Hotel Tax And Fee Calculator

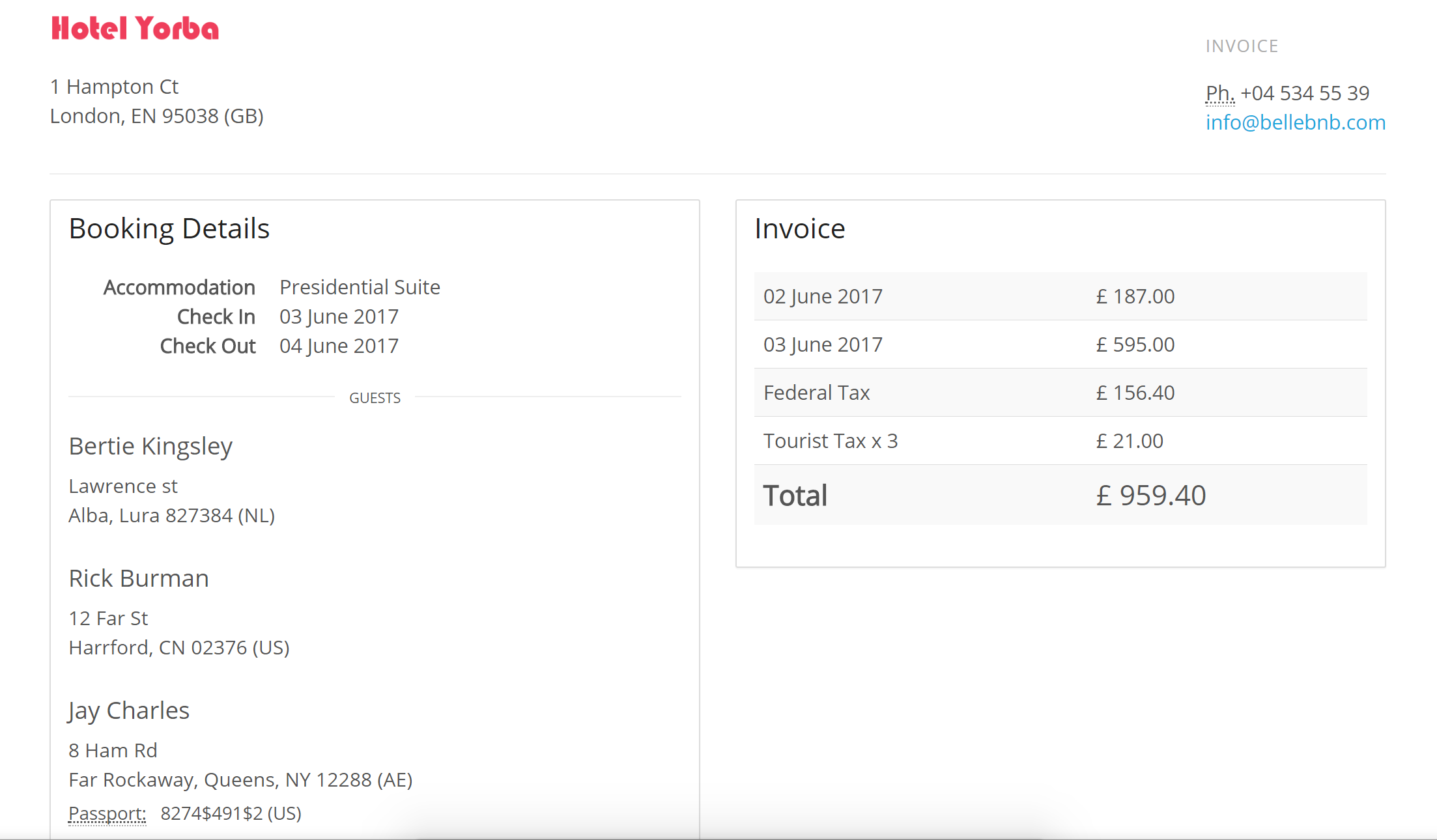

Hotel Tax And Fee Calculator - Hotel reports, texas economic development hotel owners, operators or managers. Web taxes business taxes business taxes by type hotel tax payments, assistance & taxes hotel tax due date 15th of each month, for rentals in the prior. Accurate rates for california, texas, illinois & nyc. Intuit.com has been visited by 1m+ users in the past month Web with taxes and a $30 resort fee, the total is $114 (tax) + $30 = $144 per night.

