How To Calculate Interest On A Loan Excel

How To Calculate Interest On A Loan Excel - Pmt (rate, nper, pv, [fv], [type]). We divide 5% by 12 because 5% represents annual interest. These templates cover the most common types of loans and are all available for free. Web things you should know. Web how to calculate loan interest in excel.

For example, if you received a loan of $20,000, which you must pay off in annual installments during the next 3 years with an annual interest rate of 6%, the interest portion of the 1 st year payment can be calculated with this formula: Input into cell d3 the amount of the loan. The total number of payment periods. Web the equation reads: Web the decimal will be converted into a percentage. Use the ppmt function to calculate the principal part of the payment. In this function, c7 denotes the monthly interest rate of 0.58%.

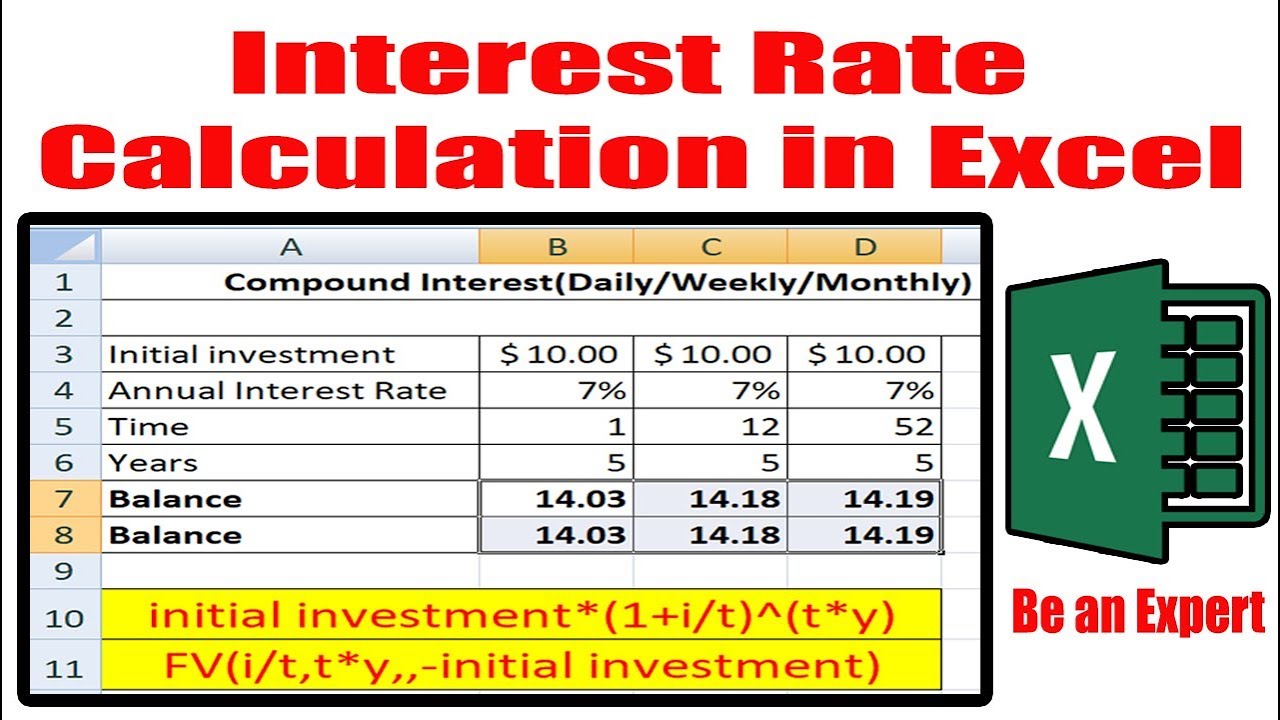

Interest Rate Calculation in Excel YouTube

Web you can use the cumipmt function in excel to calculate the total interest that will be paid on a loan. Beginning value x [1 + (interest rate ÷ number of compounding periods per year)] ^ (years x number of compounding periods per year) = future. Starting value of the loan) For this step, you.

