How To Calculate Lease Liability

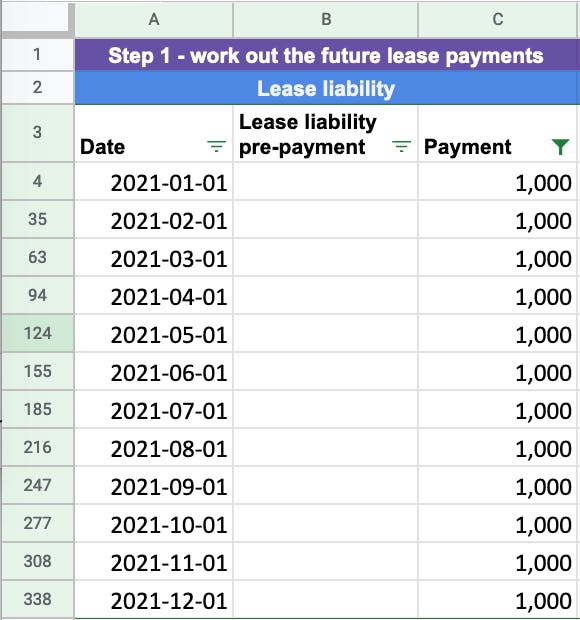

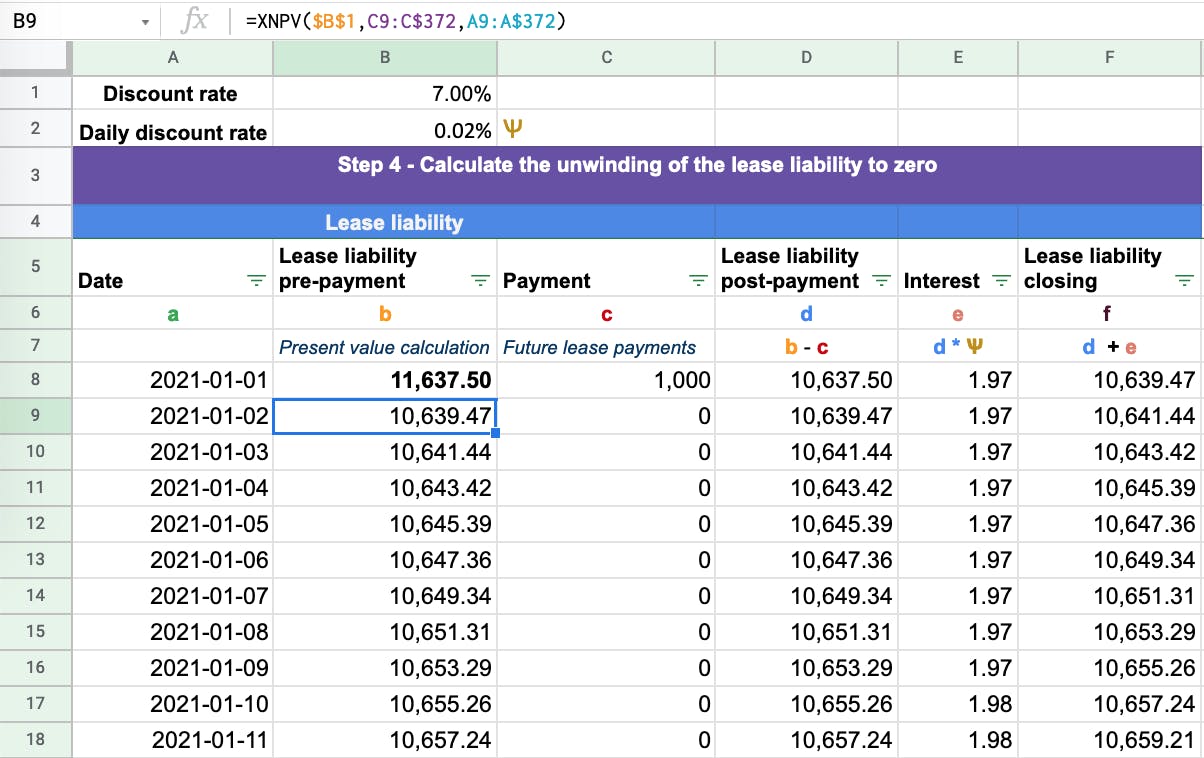

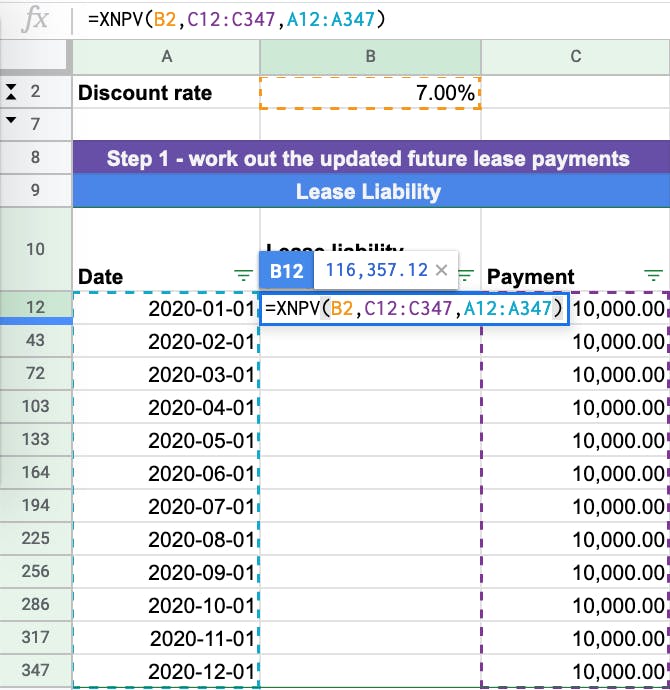

How To Calculate Lease Liability - Web asset in the measurement of the lease liability: Web from a lease accounting perspective, three main inputs need to be extracted to be able to calculate the net present value calculation of the lease liability: Web the lease liability we’re going to calculate is based on the following terms: First, determine the lease term. Web this video shows you how to use microsoft excel to calculate the lease liability required under asc 842, ifrs 16 & gasb 87 at initial recognition.

Web from a lease accounting perspective, three main inputs need to be extracted to be able to calculate the net present value calculation of the lease liability: Web according to asc 842 and ifrs 16, the lease liability value is calculated with the following formula: The amount of each lease. Web learn how to use the npv function in excel to calculate a monthly lease liability amortization schedule based on a simple lease agreement. Web the lease liability is equal to the present value of the remaining lease payments. If the interest rate is known, use the fixed rate tab to. Fixed payments required by the lease agreement, such as base rent.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

The amount of each lease. Web the lease liability is equal to the present value of the remaining lease payments. Web asc 842 defines the future lease payments to include in the lease liability calculation as: Web lessee corp would first calculate the lease liability as the present value of the remaining unpaid annual lease.