Web hotel tax and fee calculator. All tickets can be paid in one transaction with one ticket number listed for the account number and the additional tickets listed in the comment. Web it provides an estimate of past, present, or future taxes and fees, allowing users to plan their expenses accordingly. Web taxes business taxes business taxes by type hotel tax payments, assistance & taxes hotel tax due date 15th of each month, for rentals in the prior. Accurate rates for california, texas, illinois & nyc. Web minimum fee charged is $2.00. Total room charges = room rate *.

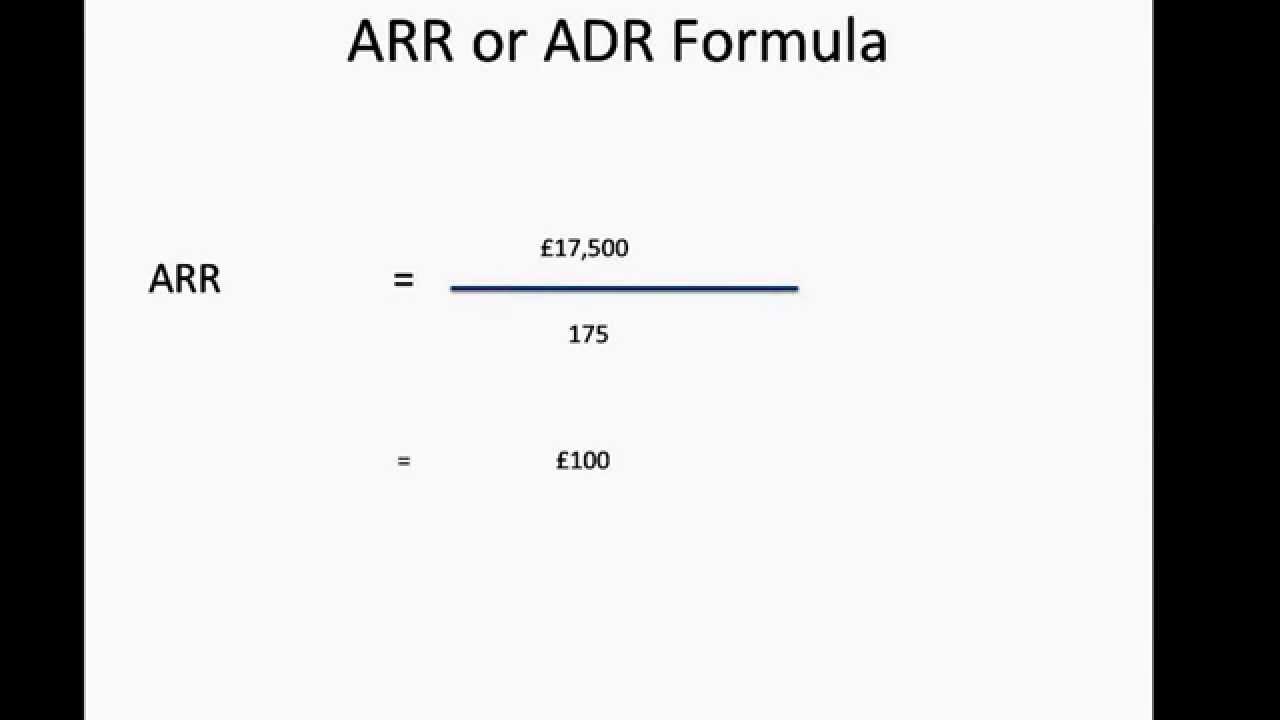

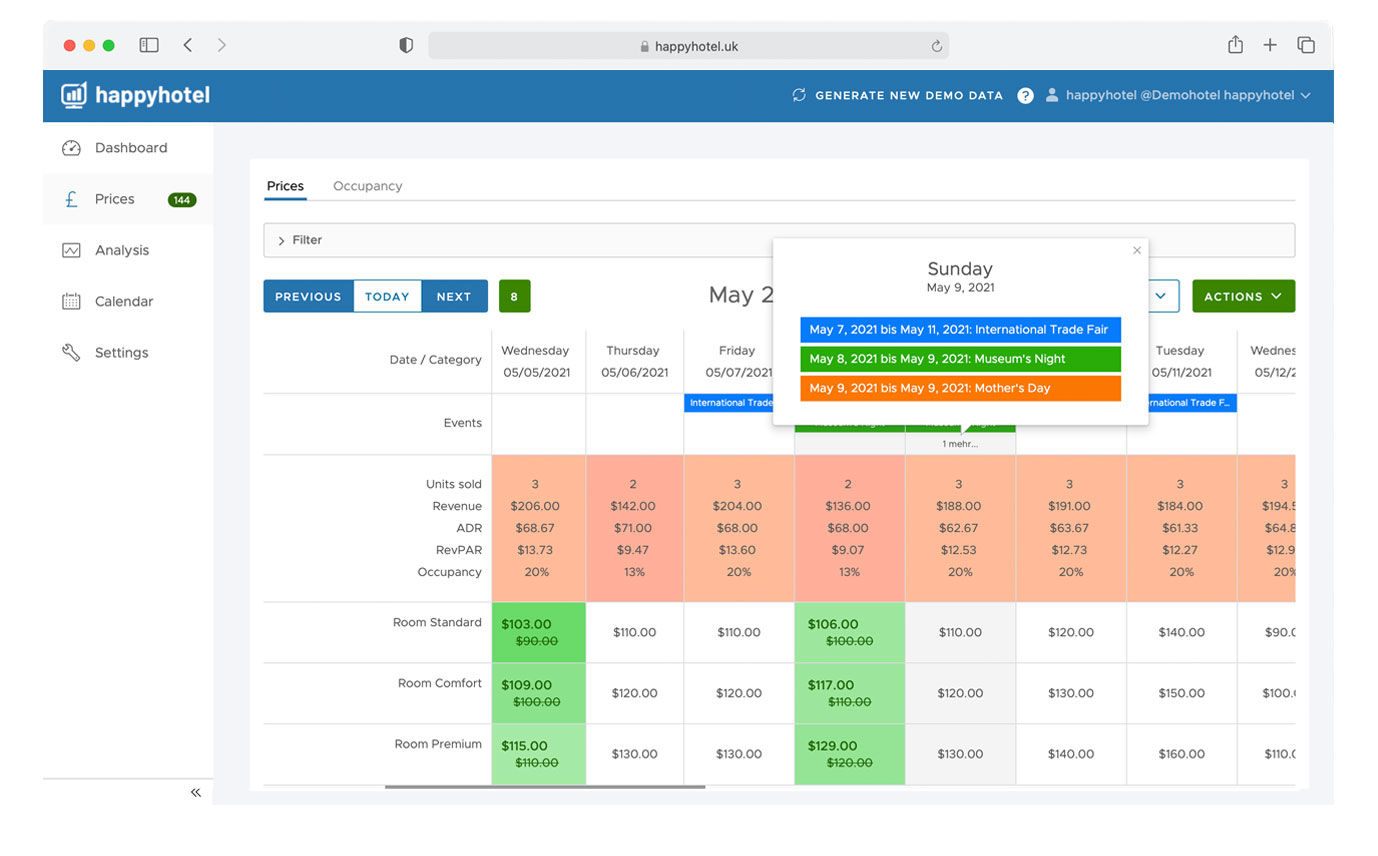

How to Calculate Hotel's Average Room Rate (ARR/ADR) YouTube

Web calculate the total room charges: Intuit.com has been visited by 1m+ users in the past month The answer will tell you the additional ‘tax’ that the fee adds to your bill. All tickets can be paid in one transaction with one ticket number listed for the account number and the additional tickets listed in.

