How To Calculate Nj Property Tax

How To Calculate Nj Property Tax - Zillow has 17 photos of this $190,000 3 beds, 1 bath, 1,366 square feet single family home located at. Web estimate my new jersey property tax. The total amount of property tax to be collected by a town is determined by its county, municipal, and school budget costs. Web property taxes are top of mind for many new jersey homeowners. Web how are nj property taxes calculated?

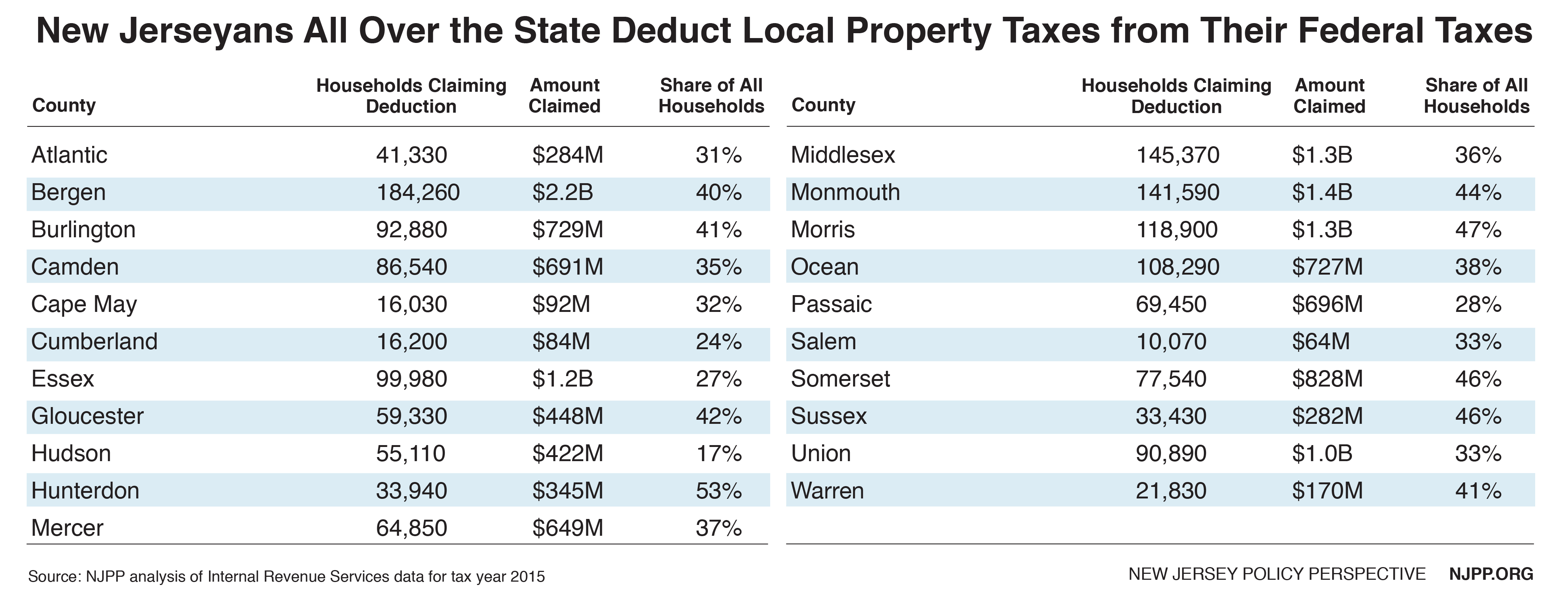

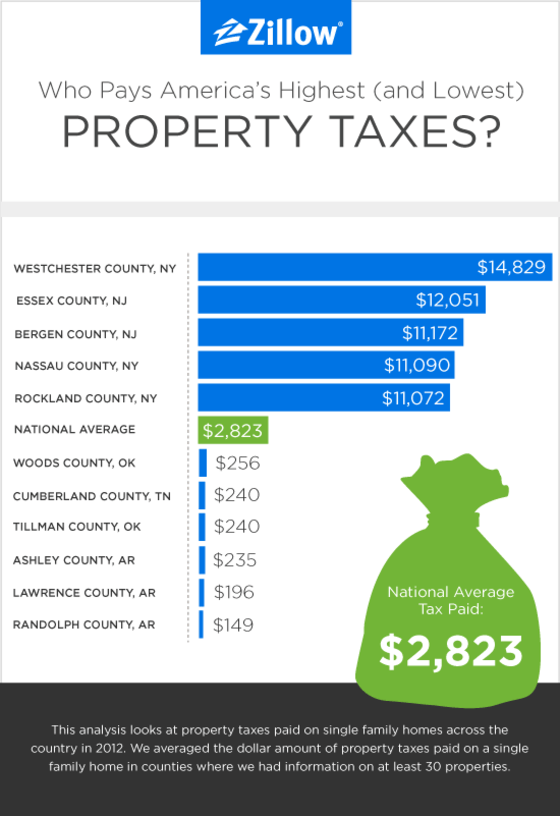

