Home Depot Sales Tax California

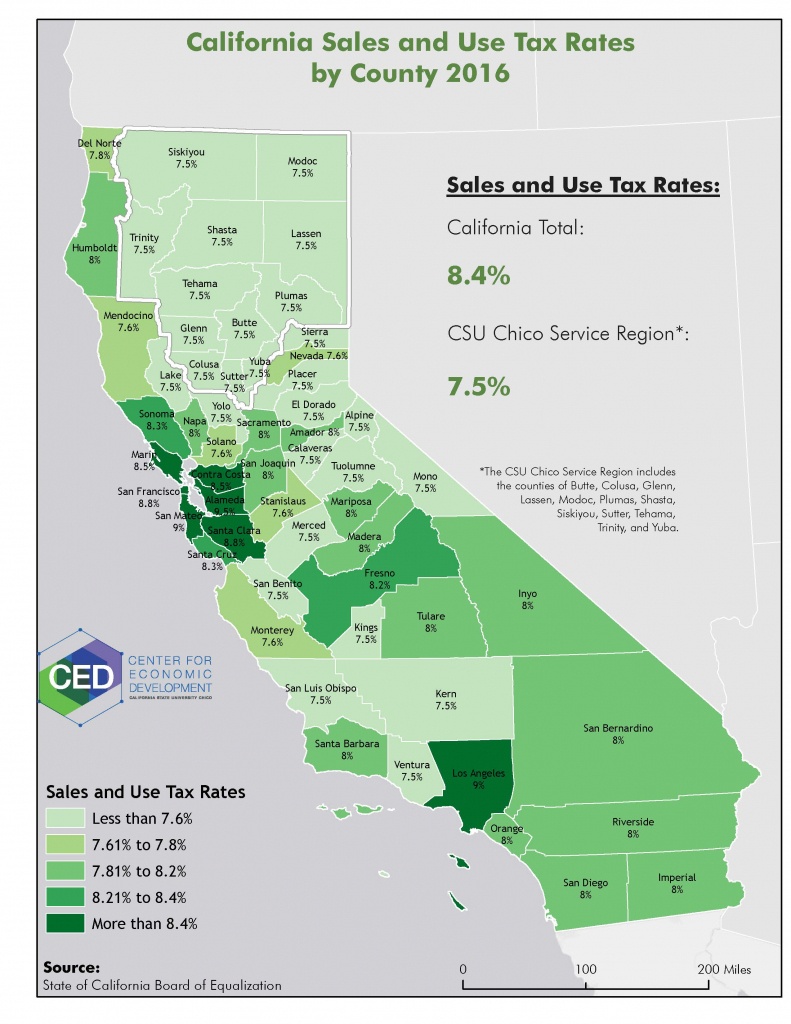

Home Depot Sales Tax California - Web the sales tax ranges from 7.25 percent to 9.25 percent, depending on city and county. Web savings center specials & offers today's big savings all in one place browse all departments, savings end today! The actual charge to your credit card will include the applicable state and local sales taxes and will be calculated when the order is shipped. Oxnard shores, ca sales tax rate: The home depot is required by law to charge all applicable sales taxes for online orders.

