How Do You Calculate Cash Flow To Creditors

How Do You Calculate Cash Flow To Creditors - Web cash flow to creditors can be an important indicator of a business’s financial position and can be used in debt management decisions. Where, i = interest paid. I am having a little bit of trouble on this question, and was hoping you could help me. Web the cash flow to debt ratio calculator is a financial analysis tool that assists in evaluating a company's overall financial health and its ability to repay outstanding debt. Web how to calculate cash flow to creditors?

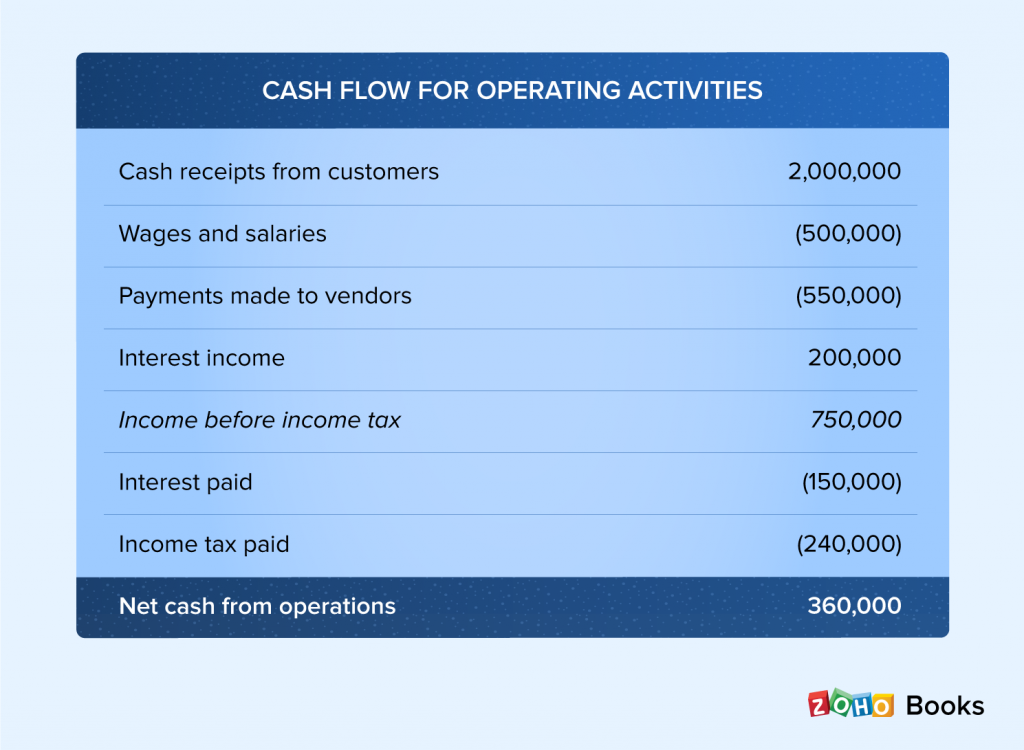

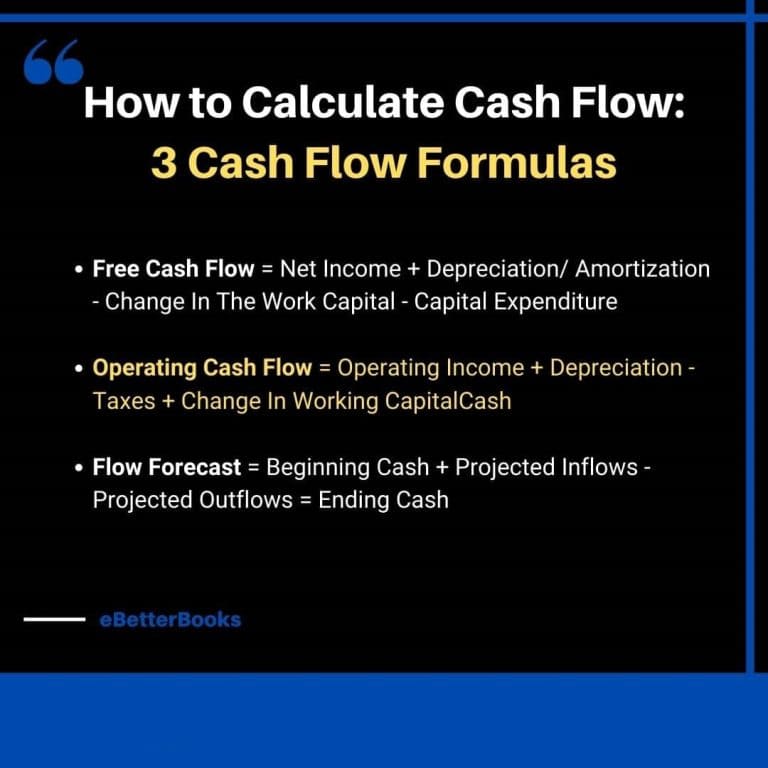

By following a few simple steps, you. Include all sources of income, such as sales. Free cash flow formula one of the most common and important cash flow formulas is free cash flow (or fcf). I am having a little bit of trouble on this question, and was hoping you could help me. When using the online cash flow to. To find the cash flow, add the. To use our cash flow calculator, you would input the following information:

Cash Flow Statement What It Is + Examples

The cash flow statement, one of the fundamental financial reports in accounting, details how changes in balance sheet accounts and. Free cash flow (fcf) is a measure of a company's financial performance , calculated as operating cash flow minus capital expenditures. B = beginning long term debt. E = ending long term debt. Where, i.

