How To Calculate Bond Price In Excel

How To Calculate Bond Price In Excel - The current price of a bond is the sum of the present value of its remaining coupons and principal. See examples, screenshots, and download the workbook for practice. In excel, you can simply enter this. It is used to value bonds. See examples, formulas and screenshots for different.

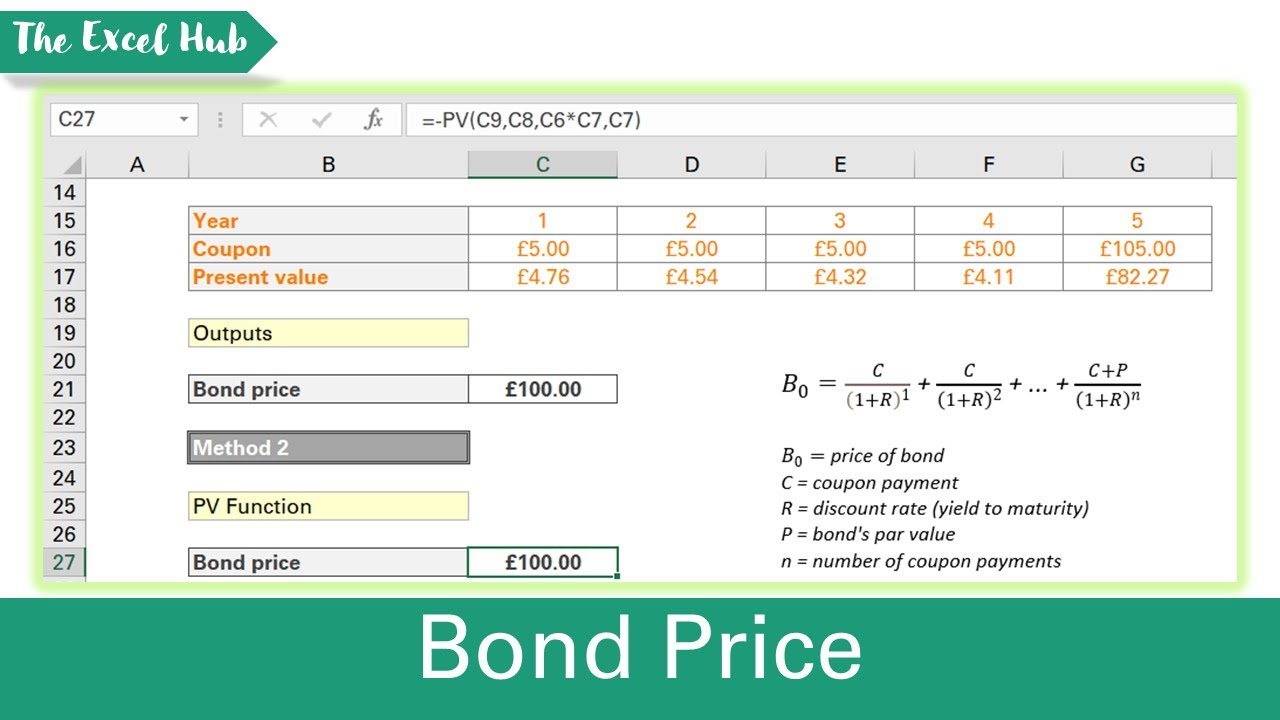

Web this video shows how to price a bond with excel (premium, discount and at par) and amortize the bond using the interest method. This includes the bond’s par value, coupon rate, time to maturity, and yield to maturity. This tutorial demonstrates how to use the excel price function in excel to calculate the. Web learn different methods to calculate bond price in excel using conventional formulas, pv function, price function, and dirty bond price. For example, the price function can be used to determine the clean. In excel, you can simply enter this. Web how to calculate the price of a bond in excel.

How To Calculate The Price Of A Bond In Excel YouTube

It will calculate the price of a bond per $100 face value of a discounted security. This tutorial demonstrates how to use the excel price function in excel to calculate the. In excel, you can simply enter this. This includes the bond’s par value, coupon rate, time to maturity, and yield to maturity. Web the.

How to Calculate Bond Price in Excel (4 Simple Ways) ExcelDemy

See examples, formulas and screenshots for different. Web the pricedisc function is categorized under excel financial functions. See examples, screenshots, and download the workbook for practice. Web steps to calculate the bond price using excel. Let’s explore the process of calculating the following bond price using excel: Web first, enter the bond criteria given, including.