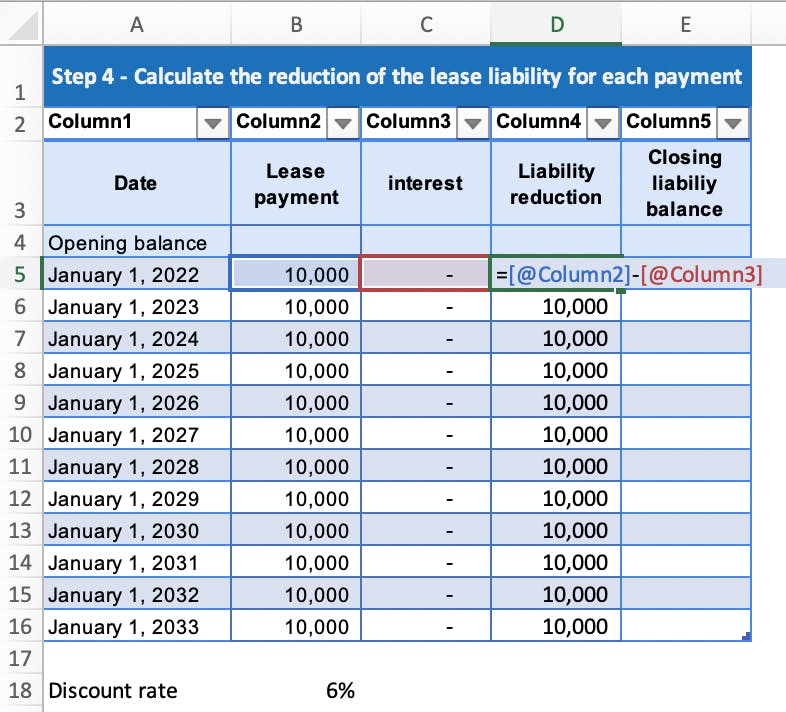

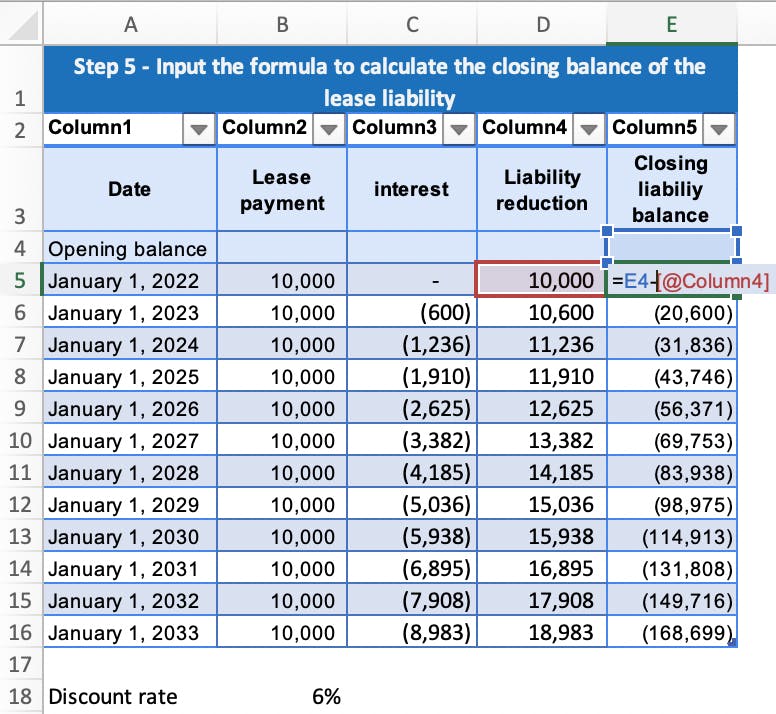

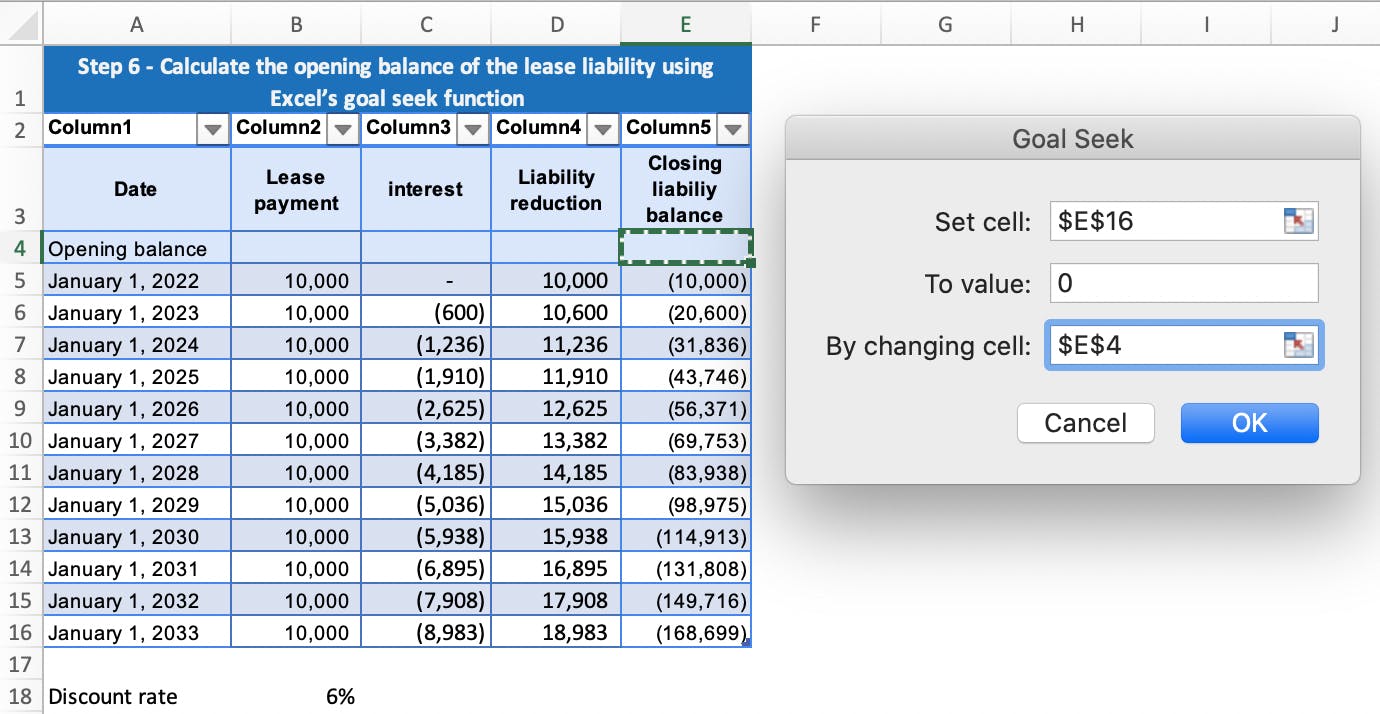

How to Calculate a Lease Liability using Excel

To calculate the present value of the modified future lease. This is done by discounting future lease payments to the lease commencement date. Three things are required to calculate the present value of the lease payments: First, determine the lease term. This method is one of the. Web this video shows you how to use.

How to Calculate a Lease Liability using Excel

Web learn how to use the npv function in excel to calculate a monthly lease liability amortization schedule