How To Calculate Amortization In Excel

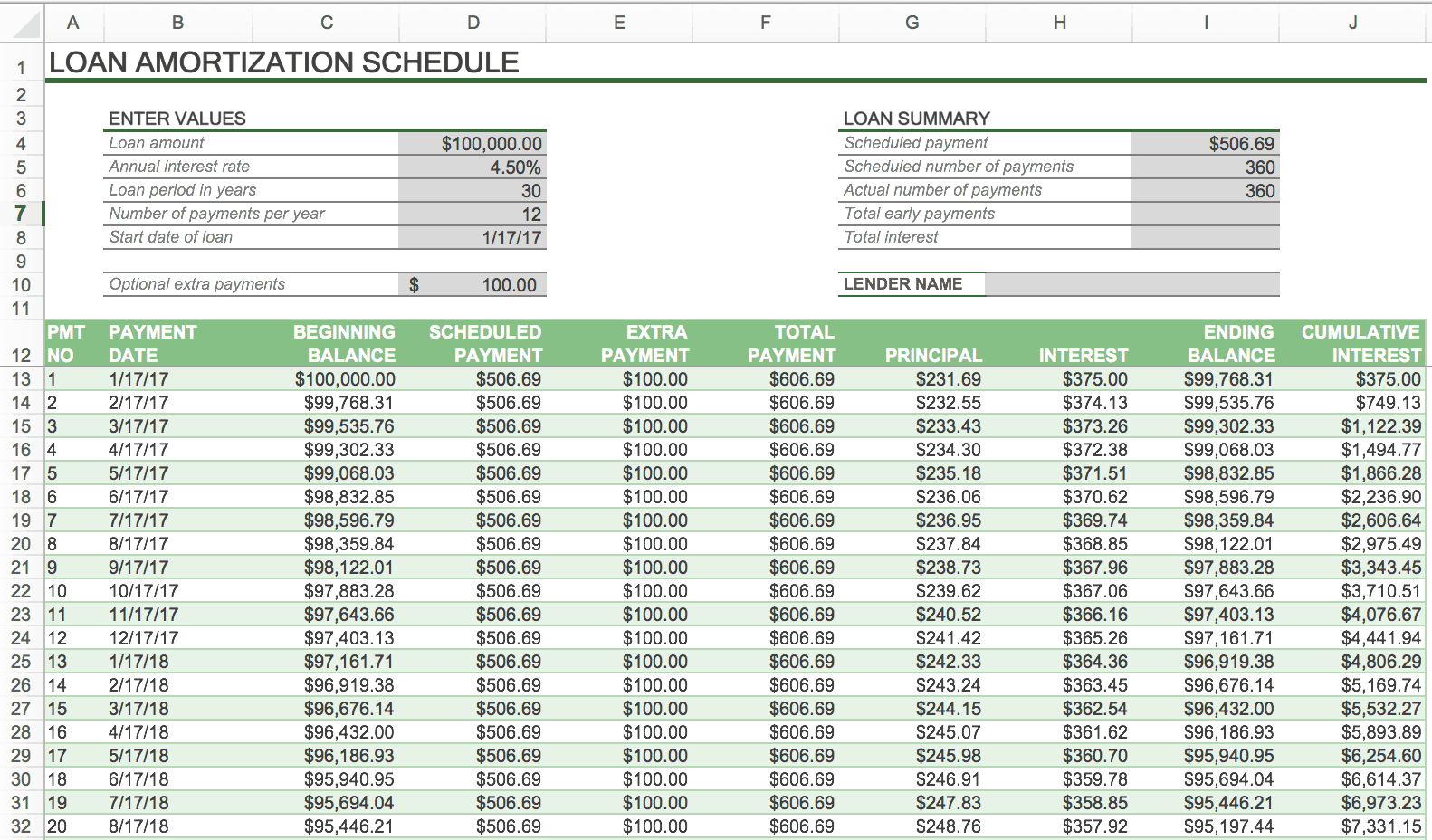

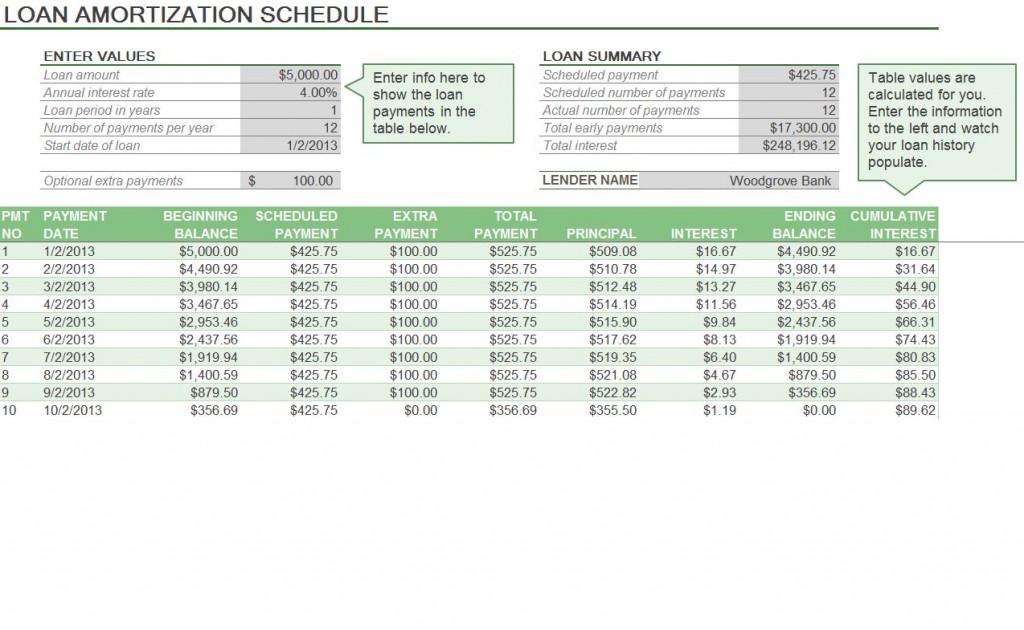

How To Calculate Amortization In Excel - For consistency in payment frequencies, you should be consistent with the values supplied for the rate and nper arguments: Web here’s how you can calculate the total interest paid over the duration of a loan: Fill cells b1 to b3 with the relevant information and leave cell b4 blank. Web excel monthly amortization schedule is a great tool to visualize one’s loan repayment process with monthly payments. And now, to calculate interest paid, we will put value in the interest formula.