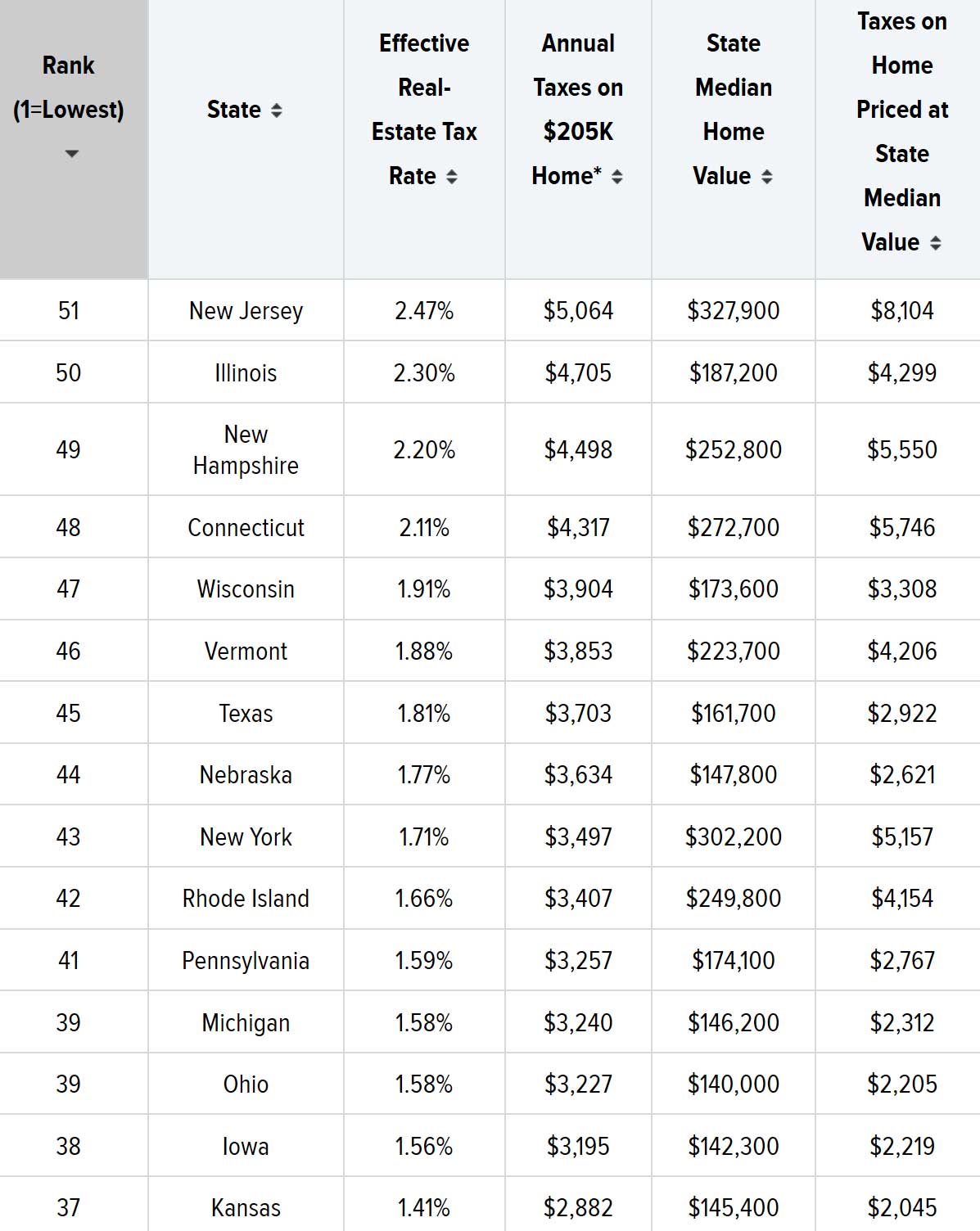

Web property tax is a tax on physical property, such as homes, real estate and land. Web property taxes are top of mind for many new jersey homeowners. Standards for valuing property new jersey. Belvidere has the highest property tax rate in warren county with a general tax rate of 5.873. Web estimate my new jersey property tax. Enter your details to estimate your salary after tax. The state has the highest property taxes in the nation, with an average property tax bill of.

