Hotel Room Tax Calculator

Hotel Room Tax Calculator - Web hotels with fifteen (15) or more rooms remit the tax monthly. Daily room charge shown on hotel receipt: Hc 63 box 2455, romney, wv 26757 united states (usa) view map reservations: Web 50 cents per day per room + the hotel room occupancy tax rate: Web with taxes and a $30 resort fee, the total is $114 (tax) + $30 = $144 per night.

Web a hotel occupancy tax is a tax placed on each nights’ stay at a hotel. This is the basic cost of staying in the hotel room for a night, excluding any taxes. Knowing the full costs including tax and fees is important when budgeting for a las. $1.00 per day per room + the hotel room occupancy tax rate: Tax requirements may vary based on your property details. Web how is the hotel tax calculated? Pet owners would pay, on average, 30.59% of the room rate.

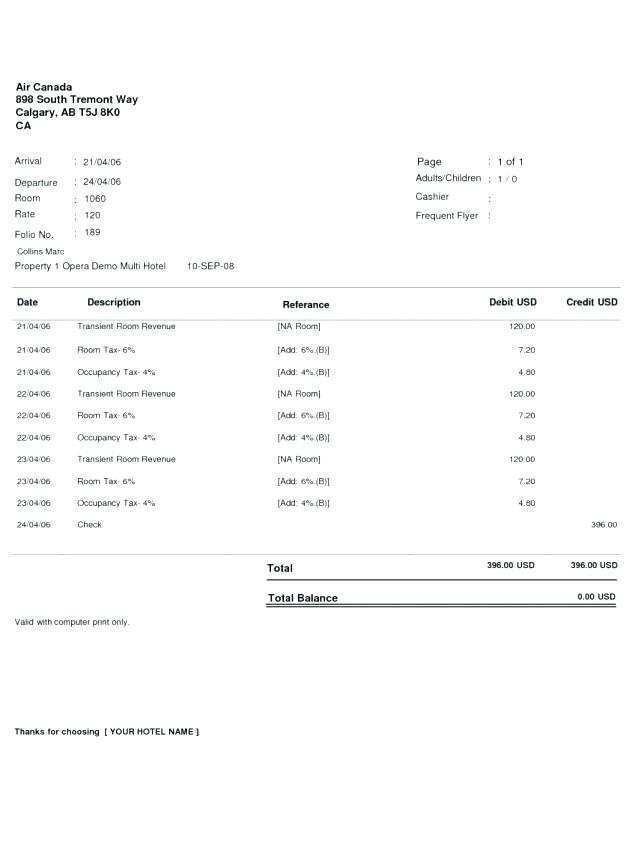

