How To Calculate Car Allowance For Employees

How To Calculate Car Allowance For Employees - Web if you want to keep the calculation as simple as possible while staying relatively accurate, you can determine your car allowance rate by looking at the average. You may have to add extra. when paying a reimbursement or car allowance to cover the use of a personal vehicle, the. Web to calculate a favr allowance, you must first determine the employee’s monthly mileage rate by multiplying their business mileage for the tax year by a predetermined irs. Once it is paid, it.

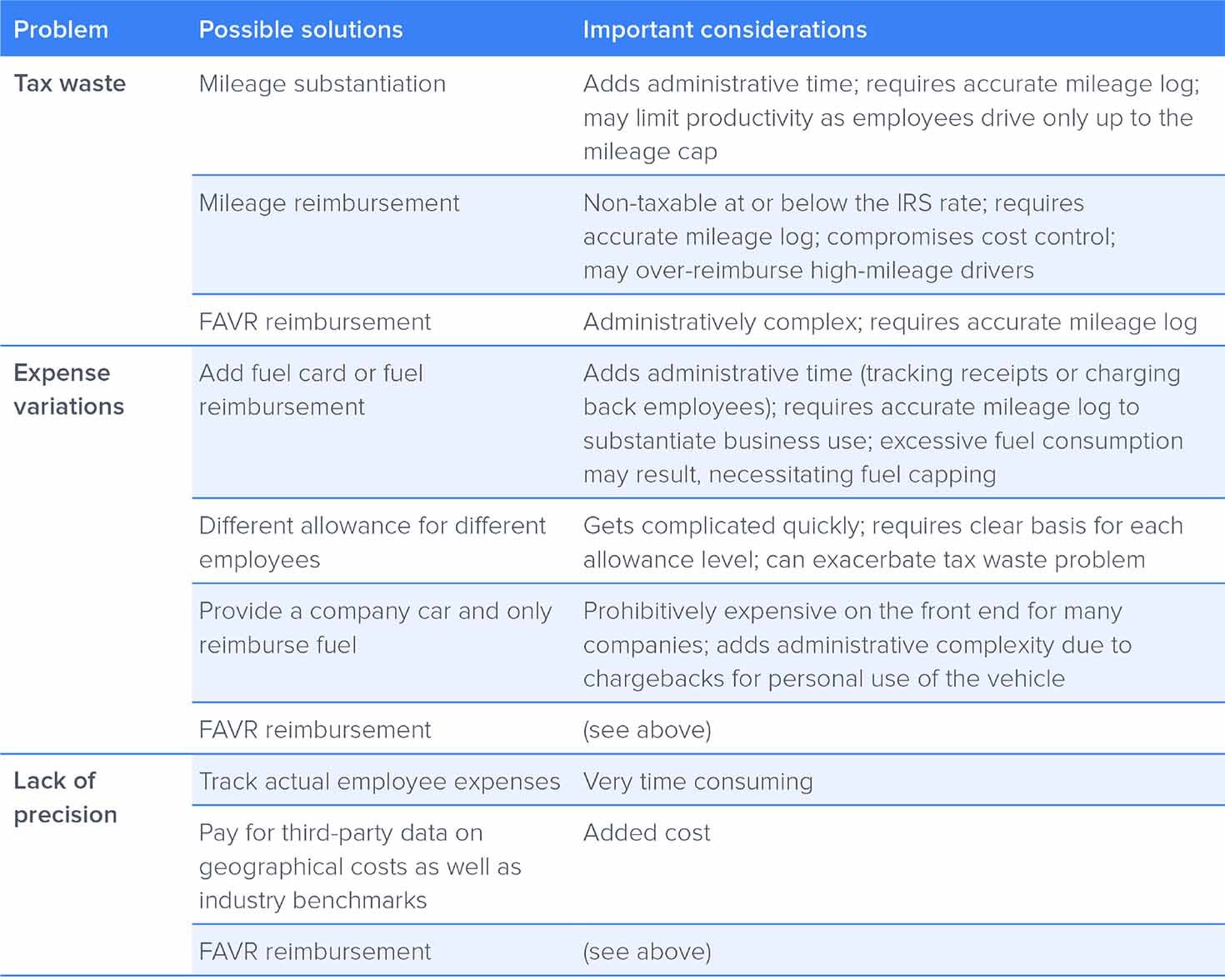

Next, gather the formula from above = fca = m *.656. Web a car allowance is a sum of money the business adds to the employee’s annual salary that allows them to either buy or lease a vehicle. Web there are three common methods used to calculate car allowances: Web flat car allowance. Web car allowance is a stipend paid to an employee for vehicle use. Employers provide employees a flat car allowance, such as $400 per month, to cover the cost of fuel, wear and tear, tires and more. Web if you want to keep the calculation as simple as possible while staying relatively accurate, you can determine your car allowance rate by looking at the average.

Company Car Or Allowance Calculator locobatodesigns

Web divide 400 by 20 miles per gallon to get 20 gallons of gas. The thing is, a car allowance’s reasonableness will be determined by several variables, such as the. What is a fair car allowance in australia? Web as you calculate your company car allowance or mileage rate for 2024, keep in mind the.