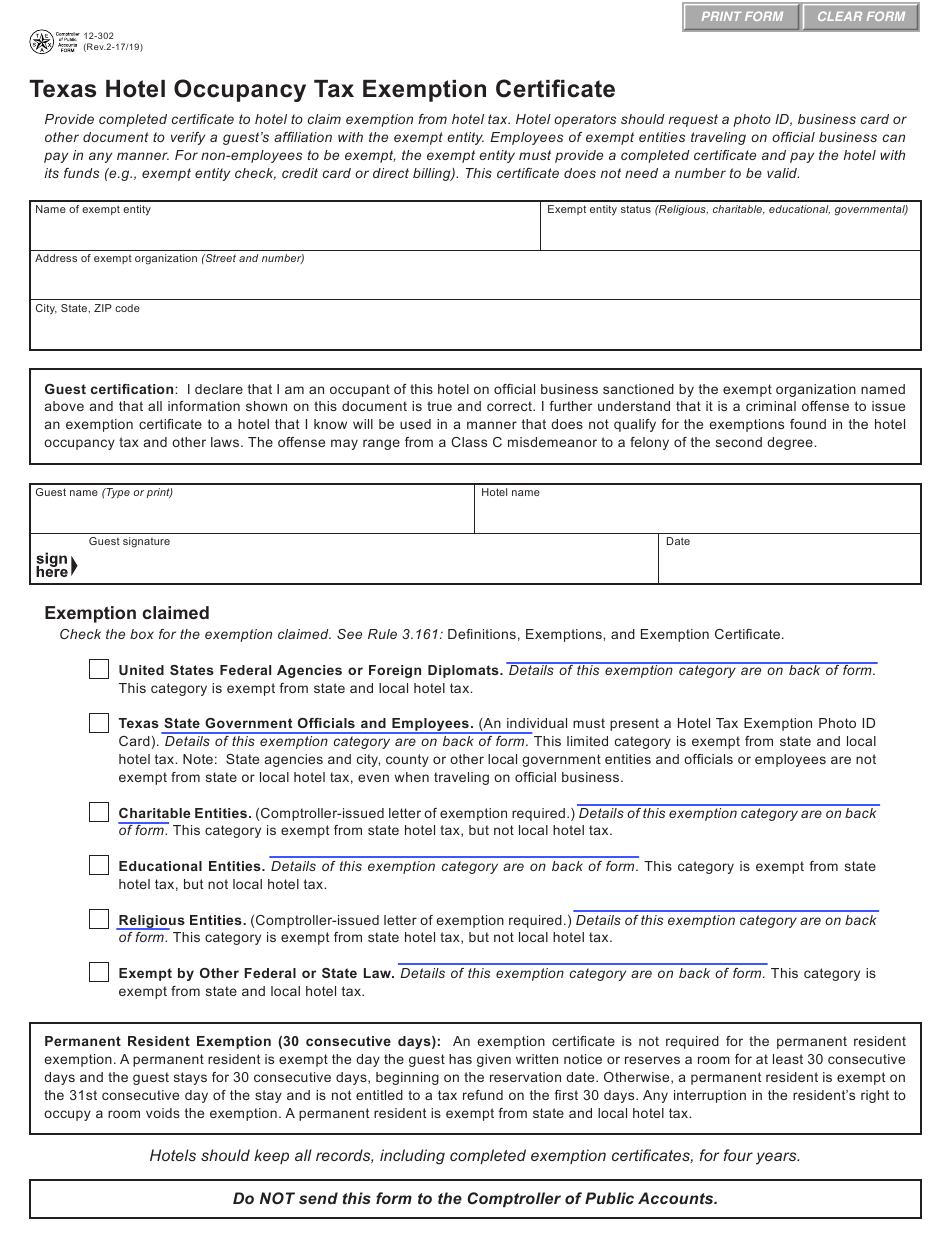

Hotel Tax Matrix Free Download

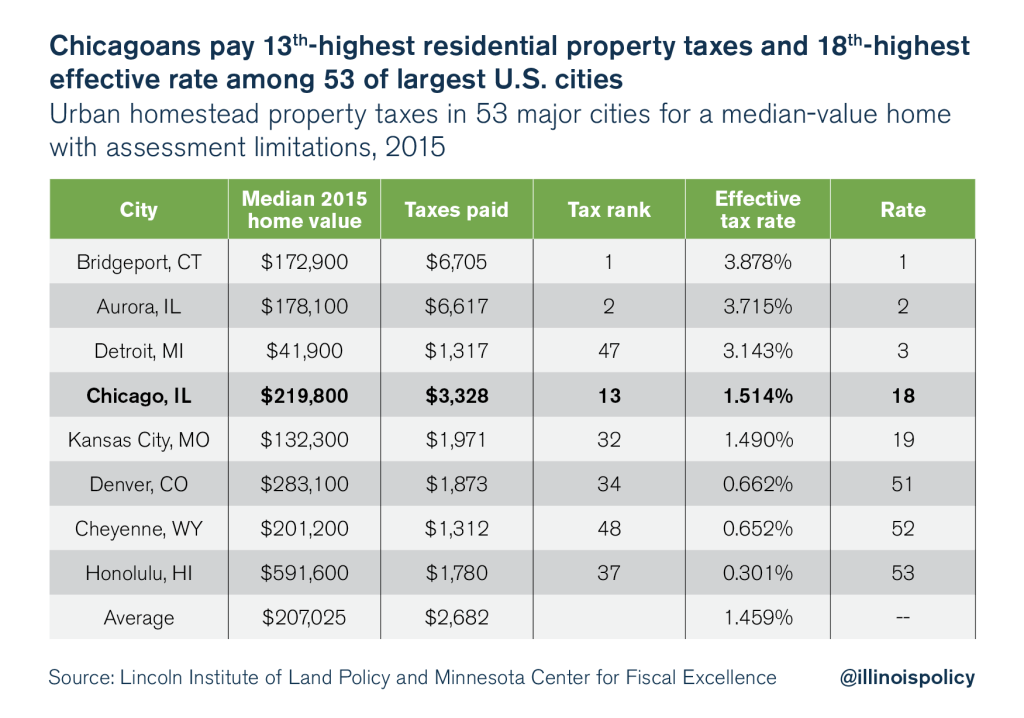

Since the effective rate is the percentage of the net hotel bill. Web taking 5.64% of 3% (1% municipal + 2% ifsa) yields a 0.17% effective rate due to those two taxes. Lodging tax requirements vary widely from state to state and even between different taxing jurisdictions within the same state. Web to get the.

How to Calculate your Hotel Room Rate? HotelTalk For Hoteliers

Effective january 1, 2022, marketplace facilitators will be responsible for collection and remittance of the hotel occupancy tax to counties and municipalities in. Daily room charge shown on hotel receipt: By entering the number of nights of stay and. So if the room costs $169 before tax at a rate of. Web 51 rows check.

hotel tax calculator illinois Abbey Kohn

Web a hotel tax calculator is a digital tool that aids in computing the total tax amount for hotel accommodations. Web quick reference guide for hotels hotel occupancy tax receipts by quarter and by month. Lodging tax requirements vary widely from state to state and even between different taxing jurisdictions within the same state. Hotel.