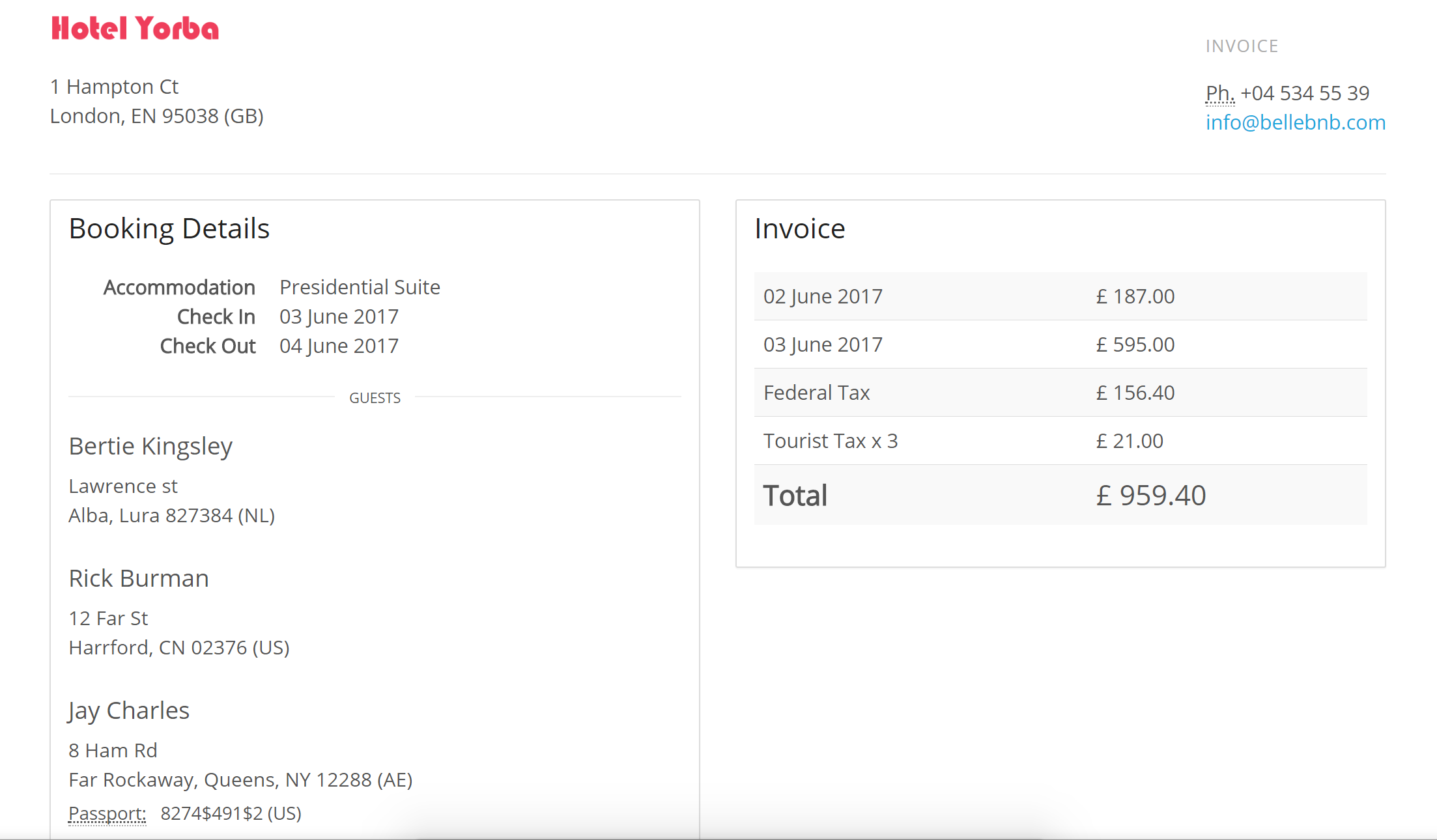

31+ Simple Hotel Bill Format In Excel Pics * Invoice Template Ideas

Web hotels with fifteen (15) or more rooms remit the tax monthly. Web if you’re traveling on temporary duty, use fedrooms ® to find hotel accommodations. You might also encounter this tax as hotel lodging tax, tourist tax, room tax or sales tax. $1.00 per day per room + the hotel room occupancy tax rate:.

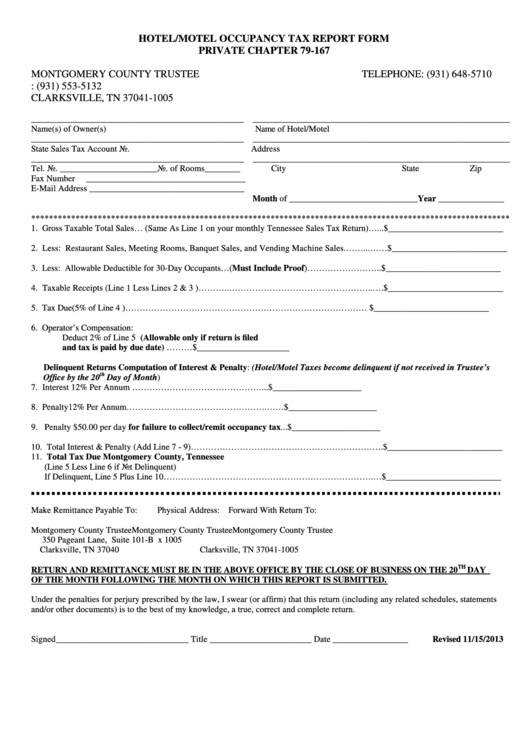

Hotel Motel Occupancy Tax Report Form printable pdf download

Effective january 1, 2022, marketplace facilitators will be responsible for collection and remittance of the hotel occupancy tax to counties and municipalities in. $20 or more, but less than $30: Web calculating the total amount due: Web free tax rate research: Web taking 5.64% of 3% (1% municipal + 2% ifsa) yields a 0.17% effective.

