How Do You Calculate Ifta

How Do You Calculate Ifta - If your state requires a paper filing, then you will need to enter the values from each of the 6 steps above into the appropriate places. Web this step includes using the applicable rates calculated by ifta. Web how to calculate ifta fuel tax reports? Web here are the steps: That may seem like a whole lot of math, but most likely, your state has an online system to calculate this for you.

Who needs to file ifta fuel tax? The ifta tax calculation process. How to calculate ifta miles? Add up all of your miles traveled for each ifta jurisdiction. Web here are the steps: Web how to calculate ifta fuel tax reports? Your ifta tax is calculated based on how many gallons of fuel you burn in each state.

IFTA for Beginners StepbyStep Guide to Calculate Taxable Gallons Blog

Use this free ifta tax calculator and state by state mileage calculator. If your state requires a paper filing, then you will need to enter the values from each of the 6 steps above into the appropriate places. But don’t worry, we have simplified the whole. Web ifta fuel tax you owe at the end.

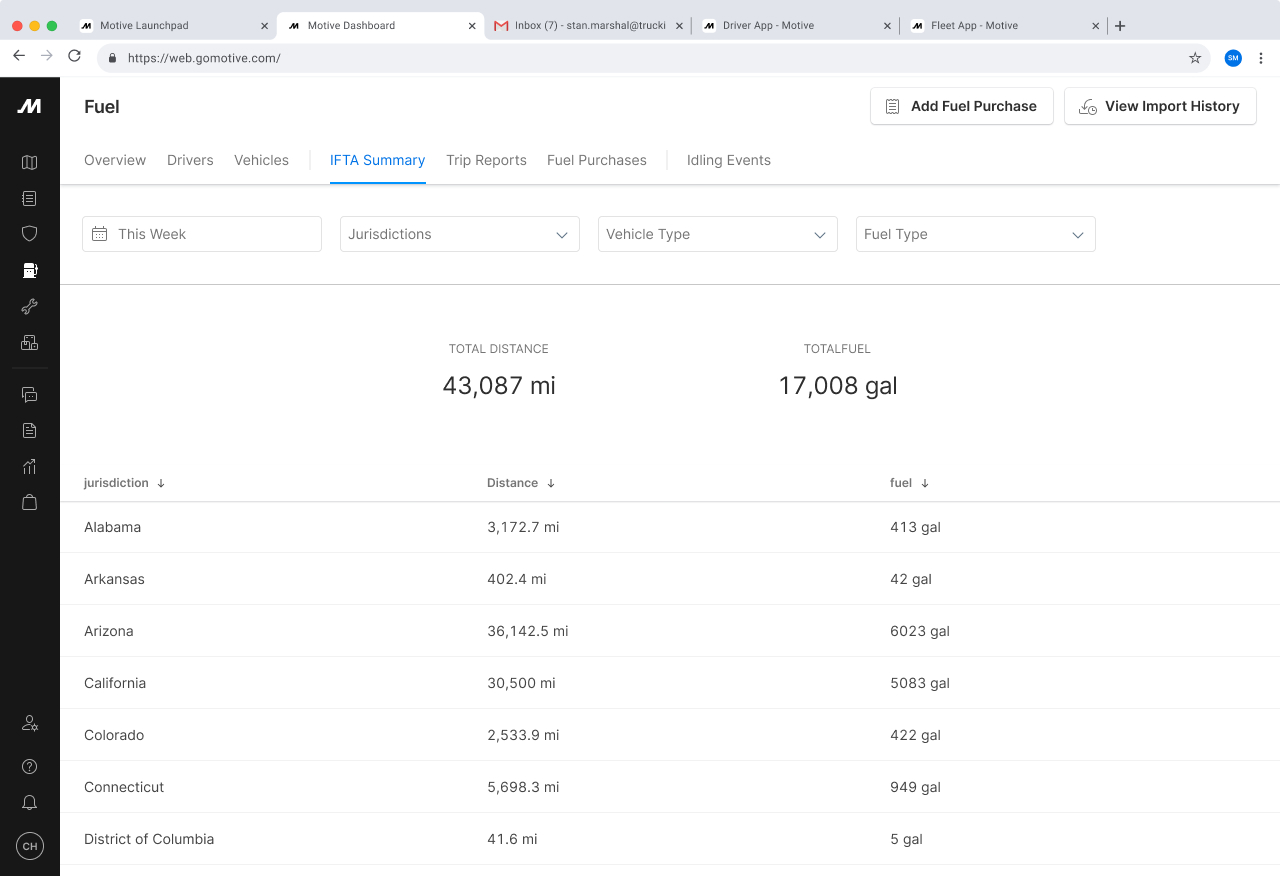

How to calculate quarterly IFTA report with Motive

You need to know details of how many miles you traveled in. There are a couple of different ways that drivers can use to keep track of miles. If your state has an online ifta filing portal, you can just enter the totals you got from steps 1 & 2 into the portal and it.

IFTA for Beginners StepbyStep Guide to Calculate Taxable Gallons Blog

You are required to record your actual odometer reading every time you cross a state or provincial line. Web how do you calculate ifta? You can do this by. In order to calculate how much tax you will need to pay per gallon, you’ll need to look at the federal tax rate, including. Web international.

