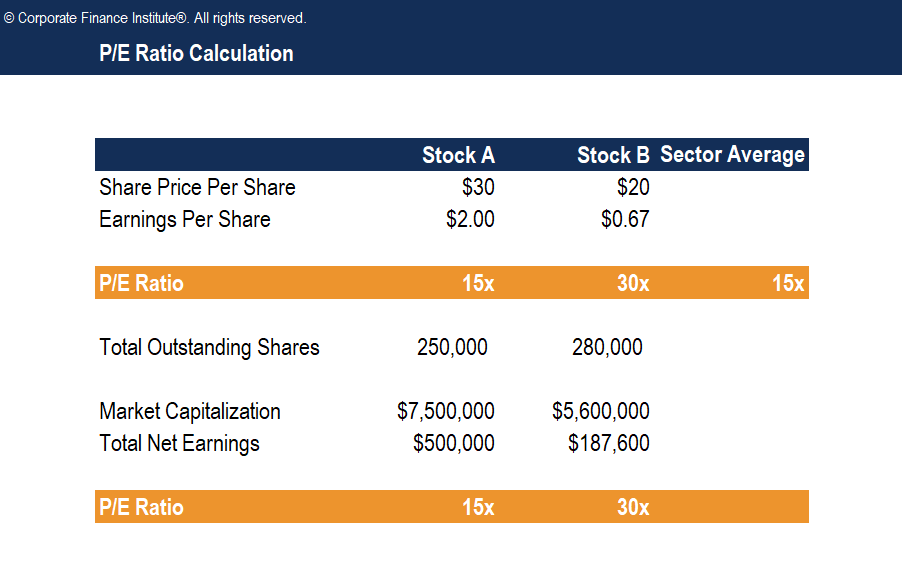

Price Earnings Ratio Formula, Examples and Guide to P/E Ratio

Web home depot (hd) rises higher than market: Web price to earnings (p/e) price to operating profit (p/op) price to sales (p/s) price to book value (p/bv) current valuation ratios home depot inc., current price multiples based. Web p/e ratio for home depot (hd) p/e ratio as of february 2024 (ttm): Pe ratio (ttm) is.

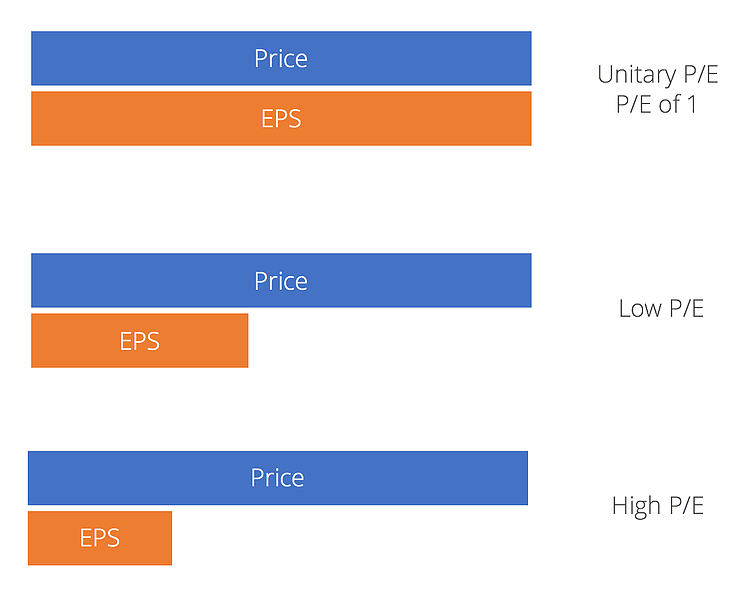

PE ratio What Is It and How to Use the Price Earnings Ratio

Pe ratio (ttm) is a widely used stock evaluation measure. Web this means investor's are paying $29 per $1 of the company's earnings. Financials are provided by nasdaq data. P/e ratio (w/ extraordinary items) 23.14: Compare the performance metrics of home depot (hd) against the. Web p/e ratio for home depot (hd) p/e ratio as.