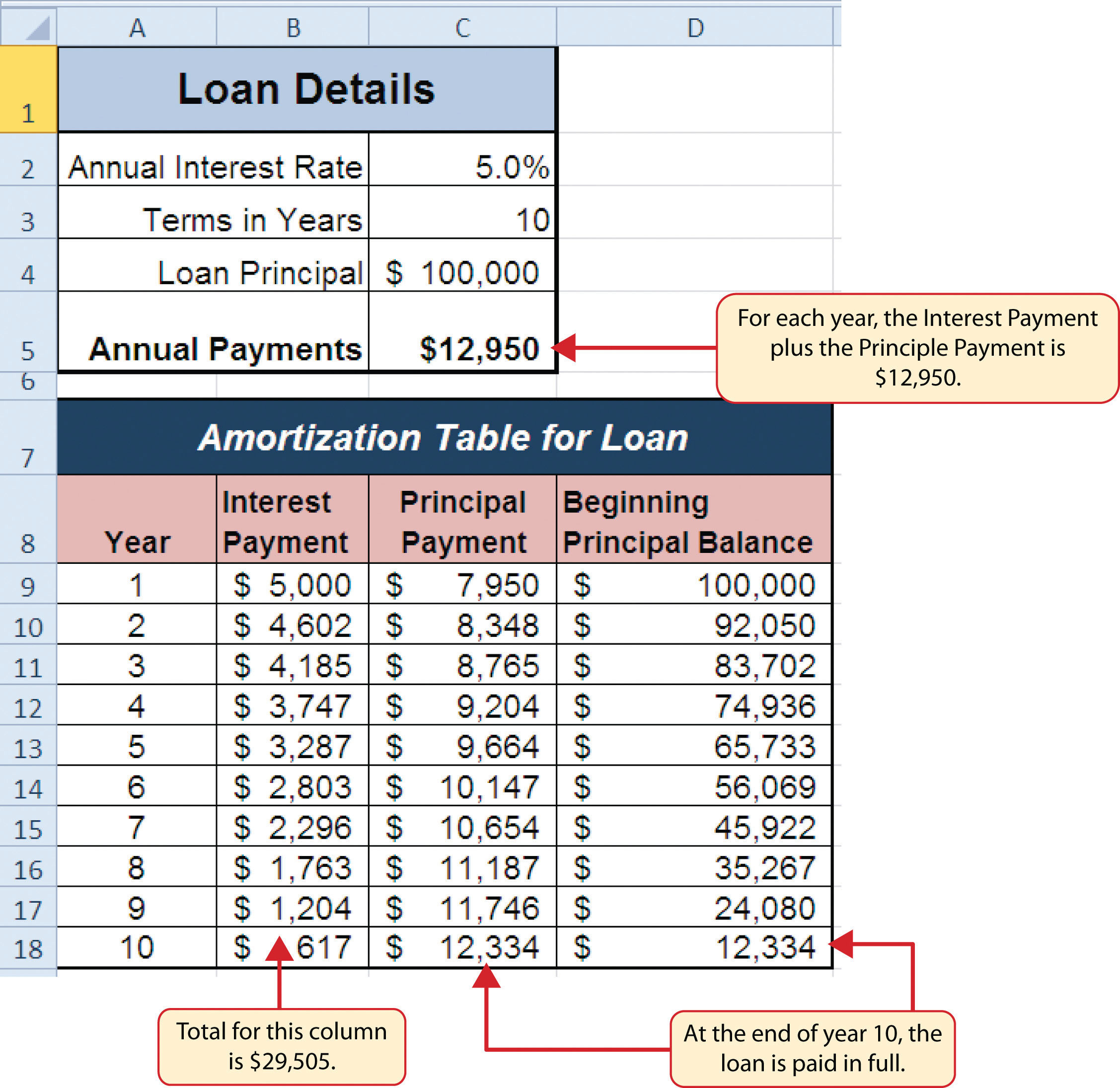

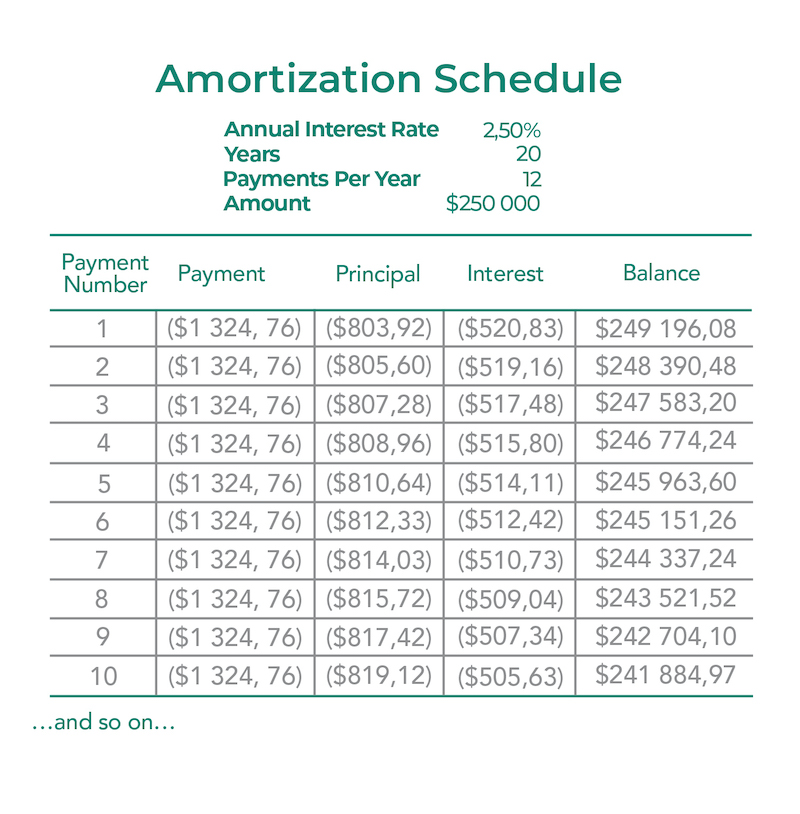

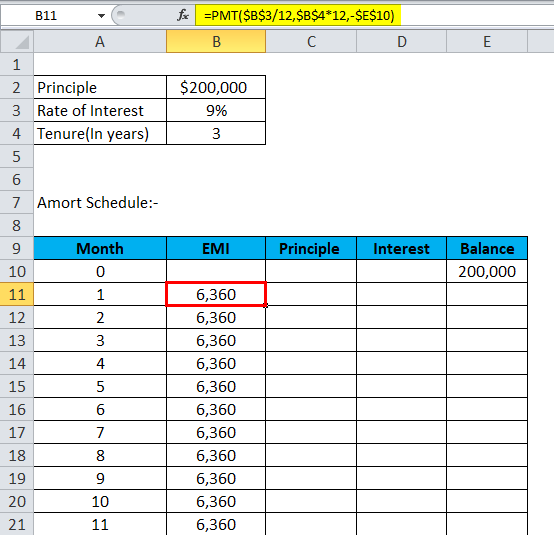

The most commonly used formulas include: Web an amortization schedule is a table that shows the breakdown of principal and interest payments over the life of a loan. Enter loan information in column b. Pmt(rate, nper, pv) is the regular payment amount. Manage your loans and payments like a pro. To calculate the monthly amortization in excel, you can use the pmt function. Some of the basics needed to calculate amortization include knowledge on how to use:

