Home Depot Tax Exempt Phone Number

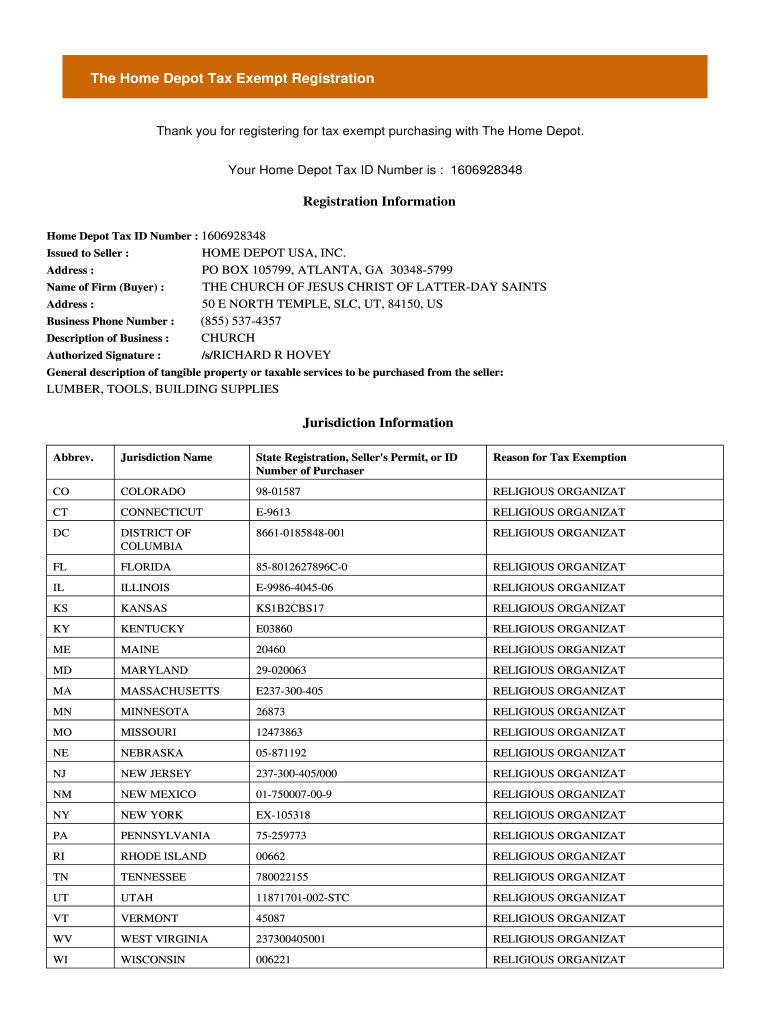

Home Depot Tax Exempt Phone Number - The hampshire assessor, located in romney, west virginia, is responsible for assessing property values for tax purposes within hampshire county. Taxpayers needing to file an appeal for their 2023 assessments may also do so online. Web the home depot sites the home depot the home depot canada the home depot mexico need help with your registration? This number is different from your state tax exemption id. The home depot tax exempt id number is used when making tax exempt purchases in lieu of the state issued tax exempt id number.

Subject to state and local tax laws. He said that an audit revealed a bunch of tax exempt receipts that weren't his business's purchases. Web if you have questions regarding your the home depot charge account, please contact our credit center at the following phone numbers: Web before your business can purchase products from home depot stores without paying sales tax, however, you will need to complete home depot's online application process that registers your. View or make changes to your tax exemption anytime. Links to the appropriate forms are listed immediately below. Web you will need to enter an email address when registering in order to use this feature.

How to Register for a Tax Exempt ID The Home Depot Pro

Web there are rules or parameters for tax exempt purchases and those with tax exemptions can be audited and held liable to pay the tax on purchases that shouldn't have been tax exempt. Web before your business can purchase products from home depot stores without paying sales tax, however, you will need to complete home.

How to Register for a Tax Exempt ID The Home Depot Pro

If you have any questions about the filing process, please. Web the home depot sites the home depot the home depot canada the home depot mexico need help with your registration? Web if you have questions regarding your the home depot charge account, please contact our credit center at the following phone numbers: Web before.