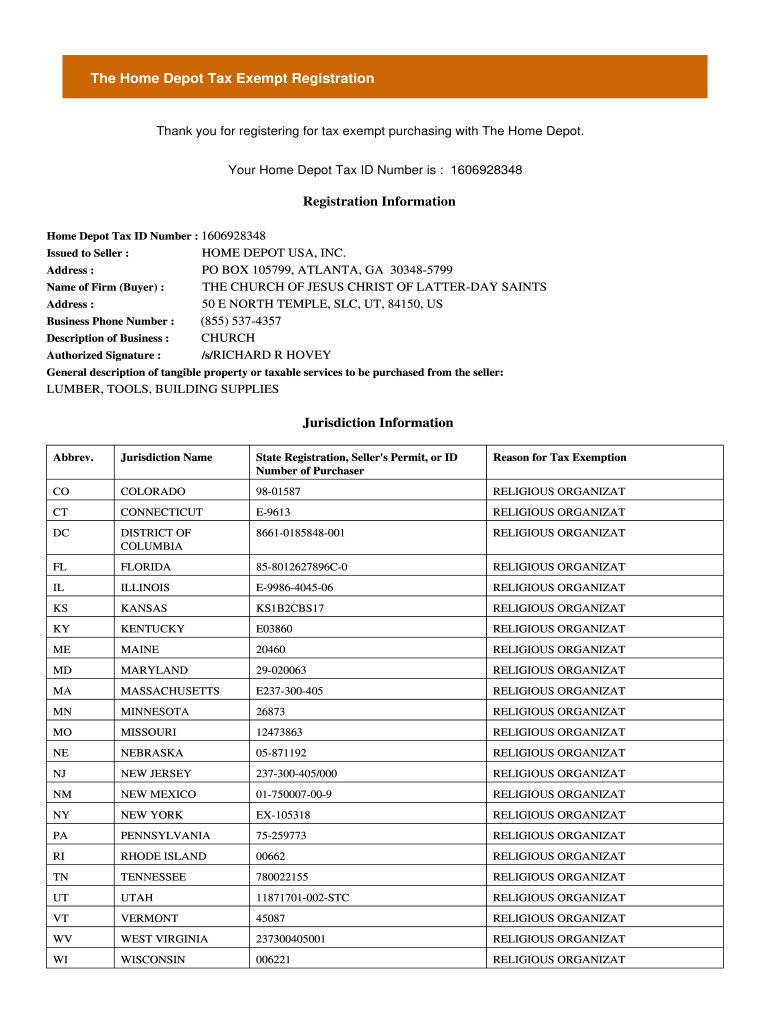

Web the new report from the california department of tax and fee administration shows how california’s local sales tax rules skew the fortunes of cities depending on where retail giants like apple, best buy, or amazon.com inc. Income taxes for your business type. 11, resulting in a transfer of fees from the timber industry to retail lumber sellers. The home depot is required by law to charge all applicable sales taxes for online orders. The actual charge to your credit card will include the applicable state and local sales taxes and will be calculated when the order is shipped. If you are a retailer or purchase goods subject to sales or use tax. If you already have a the home depot tax exempt id, skip to step 10.

Home Depot charges B.C. tax on exempt items CBC News Latest Canada

The san diego sales tax rate is %. Of los angeles county grew 20.0% over the comparable time period; The actual charge to your credit card will include the applicable state and local sales taxes and will be calculated when the order is shipped. Oakland, ca sales tax rate: Now over two million items eligible..

You should probably know this about California Sales Tax Calculator By

The california sales tax rate is currently %. The san diego sales tax rate is %. From requests by our customers we implemented a new system which has the ability to maintain a customer's tax exemption information and eliminate the need for customers to fill out and sign a tax exemption form with each transaction..

The Lakewood Scoop Lakewood Home Depot Now Charging 3 ½ Percent Sales

Oceanside, ca sales tax rate: Shop online for all your home improvement needs: Web the current standard california statewide sales and use tax rate is 7.25 percent. Web the new report from the california department of tax and fee administration shows how california’s local sales tax rules skew the fortunes of cities depending on where.

Exclusive Home Depot to donate 50M to train construction workers

Web what is the sales tax rate in san diego, california? Web the 2018 united states supreme court decision in south dakota v. It is not necessary to include a coversheet when faxing. California also taxes some services. The california sales tax rate is currently %. Oxnard shores, ca sales tax rate: Oakland, ca sales.

Home Depot Tax Exempt Id California Fill Online, Printable, Fillable

Of los angeles county grew 20.0% over the comparable time period; This is the total of state, county and city sales tax rates. Appliances, bathroom decorating ideas, kitchen remodeling, patio furniture, power tools, bbq grills, carpeting, lumber, concrete, lighting, ceiling fans and more at the home depot. Web savings center specials & offers today's big.

