How To Calculate Apr In Excel

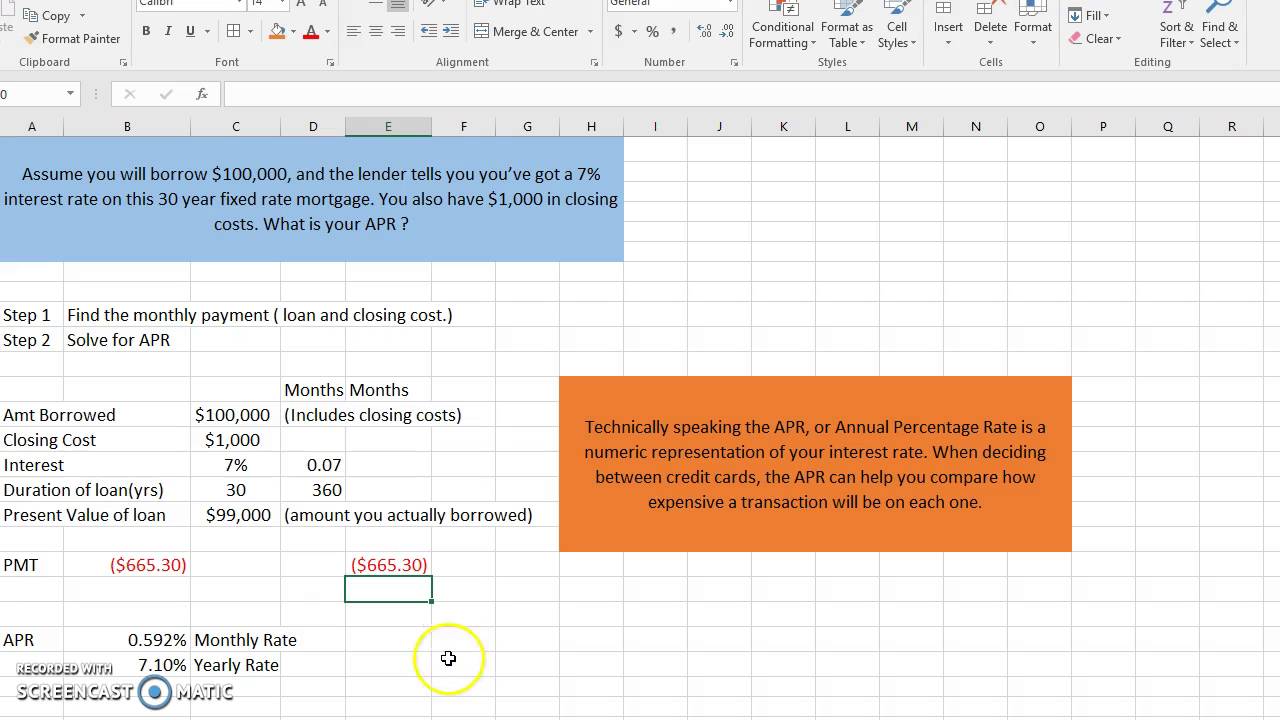

How To Calculate Apr In Excel - There are two functions to use when calculating apr in microsoft excel. Web the formula for calculating the annual percentage yield is as follows. It represents the cost of borrowing money and is usually expressed as a percentage of the loan amount. To find the annual rate for it, divide this percentage by the number of years for which you’ve sought. P = principal loan amount.