How to create a loan amortization schedule In Excel Excel Examples

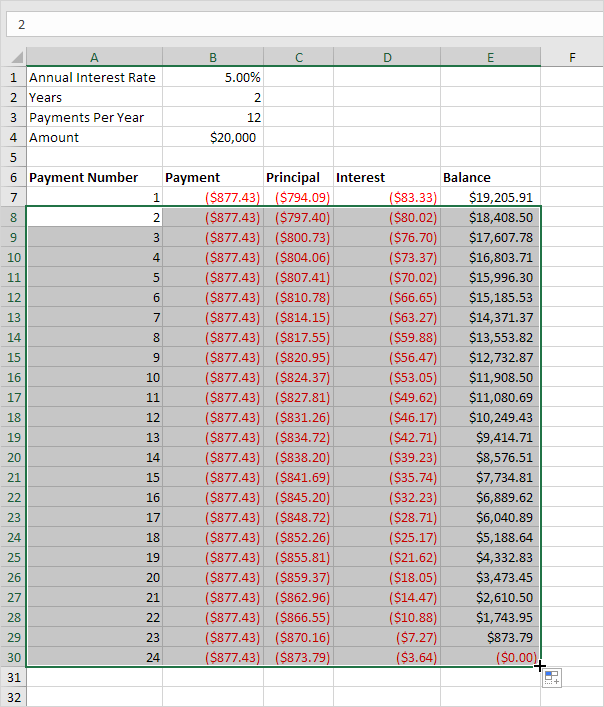

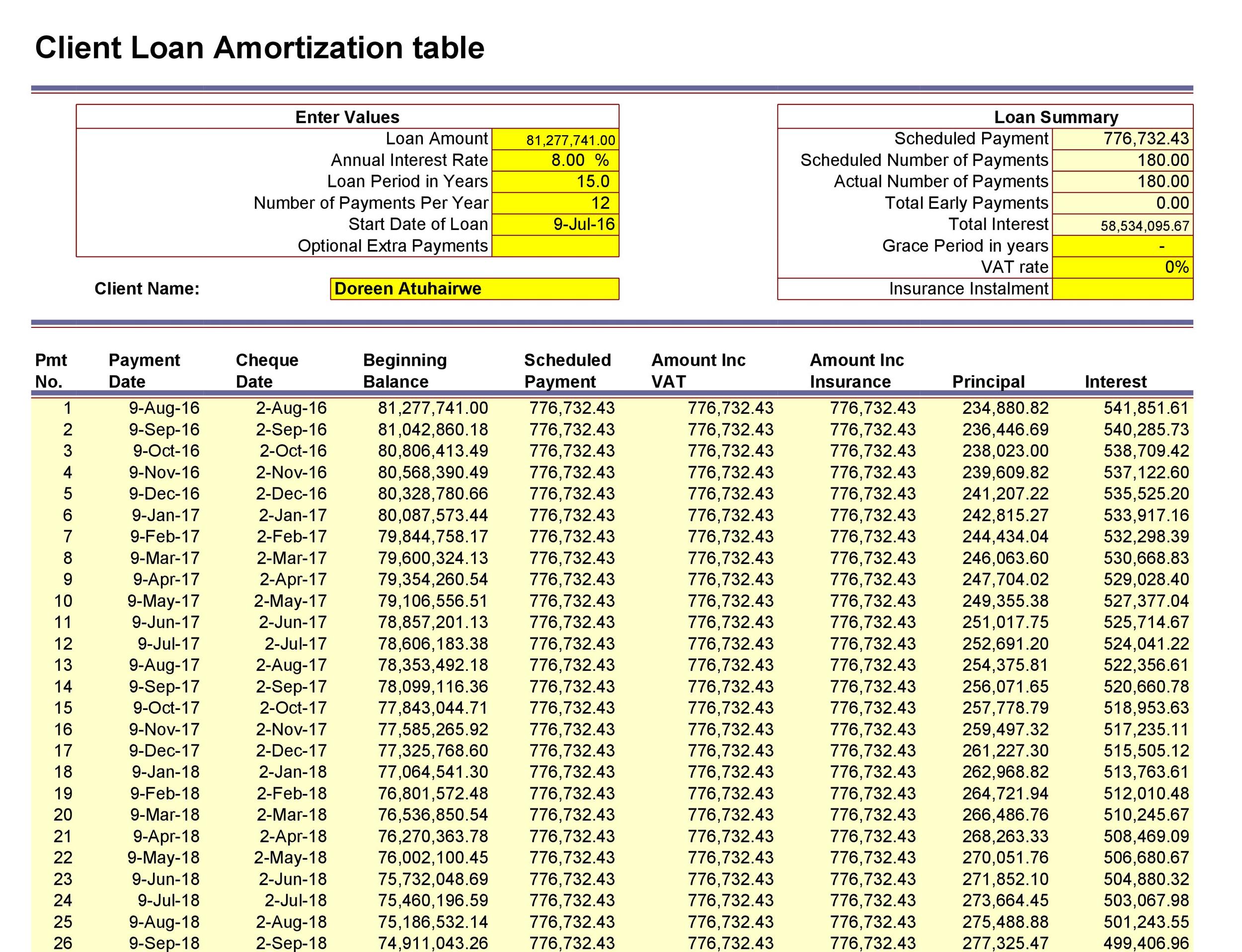

This schedule shows the beginning balance, monthly payment, monthly interest, and ending balance of a. In this worksheet, the only special excel formula that is used is the pmt function to determine the monthly payment. Ensure the value in cell b3 reflects the total number of months for the loan term. Building an amortization schedule.

Loan Amortization Schedule Spreadsheet —

Web this finance video tutorial explains how to create an amortization table in excel. Web divide your annual interest rate by 12 to determine your monthly interest rate. Ensure the value in cell b3 reflects the total number of months for the loan term. And now, to calculate interest paid, we will put value in.

Amortization Schedule and Summary Template

Web if you want an easy way to view the schedule for your loan, you can create an amortization table in microsoft excel. Remember to use a percentage value for the interest rate and a currency value for the loan amount. Web loan amortization schedule excel functions. To calculate the monthly amortization in excel, you.