based on a simple lease agreement. Web the lease calculator can be used to calculate the monthly payment or the effective interest rate on a lease. Three things are required to calculate the present value of the.

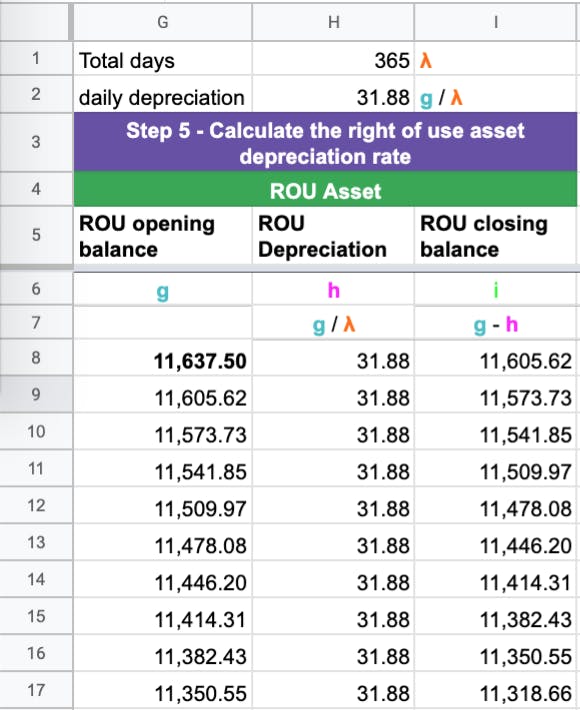

How to calculate a lease liability and rightofuse asset under IFRS 16

Web initially, it’s essential to calculate the present value of the lease liability. This method is one of the. First, determine the lease term. The present value of the lease payments payable over the. Web the lease calculator can be used to calculate the monthly payment or the effective interest rate on a lease. Web.

How to Calculate a Lease Liability using Excel

If the interest rate is known, use the fixed rate tab to. Web the lease liability is calculated as the present value of the lease payments. Web according to asc 842 and ifrs 16, the lease liability value is calculated with the following formula: Web from a lease accounting perspective, three main inputs need to.

Steps in lease accounting RVSBELL Analytics

This is done by discounting future lease payments to the lease commencement date. Web from a lease accounting perspective, three main inputs need to be extracted to be able to calculate the net present value calculation of the lease liability: Web according to asc 842 and ifrs 16, the lease liability value is calculated with.

How to calculate a lease liability and rightofuse asset under IFRS 16

Web lessee corp would first calculate the lease liability as the present value of the remaining unpaid annual lease payments, less the lease incentive paid in year 2, plus the exercise. Web the lease liability is calculated as the present value of the lease payments. Web the lease liability we’re going to calculate is based.

How to calculate a lease liability and rightofuse asset under IFRS 16

Three things are required to calculate the present value of the lease payments: First, determine the lease term. Web the lease calculator can be used to calculate the monthly payment or the effective interest rate on a lease. To calculate the present value of the modified future lease. Web asc 842 defines the future lease.

Learn How to Calculate Lease Liability With This StepbyStep Guide

The amount of each lease. Web the calculation is performed using the terms and payments specified in the lease and a rate of return, or interest rate, specific to either the lease or the organization. The present value of the lease payments payable over the. Fixed payments required by the lease agreement, such as base.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Three things are required to calculate the present value of the lease payments: The amount of each lease. Web lessee corp would first calculate the lease liability as the present value of the remaining unpaid annual lease payments, less the lease incentive paid in year 2, plus the exercise. If the interest rate is known,.

How To Calculate Lease Liability If the interest rate is known, use the fixed rate tab to. Web from a lease accounting perspective, three main inputs need to be extracted to be able to calculate the net present value calculation of the lease liability: Web this video shows you how to use microsoft excel to calculate the lease liability required under asc 842, ifrs 16 & gasb 87 at initial recognition. Web asset in the measurement of the lease liability: The present value of the lease payments payable over the.

Web Initially, It’s Essential To Calculate The Present Value Of The Lease Liability.

Web learn how to use the npv function in excel to calculate a monthly lease liability amortization schedule based on a simple lease agreement. Web asset in the measurement of the lease liability: Web the calculation is performed using the terms and payments specified in the lease and a rate of return, or interest rate, specific to either the lease or the organization. Web lessee corp would first calculate the lease liability as the present value of the remaining unpaid annual lease payments, less the lease incentive paid in year 2, plus the exercise.

This Is Done By Discounting Future Lease Payments To The Lease Commencement Date.

Web the lease calculator can be used to calculate the monthly payment or the effective interest rate on a lease. The amount of each lease. The present value of the lease payments payable over the. Three things are required to calculate the present value of the lease payments:

Fixed Payments Required By The Lease Agreement, Such As Base Rent.

First, determine the lease term. Web asc 842 defines the future lease payments to include in the lease liability calculation as: Web this video shows you how to use microsoft excel to calculate the lease liability required under asc 842, ifrs 16 & gasb 87 at initial recognition. Web the lease liability we’re going to calculate is based on the following terms:

If The Interest Rate Is Known, Use The Fixed Rate Tab To.

To calculate the present value of the modified future lease. Web from a lease accounting perspective, three main inputs need to be extracted to be able to calculate the net present value calculation of the lease liability: Web according to asc 842 and ifrs 16, the lease liability value is calculated with the following formula: Web the lease liability is calculated as the present value of the lease payments.