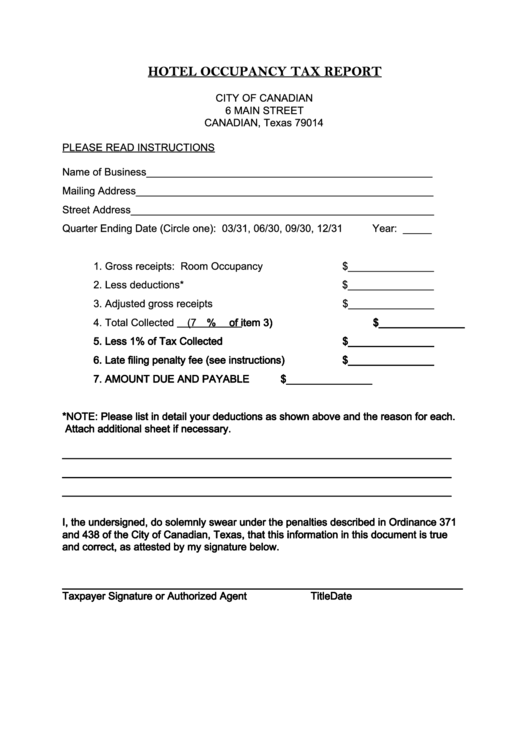

Hotel Occupancy Tax Report printable pdf download

Maximum room rate for area traveled: Web now, multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill. By entering the number of nights of stay and. Web total hotel cost = (room rate × number of nights) + taxes + additional.

Hotel PMS Software Features Automatic Taxes & Fees Sell more rooms

Hotel reports, texas economic development hotel owners, operators or managers. Web quick reference guide for hotels hotel occupancy tax receipts by quarter and by month. Intuit.com has been visited by 1m+ users in the past month Web minimum fee charged is $2.00. Web taxes that dc visitors pay hotel taxes in washington, dc the first.

How to Calculate Hotel Room Amount in MS EXCEL 2019 by using IF Formula

Web hotel tax and fee calculator. Find the perfect hotel within your budget with reviews from real travelers. Web taxes business taxes business taxes by type hotel tax payments, assistance & taxes hotel tax due date 15th of each month, for rentals in the prior. The answer will tell you the additional ‘tax’ that the.

Texas Hotel Taxes Airbnb Community

Hotel reports, texas economic development hotel owners, operators or managers. Web calculate the total room charges: Intuit.com has been visited by 1m+ users in the past month Multiply the room rate by the number of nights to get the total room charges. Web a hotel tax calculator is a digital tool that aids in computing.

Room rate calculation for hotels free template for calculation

Web municipal sales and use taxes apply to purchases made of taxable goods, custom software, and services provided within the boundaries of the taxing municipality. See tripadvisor's romney, in hotel deals and special prices all in one spot. Web quick reference guide for hotels hotel occupancy tax receipts by quarter and by month. The answer.

Form 12 302 Download Fillable PDF Or Fill Online Hotel Occupancy Tax

Lodging tax requirements vary widely from state to state and even between different taxing jurisdictions within the same state. Total room charges = room rate *. Since the effective rate is the percentage of the net hotel bill. Web taking 5.64% of 3% (1% municipal + 2% ifsa) yields a 0.17% effective rate due to.

Hotel Tax And Fee Calculator Web a hotel tax calculator is a digital tool that aids in computing the total tax amount for hotel accommodations. Intuit.com has been visited by 1m+ users in the past month Web to get the hotel tax rate, a percentage, divide the tax per night by the cost of the room before taxes. Maximum room rate for area traveled: All tickets can be paid in one transaction with one ticket number listed for the account number and the additional tickets listed in the comment.

Daily Room Charge Shown On Hotel Receipt:

Hotel reports, texas economic development hotel owners, operators or managers. Intuit.com has been visited by 1m+ users in the past month Web it provides an estimate of past, present, or future taxes and fees, allowing users to plan their expenses accordingly. Web now, multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill.

Web With Taxes And A $30 Resort Fee, The Total Is $114 (Tax) + $30 = $144 Per Night.

Web taxes that dc visitors pay hotel taxes in washington, dc the first tax that almost all washington, dc visitors will experience is the hotel/transient accommodations tax. Web hotel tax and fee calculator. Web calculate the total room charges: Web total hotel cost = (room rate × number of nights) + taxes + additional fees.

Maximum Room Rate For Area Traveled:

Web if you’re short on time, here’s a quick answer to your question: So if the room costs $169 before tax at a rate of. Web to get the hotel tax rate, a percentage, divide the tax per night by the cost of the room before taxes. Multiply the room rate by the number of nights to get the total room charges.

Knowing The Full Costs Including Tax And Fees Is Important When Budgeting For A.

The answer will tell you the additional ‘tax’ that the fee adds to your bill. Web minimum fee charged is $2.00. Multiply the answer by 100 to get the rate. It factors in various components such as room rates,.