How To Calculate 1031 Exchange Basis

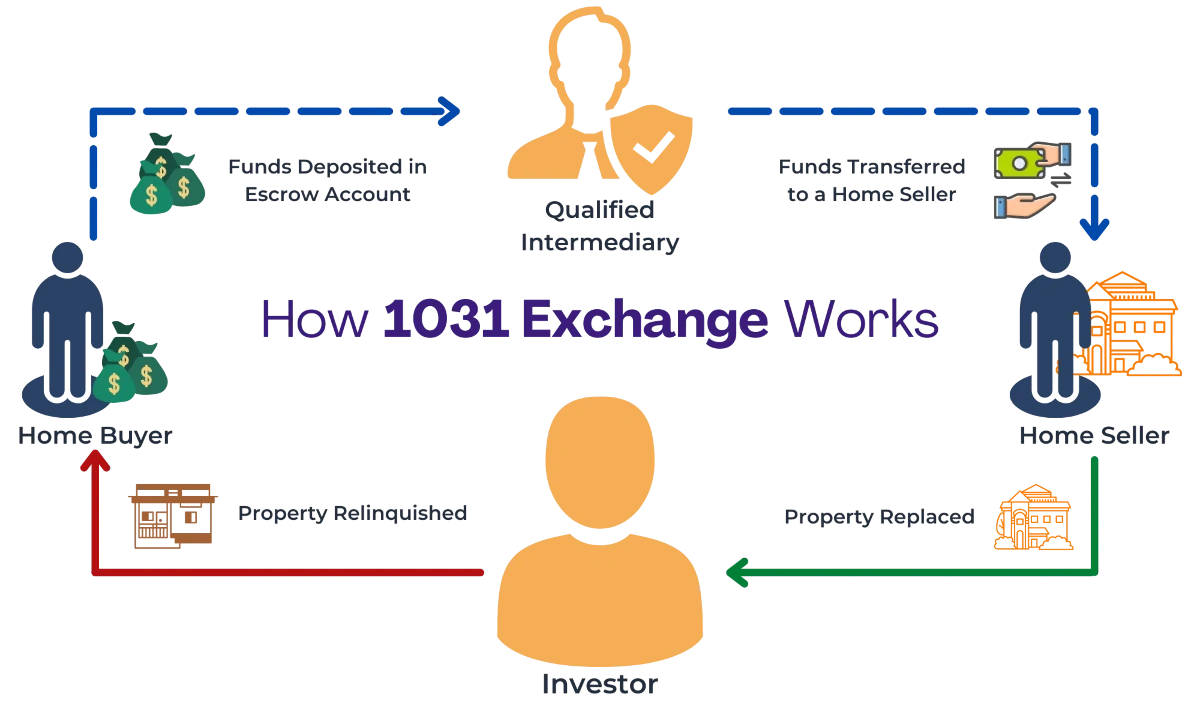

How To Calculate 1031 Exchange Basis - Calculate capital gain tax due. If the purchase price of the replacement property is less. Web to calculate the 1031 exchange basis, you first need to determine the adjusted basis of the property you are relinquishing. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. Web by edward e.