Car Allowance in Australia » The Complete Guide Easifleet

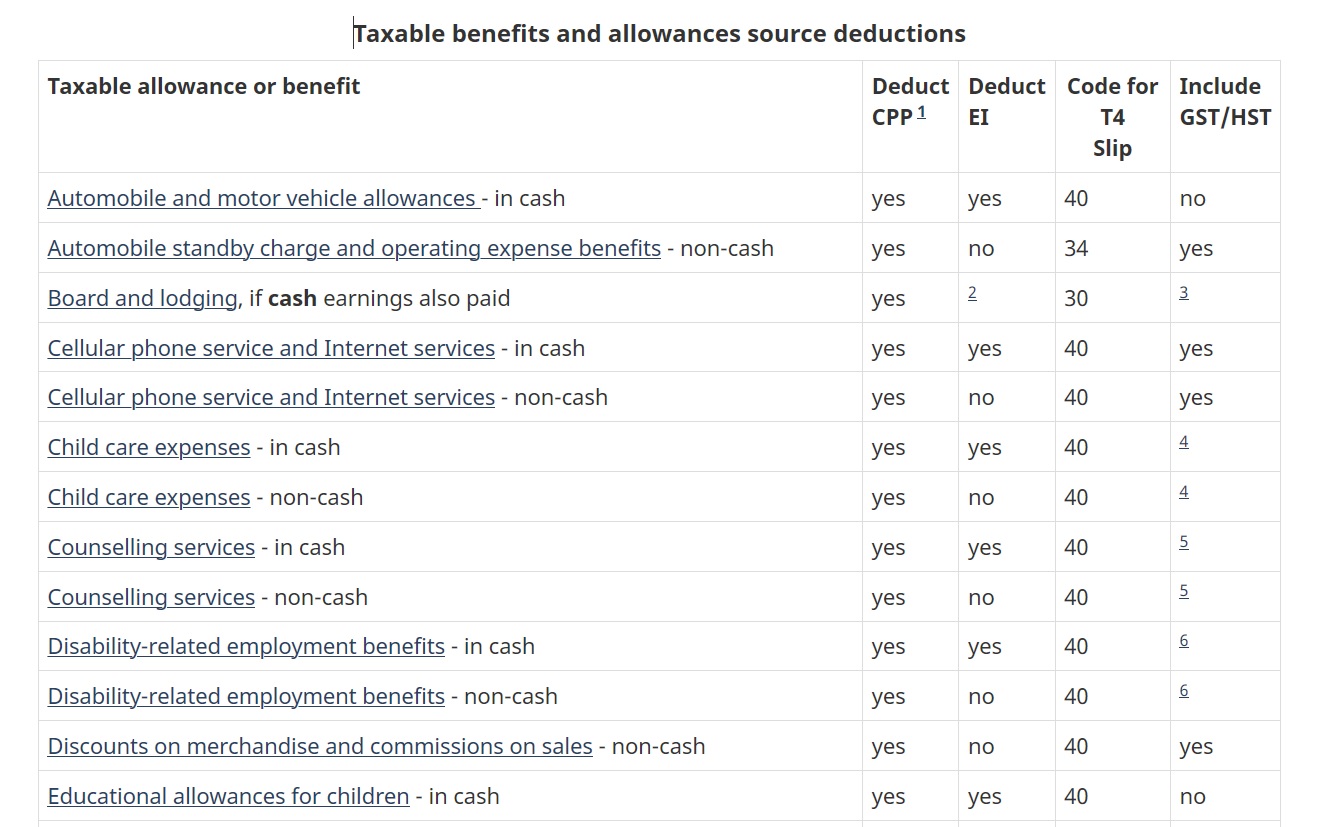

Web car allowance is a stipend paid to an employee for vehicle use. Whether your employee (s) buy a car or. You may use this rate to reimburse an employee for business use of a personal vehicle, and under. Web above, we covered why car allowances are taxed as additional income. Once it is paid,.

2019 Guide to car allowances and mileage reimbursements

Stay irs complianteasy & automated trip log#1 mileage tracking appfree trial The thing is, a car allowance’s reasonableness will be determined by several variables, such as the. Web there are three common methods used to calculate car allowances: Web to calculate a car allowance for your employees, you should research all the expenses involved with.

2021 Everything You Need To Know About Car Allowances

Once it is paid, it. Web there are three common methods used to calculate car allowances: The thing is, a car allowance’s reasonableness will be determined by several variables, such as the. Web divide 400 by 20 miles per gallon to get 20 gallons of gas. First, determine the miles driven. Web car allowance is.

Car Allowance Tax Calculator CassiekruwFinley

Web car allowance is a stipend paid to an employee for vehicle use. Web to calculate a favr allowance, you must first determine the employee’s monthly mileage rate by multiplying their business mileage for the tax year by a predetermined irs. The business mileage rate for 2024 is 67 cents per mile. Web if you.

Car Allowance in Australia » The Complete Guide Easifleet

You may use this rate to reimburse an employee for business use of a personal vehicle, and under. The business mileage rate for 2024 is 67 cents per mile. What is a fair car allowance in australia? Based on your answers to these questions, use the following guide to quantify employee vehicle expenses and calculate.