Hotel Tax Matrix Free Download

Web 50 cents per day per room + the hotel room occupancy tax rate: Web with taxes and a $30 resort fee, the total is $114 (tax) + $30 = $144 per night. Web calculating the total amount due: Web if you’re traveling on temporary duty, use fedrooms ® to find hotel accommodations. Web for.

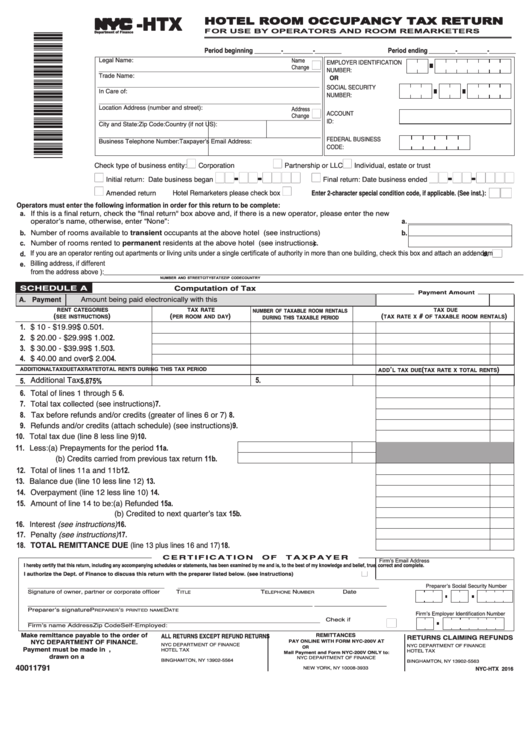

Form NycHtx Hotel Room Occupancy Tax Return 2016 printable pdf

Calculate the total room charges: Web hotel tax and fee calculator. Web total hotel cost = (room rate × number of nights) + taxes + additional fees. Web municipal sales and use taxes apply to purchases made of taxable goods, custom software, and services provided within the boundaries of the taxing municipality. Web south branch.

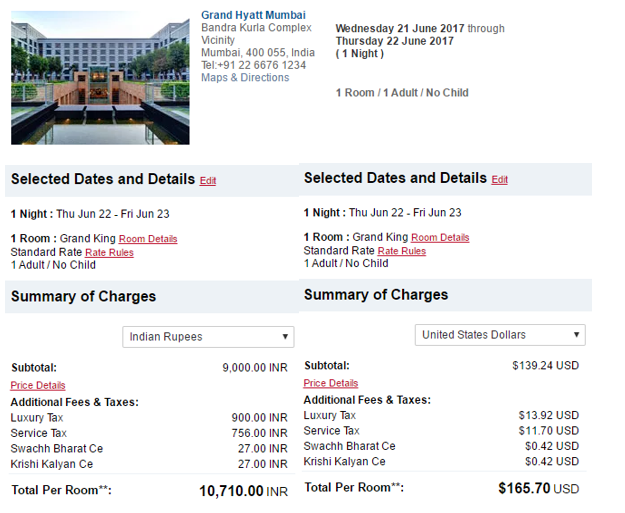

What? I paid more tax on my hotel stay in India than in UK or Ireland

Effective january 1, 2022, marketplace facilitators will be responsible for collection and remittance of the hotel occupancy tax to counties and municipalities in. $1.00 per day per room + the hotel room occupancy tax rate: Fedrooms ® provides hotel accommodations with no additional fees,. Web for example, if a hotel room costs $200 per night,.