How to Create an Amortization Schedule Smartsheet

In column b, enter your loan information. Ensure the value in cell b3 reflects the total number of months for the loan term. Pmt(rate, nper, pv) is the regular payment amount. Web to create an amortization schedule in excel, begin by entering the loan amount, interest rate, and loan period into a new spreadsheet. This.

Amortization Formula Excel Excel Amortization Formula

Web in excel, the pmt (rate, nper, pv, [fv], [type]) function is used to calculate the payment amount. Web to create an amortization schedule in excel, begin by entering the loan amount, interest rate, and loan period into a new spreadsheet. Web this finance video tutorial explains how to create an amortization table in excel..

Amortization Formula Calculator (With Excel template)

Web to create an amortization schedule in excel, begin by entering the loan amount, interest rate, and loan period into a new spreadsheet. Web here’s how you can calculate the total interest paid over the duration of a loan: In this example, we want to take a loan of. Web we can calculate loan amortization.

28 Tables to Calculate Loan Amortization Schedule (Excel) ᐅ TemplateLab

For instance, subtract your $375 interest charge from. The pmt function is used to calculate the monthly payment for a loan based on constant payments and a constant interest rate. Web excel monthly amortization schedule is a great tool to visualize one’s loan repayment process with monthly payments. Web how can i calculate the monthly.

Loan Amortization Schedule with Variable Interest Rate in Excel

Calculate amortization values for a specific range Web here’s how you can calculate the total interest paid over the duration of a loan: It also shows the detailed schedule of all payments so you can see how much is going toward principal and how much is being paid toward interest charges. Pmt(rate, nper, pv) is.

Build an amortization schedule in excel hellvsa

Enter original balance in cell a1, interest rate (as a percentage) in cell a2, term (in years) in cell a3 and monthly payment in cell a4. Web an amortization schedule is a table that shows the breakdown of principal and interest payments over the life of a loan. Web see how to make an amortization.

Amortization Formula Calculator (With Excel template)

In this example, we want to take a loan of. It also shows the detailed schedule of all payments so you can see how much is going toward principal and how much is being paid toward interest charges. The most commonly used formulas include: Subtract your interest charge from your monthly bill and get your.

How To Calculate Amortization In Excel Enter loan information in column b. Building an amortization schedule in excel allows you to visualize the repayment process of a loan. This function takes into account the loan amount, interest rate, and loan term to provide the monthly payment. Web here’s how you can calculate the total interest paid over the duration of a loan: Enter original balance in cell a1, interest rate (as a percentage) in cell a2, term (in years) in cell a3 and monthly payment in cell a4.

Web In Excel, The Pmt (Rate, Nper, Pv, [Fv], [Type]) Function Is Used To Calculate The Payment Amount.

Ensure the value in cell b3 reflects the total number of months for the loan term. Web to create an amortization schedule in excel, begin by entering the loan amount, interest rate, and loan period into a new spreadsheet. Nper is the total number of payments. Manage your loans and payments like a pro.

Enter The Corresponding Values In Cells.

Web this example teaches you how to create a loan amortization schedule in excel. Web by creating inputs for the start of the loan, loan amount, interest rate, # of periods, and the period you want to calculate for, you can setup an amortization calculator as follows in excel: Emi (equated monthly installment) is the monthly amount paid by the loaned (principal+ interest) and is calculated using the. Some of the basics needed to calculate amortization include knowledge on how to use:

Web An Amortization Schedule Shows The Interest Applied To A Fixed Interest Loan And How The Principal Is Reduced By Payments.

This function takes into account the loan amount, interest rate, and loan term to provide the monthly payment. In this example, we want to take a loan of. In column b, enter your loan information. Web excel monthly amortization schedule is a great tool to visualize one’s loan repayment process with monthly payments.

For Consistency In Payment Frequencies, You Should Be Consistent With The Values Supplied For The Rate And Nper Arguments:

Pv is the principal loan amount (total loan amount). Web loan amortization schedule excel functions. The most commonly used formulas include: Fill cells b1 to b3 with the relevant information and leave cell b4 blank.