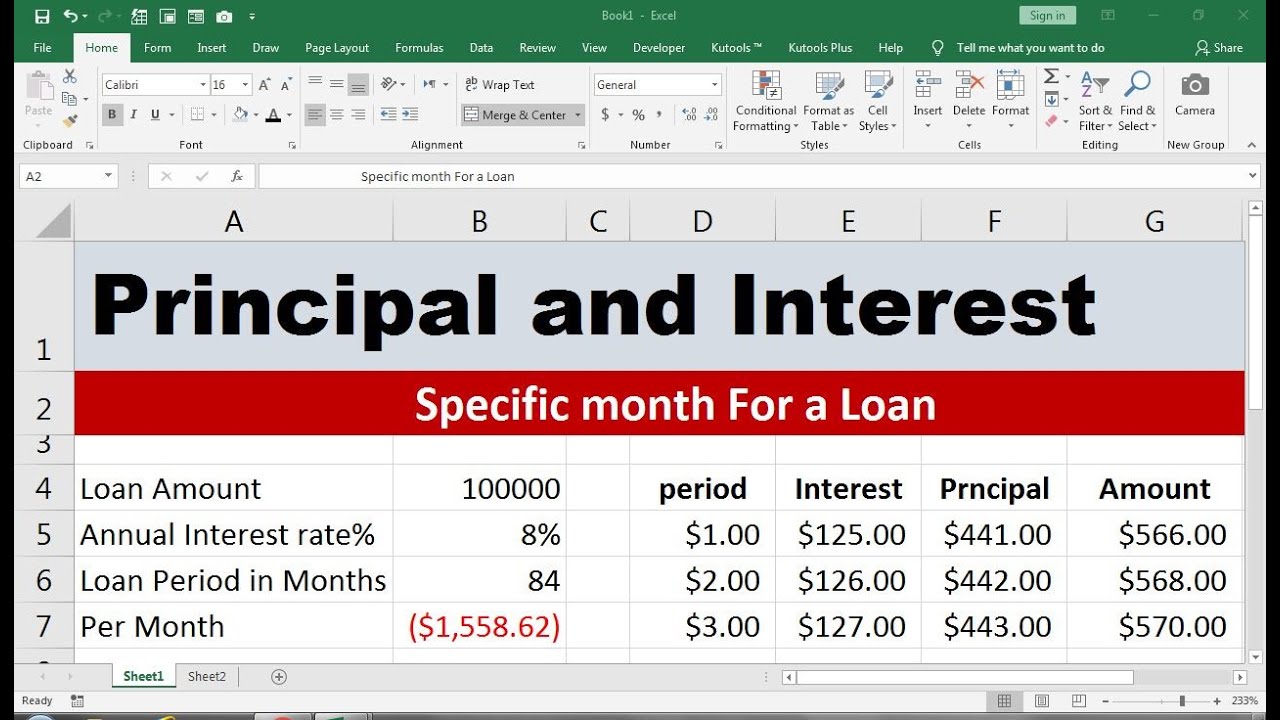

How to Calculate Principal and Interest on a Loan in Excel ExcelDemy

This function uses the following syntax: Web mind your money. One of the best ways to keep up with your loan, payments, and interest is with a handy tracking tool and loan calculator for excel. Rate (nper, pmt, pv, [fv], [type], [guess]) where: Step 5) divide this percentage by the number of years over which.

Calculate loan interest in given year Excel formula Exceljet

Nper is the total number of payments. For this step, you might want to include cells for the principal amount of the loan, your annual interest rate, how many years you plan to repay the loan, what your starting period is and what your ending period is. Use the ppmt function to calculate the principal.