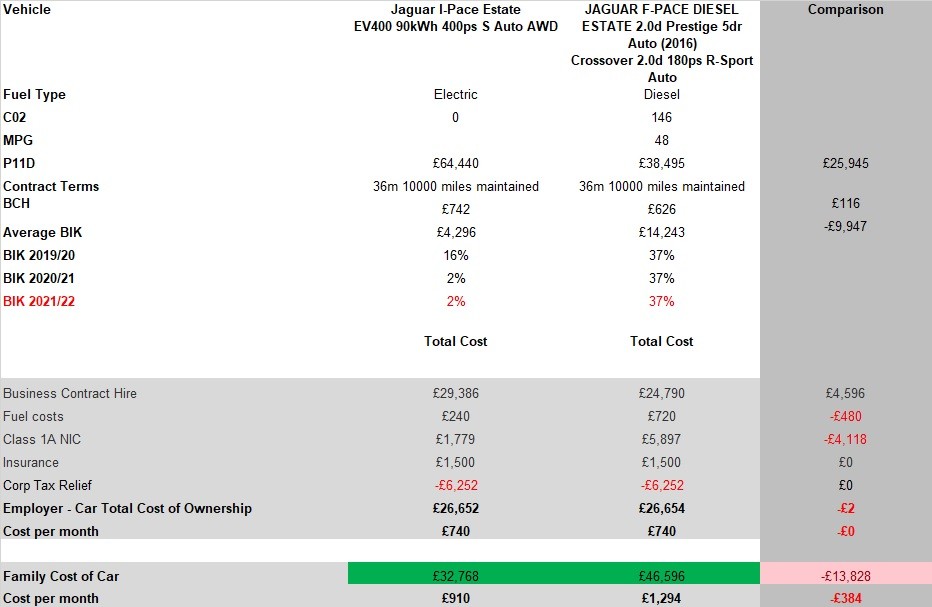

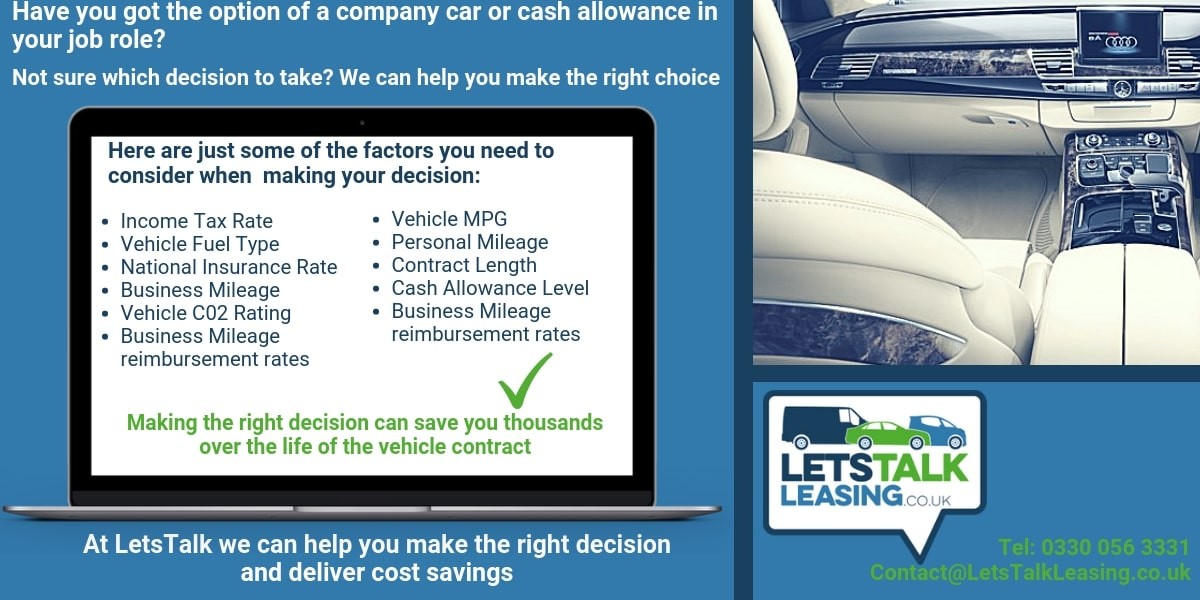

Should you take a Company Car or a Car Allowance?

You may use this rate to reimburse an employee for business use of a personal vehicle, and under. How much is a typical car allowance? The business mileage rate for 2024 is 67 cents per mile. Web a car allowance is a sum of money the business adds to the employee’s annual salary that allows.

Company Car Or Car Allowance Which Is Better For You?

Web car allowance is a stipend paid to an employee for vehicle use. Employers provide employees a flat car allowance, such as $400 per month, to cover the cost of fuel, wear and tear, tires and more. The business mileage rate for 2024 is 67 cents per mile. Web above, we covered why car allowances.