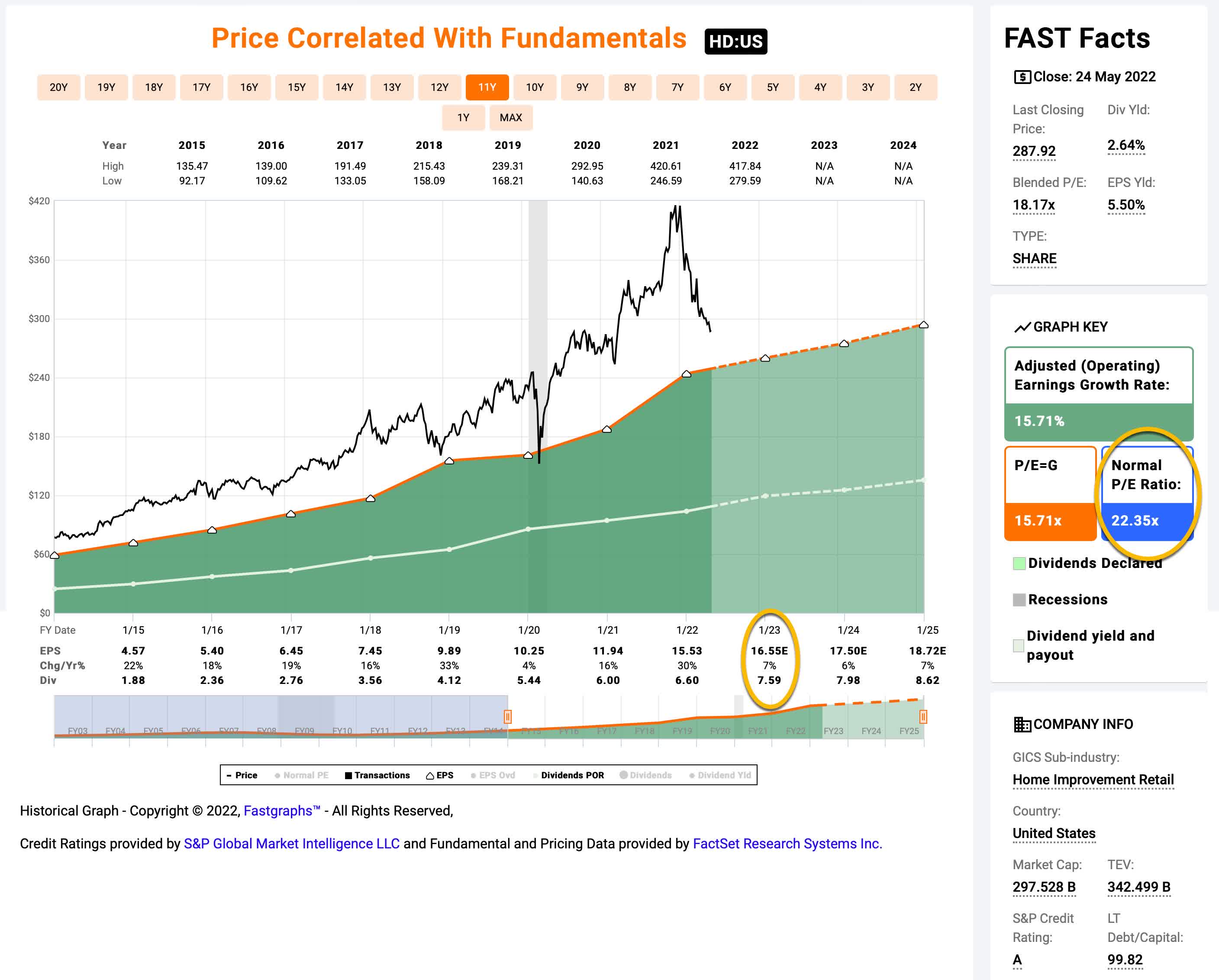

Is Home Depot Stock A Buy After Recent Earnings? Depends On Your Return

Web p/e ratio for home depot (hd) p/e ratio as of february 2024 (ttm): Web balance sheet cash flow statement find out all the key statistics for the home depot, inc. The price to earnings ratio is calculated by taking the latest closing price and dividing it by the most recent earnings per share. Nasdaq.

What is Justified P/E Ratio? Formula + Calculator

Web this hd page provides a table containing critical financial ratios such as p/e ratio, eps, roi, and others. (hd), including valuation measures, fiscal year financial statistics, trading record, share. Web in the context of valuation, home depot is at present trading with a forward p/e ratio of 23.23. Web hd fundamentals overview statements statistics.

How to read PE ratio for investing in stocks [Ultimate Guide

Web this hd page provides a table containing critical financial ratios such as p/e ratio, eps, roi, and others. Web compare to open 352.59 prior close 350.97 (01/25/24) 1 day hd 1.07% djia 0.64% s&p 500 0.53% retail/wholesale 0.04% earnings & estimates home depot inc. Financial analysts and individual investors. Jan 2015 jan 2017 jan.

