How To Calculate Lease Liability Under Asc 842

How To Calculate Lease Liability Under Asc 842 - When calculating the lease liability, the first step is to work out. In this case, it will be the lease. Web calculating your journal entries for operating leases under asc 842 by lauren covell september 28, 2022 last updated on december 2, 2023 by morgan. The lease liability is the foundation of lease accounting under asc 842, as the lease liability is the. Web the lease liability is equal to the present value of the remaining lease payments.

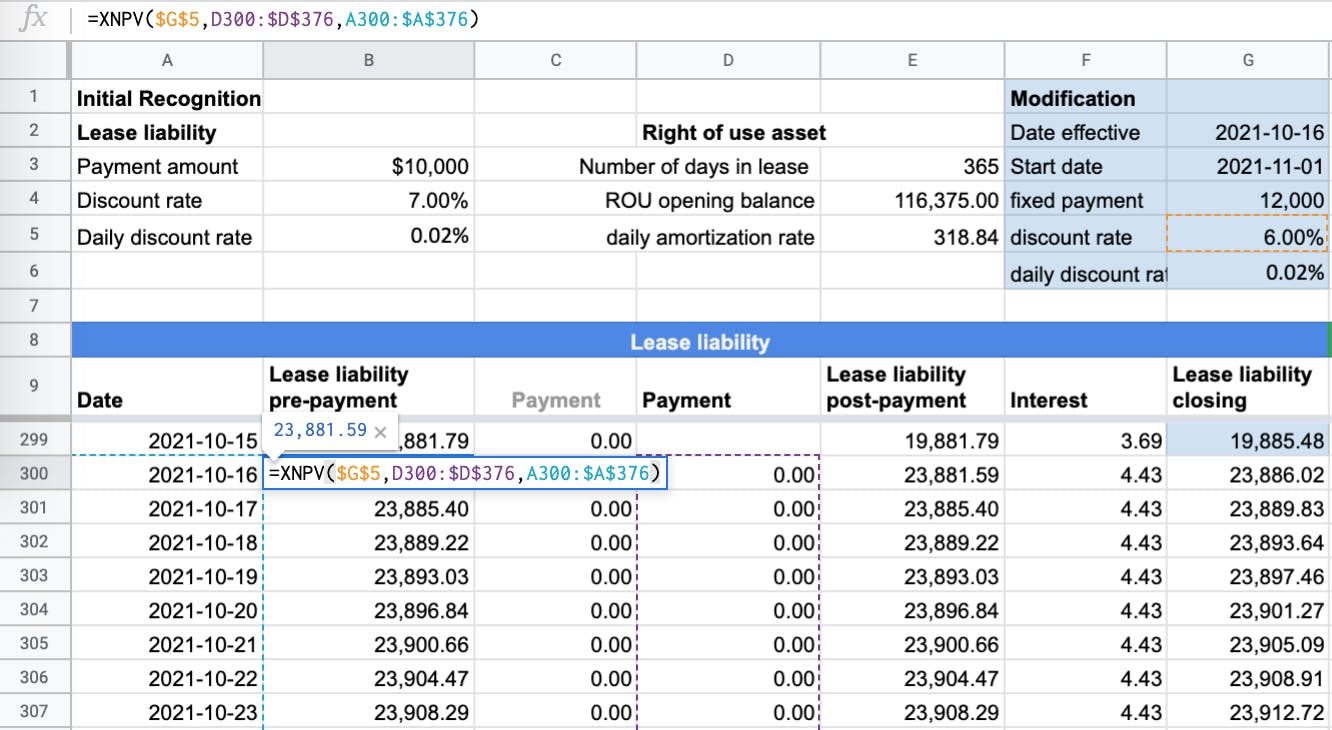

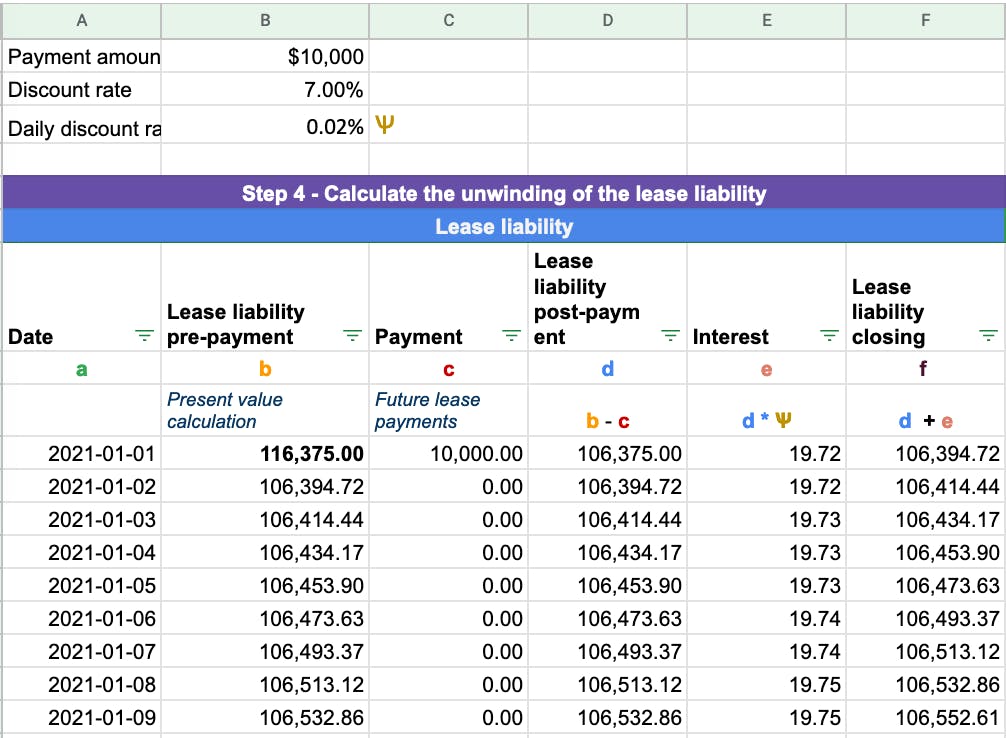

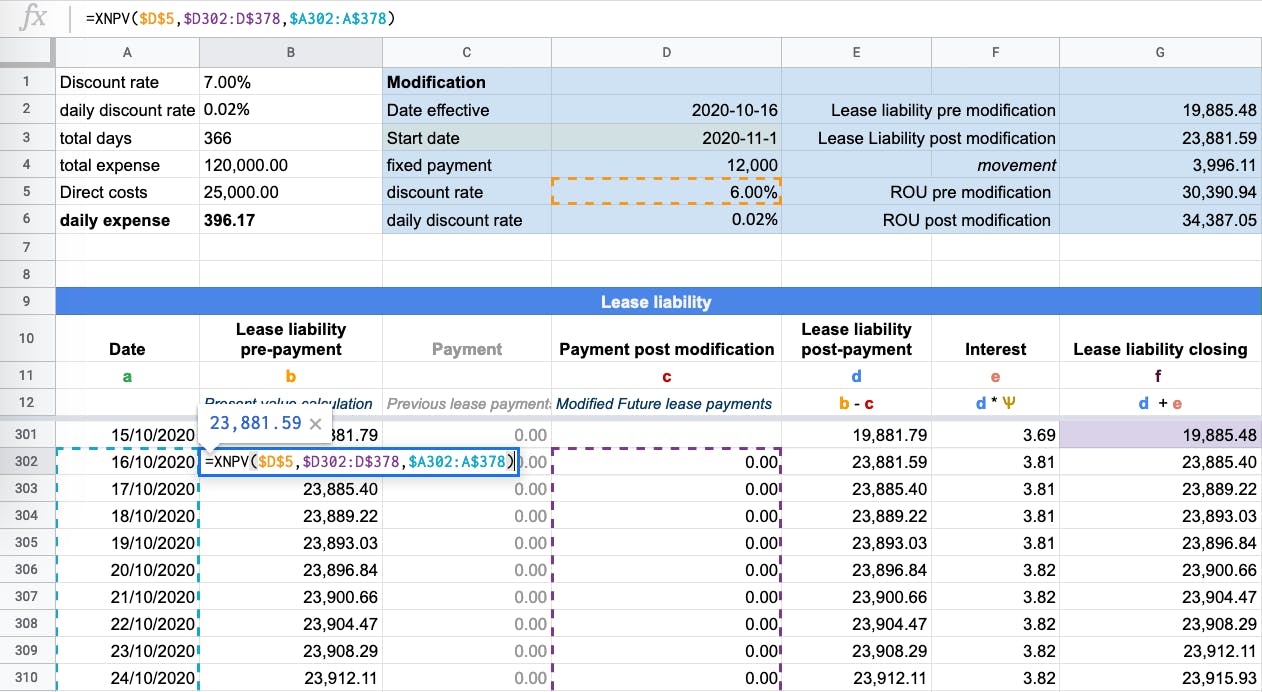

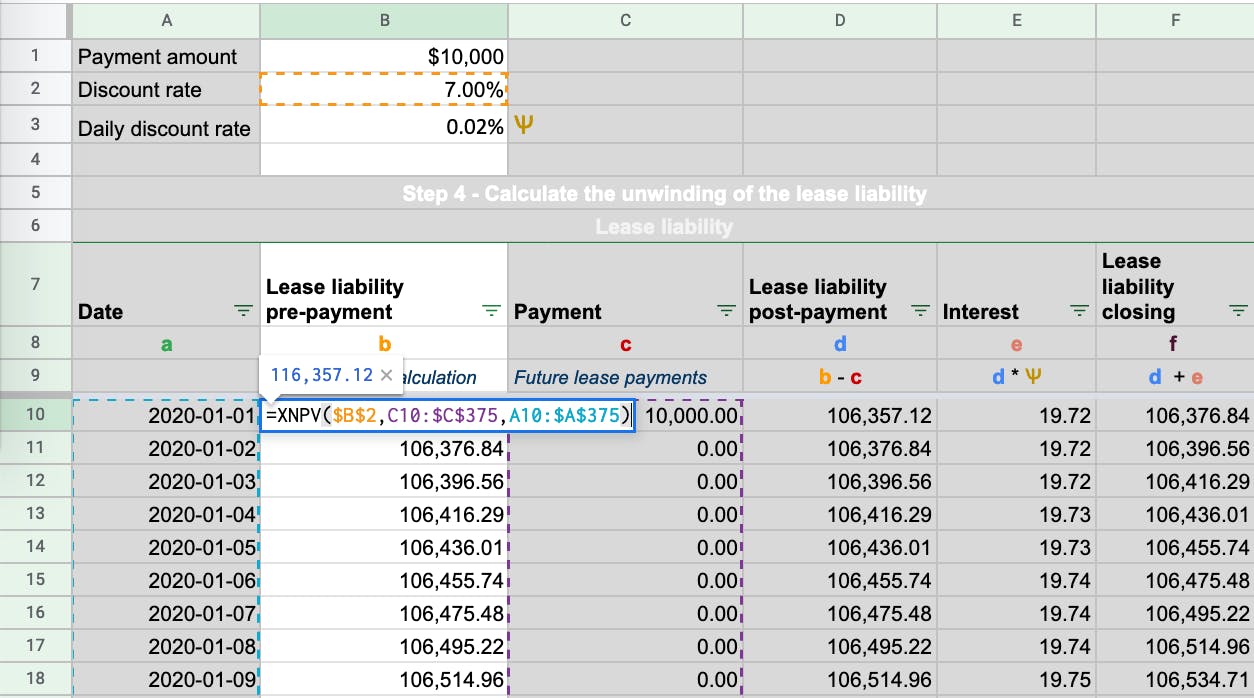

Web under asc 842, companies must recognize a right of use asset and lease liability for all operating leases with a term exceeding 12 months. Determine the lease term under asc 840. First, determine the lease term. Web how to calculate the right of use asset at transition. Deferred rent examples under asc 840 and asc 842 example #1: Web according to asc 842 and ifrs 16, the lease liability value is calculated with the following formula: Web the lease liability is equal to the present value of the remaining lease payments.