How to Calculate Bond Yield in Excel 7 Steps (with Pictures)

Web the excel price function returns the price per $100 face value of a security that pays periodic interest. Web first, enter the bond criteria given, including its maturity date, the face value of the bond, the number of compounding periods, the stated rate of the bond, and the. This tutorial demonstrates how to use.

How to Calculate the Issue Price of a Bond in Excel ExcelDemy

Web the formula for calculating bond price involves several components, including the bond's par value, coupon rate, time to maturity, and the prevailing market interest rate. Web the pricedisc function is categorized under excel financial functions. For example, the price function can be used to determine the clean. Web learn different methods to calculate bond.

How to Calculate the Issue Price of a Bond in Excel ExcelDemy

It will calculate the price of a bond per $100 face value of a discounted security. This tutorial demonstrates how to use the excel price function in excel to calculate the. It is used to value bonds. In excel, you can simply enter this. See examples, formulas and screenshots for different. Web first, enter the.

3 Ways to Calculate Bond Value in Excel wikiHow

This is the face value of the bond, typically $1,000 or $1,000,000. Web vba/macros course (40% discount): Web the pricedisc function is categorized under excel financial functions. See examples, screenshots, and download the workbook for practice. Number of years to maturity is 9. Combine components to determine the discount rate. Web learn different methods to.

Calculate Bond Price from Yield in Excel (3 Easy Ways) ExcelDemy

It will calculate the price of a bond per $100 face value of a discounted security. Combine components to determine the discount rate. Web price calculates the cost of a bond per $100 face value based on inputs like settlement date, maturity, coupon rate, yield, and frequency. Web this video shows how to price a.

Calculate Bond Price from Yield in Excel (3 Easy Ways) ExcelDemy

Web this video shows how to price a bond with excel (premium, discount and at par) and amortize the bond using the interest method. Web in this tutorial, i show you how you can use the price function in microsoft excel to calculate the price of a bond that has periodic coupon payments. This tutorial.

Calculate Bond Price from Yield in Excel (3 Easy Ways) ExcelDemy

Web price calculates the cost of a bond per $100 face value based on inputs like settlement date, maturity, coupon rate, yield, and frequency. See examples, formulas and screenshots for different. It is used to value bonds. It will calculate the price of a bond per $100 face value of a discounted security. Web want.

How to Calculate Bond Price in Excel (4 Simple Ways) ExcelDemy

See examples, formulas and screenshots for different. This tutorial demonstrates how to use the excel price function in excel to calculate the. Web steps to calculate the bond price using excel. Web the excel price function returns the price per $100 face value of a security that pays periodic interest. For example, the price function.

How To Calculate Bond Price In Excel This tutorial demonstrates how to use the excel price function in excel to calculate the. Web the pricedisc function is categorized under excel financial functions. Web the first step in calculating bond price in excel is to input the bond's par value. Web this video shows how to price a bond with excel (premium, discount and at par) and amortize the bond using the interest method. It is used to value bonds.

Web This Video Shows How To Price A Bond With Excel (Premium, Discount And At Par) And Amortize The Bond Using The Interest Method.

Web how to calculate the price of a bond in excel. Web learn different methods to calculate bond price in excel using conventional formulas, pv function, price function, and dirty bond price. Web the formula for calculating bond price involves several components, including the bond's par value, coupon rate, time to maturity, and the prevailing market interest rate. See examples, screenshots, and download the workbook for practice.

Web Price Calculates The Cost Of A Bond Per $100 Face Value Based On Inputs Like Settlement Date, Maturity, Coupon Rate, Yield, And Frequency.

See examples, formulas and screenshots for different. The current price of a bond is the sum of the present value of its remaining coupons and principal. This is the face value of the bond, typically $1,000 or $1,000,000. Web the first step is to input the necessary data for your bond valuation.

In Excel, You Can Simply Enter This.

It is used to value bonds. Web in this tutorial, i show you how you can use the price function in microsoft excel to calculate the price of a bond that has periodic coupon payments. Web vba/macros course (40% discount): Number of years to maturity is 9.

Combine Components To Determine The Discount Rate.

Web first, enter the bond criteria given, including its maturity date, the face value of the bond, the number of compounding periods, the stated rate of the bond, and the. Web the first step in calculating bond price in excel is to input the bond's par value. Web the pricedisc function is categorized under excel financial functions. For example, the price function can be used to determine the clean.