P/E Ratio Definition PricetoEarnings Ratio Formula and Examples

Web current and historical daily pe ratio for the home depot inc from 1990 to feb 11 2024. Find the latest pe ratio (ttm) for home. Web 26 rows home depot pe ratio: The price to earnings ratio is calculated by taking the latest closing price and dividing it by the most recent earnings per.

Price Earnings Ratio Formula, Examples and Guide to P/E Ratio

The price to earnings ratio is calculated by taking the latest closing price and dividing it by the most recent earnings per share. (hd), including valuation measures, fiscal year financial statistics, trading record, share. Web applying this formula, home depot’s p/e ratio (fwd) is calculated below: Web 60 rows p/s ratio. P/e ratio (w/ extraordinary.

Price Earnings Ratio Formula, Examples and Guide to P/E Ratio

Web this means investor's are paying $29 per $1 of the company's earnings. Web compare to open 352.59 prior close 350.97 (01/25/24) 1 day hd 1.07% djia 0.64% s&p 500 0.53% retail/wholesale 0.04% earnings & estimates home depot inc. Market capitalization [ 345.7 b ] (/) forecast net income [ 15.003 b ] (=) p/e.

The P/E Ratio Explained! Best Way To Value A Stock (Part 1) YouTube

Web p/e ratio for home depot (hd) p/e ratio as of february 2024 (ttm): Hd's forward pe ratio is 21.41. Web current and historical daily pe ratio for the home depot inc from 1990 to feb 11 2024. (hd), including valuation measures, fiscal year financial statistics, trading record, share. Current and historical p/e ratio for.

What is P/E Ratio? (PriceEarnings) Formula + Calculator

Market capitalization [ 345.7 b ] (/) forecast net income [ 15.003 b ] (=) p/e ratio (fwd) [ 23.0x. Web 26 rows home depot pe ratio: (hd), including valuation measures, fiscal year financial statistics, trading record, share. Find the latest pe ratio (ttm) for home. The p/e ratio gives us insight into how the.

Home Depot P E Ratio Web this means investor's are paying $29 per $1 of the company's earnings. Web p/e ratio for home depot (hd) p/e ratio as of february 2024 (ttm): Web price to earnings (p/e) price to operating profit (p/op) price to sales (p/s) price to book value (p/bv) current valuation ratios home depot inc., current price multiples based. Compare the performance metrics of home depot (hd) against the. Web fair value is the appropriate price for the shares of a company, based on its earnings and growth rate also interpreted as when p/e ratio = growth rate.

Web Hd Fundamentals Overview Statements Statistics Dividends Earnings Revenue Home Depot, Inc.

Current and historical p/e ratio for home depot (hd) from 2010 to 2023. Web the following section summarizes insights on the home depot, inc.'s p/e ratio: Web p/e ratio for home depot (hd) p/e ratio as of february 2024 (ttm): Market capitalization [ 345.7 b ] (/) forecast net income [ 15.003 b ] (=) p/e ratio (fwd) [ 23.0x.

Web Home Depot (Hd) Rises Higher Than Market:

Web this hd page provides a table containing critical financial ratios such as p/e ratio, eps, roi, and others. View our latest analysis for. Web the p/e ratio for home depot (hd) stock today is 22.82. This valuation marks a premium compared to its industry's average.

Web Price To Earnings (P/E) Price To Operating Profit (P/Op) Price To Sales (P/S) Price To Book Value (P/Bv) Current Valuation Ratios Home Depot Inc., Current Price Multiples Based.

Web 26 rows home depot pe ratio: Web 29 rows 7.10%. Web this means investor's are paying $29 per $1 of the company's earnings. Nasdaq provides price/earnings ratio (or pe ratio) and peg ratio for stock evaluation.

Web Applying This Formula, Home Depot’s P/E Ratio (Fwd) Is Calculated Below:

Jan 2015 jan 2017 jan 2019 jan 2021 jan 2023 20.0x 25.0x 30.0x performance summary home. Hd's forward pe ratio is 21.41. Web about the price/ earnings & peg ratios. That corresponds to an earnings yield of approximately 5.3%.

:max_bytes(150000):strip_icc()/Price-to-EarningsRatio_final-23bff9e93e624fdea7eb34ec993ea8a9.png)