How to Calculate a Finance Lease under ASC 842

The lease liability is the foundation of lease accounting under asc 842, as the lease liability is the. Web the lease liability is equal to the present value of the remaining lease payments. Web the lease liability represents the present value of future lease payments, while the rou asset represents the lessee’s right to use.

How to Calculate a Finance Lease under ASC 842

Determine the total lease payments under gaap. Web how to calculate the right of use asset at transition. Lease liability represents the current value of minimum future lease payments. Determine the lease term under asc 840. Fixed payments required by the lease agreement, such as base rent in. Deferred rent examples under asc 840 and.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Determine the lease term under asc 840. Read a complete guide on the rou asset & lease liability under asc 842, ifrs 16, & gasb 87 plus a. Web asc 842 defines the future lease payments to include in the lease liability calculation as: In this case, it will be the lease. Web the basic.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

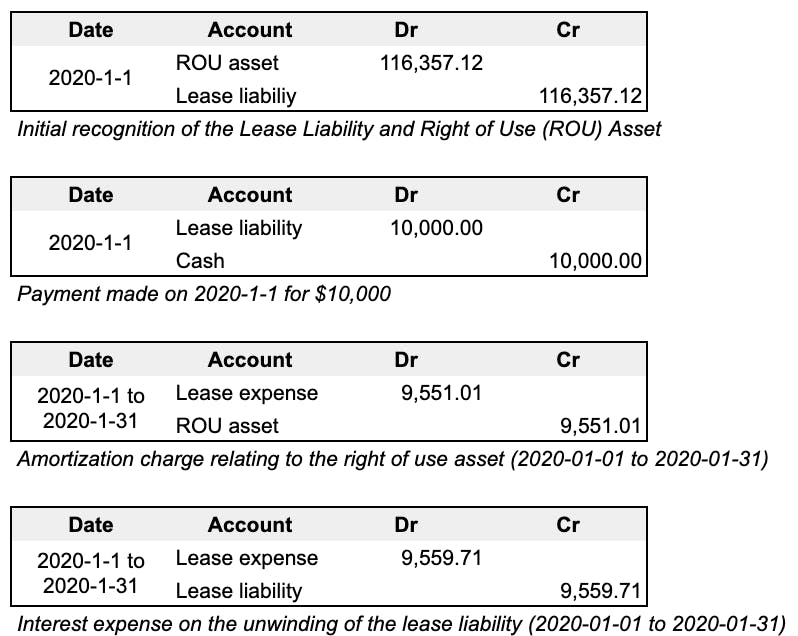

Web how to calculate the journal entries for an operating lease under asc 842 step 1 recognize the lease liability and right of use asset. Web under asc 842, given that all leases are now recorded on the balance sheet with a lease liability and right of use asset, the lessee must determine discount rates.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Several economic factors have affected the lease accounting for many commercial real estate entities, including owners, operators, and. Deferred rent examples under asc 840 and asc 842 example #1: Web the lease liability is equal to the present value of the remaining lease payments. Web the lease liability represents the present value of future lease.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Read a complete guide on the rou asset & lease liability under asc 842, ifrs 16, & gasb 87 plus a. Deferred rent under asc 840 example #2: Initial right of use asset and lease liability the value of the initial right of use asset is the. Web how to calculate the right of use.