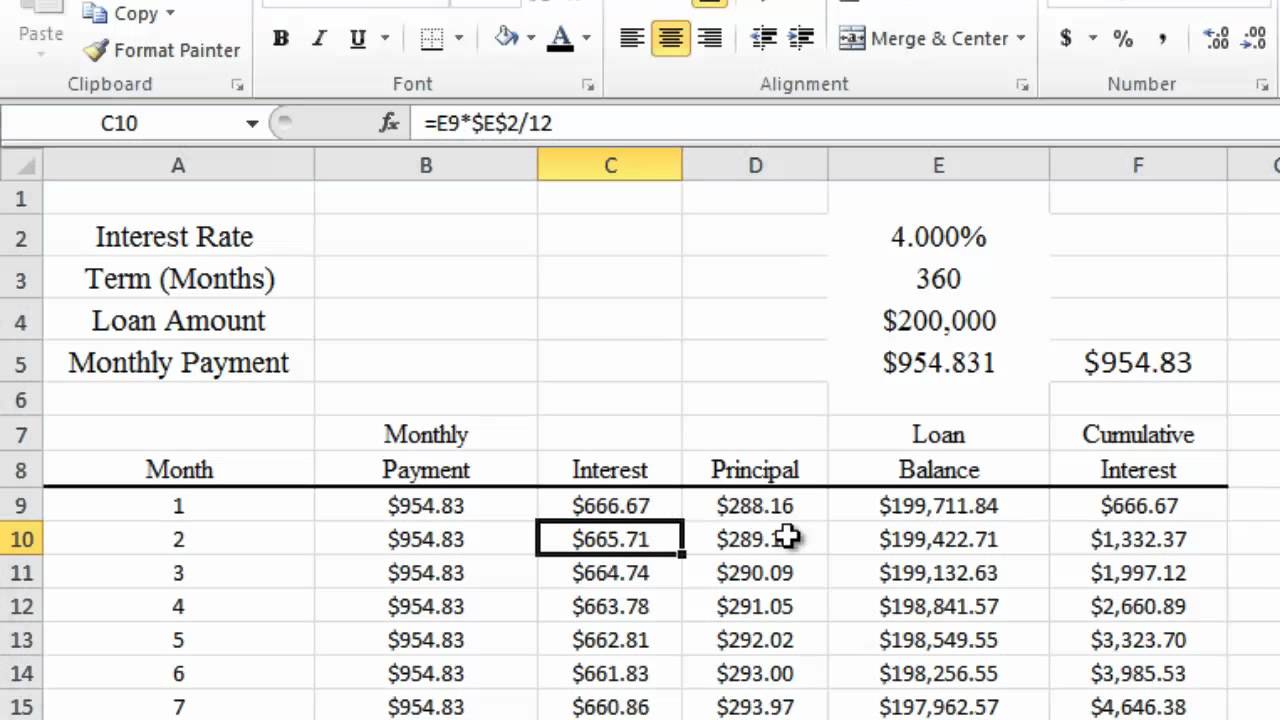

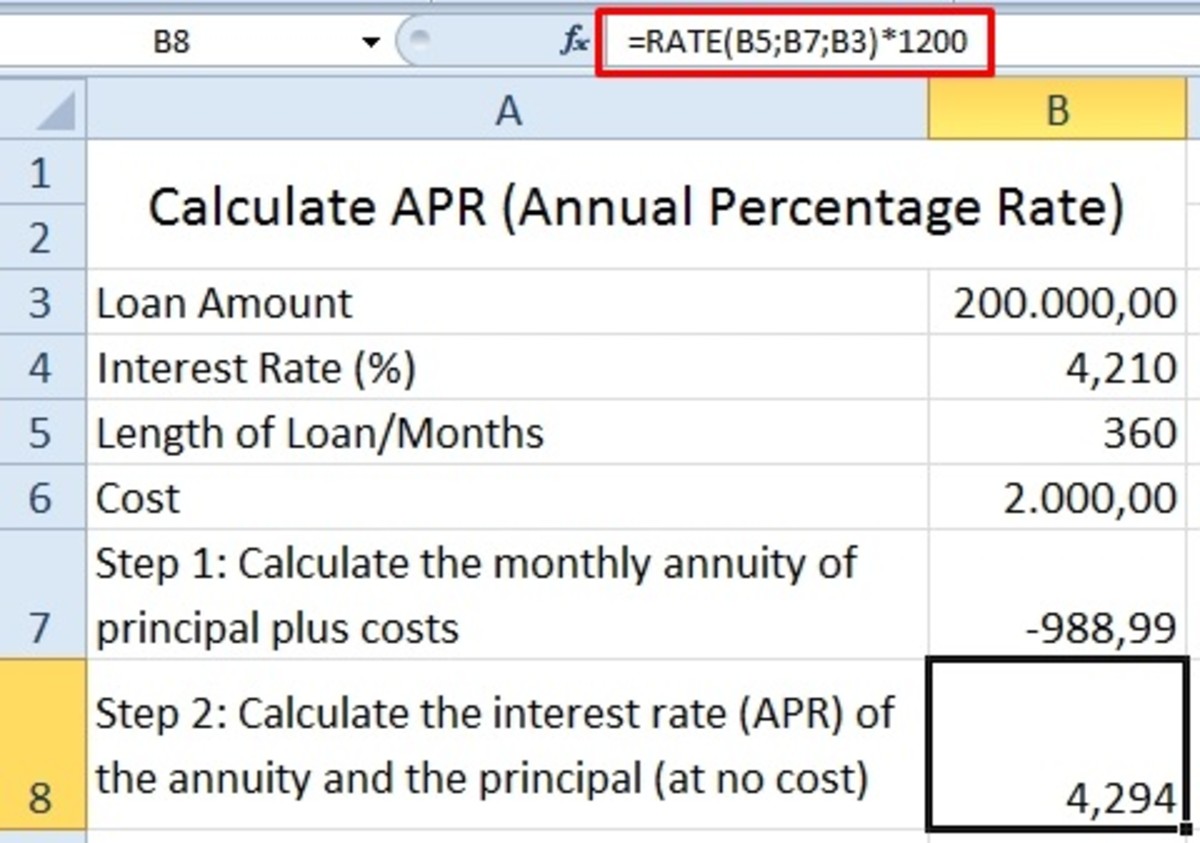

Choose a blank cell, and type =rate( into it. Enter the annual interest rate in another cell. Remember that apr is often higher than the interest rate due to additional charges. Open a new excel spreadsheet. Web the formula for calculating the annual percentage yield is as follows. Calculating apr in excel offers advantages such as automation, accuracy, and the ability to easily compare different loan or investment options. In the example shown, the formula in c10 is:

