How To Calculate Employee Benefits

How To Calculate Employee Benefits - Find suta tax rate information. Web how to calculate the value of your salary & benefits. The right software reduces stress and a heavy administrative lift. Web these benefits are relatively easy to calculate; Web that includes an average of $28.97 per hour for wages and salary and $12.06 per hour for benefits, which is 29.4% of total compensation costs.

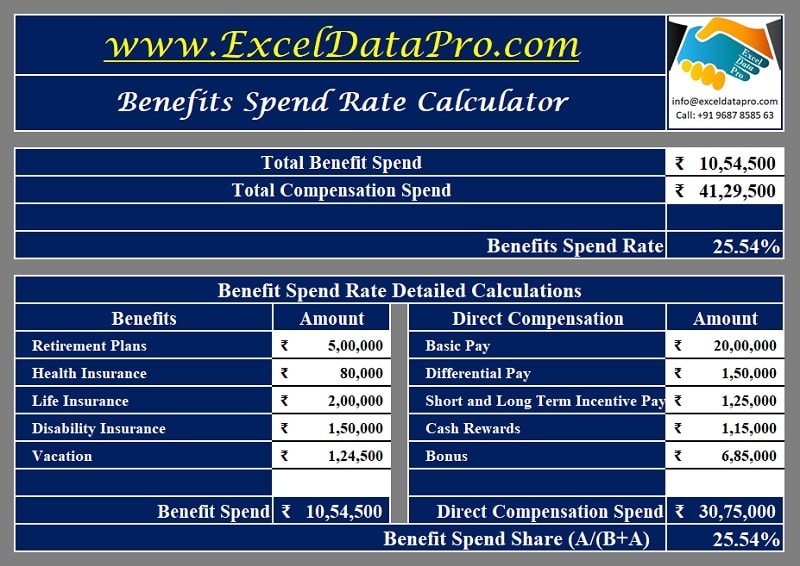

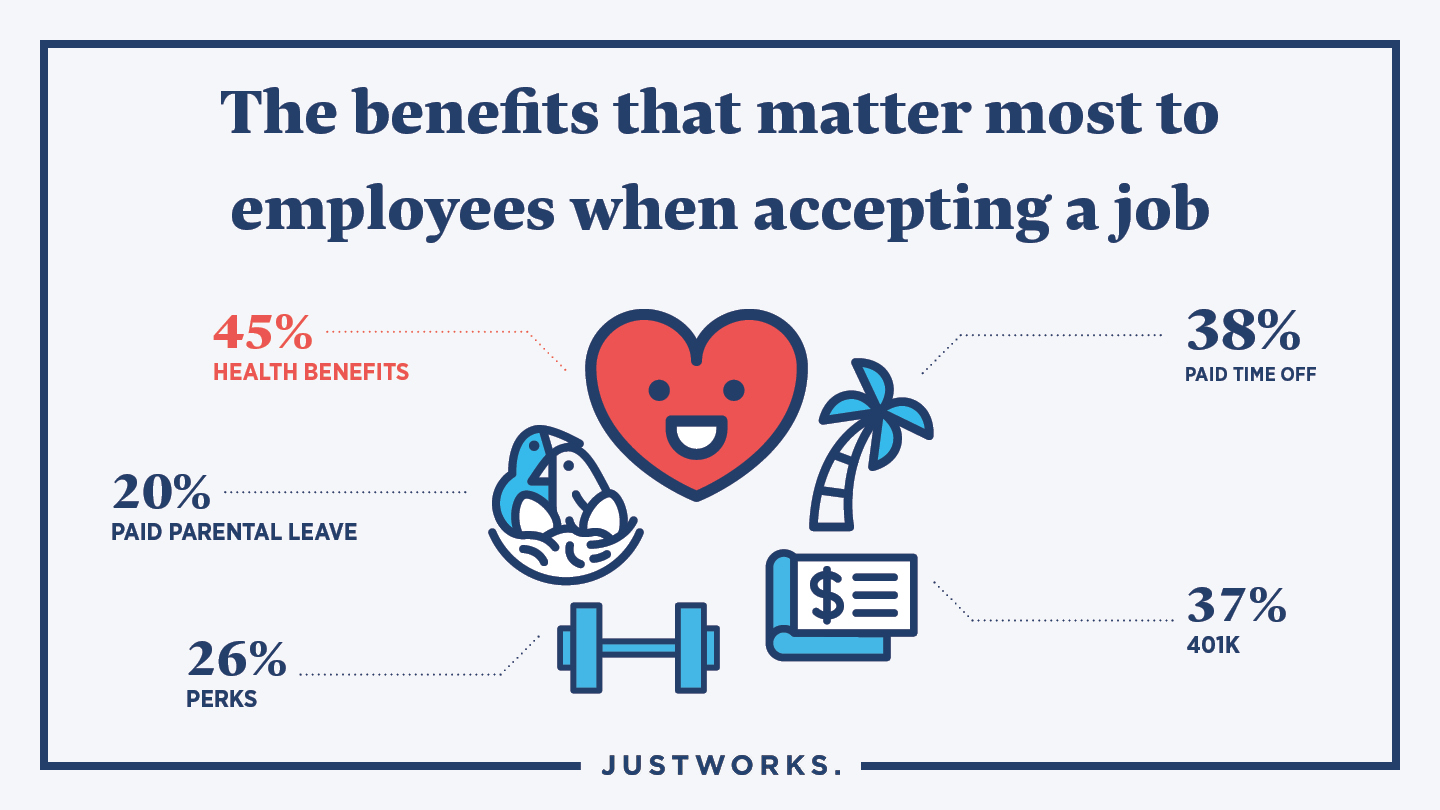

Web method is to total the actual employer contributions to benefits and retirement and divide by the actual salary. Web to get each employee metric, divide the total cost of employee benefits by the total number of employees in the organization. Web collecting employee feedback is key to structuring a total reward strategy and offering benefits that appeal to an entire workforce. There is a lot more to your total compensation than just your salary. Web the simplest method to calculate the total cost of employee benefits is this. Find suta tax rate information. Web these benefits are relatively easy to calculate;