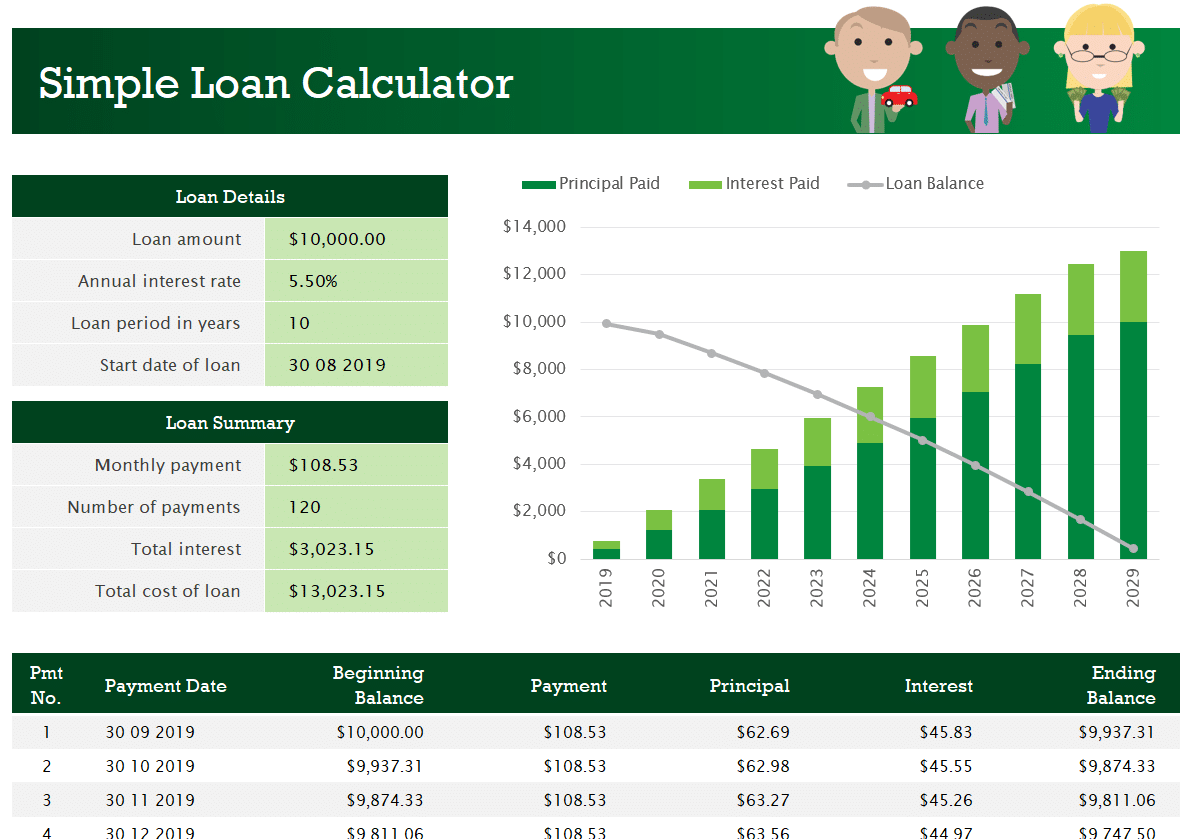

How To Use Excel's Loan Calculator Get The Simple Template Here

Web the general formula for simple interest is: This function uses the following syntax: Web the first step to calculating your loan interest in excel is to create a data table with the relevant information. You can enter a beginning. Web =pmt (17%/12,2*12,5400) the result is a monthly payment of $266.99 to pay the debt.

How to Calculate the Total Interest on a Loan in Excel YouTube

These templates cover the most common types of loans and are all available for free. In the payment row, use the formula =ipmt(b2, 1, b3, b1) to calculate the interest payment. Fill out the principal amount, interest rate, and the number of payment periods. The higher your interest rate, or yield, the more your bank.

how to calculate principal and interest on a loan in excel YouTube

=pmt(b2/12,b3,b4) as you see here, the interest rate is in cell b2 and we divide that by. Web =pmt (17%/12,2*12,5400) the result is a monthly payment of $266.99 to pay the debt off in two years. = cumipmt ( rate, nper, pv, start, end, type) explanation. Use the ppmt function to calculate the principal part.

How To Calculate Loan Payments Using The PMT Function In Excel Excel

Web things you should know. To do this, we set up ppmt like this: It is easy and simple to calculate apr in excel. Web here’s how you can calculate the total interest paid over the duration of a loan: One of the best ways to keep up with your loan, payments, and interest is.