How to Calculate APR in Excel (3 Simple Methods) ExcelDemy

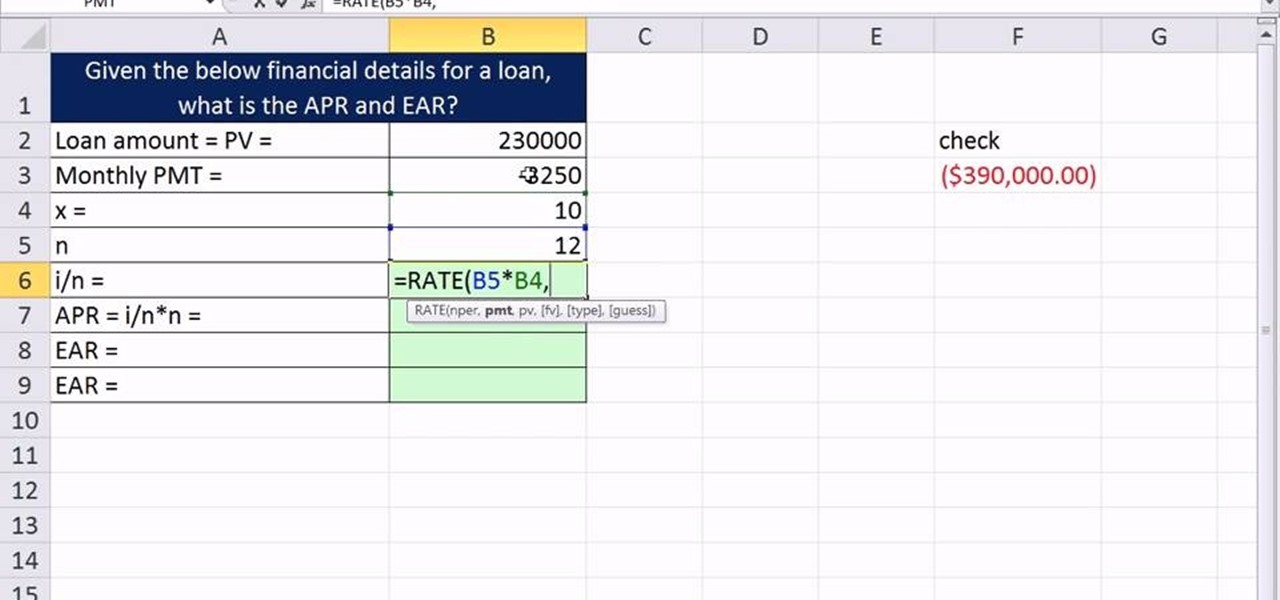

Web the function calculates by iteration and can have no or more than one solution. Web deciphering the annual percentage rate (apr) at its core, the annual percentage rate (apr) encapsulates the total cost of borrowing money over a year, incorporating not only the interest rate but also any additional fees. The interest rate is.

How To Calculate Apr In Excel Uk?

The apr includes the interest rate plus any fees. Apr is usually higher than the. N = number of payments (loan term in months) b. Using excel formula to calculate monthly payment. Web the apr, or annual percentage rate, is a percentage that represents the total cost of borrowing on a yearly basis. Web the.

Calculating Mortgage and APR in Excel 2010 YouTube

There are two functions to use when calculating apr in microsoft excel. N = number of payments (loan term in months) b. Web formula to calculate an interest rate in excel. Apr or standard rate or nominal rate. Web using those payment amounts, we can now calculate the apr, using the rate function: =effect (rate,c5).

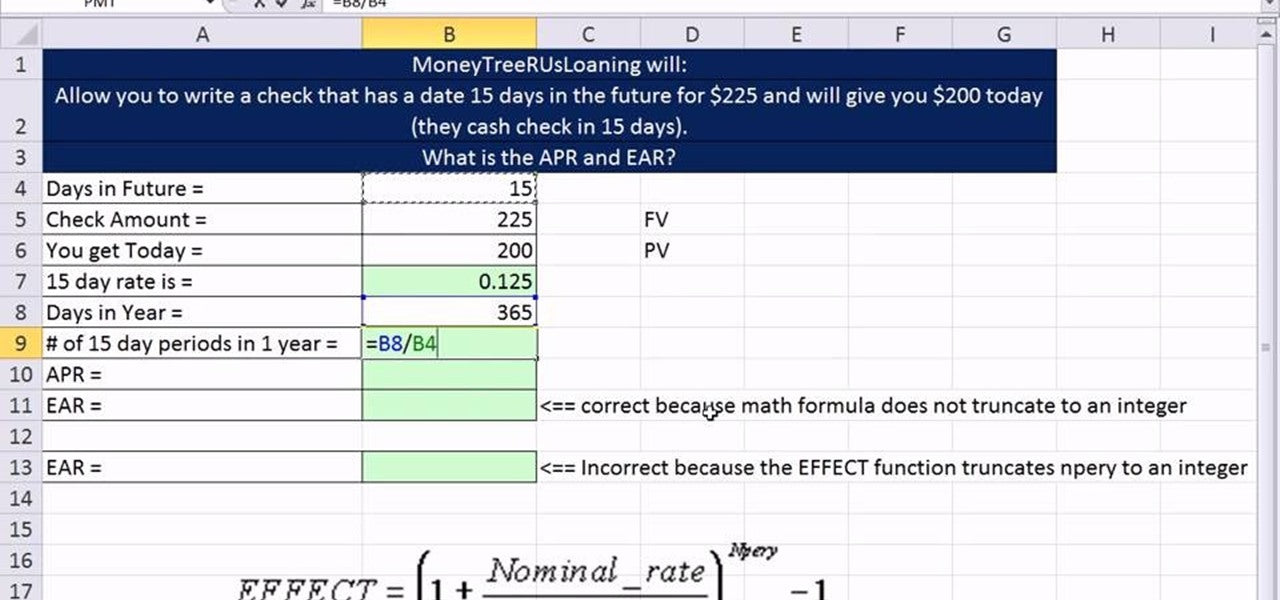

How to Calculate APR and EAR given cash flows from annuity in Excel

Apr or standard rate or nominal rate. How to calculate the annual percentage rate (apr) in excel? Web using those payment amounts, we can now calculate the apr, using the rate function: Web to calculate the apr in excel: Web the formula for calculating the annual percentage yield is as follows. The apr includes the.

How to Calculate Monthly Payment with APR in Excel ExcelDemy

How to calculate the annual percentage rate (apr) in excel? Web the function calculates by iteration and can have no or more than one solution. =effect (rate,c5) where rate is the named range h4. Remember that apr is often higher than the interest rate due to additional charges. Web to calculate the effective annual interest.

How to calculate annual percentage rate (APR) in MS Excel? APR or

Remember that apr is often higher than the interest rate due to additional charges. Bank deposit apy calculation example. Enter the loan amount in one cell. Apr is usually higher than the. Apply the following formula in cell c10 to calculate the monthly payment using the pmt function in excel. In the example shown, the.

How to Calculate APR in Excel (3 Simple Methods) ExcelDemy

Gathering accurate information is essential for getting an accurate mortgage apr calculation. The apr includes the interest rate plus any fees. 3.9k views 4 years ago excel. Web deciphering the annual percentage rate (apr) at its core, the annual percentage rate (apr) encapsulates the total cost of borrowing money over a year, incorporating not only.

How to calculate APR using Excel YouTube

The loan amount is another important factor in the apr formula. =pmt(c6/12,c7,c5+c8) don’t forget to add all the costs and charges with the principal loan amount in the formula. You need to add up the total interest and the other expenses you’re paying on a loan and see it as a proportion of the total.

How to Calculate Effective Interest Rate Using Excel ToughNickel

Open a new excel spreadsheet. It represents the cost of borrowing money and is usually expressed as a percentage of the loan amount. The loan amount is another important factor in the apr formula. Understanding the annual percentage rate (apr) is crucial for fully grasping the cost of borrowing on a mortgage. Apply the following.

How to Calculate an Interest Payment in Excel 7 Easy Steps

Web to calculate the apr in excel, use the rate function. Web the basic formula for calculating monthly payment with apr is: R = nominal interest rate. =effect (rate,c5) where rate is the named range h4. It requires inputs such as the number of payment periods, payment amount, present loan value, and future value (typically.

How To Calculate Apr In Excel Web formula to calculate an interest rate in excel. 3.9k views 4 years ago excel. N = number of payments (loan term in months) b. Web the function calculates by iteration and can have no or more than one solution. As simple as calculating a payment with basic loan details, you can do the same to determine the interest rate.

N = Number Of Payments (Loan Term In Months) B.

Web the function calculates by iteration and can have no or more than one solution. In the example shown, the formula in c10 is: Apr or standard rate or nominal rate. Understanding the annual percentage rate (apr) is crucial for fully grasping the cost of borrowing on a mortgage.

For Example, In This Formula The 17% Annual Interest Rate Is Divided By 12, The Number Of Months In A Year.

P = principal loan amount. Web the rate function in excel provides a straightforward way to calculate apr. R = nominal interest rate. Web using those payment amounts, we can now calculate the apr, using the rate function:

The Number Of Periods (Loan Term In Years), Payment Amount Per Period, Present Value (Loan Amount), And Future Value (Typically 0 For Loans).

“ =rate( nper , pmt , pv)*12 ”, replacing each value with the quantities of your loan. 3.9k views 4 years ago excel. Gathering accurate information is essential for getting an accurate mortgage apr calculation. Web to calculate the periodic interest rate for a loan, given the loan amount, the number of payment periods, and the payment amount, you can use the rate function.

Web The Formula For Calculating The Annual Percentage Yield Is As Follows.

Web to calculate the apr in excel: R = monthly interest rate. There are two functions to use when calculating apr in microsoft excel. Enter the annual interest rate in another cell.