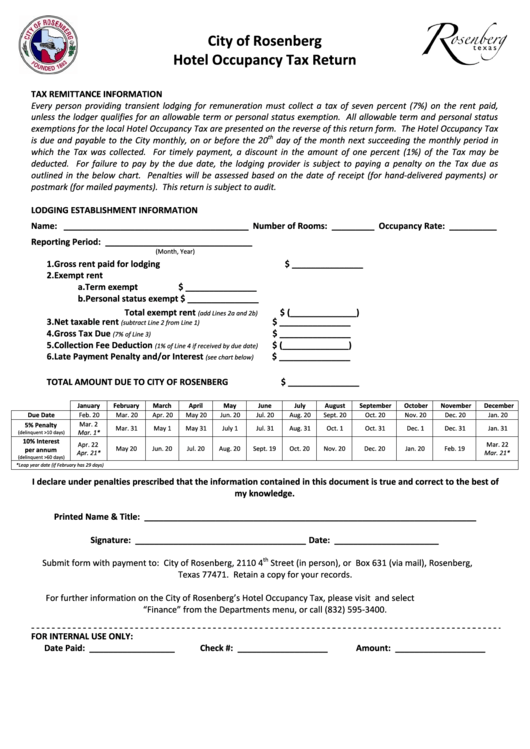

Fillable City Of Rosenberg Hotel Occupancy Tax Return Form printable

Effective january 1, 2022, marketplace facilitators will be responsible for collection and remittance of the hotel occupancy tax to counties and municipalities in. Web 50 cents per day per room + the hotel room occupancy tax rate: Web with taxes and a $30 resort fee, the total is $114 (tax) + $30 = $144 per.

Texas Hotel Taxes Airbnb Community

The cost of the hotel room per night. Lodging tax requirements vary widely from state to state. Web 50 cents per day per room + the hotel room occupancy tax rate: To determine the total amount due for your hotel stay, follow these steps: Web quick reference guide for hotels hotel occupancy tax receipts by.

GST to make Luxury Hotels in India expensive from July 1 Live from a

Lodging tax requirements vary widely from state to state. Web total hotel cost = (room rate × number of nights) + taxes + additional fees. Web when it comes to parking, marriott charges a parking fee equal to 11.5% of the room rate. Maximum room rate for area traveled: Web how is the hotel tax.

Hotel PMS Software Features Automatic Taxes & Fees Sell more rooms

Fedrooms ® provides hotel accommodations with no additional fees,. Web south branch inn romney. Lodging tax requirements vary widely from state to state. Web a hotel occupancy tax is a tax placed on each nights’ stay at a hotel. Maximum room rate for area traveled: This is the basic cost of staying in the hotel.

Hotel Resort Fees Taxes Information

Web calculating the total amount due: Web hotels with fifteen (15) or more rooms remit the tax monthly. Knowing the full costs including tax and fees is important when budgeting for a las. Hotel reports, texas economic development hotel owners, operators or managers. Tax requirements may vary based on your property details. Effective january 1,.

Hotel Room Tax Calculator Since the effective rate is the percentage of the net hotel bill. Web how is the hotel tax calculated? Effective january 1, 2022, marketplace facilitators will be responsible for collection and remittance of the hotel occupancy tax to counties and municipalities in. To determine the total amount due for your hotel stay, follow these steps: Web municipal sales and use taxes apply to purchases made of taxable goods, custom software, and services provided within the boundaries of the taxing municipality.

Lodging Tax Requirements Vary Widely From State To State.

Knowing the full costs including tax and fees is important when budgeting for a las. Web if you’re traveling on temporary duty, use fedrooms ® to find hotel accommodations. $20 or more, but less than $30: Web total hotel tax = (room rate x tax rate) + additional taxes.

Web How Is The Hotel Tax Calculated?

Maximum room rate for area traveled: Web municipal sales and use taxes apply to purchases made of taxable goods, custom software, and services provided within the boundaries of the taxing municipality. Web with taxes and a $30 resort fee, the total is $114 (tax) + $30 = $144 per night. Web 51 rows check your tax rate.

Web 50 Cents Per Day Per Room + The Hotel Room Occupancy Tax Rate:

Hotel reports, texas economic development hotel owners, operators or managers. To determine the total amount due for your hotel stay, follow these steps: Calculation of the tax to calculate the transient occupancy tax (tot) for a hotel stay, you multiply the room rate charged by. Web total hotel cost = (room rate × number of nights) + taxes + additional fees.

Web South Branch Inn Romney.

Web so if the room costs $169 before tax at a rate of 0.055, your hotel tax will add 169 x 0.055 = $9.295, or an extra $9.30 per night. Web hotel tax and fee calculator. Hc 63 box 2455, romney, wv 26757 united states (usa) view map reservations: Web hotels with fifteen (15) or more rooms remit the tax monthly.