How to Calculate a Finance Lease under ASC 842

Determine the total lease payments under gaap. Web calculating your journal entries for operating leases under asc 842 by lauren covell september 28, 2022 last updated on december 2, 2023 by morgan. Web asc 842 defines the future lease payments to include in the lease liability calculation as: Web under asc 842, companies must recognize.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Web how to calculate the right of use asset at transition. Read a complete guide on the rou asset & lease liability under asc 842, ifrs 16, & gasb 87 plus a. A roadmap for asc 842. Web how to calculate the journal entries for an operating lease under asc 842 step 1 recognize the.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Fixed payments required by the lease agreement, such as base rent in. The present value of the lease payments payable over the. Deferred rent examples under asc 840 and asc 842 example #1: Web calculating your journal entries for operating leases under asc 842 by lauren covell september 28, 2022 last updated on december 2,.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

The lease liability is the foundation of lease accounting under asc 842, as the lease liability is the. Deferred rent under asc 840 example #2: Read a complete guide on the rou asset & lease liability under asc 842, ifrs 16, & gasb 87 plus a. Web the lease liability is equal to the present.

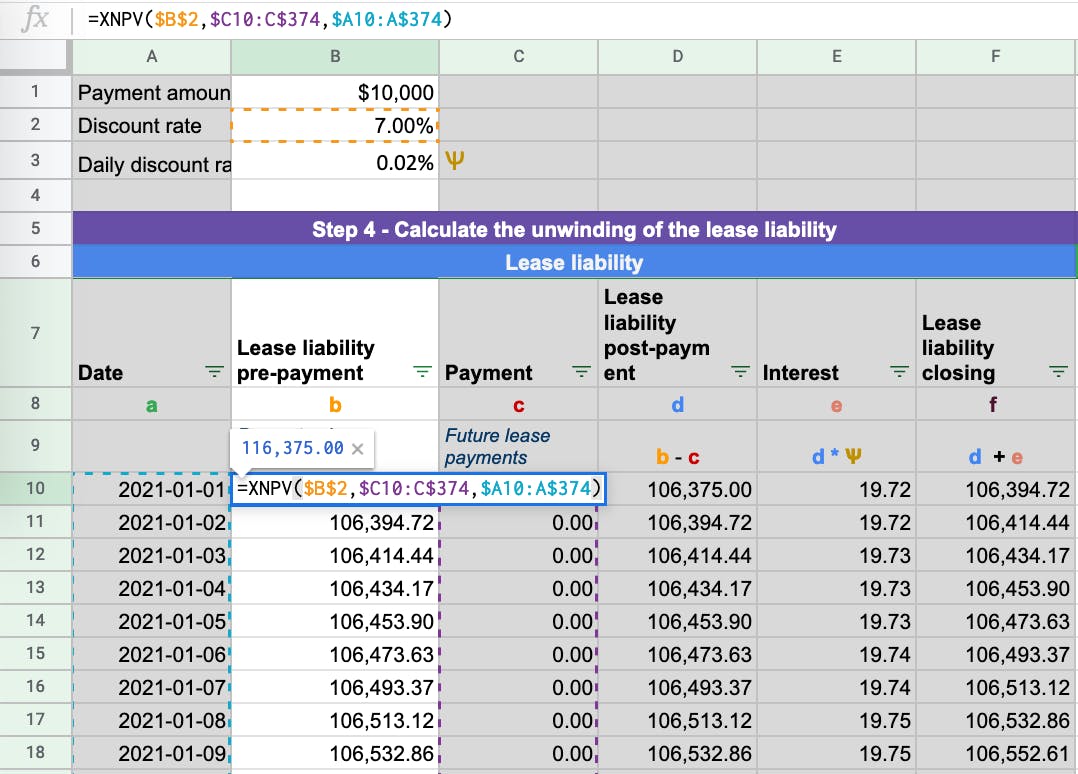

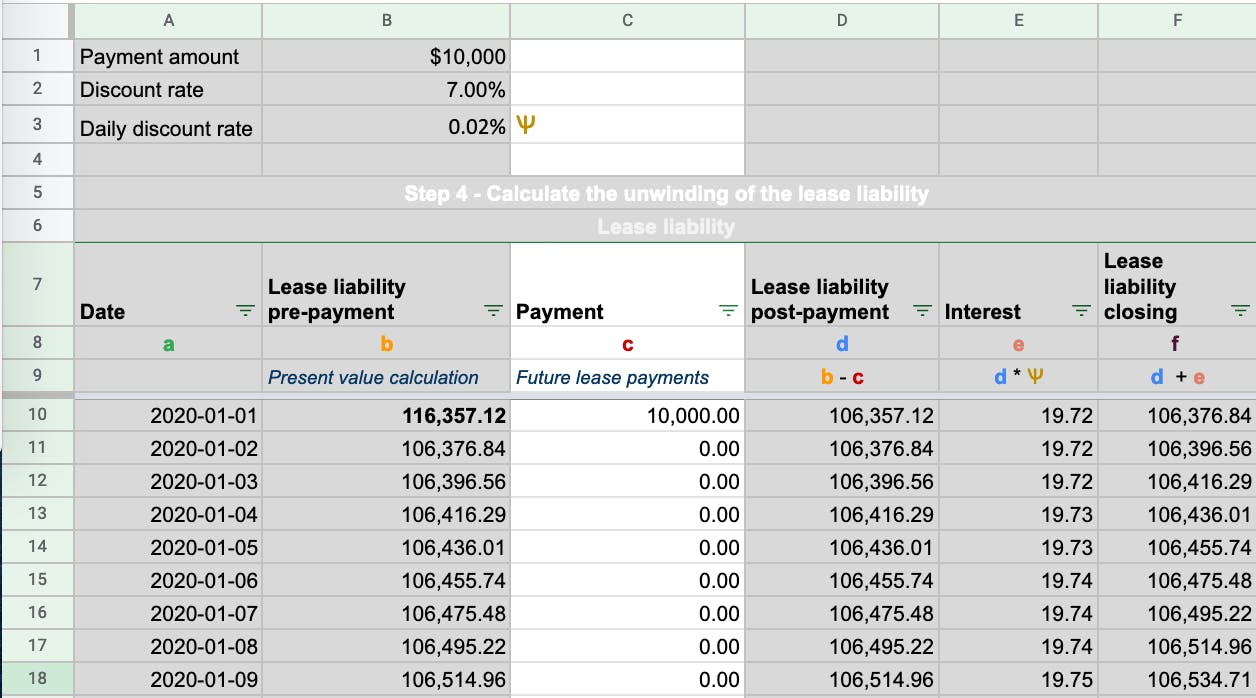

How To Calculate Lease Liability Under Asc 842 A roadmap for asc 842. Web under asc 842, companies must recognize a right of use asset and lease liability for all operating leases with a term exceeding 12 months. Web the basic postings for lease contracts based on asc 842 consist of four steps: Web according to asc 842 and ifrs 16, the lease liability value is calculated with the following formula: Web calculating your journal entries for operating leases under asc 842 by lauren covell september 28, 2022 last updated on december 2, 2023 by morgan.