Easiest Way To Calculate Your IFTA A 4 Step Guide Switchboard

Web every time you fuel up, keep the receipt. Total miles, taxable and nontaxable traveled by your qualified motor vehicle(s) per jurisdiction,. In order to calculate how much tax you will need to pay per gallon, you’ll need to look at the federal tax rate, including. You can use the following formula to calculate the.

Ifta State miles Calculator Calculate State by State Ifta Miles in

You can use the following formula to calculate the ifta tax required in a state. Web how do you calculate ifta miles? How to do ifta, i.e.,. Web how do i calculate what i owe for ifta? Who needs to file ifta fuel tax? Use this free ifta tax calculator and state by state mileage.

IFTA How to file Free IFTA calculator included YouTube

You need to know details of how many miles you traveled in. There are a couple of different ways that drivers can use to keep track of miles. How to do your ifta. Web international fuels tax agreement (ifta) determining your base jurisdiction for ifta; Web here are the steps: You can do this by..

What Is IFTA And How To Calculate It? Ameri Trust Truck Dispatch

In order to calculate your ifta return, you will need to do the following: That may seem like a whole lot of math, but most likely, your state has an online system to calculate this for you. In order to calculate how much tax you will need to pay per gallon, you’ll need to look.

Ifta Spreadsheet Template Free for Ifta Calculator Excel Fresh Mileage

Add up all of your miles traveled for each ifta jurisdiction. You are required to record your actual odometer reading every time you cross a state or provincial line. There are a couple of different ways that drivers can use to keep track of miles. Web how to calculate ifta fuel tax reports? How to.