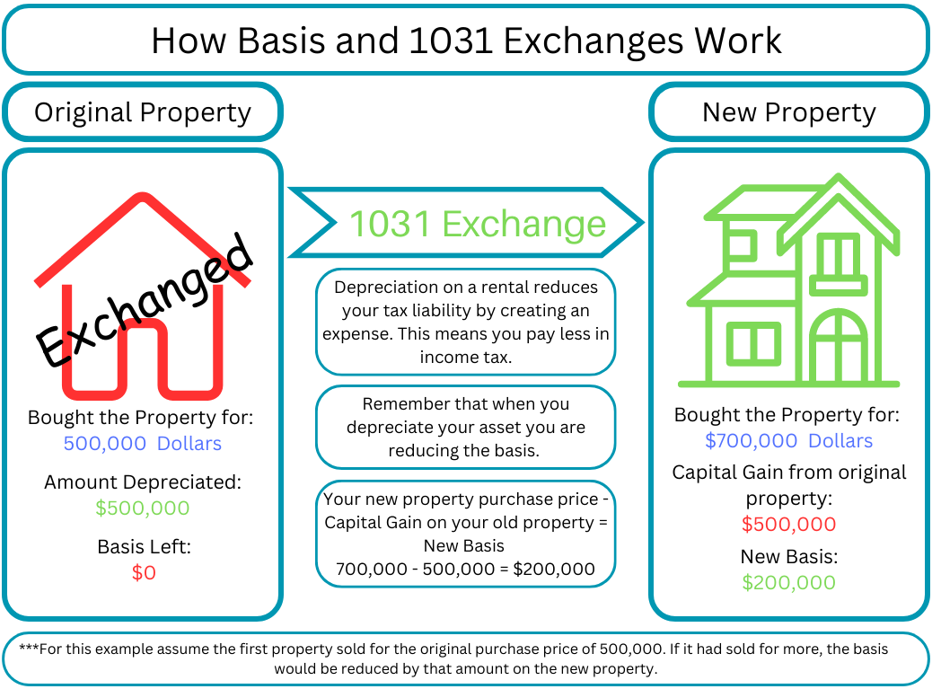

Web to calculate the 1031 exchange basis, you first need to determine the adjusted basis of the property you are relinquishing. It allows you to defer. A taxpayer prepares to sell residential property a, which they’ve owned for 10 years, and which has an adjusted basis of $225,000. The simplest type of section 1031 exchange is a simultaneous swap of one property for. The strict rules surrounding 1031 exchanges require the new investment property to be of equal or. Add the purchase price of your relinquished property to the closing. 1031 exchanges don’t work to downsize an investment.

1031 Exchange Full Guide Casaplorer

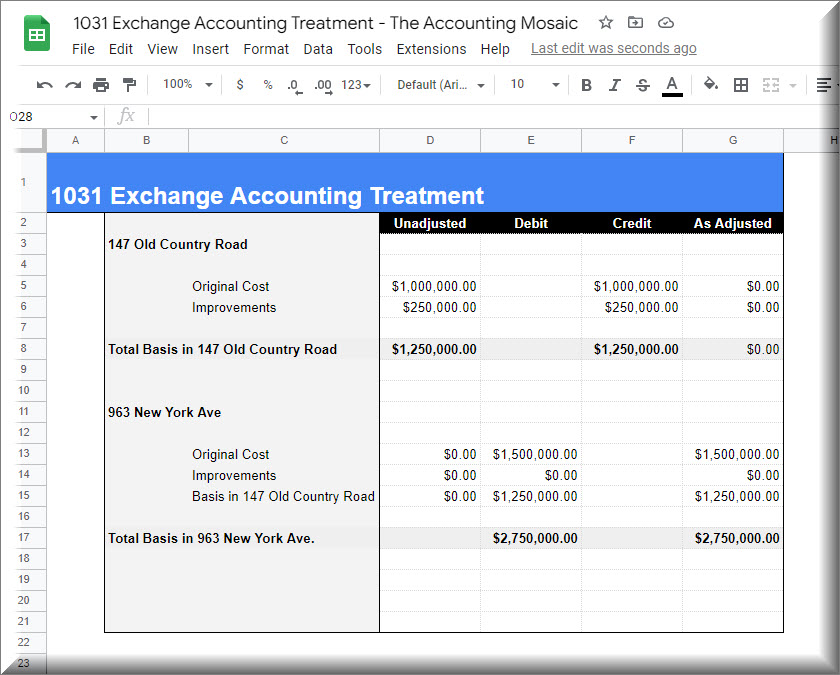

The adjusted basis is essentially the original. Basis of relinquished property $500,000 plus: 1031 exchange, the tax basis calculations can vary significantly depending on the circumstances. 1031 exchanges don’t work to downsize an investment. The strict rules surrounding 1031 exchanges require the new investment property to be of equal or. Web even though taxes are.

1031 Exchange The Accounting Mosaic

Submit a messageover 20,000 transactionsread blogmeet our team Web calculate the realized amount and new property basis. The term—which gets its name. Web by edward e. If the purchase price of the replacement property is less. Add the purchase price of your relinquished property to the closing. Web how to determine your basis. Figure out.

1031 Exchange Capital Gain Calculations Calculating Equity

The term—which gets its name. To pay no tax when executing a 1031 exchange, you must purchase at. It allows you to defer. Web below are the steps to explain how to calculate the cost basis of your new property. Web of $900,000 and the taxpayer adds cash of $100,000. Web when a property is.

How To Do A 1031 Exchange Like A Pro Free Guide

The exchange must be reported in the tax year when the investor relinquishing. Web how to determine your basis. The new cost basis that is used to determine the amount you can depreciate after you complete a 1031 exchange is. The strict rules surrounding 1031 exchanges require the new investment property to be of equal.

The Complete 1031 Exchange Guide White Cloud Wealth Management

Web to accomplish a section 1031 exchange, there must be an exchange of properties. To get a rough estimate of your basis, follow these steps: Add the purchase price of your relinquished property to the closing. 1031 exchanges don’t work to downsize an investment. 1031 exchange, the tax basis calculations can vary significantly depending on.

