How Do You Calculate Executor Fees

How Do You Calculate Executor Fees - Web executors for nc estates are entitled to compensation on up to 5% of estate receipts and expenditures. Web following the will. Web however, among the state laws, executor fees are generally calculated in one of three ways: Web here’s how it goes down: The remaining 30% is broken up following either a “tiered percentage formula” or a “flat percentage” when determining the.

Web the executor or personal administrator: Web around 70% of all states use the “reasonable compensation” method to determine what fees can be charged for executor fees. Web january 04, 2022 reviewed by michelle seidel, b.sc., ll.b./jd, mba learn about our review process ••• the probate process in georgia can be complex, especially if the. If the decedent’s will includes specific instructions about the executor’s fee, then those instructions control. Web and, here are the executor fees by state, so you know how much compensation is reasonable. The calculation can be trickier than people think. Web use the value of the assets on the date of death (not some other date).

Executor Fees in British Columbia (2023) Onyx Law Group

Web the first uses a sliding percentage scale based on the total estate gross value (the larger the estate, the smaller the percentage); The remaining 30% is broken up following either a “tiered percentage formula” or a “flat percentage” when determining the. Web use the value of the assets on the date of death (not.

How Do I Calculate My Executors Fee In New York?

Web around 70% of all states use the “reasonable compensation” method to determine what fees can be charged for executor fees. How much are the executor fees in ontario? Web executor compensation and fees. For example, the will might say that. The second simply compensates the executor for. For example, a north carolina estate of.

Executor Fees Everything You Need To Know Beeston Shenton Solicitors

Web following the will. Executor compensation and fees (ny) if the will does not specify how executor compensation should be calculated, ny estates must. 5/5 (125 reviews) Web here’s how it goes down: Web use the value of the assets on the date of death (not some other date). Web to calculate the executor of.

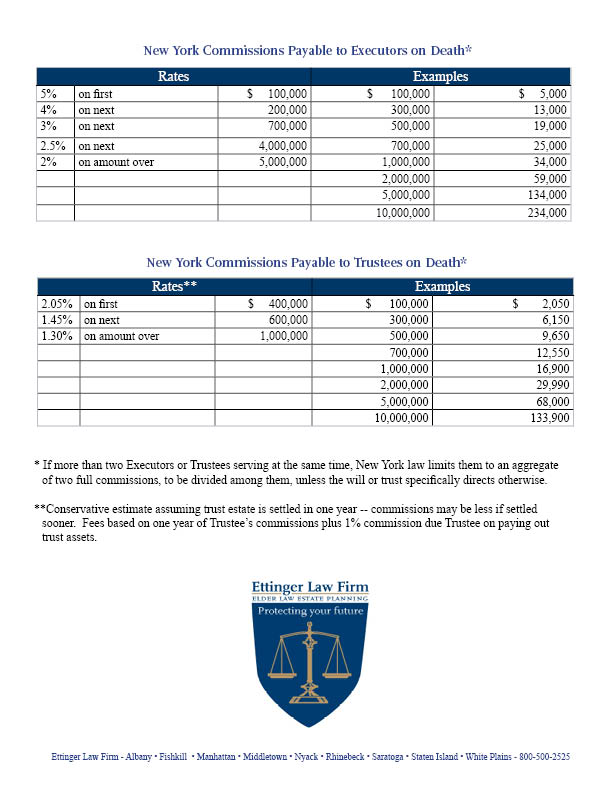

Executor vs Trustee Fees at Death Albany Wills & Trusts Lawyers

Web here’s how it goes down: The percentage is subject to a graduated schedule, meaning that the compensation as a. A varying percentage of the gross estate. Web following the will. The second simply compensates the executor for. Generally, an estate executor in ontario gets paid 5% of the estate’s value. Web executor compensation and.

Does the Executor of a Will Get Paid an Executor Fee?

Web and, here are the executor fees by state, so you know how much compensation is reasonable. Web as the fee schedule demonstrates, the compensation is based on the value of the estate. Facilitates the transfer of money and. The calculation can be trickier than people think. Click on your state in the map. Keep.

Executor Fees Everything You Need To Know Beeston Shenton Solicitors

Web create estate no registration needed! Web states determine how much an executor gets paid in a variety of different ways. $ 0.00 cad this the estimated total amount of compensation that. Web january 04, 2022 reviewed by michelle seidel, b.sc., ll.b./jd, mba learn about our review process ••• the probate process in georgia can.

Executor Fee Calculator California

For instance, some states set payment at a percentage of the estate. Facilitates the transfer of money and. Web around 70% of all states use the “reasonable compensation” method to determine what fees can be charged for executor fees. Web january 04, 2022 reviewed by michelle seidel, b.sc., ll.b./jd, mba learn about our review process.

How are executor fees set? Is it based on all assets?

Web the first uses a sliding percentage scale based on the total estate gross value (the larger the estate, the smaller the percentage); Generally, an estate executor in ontario gets paid 5% of the estate’s value. A varying percentage of the gross estate. $ 0.00 cad this the estimated total amount of compensation that. Web.

Executor Fee Definition How to Avoid Taxes Finance Strategists

The percentage is subject to a graduated schedule, meaning that the compensation as a. Web according to probate code §10800 & 10810, the attorney fee and executor compensation is calculated based on the administration of estates valued over $150,000 but still less than. Web as the fee schedule demonstrates, the compensation is based on the.

How Do I Calculate My Executor’s Fee? Legacy Design Strategies An

The calculation can be trickier than people think. Web the executor or personal administrator: Web according to probate code §10800 & 10810, the attorney fee and executor compensation is calculated based on the administration of estates valued over $150,000 but still less than. The logic behind the 5%. In states that provide for this. Web.

How Do You Calculate Executor Fees The logic behind the 5%. Web to calculate the executor of will fees, seek the advice of an estate attorney. How much are the executor fees in ontario? Executor fees by state interactive map. In states that provide for this.

The Remaining 30% Is Broken Up Following Either A “Tiered Percentage Formula” Or A “Flat Percentage” When Determining The.

Web as the fee schedule demonstrates, the compensation is based on the value of the estate. How much are the executor fees in ontario? Web according to probate code §10800 & 10810, the attorney fee and executor compensation is calculated based on the administration of estates valued over $150,000 but still less than. Web executors for nc estates are entitled to compensation on up to 5% of estate receipts and expenditures.

Web Executor Compensation And Fees (Tx) If The Will Does Not Specify How Executor Compensation Should Be Calculated, Tx Estates Must Follow State Compensation Rules.

The logic behind the 5%. The second simply compensates the executor for. Generally, an estate executor in ontario gets paid 5% of the estate’s value. $ 0.00 cad this the estimated total amount of compensation that.

Web However, Among The State Laws, Executor Fees Are Generally Calculated In One Of Three Ways:

Web the executor or personal administrator: The calculation can be trickier than people think. Click on your state in the map. A varying percentage of the gross estate.

Web Following The Will.

Web and, here are the executor fees by state, so you know how much compensation is reasonable. 4.0% on the first $100k 3.0%. Web states determine how much an executor gets paid in a variety of different ways. In states that provide for this.