How To Calculate Doordash Mileage

How To Calculate Doordash Mileage - Web how to calculate your doordash tax impact. (120% x $16) x 10 active hours) + ($0.35 x 100 miles). Web firstly, start by tracking the start and end locations of each delivery. For more information on delivery radius, please reach out to your account manager or. Look through previous doordash orders my favorite method for any driving app that pays is to use a mileage tracking app since it handles everything automatically.

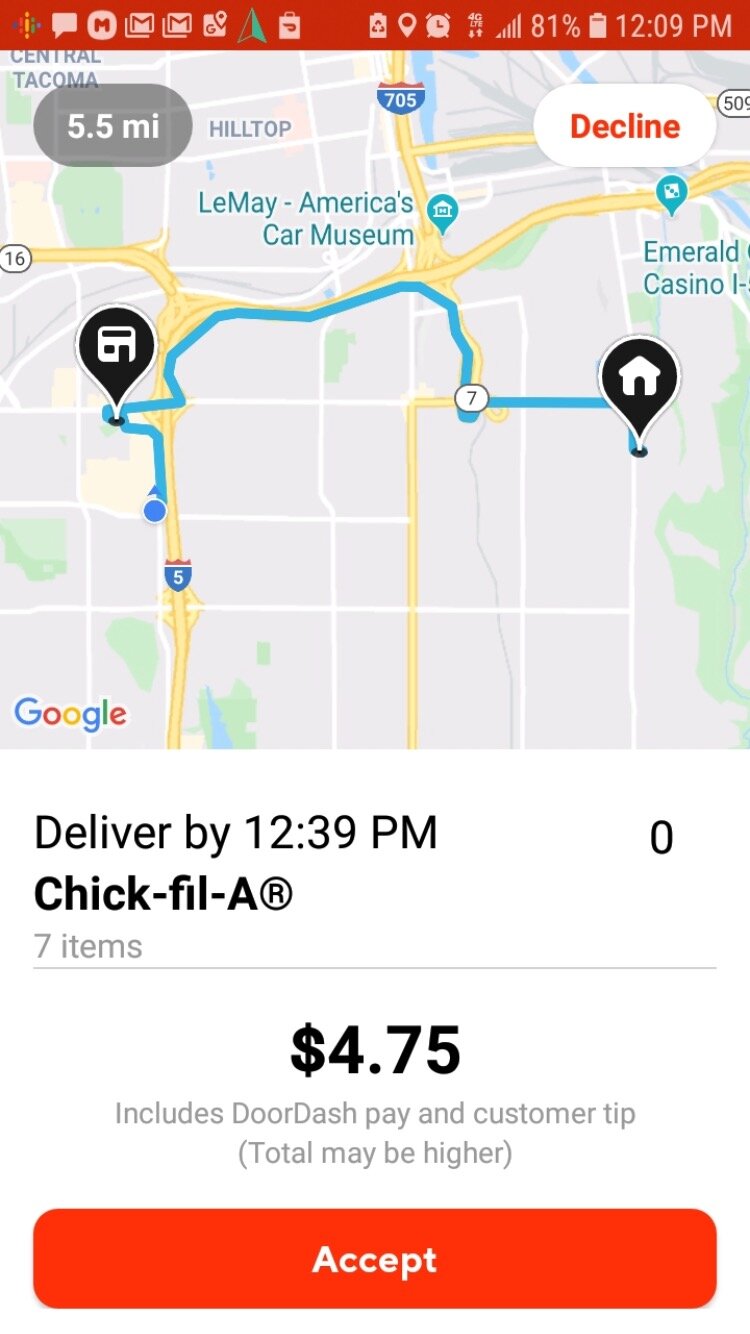

Doordash does not track its drivers’ mileage. There are three main ways to track doordash mileage: Use a mile tracking app 2. There are way more benefits to auto mileage tracking compared to paper mileage logging or. Web with the standard mileage rate method, you total how many business miles you drove while delivering in the calendar year. Web the default delivery radius is set to optimize for travel time and customer experience. How doordash's mileage estimate works, and why it's inadequate what miles can you track as a dasher?

How Much Money Do You Make With Doordash Is Doordash Worth It 2021

Understand three important facts about doordash taxes. Web the irs requires the following: Web base pay is doordash’s base contribution for each order. Web the ca treasurer’s office is responsible for publishing mileage rates, which are updated on an annual basis. If you’re driving for doordash, you might be asking, “does doordash track my miles?”.