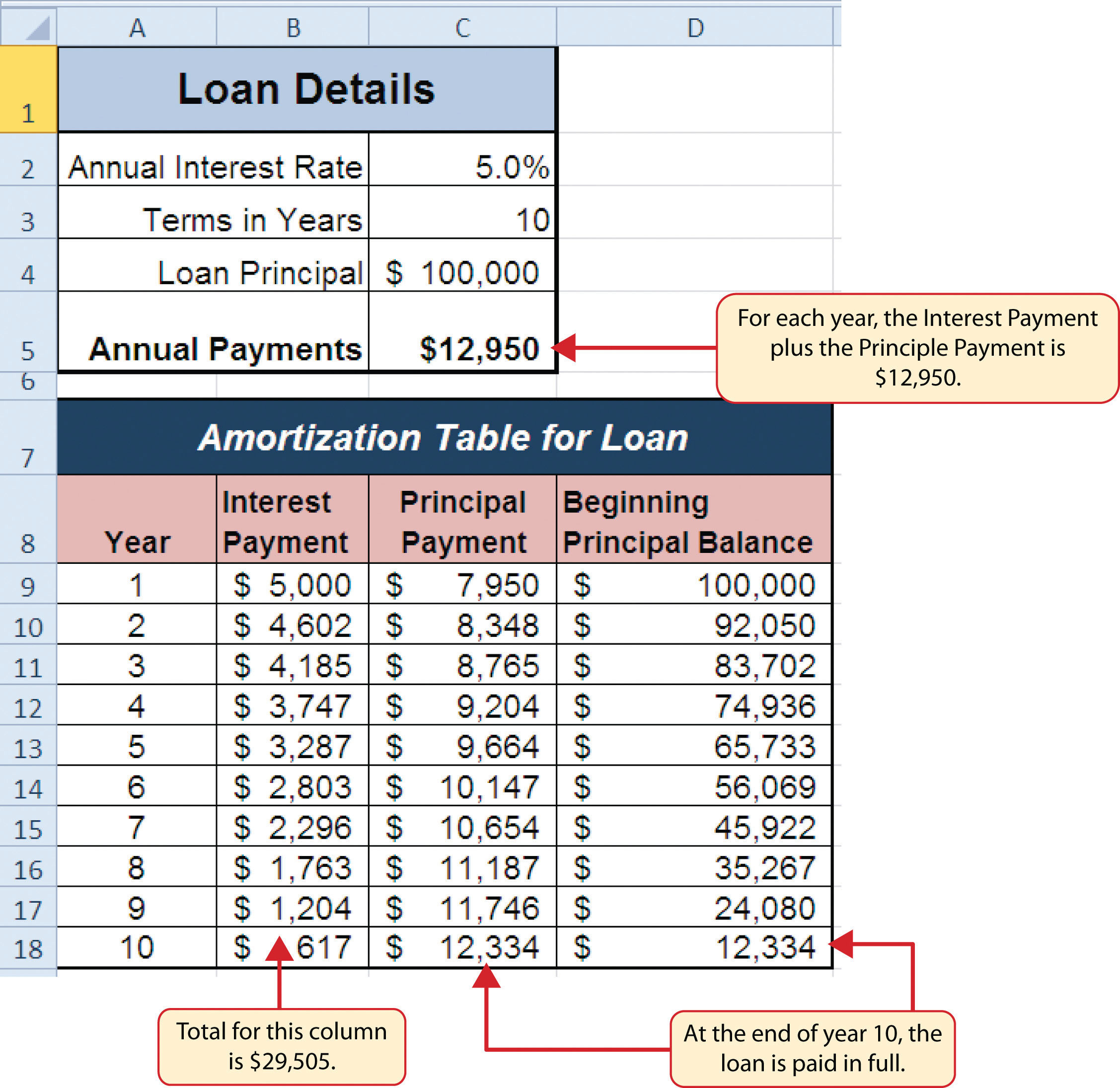

Loan Amortization Schedule Spreadsheet —

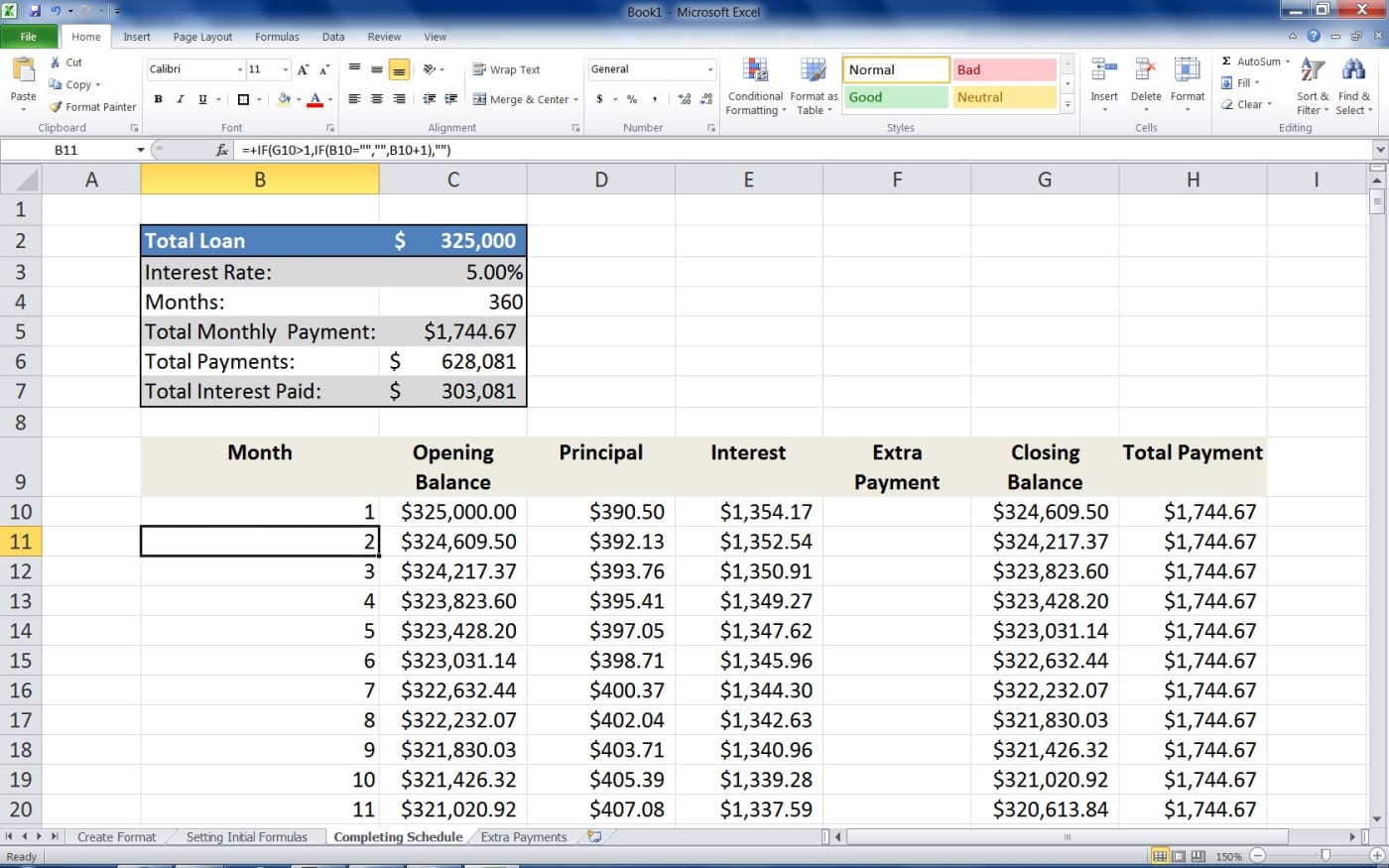

One of the best ways to keep up with your loan, payments, and interest is with a handy tracking tool and loan calculator for excel. Web mind your money. To do this, we set up cumipmt like this: For a more complete description of the arguments in pmt, see the pv function. Pmt (rate, nper,.

Mortgage Loan Calculator Using Excel TurboFuture

In the example shown, the formula in c10 is: Web to get the monthly payment amount for a loan with four percent interest, 48 payments, and an amount of $20,000, you would use this formula: Web the general formula for simple interest is: The rate argument is the interest rate per period for the loan..

Calculate payment for a loan Excel formula Exceljet

Input the repayment amount per month into cell d7. Web let’s break down how to calculate interest on a loan in excel using the pmt function. Nper is the total number of payments. For example, it can calculate interest rates in situations where car dealers only provide monthly payment information and total price without including.

How To Calculate Interest On A Loan Excel Web here’s how you can calculate the total interest paid over the duration of a loan: To do this, we set up cumipmt like this: Fill out the principal amount, interest rate, and the number of payment periods. Web the general formula for simple interest is: Web let’s break down how to calculate interest on a loan in excel using the pmt function.

Web Here’s How You Can Calculate The Total Interest Paid Over The Duration Of A Loan:

In this function, c7 denotes the monthly interest rate of 0.58%. Rate (nper, pmt, pv, [fv], [type], [guess]) where: The rate argument is the interest rate per period for the loan. Loan calculator templates for excel.

Starting Value Of The Loan)

Web mind your money. Pmt (rate, nper, pv, [fv], [type]). For this step, you might want to include cells for the principal amount of the loan, your annual interest rate, how many years you plan to repay the loan, what your starting period is and what your ending period is. Web you can use the cumipmt function in excel to calculate the total interest that will be paid on a loan.

Web The Decimal Will Be Converted Into A Percentage.

Web the equation reads: We divide 5% by 12 because 5% represents annual interest. Interest that is not compounded), you can use a. For example, in this formula the 17% annual interest rate is divided by 12, the number of months in a year.

For The Pv Argument, Enter The Loan Amount ($C$5).

Pmt (rate, nper, pv, [fv], [type]) note: Input the repayment amount per month into cell d7. Step 5) divide this percentage by the number of years over which the loan is spread to calculate the annualized percentage of expense. You can enter a beginning.