Employee Benefits Types, Importance, and Examples

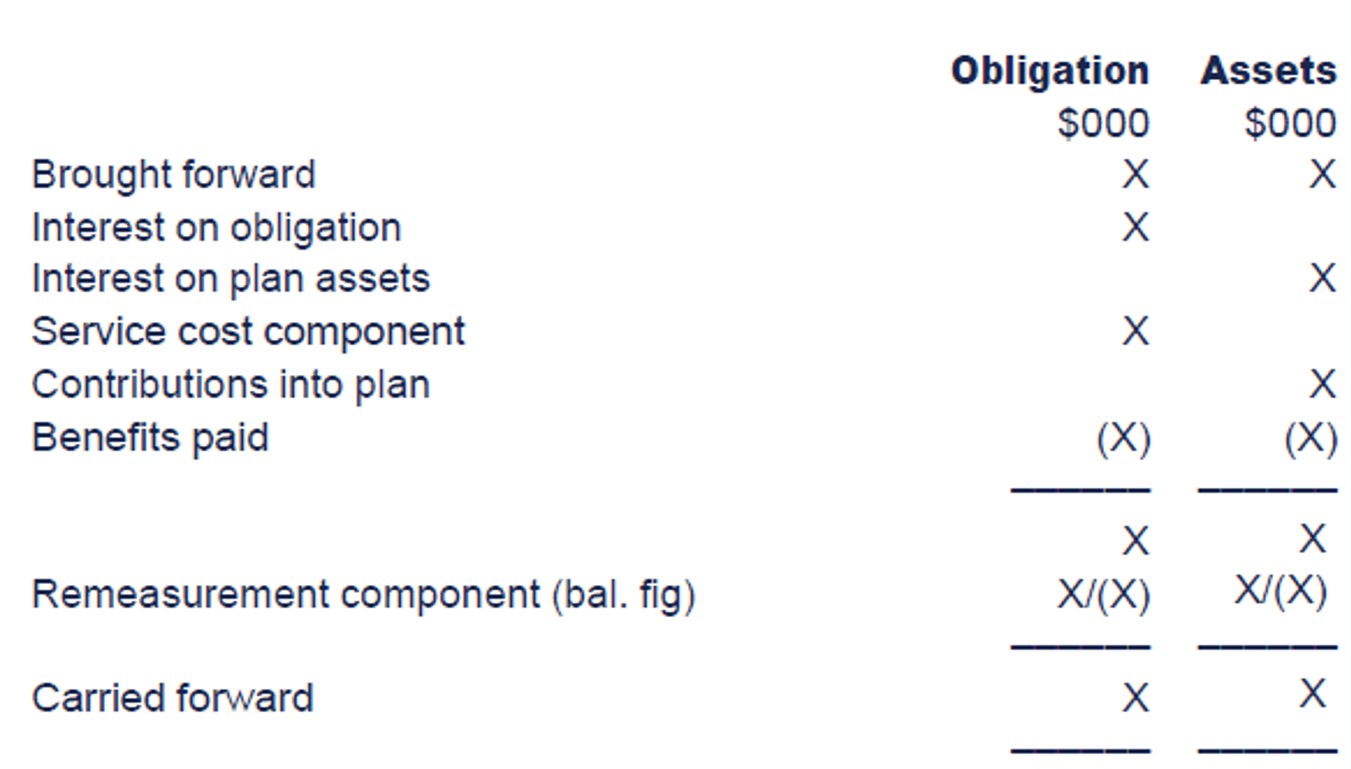

Find suta tax rate information. The amount is calculated with a formula that may include salary, years of service, and a fixed percentage. Web every employee’s fringe benefit rate can be calculated by comparing fringe benefit costs to the base salary they receive. Most pension plans allow employees to start. Just multiply the benefit percentage.

Download Benefits Spend Rate Calculator Excel Template ExcelDataPro

The average for civilian workers is. There are multiple ways to. Web if the job expense figure is the