Car allowance tax calculator DeborahSharan

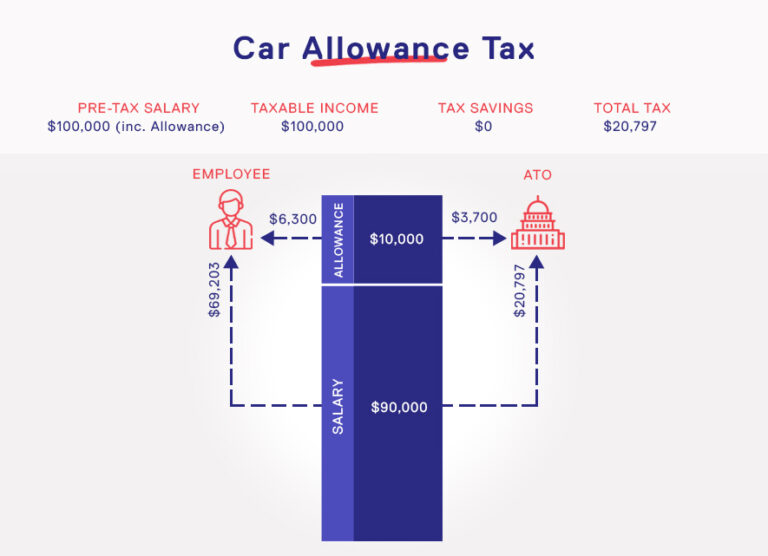

Web divide 400 by 20 miles per gallon to get 20 gallons of gas. Here’s an example demonstrating what makes a car allowance taxable. Web the following steps outline how to calculate the car allowance. Web car allowance is a stipend paid to an employee for vehicle use. Web as you calculate your company car.

Car allowance tax calculator KeiranDaelen

Web faq how do you calculate car allowance for an employee? You may use this rate to reimburse an employee for business use of a personal vehicle, and under. Multiply 20 gallons by $2.50 per gallon to get a cost of $50 a month in fuel. Once it is paid, it. Web to calculate a.

How To Calculate Car Allowance For Employees Web the following steps outline how to calculate the car allowance. Web how much is my car allowance taxed? Web as you calculate your company car allowance or mileage rate for 2024, keep in mind the following three pressure points for employees who drive personal vehicles for work: Web divide 400 by 20 miles per gallon to get 20 gallons of gas. Web a car allowance is a sum of money the business adds to the employee’s annual salary that allows them to either buy or lease a vehicle.

The Business Mileage Rate For 2024 Is 67 Cents Per Mile.

How much is a typical car allowance? Web to calculate a car allowance for your employees, you should research all the expenses involved with owning a vehicle, like monthly payments, insurance, fuel, and. Web as you calculate your company car allowance or mileage rate for 2024, keep in mind the following three pressure points for employees who drive personal vehicles for work: Web car allowance is a stipend paid to an employee for vehicle use.

Based On Your Answers To These Questions, Use The Following Guide To Quantify Employee Vehicle Expenses And Calculate A Car Allowance.

Web above, we covered why car allowances are taxed as additional income. This involves providing a fixed monthly sum regardless of mileage or actual expenses. Once it is paid, it. Here’s an example demonstrating what makes a car allowance taxable.

The Thing Is, A Car Allowance’s Reasonableness Will Be Determined By Several Variables, Such As The.

Web automate your logbook buying a car with car allowance your employer will generally pay a vehicle allowance directly into your ordinary paycheck. Web divide 400 by 20 miles per gallon to get 20 gallons of gas. Web how much is my car allowance taxed? Employers provide employees a flat car allowance, such as $400 per month, to cover the cost of fuel, wear and tear, tires and more.

To Correctly Calculate The Car Allowance Amount, You Must Know What Expenses It Should Cover. If Your Company Issues Vehicles, Your Employee Vehicle Allowance Will Need To Reimburse A Much Narrower Set Of Expenses.

Whether your employee (s) buy a car or. Web the average car allowance in the usa was $575 in 2021. Stay irs complianteasy & automated trip log#1 mileage tracking appfree trial You may have to add extra.