Household Employee Tax Calculator

Household Employee Tax Calculator - Web federal paycheck quick facts. Web oct 21, 2022 | gtm blog. As a household employee, your employer is responsible for withholding social security and medicare. Futa wages — total cash wages of $1,000 or more in any calendar quarter to all household employees;. $27,700 for married couples filing jointly or qualifying surviving spouse.

However, this tax payment is divided in half between the employer and the employee. Household work is work done in or around your home. Web updated on october 17, 2022 reviewed by eric estevez fact checked by lars peterson in this article view all definition of an employee when an employee isn't an employee. Some examples of workers who do household work are: Web note that as of 2020, you can pay your nanny up to $2,199 gross per year before you both may be responsible for fica taxes. Web calculate your take home pay per paycheck for both salary and hourly employees using forbes advisor`s paycheck calculator. Web here’s how the taxes would break out:

FREE 12+ Sample Tax Calculator Templates in PDF

Here’s what that means for families with household help like nannies, housekeepers, and senior. If you hired a household employee and exceeded these thresholds, you'll be responsible for paying and reporting. Web you must include schedule h as part of your tax return if you paid any single employee at least $2,600 in the 2023.

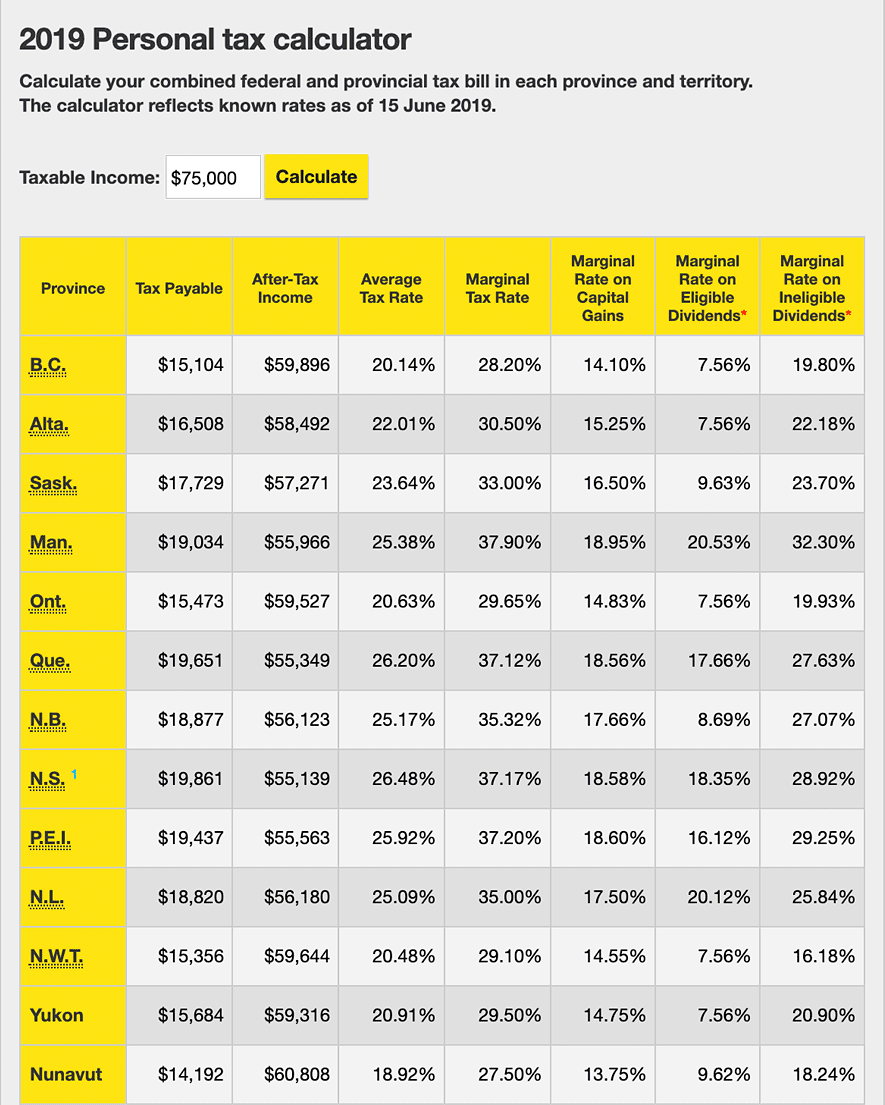

Tax returns calculator

Web the household employment taxes that you may have to account for on schedule h cover the same three taxes that are withheld from all employment wages:. As a household employee, your employer is responsible for withholding social security and medicare. Web understand your nanny tax and payroll obligations with our nanny tax calculator. Care.com.

Oct 19 IRS Here are the new tax brackets for 2023

See how your withholding affects. The 2023 nanny tax threshold will be $2,600. Web simply multiply your nanny’s gross wages by 7.65% to get your fica tax responsibility. Care.com has been visited by 100k+ users in the past month Web cash wages of $1,900 or more to any one household employee; Web for example, if.

13+ Sample Tax Calculators Sample Templates

But if your income remains at $45,000 in 2024, you'll drop. Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your. Web here’s how the taxes would break out: Web the fica rate due every pay period.

Amazing Calculator for Household Employment Taxes 2022 & 2023 With FAQs

Web oct 21, 2022 | gtm blog. Web here’s how the taxes would break out: Web cash wages of $1,900 or more to any one household employee; If you hired a household employee and exceeded these thresholds, you'll be responsible for paying and reporting. Some examples of workers who do household work are: Web the.

How to Create an Tax Calculator in Excel YouTube

Real median household income (adjusted for inflation) in. Web you must include schedule h as part of your tax return if you paid any single employee at least $2,600 in the 2023 tax year or if cash wages to all household. Web note that as of 2020, you can pay your nanny up to $2,199.