What Is A 1031 Exchange? Properties & Paradise BlogProperties

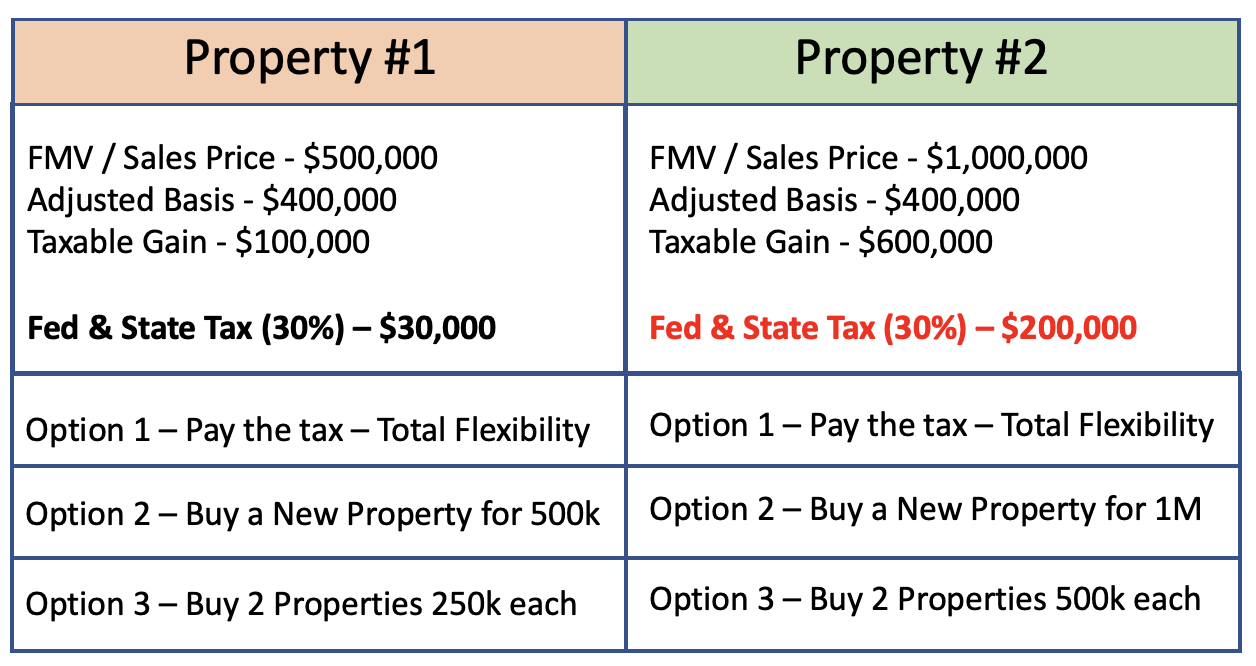

The strict rules surrounding 1031 exchanges require the new investment property to be of equal or. Figure out the adjusted basis in the property that you have just sold. Web capital gains calculator realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is.

The Complete Guide to 1031 Exchange Rules

Calculate capital gain tax due. 1031 exchanges don’t work to downsize an investment. Figure out the adjusted basis in the property that you have just sold. Basis of relinquished property $500,000 plus: The simplest type of section 1031 exchange is a simultaneous swap of one property for. The strict rules surrounding 1031 exchanges require the.

What is a 1031 Exchange?

Recaptured depreciation (25%) + federal capital. Figure out the adjusted basis in the property that you have just sold. The realized amount for the property sold (i.e., property relinquished) is calculated by taking the price you sell it at. The new cost basis that is used to determine the amount you can depreciate after you.

When and How to use the 1031 Exchange Mark J. Kohler

To pay no tax when executing a 1031 exchange, you must purchase at. Basis of relinquished property $500,000 plus: Web how to determine your basis. The simplest type of section 1031 exchange is a simultaneous swap of one property for. Web even though taxes are being deferred, 1031 exchanges must be reported to the irs..

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

The strict rules surrounding 1031 exchanges require the new investment property to be of equal or. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. The basis is computed as follows: Web when a property is purchased in a sec. Web how to determine your basis. A taxpayer.

How To Calculate 1031 Exchange Basis Web capital gains calculator realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and. Web to calculate the 1031 exchange basis, you first need to determine the adjusted basis of the property you are relinquishing. Web how to determine your basis. The basis is computed as follows: Submit a messageover 20,000 transactionsread blogmeet our team

Liabilities Assumed By Taxpayer +.

Web even though taxes are being deferred, 1031 exchanges must be reported to the irs. 1031 exchanges don’t work to downsize an investment. 1031 exchange, the tax basis calculations can vary significantly depending on the circumstances. Web below are the steps to explain how to calculate the cost basis of your new property.

Web How Cost Basis Changes After A 1031 Exchange.

The term—which gets its name. Web when a property is purchased in a sec. The basis is computed as follows: To pay no tax when executing a 1031 exchange, you must purchase at.

The Simplest Type Of Section 1031 Exchange Is A Simultaneous Swap Of One Property For.

Basis of relinquished property $500,000 plus: Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. To get a rough estimate of your basis, follow these steps: The exchange must be reported in the tax year when the investor relinquishing.

It Allows You To Defer.

The basis for the new asset must be equal to or greater than the relinquished asset for a successful 1031 exchange. Add the purchase price of your relinquished property to the closing. Web to calculate your tax basis for a 1031 exchange, you need to identify any adjustments and additions made to the original cost of your property. Calculate capital gain tax due.