Sales Taxstate Here's How Much You're Really Paying California Sales

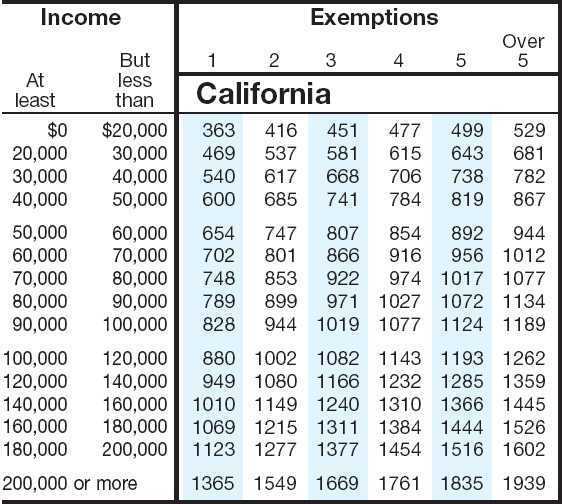

For a home sale, those gains are taxed according to the following table. Web the 2018 united states supreme court decision in south dakota v. Why did the home depot's tax exempt transaction process change? California also taxes some services. You just have to apply once. This is the total of state, county and city.

How To Get Home Depot Tax Exemption Tax Exemption For Home Depot

The tax rate given here will reflect the current rate of tax for the address that you enter. Oxnard shores, ca sales tax rate: Web sales & use tax in california. Oakland, ca sales tax rate: Please note that the order totals during your checkout reflect estimated sales tax. Look up the current sales and.

Home Depot Black Friday 2020 Current flyer 11/26 12/02/2020

This number is different from your state tax exemption id. If you already have a the home depot tax exempt id, skip to step 10. It is not necessary to include a coversheet when faxing. Web the 2018 united states supreme court decision in south dakota v. To balance the budget, gov. Web savings center.

31 Home Depot Hacks to Score Coupons & Deals For Savings Home depot

Let us know and we’ll give you a tax exempt id to use in our stores and online. All registrations are subject to review and approval based on state and local laws. This is the total of state, county and city sales tax rates. Has impacted many state nexus laws and sales tax collection requirements..

Home Depot Ad Circular 06/25 07/05/2020 Rabato

Web los angeles, ca sales tax rate: If you have independent contractors. Retailers engaged in business in california must register with the california department of tax and fee administration (cdtfa) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales specifically exempted by law. Appliances, bathroom.

Home Depot Sales Tax California Now over two million items eligible. The county sales tax rate is %. If you already have a the home depot tax exempt id, skip to step 10. Please ensure the address information you input is the address you intended. That, in turn, reduces the home’s annual tax bill.

Web Tax, Experienced Similar Positive Results.

Retailers engaged in business in california must register with the california department of tax and fee administration (cdtfa) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales specifically exempted by law. Let us know and we’ll give you a tax exempt id to use in our stores and online. For a home sale, those gains are taxed according to the following table. California region was up 19.9%.

Please Ensure The Address Information You Input Is The Address You Intended.

Income taxes for your business type. Oxnard shores, ca sales tax rate: Shop online for all your home improvement needs: A proposed 1% additional sales tax on selected lumber products was signed into california law by gov.

Oceanside, Ca Sales Tax Rate:

If you are a retailer or purchase goods subject to sales or use tax. 11, resulting in a transfer of fees from the timber industry to retail lumber sellers. Are you a tax exempt shopper? Web if you’re doing business in california or you plan on starting a california business, here’s information that may be helpful.

Of Los Angeles County Grew 20.0% Over The Comparable Time Period;

This number is different from your state tax exemption id. North glendale, ca sales tax rate: Web the 2018 united states supreme court decision in south dakota v. It is not necessary to include a coversheet when faxing.