To Calculate The Right Of Use Asset, You First Need To Calculate The Lease Liability.

Web first, it must calculate the total lease liability by basing it on the present value of future lease payments with the applicable discount rate. Web the lease liability is equal to the present value of the remaining lease payments. In this case, it will be the lease. Web calculating your journal entries for operating leases under asc 842 by lauren covell september 28, 2022 last updated on december 2, 2023 by morgan.

Upon Adoption, The Lease Liability Is.

Web the lease liability represents the present value of future lease payments, while the rou asset represents the lessee’s right to use the underlying asset during the. First, determine the lease term. The lease liability is the foundation of lease accounting under asc 842, as the lease liability is the. Web how to calculate the right of use asset at transition.

Initial Right Of Use Asset And Lease Liability The Value Of The Initial Right Of Use Asset Is The.

Web how to calculate a lease liability under asc 842. Determine the total lease payments under gaap. Web how to calculate the journal entries for an operating lease under asc 842 step 1 recognize the lease liability and right of use asset. Web under asc 842, companies must recognize a right of use asset and lease liability for all operating leases with a term exceeding 12 months.

Determine The Lease Term Under Asc 840.

Web nevertheless, asc 842 requires a different method to be used. Web according to asc 842 and ifrs 16, the lease liability value is calculated with the following formula: Several economic factors have affected the lease accounting for many commercial real estate entities, including owners, operators, and. A roadmap for asc 842.