How to Calculate Cash Flow The Ultimate Guide for Small Businesses

Web cash flow to creditors can be an important indicator of a business’s financial position and can be used in debt management decisions. Below is the explanation of the components of the formula: Gather the relevant financial statements to calculate cash flow to creditors, the first step is obtaining the required financial statements. Positive flow.

Cash Flow Statement How to Calculate the Net Increase or Decrease in Cash?

Interest paid:this is the total value that you have paid as interest on the total liabilities during an accounting period. To use our cash flow calculator, you would input the following information: Web to calculate cash flow to creditors, you need to consider various components such as interest payments, dividends, and repayments of principal. Free.

The cash flow statement and it’s role in accounting

Web cash flow to creditors can be an important indicator of a business’s financial position and can be used in debt management decisions. Web formula the formula for calculating cash flow to creditors (cfc) is defined as follows: Below is the explanation of the components of the formula: Web calculate cash flow to creditors for.

How to Calculate Cash Flow for Your Business Direct vs Indirect Cash

Web calculate cash flow to creditors for fy21? Where, i = interest paid e = ending long term debt b = beginning long term debt To find the cash flow, add the. Free cash flow (fcf) is a measure of a company's financial performance , calculated as operating cash flow minus capital expenditures. Interest paid:this.

Cash Flow to Creditors and Cash Flow to Shareholders using Excel YouTube

Web formula the formula for calculating cash flow to creditors (cfc) is defined as follows: The total interest payments made to creditors during. Web the formula for calculating cash flow to creditors is as follows: Web cash flow statements: Web to calculate cash flow to creditors, you need to consider both operating and financing activities,.

How to calculate cash flow 3 cash flow formulas, calculations, and

Investments · home loans · annuities · market insights · life insurance I am having a little bit of trouble on this question, and was hoping you could help me. To find the cash flow, add the. E = ending long term debt. Positive flow (more money moving in than out) can indicate solvency, while.

How to Calculate Cash Flow The Ultimate Guide for Small Businesses

The total interest payments made to creditors during. Include all sources of income, such as sales. Web calculate cash flow to creditors for fy21? The same details are required for the calculations. I have to figure out: Web to calculate cash flow to creditors, you need to consider both operating and financing activities, as well.

How to Calculate Cash Flow 3 Cash Flow Formulas (With Examples)

B = beginning long term debt. The cash flow statement, one of the fundamental financial reports in accounting, details how changes in balance sheet accounts and. Web to calculate cash flow to creditors, you need to consider both operating and financing activities, as well as dividends paid to shareholders. Include all sources of income, such.

Cash Flow Statement Explanation and Examples AccountingCoach

Positive flow (more money moving in than out) can indicate solvency, while a negative value (more money. Free cash flow formula one of the most common and important cash flow formulas is free cash flow (or fcf). Web formula the formula for calculating cash flow to creditors (cfc) is defined as follows: Typically, you need.

How Do You Calculate Cash Flow To Creditors I am having a little bit of trouble on this question, and was hoping you could help me. Interest paid:this is the total value that you have paid as interest on the total liabilities during an accounting period. When using the online cash flow to. The ending period of the long. Web to calculate cash flow to creditors, you need to consider various components such as interest payments, dividends, and repayments of principal.

Web Cash Flow Statements:

Web how to calculate cash flow. Web cash flow can help indicate the health of a business: A business holder who paid interest of. Cfc=i−e+b interest paidinterest paid represents the total interest.

Web Formula The Formula For Calculating Cash Flow To Creditors (Cfc) Is Defined As Follows:

Where, i = interest paid. Typically, you need access to the. The cash flow to creditors calculator uses the following formula: Investments · home loans · annuities · market insights · life insurance

Web Calculate Cash Flow To Creditors For Fy21?

To use our cash flow calculator, you would input the following information: Gather the relevant financial statements to calculate cash flow to creditors, the first step is obtaining the required financial statements. Web the cash flow to debt ratio calculator is a financial analysis tool that assists in evaluating a company's overall financial health and its ability to repay outstanding debt. B = beginning long term debt.

Free Cash Flow Formula One Of The Most Common And Important Cash Flow Formulas Is Free Cash Flow (Or Fcf).

E = ending long term debt. Below is the explanation of the components of the formula: I am having a little bit of trouble on this question, and was hoping you could help me. Web to calculate cash flow to creditors, you need to consider both operating and financing activities, as well as dividends paid to shareholders.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)