Does Doordash Track Miles? How Mileage Tracking Works For Dashers

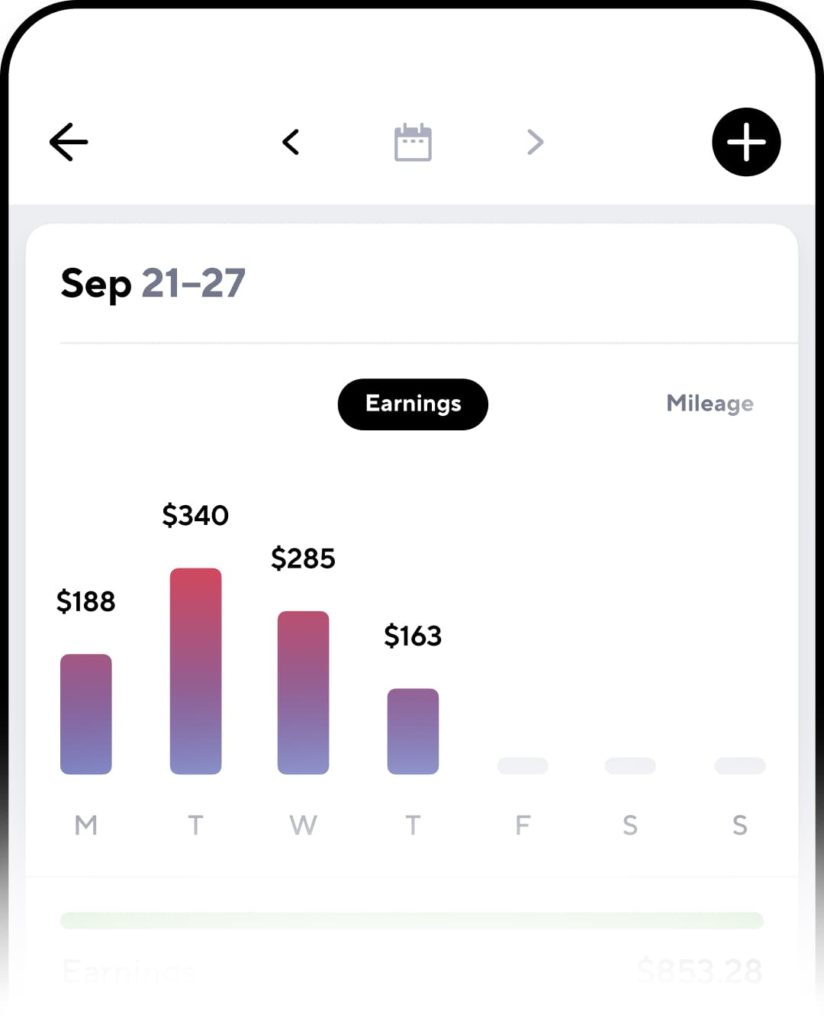

Web firstly, start by tracking the start and end locations of each delivery. Hi guys, i didn’t know that we should track mileage by ourselves so i don’t know how many miles i had last year. Web last year i made $83844 with 31714 miles, ($2.64/mile) whereas 2022 i made $87896 with 37118 miles ($$2.36/mile).