Understanding what is home depot tax exempt id Track and receive

Taxpayers needing to file an appeal for their 2023 assessments may also do so online. If you have any questions about the filing process, please. Step 2 sign into your pro xtra account to register for a new tax exempt id. Web if you have questions regarding your the home depot charge account, please contact.

Tax exempt form home depot Fill out & sign online DocHub

The hampshire assessor, located in romney, west virginia, is responsible for assessing property values for tax purposes within hampshire county. The number is “auto assigned” by the system during the registration process. Tax exempt fraud is the reason we can no longer look up tax exemptions by phone number. Subject to state and local tax.

How to Register for a Tax Exempt ID The Home Depot Pro

Web go to the home depot tax exempt registration page in your web browser (see resources). Web there are rules or parameters for tax exempt purchases and those with tax exemptions can be audited and held liable to pay the tax on purchases that shouldn't have been tax exempt. The number is “auto assigned” by.

How to Register for a Tax Exempt ID The Home Depot Pro

The hampshire assessor, located in romney, west virginia, is responsible for assessing property values for tax purposes within hampshire county. Web williamstown use tax is due. Request new channels or features. Tax exempt fraud is the reason we can no longer look up tax exemptions by phone number. Web the home depot mexico. Subject to.

How to Register for a Tax Exempt ID The Home Depot Pro

Web federal tax identification number: And since the ohio sales tax rate is lower than west virginia sales tax rate, a 0.25% west virginia state use tax is due. The hampshire assessor, located in romney, west virginia, is responsible for assessing property values for tax purposes within hampshire county. Step 2 sign into your pro.

How to get Home Depot Tax Exempt ID in 20 minutes How To Get Home

We suggested he change the phone number on his tax exemption. Web there are rules or parameters for tax exempt purchases and those with tax exemptions can be audited and held liable to pay the tax on purchases that shouldn't have been tax exempt. The number is “auto assigned” by the system during the registration.

How to Register for a Tax Exempt ID The Home Depot Pro

Web before your business can purchase products from home depot stores without paying sales tax, however, you will need to complete home depot's online application process that registers your. The id number will be numeric only and is displayed on the printed registration document. Web there are rules or parameters for tax exempt purchases and.

home depot tax exempt id military Adan Cathey

Web the home depot tax exempt id number is used when making tax exempt purchases in lieu of the state issued tax exempt id number. Web about hampshire county assessor. Because the 1% williamstown use tax rate is lower that the local sales tax rates imposed in ohio, the construction materials will not be subject.

Home Depot Tax Exempt Phone Number Web you will need to enter an email address when registering in order to use this feature. Web federal tax identification number: Web go to the home depot tax exempt registration page in your web browser (see resources). Web the home depot sites the home depot the home depot canada the home depot mexico need help with your registration? Links to the appropriate forms are listed immediately below.

Links To The Appropriate Forms Are Listed Immediately Below.

Web about a year ago, one of our pro customers called to ask what could be done about others using his tax exempt phone number. The number is “auto assigned” by the system during the registration process. Web go to the home depot tax exempt registration page in your web browser (see resources). He said that an audit revealed a bunch of tax exempt receipts that weren't his business's purchases.

Taxpayers Needing To File An Appeal For Their 2023 Assessments May Also Do So Online.

And since the ohio sales tax rate is lower than west virginia sales tax rate, a 0.25% west virginia state use tax is due. This number is different from your state tax exemption id. Web you will need to enter an email address when registering in order to use this feature. If you already have a the home depot tax exempt id, skip to step 10.

Web About Hampshire County Assessor.

Web there are rules or parameters for tax exempt purchases and those with tax exemptions can be audited and held liable to pay the tax on purchases that shouldn't have been tax exempt. The number is auto assigned by the system during the registration process. Et monday through friday view tax exempt customer faqs Web the home depot mexico.

The Id Number Will Be Numeric Only And Is Displayed On The Printed Registration Document.

Web if you have questions regarding your the home depot charge account, please contact our credit center at the following phone numbers: Because the 1% williamstown use tax rate is lower that the local sales tax rates imposed in ohio, the construction materials will not be subject to the use tax imposed by williamstown, west virginia. Web step 1 to shop tax free, you need a tax exempt id from the home depot. Web federal tax identification number: