How Do You Calculate Benefits

How Do You Calculate Benefits - Web these contributions are generally calculated as a percentage of payroll and sent directly to the relevant government agency. Web benefit estimates depend on your date of birth and on your earnings history. The farther away you are from retirement, the more. Typically the pia is a function of average indexed monthly earnings (aime). Web if you make $100,000 at retirement, then you’ll need $1 million in savings.

Use this social security benefits calculator to. The farther away you are from retirement, the more. Web use this calculator to help illustrate the total compensation package for an employee. We determine the pia by. Web you can calculate the home office deduction in one of two ways: But this is a very rough estimate. See the table of bend points for the bend points applicable in.

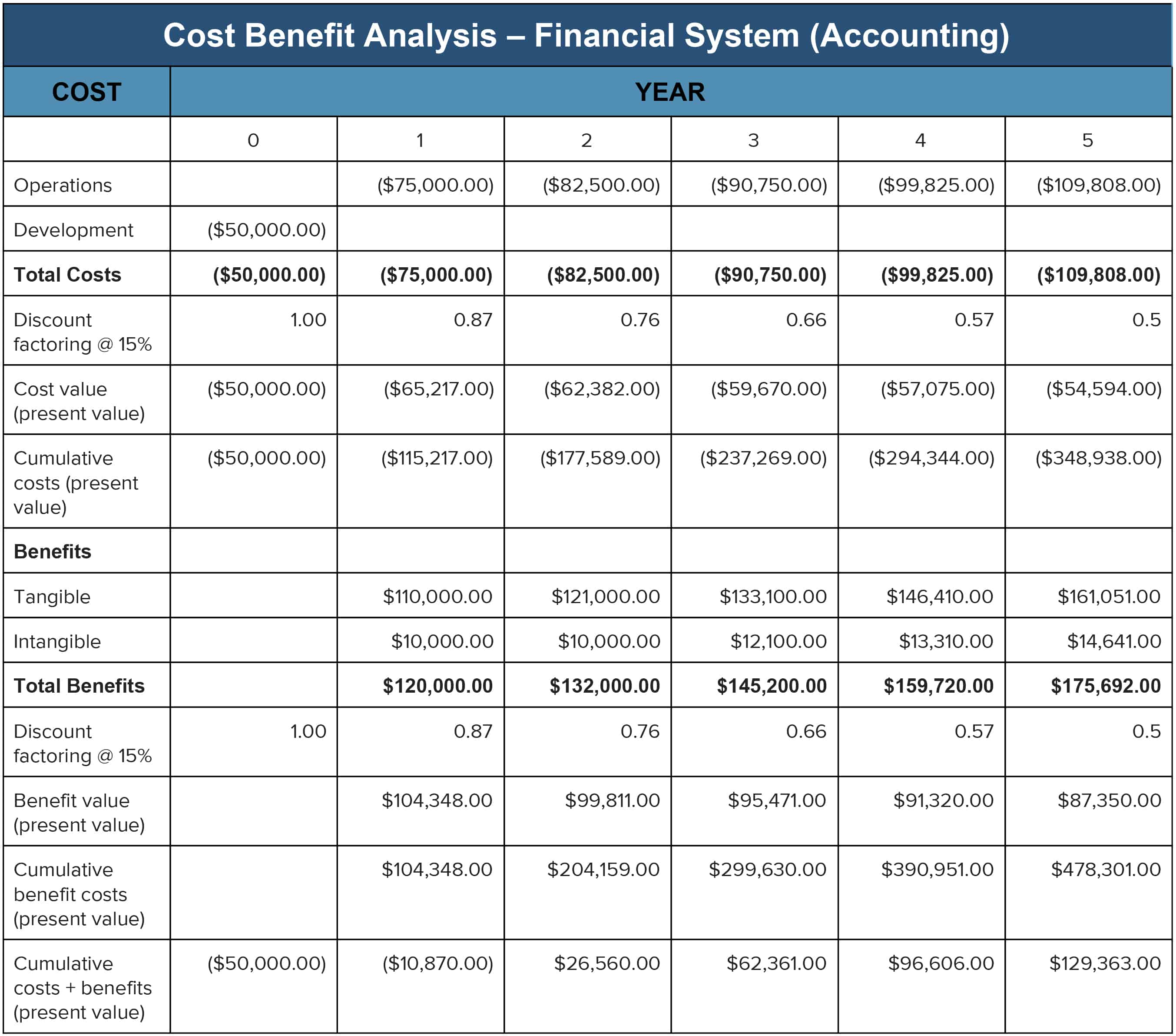

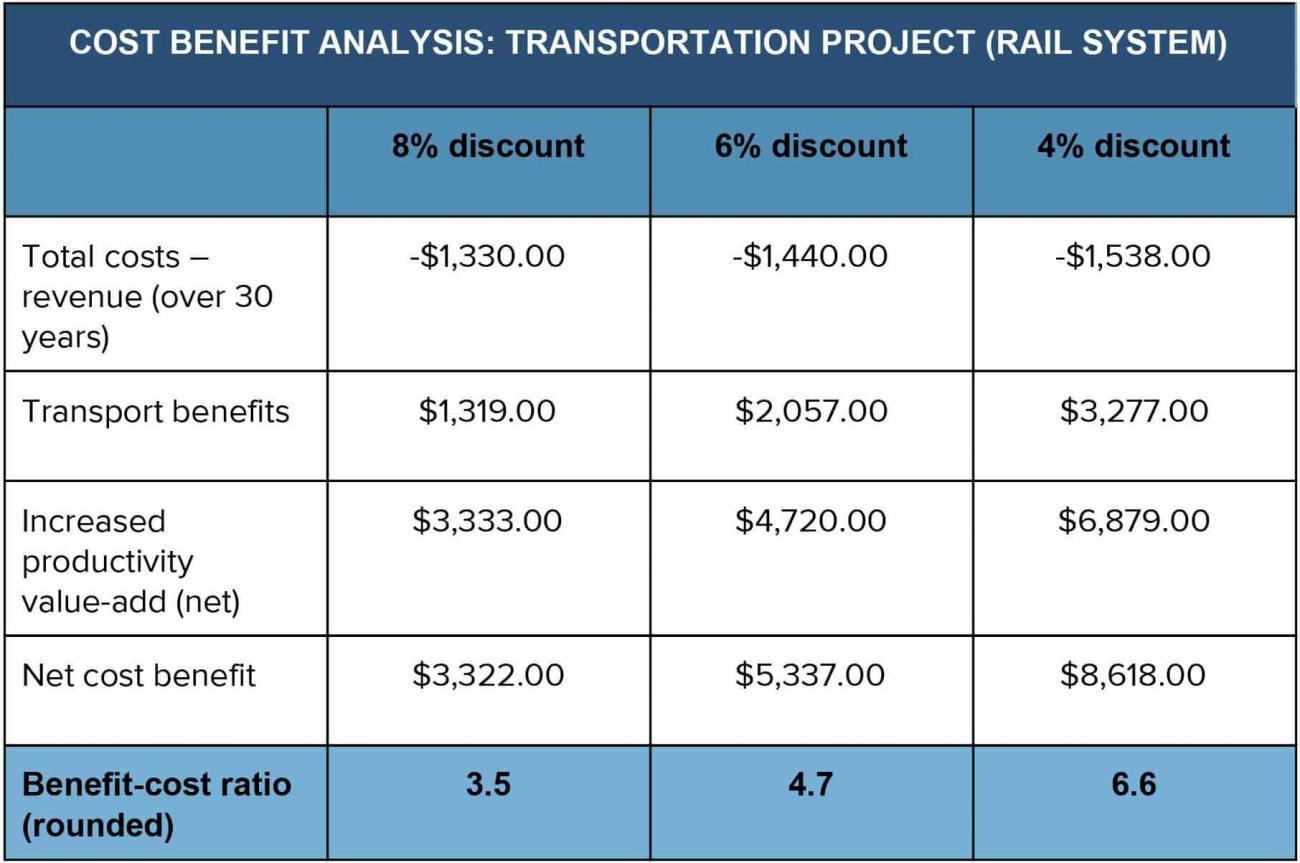

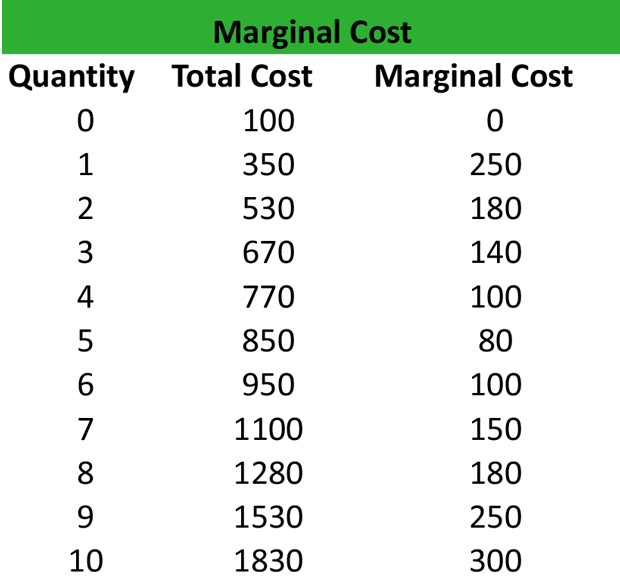

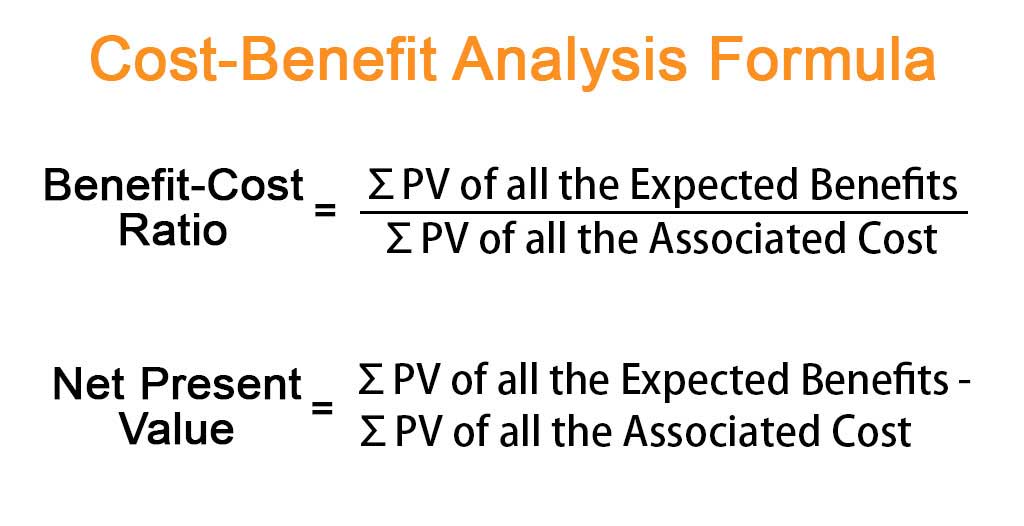

How To Calculate Cost Benefit

Typically the pia is a function of average indexed monthly earnings (aime). The simplified option or the regular method. To do this, you’ll need to get use a notepad or a tool like. For combined income between $25,000. Our tool also helps you see. Multiply the amount of your pia. Web the basic social security.

How To Calculate Cost Benefit

Web use this calculator to help illustrate the total compensation package for an employee. Web the bend points in the year 2024 pia formula, $1,174 and $7,078, apply for workers becoming eligible in 2024. So benefit estimates made by. Web to calculate it manually you’ll need to take the following steps with your pia. Web.

Cost Benefit Analysis An Expert Guide Smartsheet

Gainbridge.io has been visited by 10k+ users in the past month Multiply the amount of your pia. The aarp retirement calculator helps you refine that. Web the maximum social security benefit you can receive in 2023 ranges from $2,572 to $4,555 per month, depending on the age you retire. Web to calculate it manually you’ll.

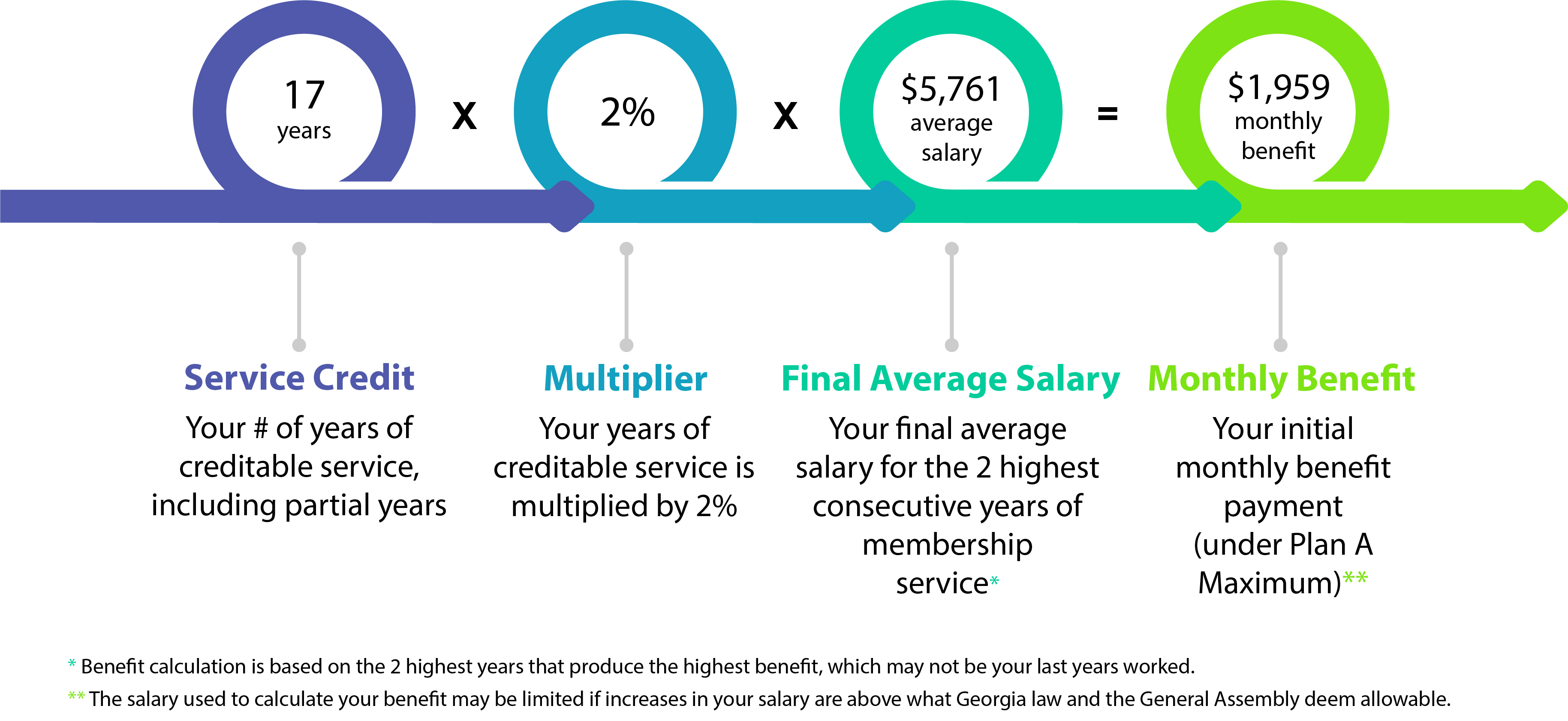

Calculating Your Benefit

Instead, it will estimate your earnings based on information you provide. So let’s jump in with calculating your aime. Web you can use social security's benefit calculators to: The aarp retirement calculator helps you refine that. Adjust all earnings for inflation. Web the bend points in the year 2024 pia formula, $1,174 and $7,078, apply.

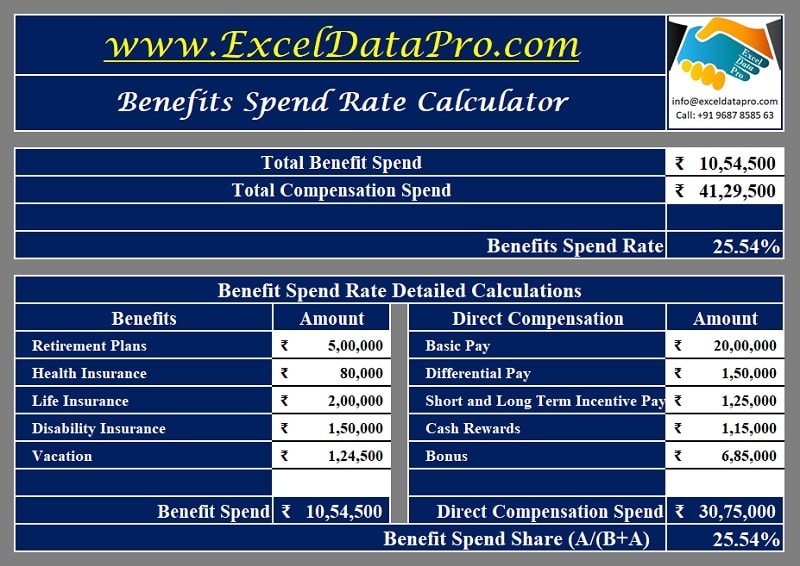

Download Benefits Spend Rate Calculator Excel Template ExcelDataPro

Gainbridge.io has been visited by 10k+ users in the past month Plus 32 percent of any amount over $1,115 up to $6,721; To do this, you’ll need to get use a notepad or a tool like. Web you can calculate the home office deduction in one of two ways: But this is a very rough.

How to Calculate Social Security Benefits 13 Steps

Web you can calculate the home office deduction in one of two ways: The farther away you are from retirement, the more. But this is a very rough estimate. Web if your combined income is under $25,000 (single) or $32,000 (joint filing), there is no tax on your social security benefits. Adjust all earnings for.

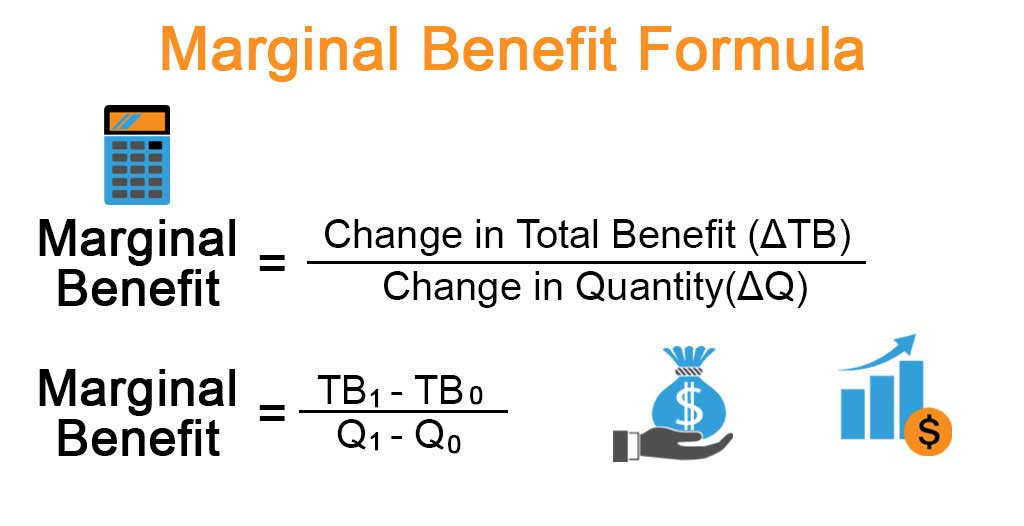

Marginal Benefit Formula Calculator (Examples with Excel Template)

So benefit estimates made by. The farther away you are from retirement, the more. Typically the pia is a function of average indexed monthly earnings (aime). Web to calculate it manually you’ll need to take the following steps with your pia. Web when you calculate how much of your social security benefit is taxable, use.

Cost Benefit Analysis An Expert Guide Smartsheet

Web social security calculation step 1: Web if your combined income is under $25,000 (single) or $32,000 (joint filing), there is no tax on your social security benefits. Plus 15 percent of any amount over $6,721. For security, the quick calculator does not access your earnings record; Web if your production costs are $50 and.

How To Calculate Marginal Benefit In Economics

Web the maximum benefit for a retired worker who claims at full retirement age will go up to $3,822 per month in 2024, up from $3,627 per month in 2023. Web use this calculator to help illustrate the total compensation package for an employee. Web the calculator provides an estimate of your monthly social security.

Cost Benefit Analysis Formula Calculator (Example with Excel Template)

Web to calculate it manually you’ll need to take the following steps with your pia. Plus 32 percent of any amount over $1,115 up to $6,721; Web calculate what your employer spends on your total compensation package which is based on the base salary plus bonuses and benefits with this personalized tool. $50 x (1.

How Do You Calculate Benefits The aarp retirement calculator helps you refine that. Web when you calculate how much of your social security benefit is taxable, use the $2,000/month number and multiply that by the number of months to get the. For security, the quick calculator does not access your earnings record; Web use this calculator to help illustrate the total compensation package for an employee. Web you can use social security's benefit calculators to:

Multiply The First $1,425 Of Your Pia By 150%.

Web if your production costs are $50 and you want to achieve a 40% profit margin, your selling price would be $70. Web the average cost for professional liability insurance for sole proprietors is $61 per month and workers compensation costs an average of $45 per month. Web you can use social security's benefit calculators to: Web calculate what your employer spends on your total compensation package which is based on the base salary plus bonuses and benefits with this personalized tool.

Our Tool Also Helps You See.

Web the calculator provides an estimate of your monthly social security retirement benefit, based on your earnings history and age. So benefit estimates made by. Web if you make $100,000 at retirement, then you’ll need $1 million in savings. As cnbc said, the simplified option uses a standard.

Web The Basic Social Security Benefit Is Called The Primary Insurance Amount (Pia).

But this is a very rough estimate. Adjust all earnings for inflation. For security, the quick calculator does not access your earnings record; Instead, it will estimate your earnings based on information you provide.

Web You Can Calculate The Home Office Deduction In One Of Two Ways:

Typically the pia is a function of average indexed monthly earnings (aime). For combined income between $25,000. To do this, you’ll need to get use a notepad or a tool like. Web when you calculate how much of your social security benefit is taxable, use the $2,000/month number and multiply that by the number of months to get the.