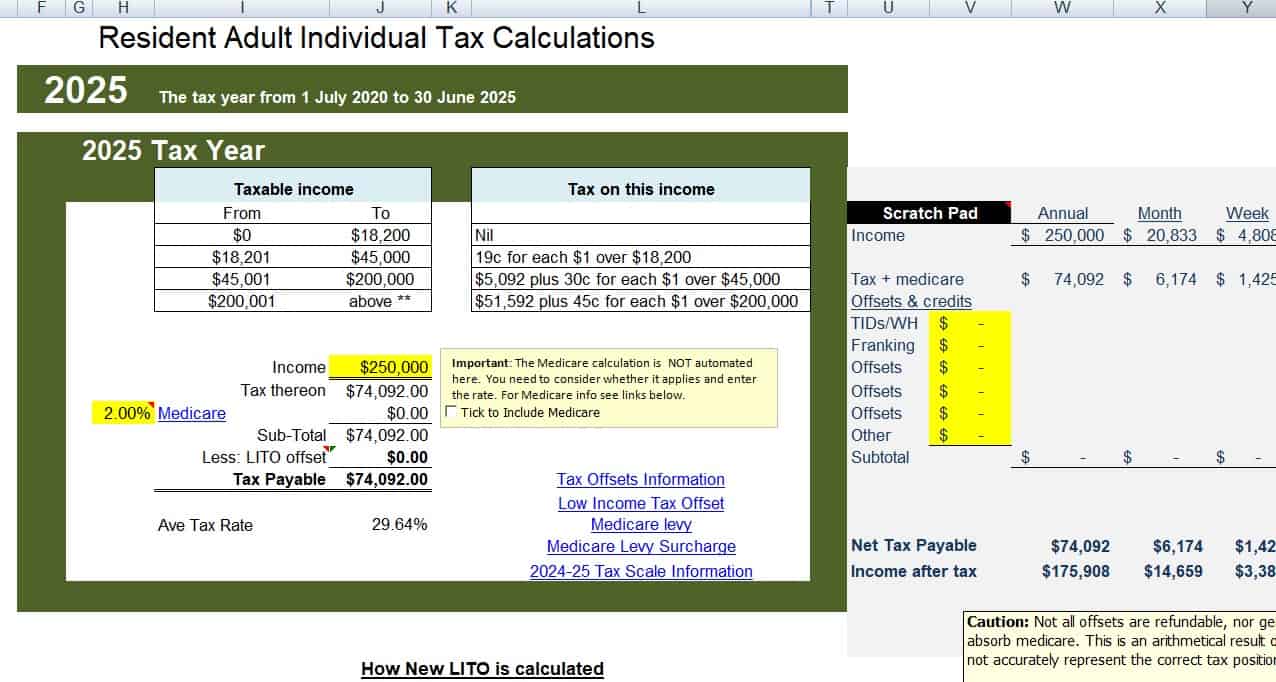

Tax Calculator atotaxrates.info

Web federal paycheck quick facts. $27,700 for married couples filing jointly or qualifying surviving spouse. $13,850 for single or married filing separately. Web the household employment taxes that you may have to account for on schedule h cover the same three taxes that are withheld from all employment wages:. Real median household income (adjusted for.

tax calculator Excel sheet for salaried individuals YouTube

Web how to calculate annual income. Web note that as of 2020, you can pay your nanny up to $2,199 gross per year before you both may be responsible for fica taxes. Web the standard deduction for 2023 is: Web calculate your take home pay per paycheck for both salary and hourly employees using forbes.

Tax Return Should I claim 400 or 3,000 for Home Office Expenses for

Web oct 21, 2022 | gtm blog. Web federal paycheck quick facts. Web the fica rate due every pay period is 15.3% of an employee’s wages. Web the standard deduction for 2023 is: However, this tax payment is divided in half between the employer and the employee. $27,700 for married couples filing jointly or qualifying.

Amazing Calculator for Household Employment Taxes 2022 & 2023 With FAQs

Web the fica rate due every pay period is 15.3% of an employee’s wages. Web federal paycheck quick facts. For example, if your nanny grosses $800/week then your fica tax for that. Our nanny tax calculator will help you to calculate nanny pay and determine your tax. Web note that as of 2020, you can.

Household Employee Tax Calculator Web federal paycheck quick facts. Web you must include schedule h as part of your tax return if you paid any single employee at least $2,600 in the 2023 tax year or if cash wages to all household. Care.com has been visited by 100k+ users in the past month Web use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. If you hired a household employee and exceeded these thresholds, you'll be responsible for paying and reporting.

Web Here’s How The Taxes Would Break Out:

Web paycheck manager's free payroll calculator offers online payroll tax deduction calculation, federal income tax withheld, pay stubs, and more. Web how to calculate annual income. Here’s what that means for families with household help like nannies, housekeepers, and senior. For example, if your nanny grosses $800/week then your fica tax for that.

Withhold 7.65% Or $2,295 As The Employee’s Share Of Social Security And Medicare Taxes.

Web understand your nanny tax and payroll obligations with our nanny tax calculator. If you hired a household employee and exceeded these thresholds, you'll be responsible for paying and reporting. Household work is work done in or around your home. Web simply multiply your nanny’s gross wages by 7.65% to get your fica tax responsibility.

Web Updated On October 17, 2022 Reviewed By Eric Estevez Fact Checked By Lars Peterson In This Article View All Definition Of An Employee When An Employee Isn't An Employee.

Web the fica rate due every pay period is 15.3% of an employee’s wages. Web federal paycheck quick facts. However, this tax payment is divided in half between the employer and the employee. Real median household income (adjusted for inflation) in.

Care.com Has Been Visited By 100K+ Users In The Past Month

See how your withholding affects. Some examples of workers who do household work are: Web oct 21, 2022 | gtm blog. Web the household employment taxes that you may have to account for on schedule h cover the same three taxes that are withheld from all employment wages:.