sum of all benefits an employee receives during the year, then apply this figure to the job benefits. Web how to calculate the value of your salary & benefits. This rate helps businesses calculate the. Web.

How To Calculate Projected Benefit Obligation

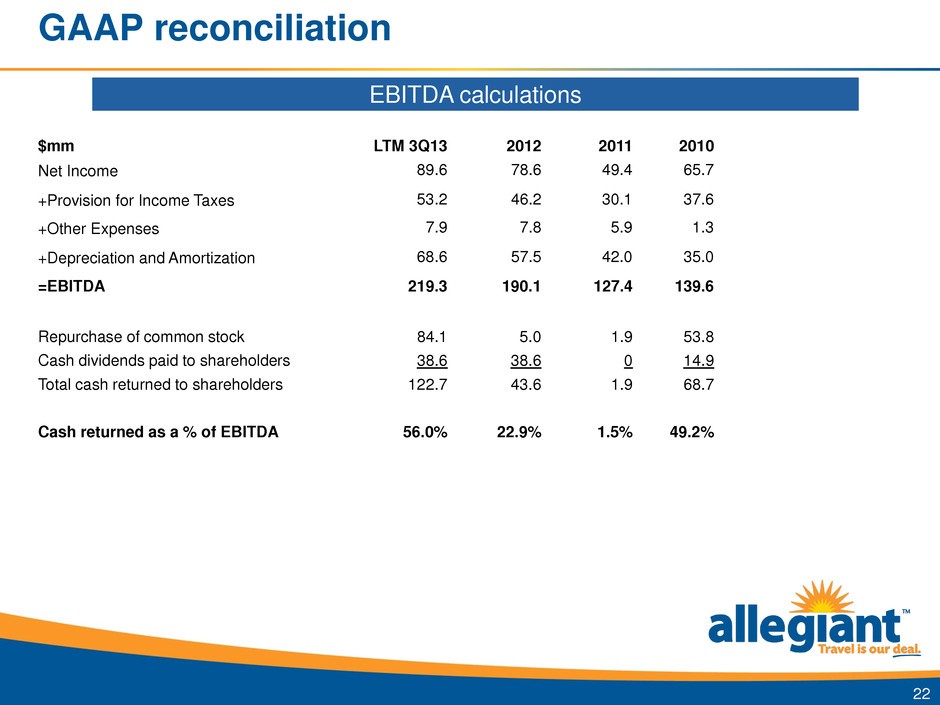

Web that includes an average of $28.97 per hour for wages and salary and $12.06 per hour for benefits, which is 29.4% of total compensation costs. Web the simplest method to calculate the total cost of employee benefits is this. With a $30,000 salary and no annual cost for health insurance, your net salary is.