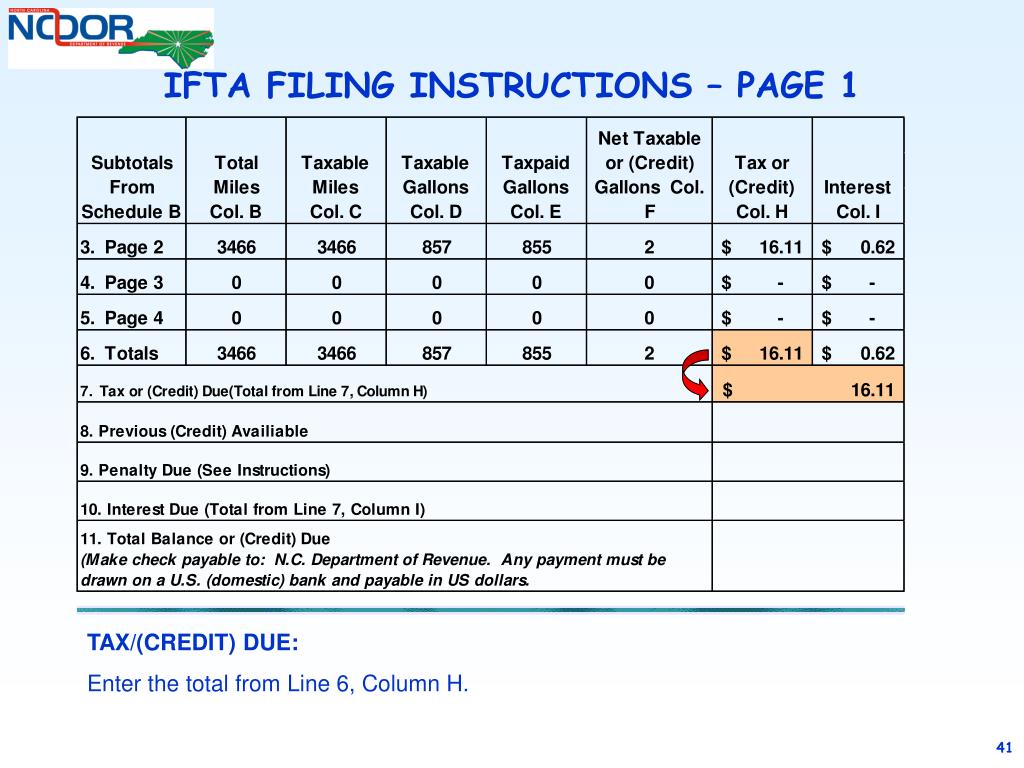

PPT COMPLETING AN IFTA TAX RETURN PowerPoint Presentation, free

Organize your receipts by the state(s) where you bought the fuel. The ifta tax calculation process. In order to calculate your ifta return, you will need to do the following: Finally, to complete the process on how to do and file ifta taxes owed by state or province, simply use the following formula: Web how.

Excel Ifta Mileage Calculator YouTube

That may seem like a whole lot of math, but most likely, your state has an online system to calculate this for you. How to do ifta, i.e.,. State or canadian province are required to file a consolidated report. Web here are the steps: Web how to calculate ifta tax returns. Web how do you.

How Do You Calculate Ifta In order to calculate how much tax you will need to pay per gallon, you’ll need to look at the federal tax rate, including. Web how do you calculate ifta? You are required to record your actual odometer reading every time you cross a state or provincial line. Total miles, taxable and nontaxable traveled by your qualified motor vehicle(s) per jurisdiction,. But don’t worry, we have simplified the whole.

How To Calculate Ifta Miles?

Web international fuels tax agreement (ifta) determining your base jurisdiction for ifta; You can use the following formula to calculate the ifta tax required in a state. Web how do you calculate ifta? Web international fuel tax agreement (ifta) qualifying commercial motor vehicles traveling in more than one u.s.

Web This Step Includes Using The Applicable Rates Calculated By Ifta.

If your state requires a paper filing, then you will need to enter the values from each of the 6 steps above into the appropriate places. Web using our ifta calculator, you can calculate your state tax and the total taxes due for the current ifta quarter. Web you qualify for an ifta license if you operate your qualified motor vehicle in california and any other u.s. In order to calculate how much tax you will need to pay per gallon, you’ll need to look at the federal tax rate, including.

How To Do Your Ifta.

How to do ifta, i.e.,. Web in order to complete your ifta return, you will need to provide your: Before you submit your ifta tax report, you need to do a few calculations. Your ifta tax is calculated based on how many gallons of fuel you burn in each state.

In Order To Calculate Your Ifta Return, You Will Need To Do The Following:

Web how do you calculate tax on gallons? But don’t worry, we have simplified the whole. Web how do you calculate ifta miles? Web how to calculate ifta tax returns.