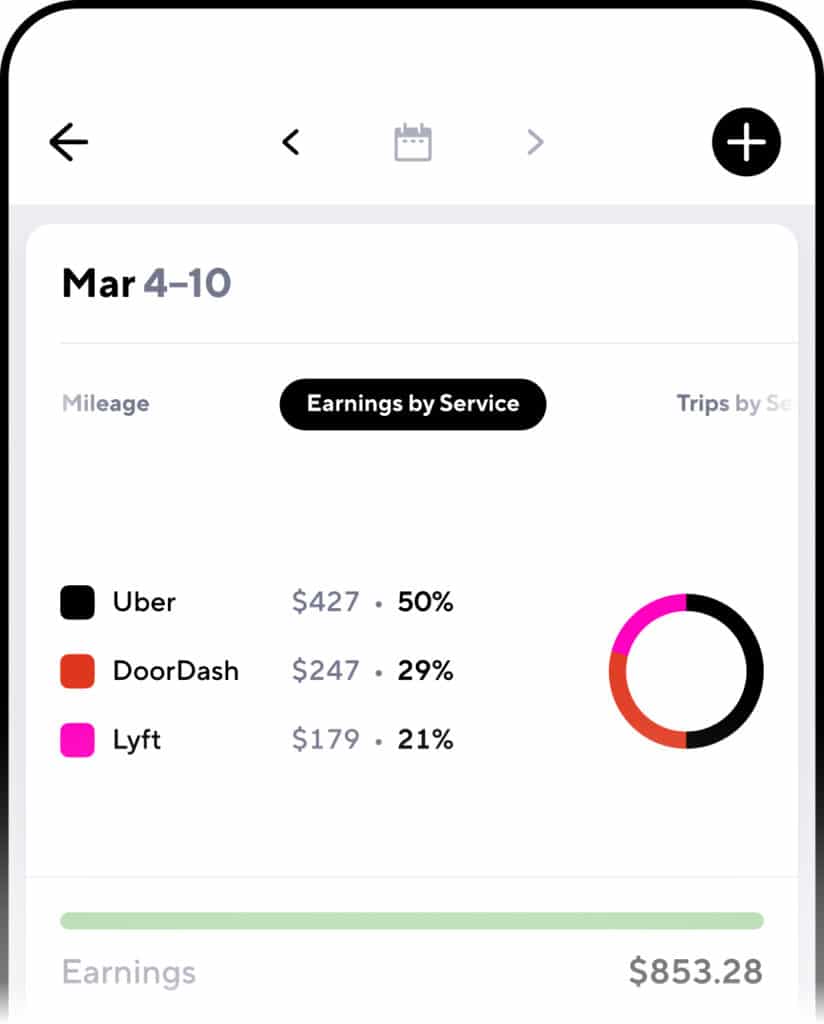

Gridwise + DoorDash Mileage Tracking For DoorDash Drivers

On driver.doordash.com only shows the estimate. Understand three important facts about doordash taxes. Web i've only been dashing since march 2023. It is essential to note that you should not include. Web the irs requires the following: There are three main ways to track doordash mileage: Web firstly, start by tracking the start and end.

9 Best Apps To Track Mileage For DoorDash (2024)

However, your doordash application may give you an estimate of the. Web base pay is doordash’s base contribution for each order. Web the ca treasurer’s office is responsible for publishing mileage rates, which are updated on an annual basis. Web the default delivery radius is set to optimize for travel time and customer experience. On.

Doordash Driver Monthly Stats/profit Excel Template Etsy

Web the default delivery radius is set to optimize for travel time and customer experience. How doordash's mileage estimate works, and why it's inadequate what miles can you track as a dasher? The #1 mileage & expense tracking app go for a drive classify as work or personal download your trips and expenses anytime get.

Mileage Tracker for Businesses, Mileage Tracker for Delivery Drivers

For more information on delivery radius, please reach out to your account manager or. At some point, i read/heard that. Web firstly, start by tracking the start and end locations of each delivery. The #1 mileage & expense tracking app go for a drive classify as work or personal download your trips and expenses anytime.

9 Best Apps To Track Mileage For DoorDash (2024)

At some point, i read/heard that. Use a written mileage log. Web how to calculate your doordash tax impact. What does the irs require for. Web last year i made $83844 with 31714 miles, ($2.64/mile) whereas 2022 i made $87896 with 37118 miles ($$2.36/mile) so just with that it’s.30/mile difference. On driver.doordash.com only shows the.

Gridwise + DoorDash Mileage Tracking For DoorDash Drivers

Web last year i made $83844 with 31714 miles, ($2.64/mile) whereas 2022 i made $87896 with 37118 miles ($$2.36/mile) so just with that it’s.30/mile difference. Look through previous doordash orders my favorite method for any driving app that pays is to use a mileage tracking app since it handles everything automatically. At some point, i.

DoorDash Mileage Tracker The Best Ways to Track In 2023

You need to know your odometer reading at the year's start and end. Web base pay is doordash’s base contribution for each order. Everlance comparison of features how to choose the right mileage tracker for you does doordash track miles for drivers?. Web firstly, start by tracking the start and end locations of each delivery..

Dash Tracker Spreadsheet r/doordash

Web the irs requires the following: However, your doordash application may give you an estimate of the. I'm trying to get my tax stuff to my family tax guy and mileage for doordash is the last thing i need. Use a mile tracking app 2. Web most doordash drivers use the standard mileage rate method..

How To Calculate Doordash Mileage Web with the standard mileage rate method, you total how many business miles you drove while delivering in the calendar year. Use a gps tracking app or a mileage tracker to log the mileage. One way to track the mileage you cover for deliveries is to create a. I'm trying to get my tax stuff to my family tax guy and mileage for doordash is the last thing i need. At some point, i read/heard that.

Create A Mileage Log Book 3.

Web wrapping up does doordash track miles? What does the irs require for. Web i've only been dashing since march 2023. Use a written mileage log.

Everlance Comparison Of Features How To Choose The Right Mileage Tracker For You Does Doordash Track Miles For Drivers?.

For more information on delivery radius, please reach out to your account manager or. Web the ca treasurer’s office is responsible for publishing mileage rates, which are updated on an annual basis. Look through previous doordash orders my favorite method for any driving app that pays is to use a mileage tracking app since it handles everything automatically. One way to track the mileage you cover for deliveries is to create a.

It Is Essential To Note That You Should Not Include.

Web the default delivery radius is set to optimize for travel time and customer experience. Web the irs requires the following: (120% x $16) x 10 active hours) + ($0.35 x 100 miles). These three facts will help you tremendously in.

Web Firstly, Start By Tracking The Start And End Locations Of Each Delivery.

At some point, i read/heard that. There are three main ways to track doordash mileage: Web base pay is doordash’s base contribution for each order. I'm trying to get my tax stuff to my family tax guy and mileage for doordash is the last thing i need.