How To Calculate Value Of Defined Benefit Pension

Web the annual deductible is $1,000. The simplified option or the regular method. The talent crunch is a real business problem that employers have been facing. Web these benefits are relatively easy to calculate; Just multiply the benefit percentage by each employee’s wages up to the wage base. Web you can calculate the home office.

How To Set Up Benefits For Employees

Web how to calculate the value of your salary & benefits. There are multiple ways to. The result will indicate each. When calculating the total value of your. For workers’ compensation insurance, your. With a $30,000 salary and no annual cost for health insurance, your net salary is $30,000. The talent crunch is a real.

How to Set Up an Employee Benefits Package in 6 Steps

Web you can calculate the home office deduction in one of two ways: When calculating the total value of your. Web method is to total the actual employer contributions to benefits and retirement and divide by the actual salary. Web the annual deductible is $1,000. The result will indicate each. Web these benefits are relatively.

How to calculate employee checks QuickBooks

Web how to calculate the value of your salary & benefits. When calculating the total value of your. Web use this calculator to help illustrate the total compensation package for an employee. The talent crunch is a real business problem that employers have been facing. Through this equation, you can determine if the increased revenue.

How To Calculate Benefits As A Percentage Of Salary

Web use this calculator to help illustrate the total compensation package for an employee. There are multiple ways to. $27,700 for married couples filing jointly or qualifying. Web the simplest method to calculate the total cost of employee benefits is this. There is a lot more to your total compensation than just your salary. Most.

How to calculate employee benefits

When calculating the total value of your. Web how to calculate fringe benefits: The amount is calculated with a formula that may include salary, years of service, and a fixed percentage. The standard deduction for 2023 is: Most pension plans allow employees to start. Web the annual deductible is $1,000. The right software reduces stress.

Calculate Your Expected Employee Benefits Costs Capterra

The simplified option or the regular method. The result will indicate each. Web the annual deductible is $1,000. With a $30,000 salary and no annual cost for health insurance, your net salary is $30,000. Web payroll tax management is crucial to a business’s compliance. Web every employee’s fringe benefit rate can be calculated by comparing.

How To Calculate Employee Benefits Web how to calculate the value of your salary & benefits. There are multiple ways to. Web collecting employee feedback is key to structuring a total reward strategy and offering benefits that appeal to an entire workforce. Web if the job expense figure is the sum of all benefits an employee receives during the year, then apply this figure to the job benefits. This rate helps businesses calculate the.

There Are Multiple Ways To.

Web every employee’s fringe benefit rate can be calculated by comparing fringe benefit costs to the base salary they receive. Web our company professional partnerships login let's get started stay competitive by offering employees fair compensation for their work. A comprehensive guide hub payroll january 9, 2024 offering benefits to your employees can bring several advantages. Web you can calculate the home office deduction in one of two ways:

$27,700 For Married Couples Filing Jointly Or Qualifying.

Find suta tax rate information. Web these benefits are relatively easy to calculate; Web the annual deductible is $1,000. The simplified option or the regular method.

Web Method Is To Total The Actual Employer Contributions To Benefits And Retirement And Divide By The Actual Salary.

Web how to calculate fringe benefits: Web use this calculator to help illustrate the total compensation package for an employee. Just multiply the benefit percentage by each employee’s wages up to the wage base. Web standard deduction amounts.

The Standard Deduction For 2023 Is:

Let’s assume half of all employees receive a. Through this equation, you can determine if the increased revenue of. Web payroll tax management is crucial to a business’s compliance. Most pension plans allow employees to start.