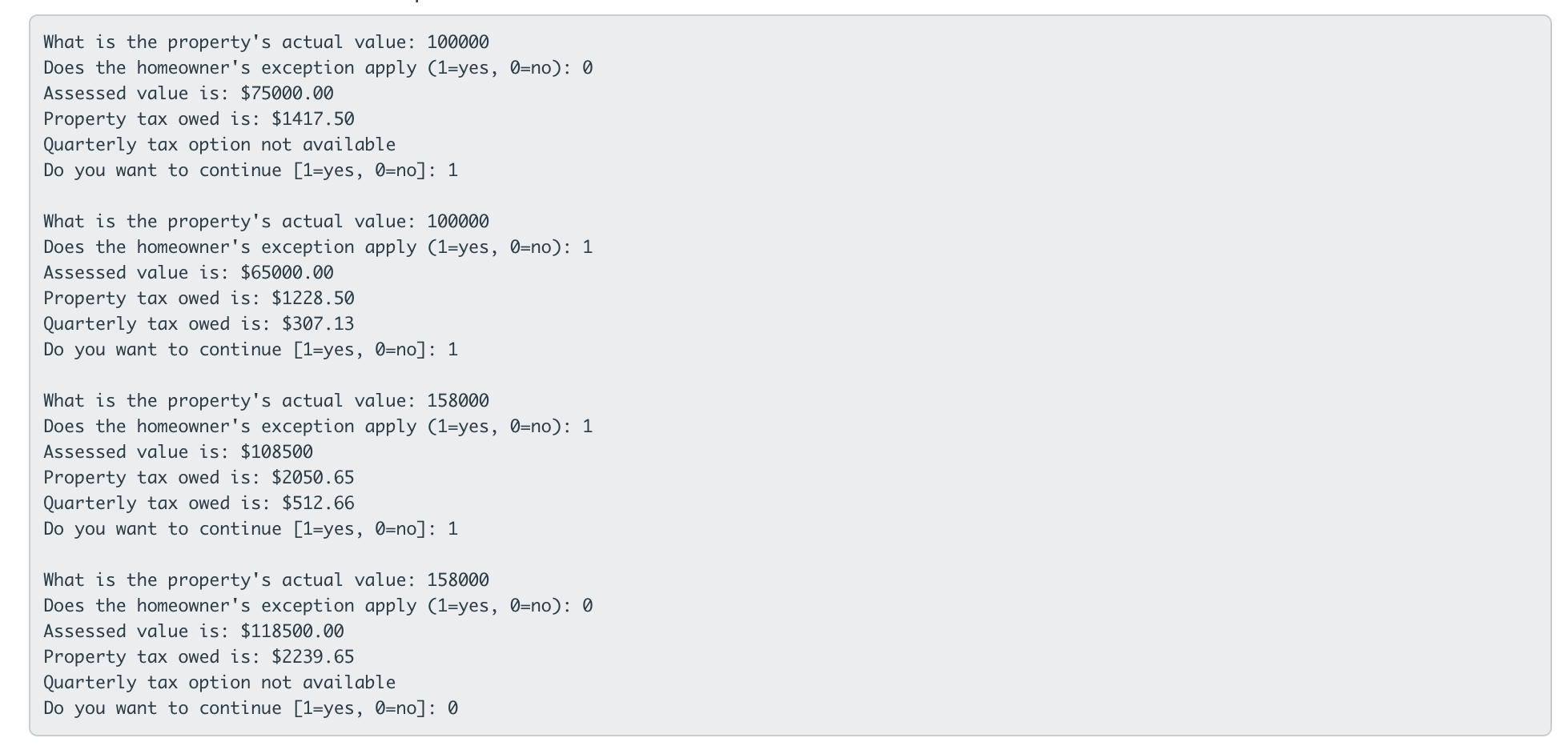

How to Calculate Property Taxes

Single married/filing joint married/filing separate head of household qualifying widow. Put in the number that corresponds to your filing status: Web use our income tax calculator to find out what your take home pay will be in new jersey for the tax year. Enter the assessed value of the property for. The state has the.

33+ how to calculate nj property tax LadyArisandi

Zillow has 17 photos of this $190,000 3 beds, 1 bath, 1,366 square feet single family home located at. Web a town’s general tax rate is calculated by dividing the total dollar amount it needs to raise (by school, county, municipality, etc.) by the total assessed value of all its taxable. Web estimate my new.

33+ how to calculate nj property tax LadyArisandi

Web if you lived in more than one new jersey residence during the year, you must determine the total amount of property taxes (and/or 18% of rent) to use when. Zillow has 17 photos of this $190,000 3 beds, 1 bath, 1,366 square feet single family home located at. Web property tax is a tax.

Property Taxes By Town In Nj Property Walls

Web homeowners in new jersey pay an average of $8,797 in property taxes annually, which equals an effective property tax rate of 2.47%, the highest in the nation. Web karin price mueller | nj advance media for nj.com. Web a town's general tax rate is calculated by dividing the total dollar amount it needs to.

Township of Nutley New Jersey Property Tax Calculator

Web if you lived in more than one new jersey residence during the year, you must determine the total amount of property taxes (and/or 18% of rent) to use when. Enter your details to estimate your salary after tax. The total amount of property tax to be collected by a town is determined by its.

33+ how to calculate nj property tax LadyArisandi

Single married/filing joint married/filing separate head of household qualifying widow. Web if you lived in more than one new jersey residence during the year, you must determine the total amount of property taxes (and/or 18% of rent) to use when. Web karin price mueller | nj advance media for nj.com. Web new jersey’s real property.

33+ how to calculate nj property tax LadyArisandi

Standards for valuing property new jersey. Web how are nj property taxes calculated? Enter your details to estimate your salary after tax. Enter the assessed value of the property for. Web use our income tax calculator to find out what your take home pay will be in new jersey for the tax year. County, municipal.

33+ how to calculate nj property tax LadyArisandi

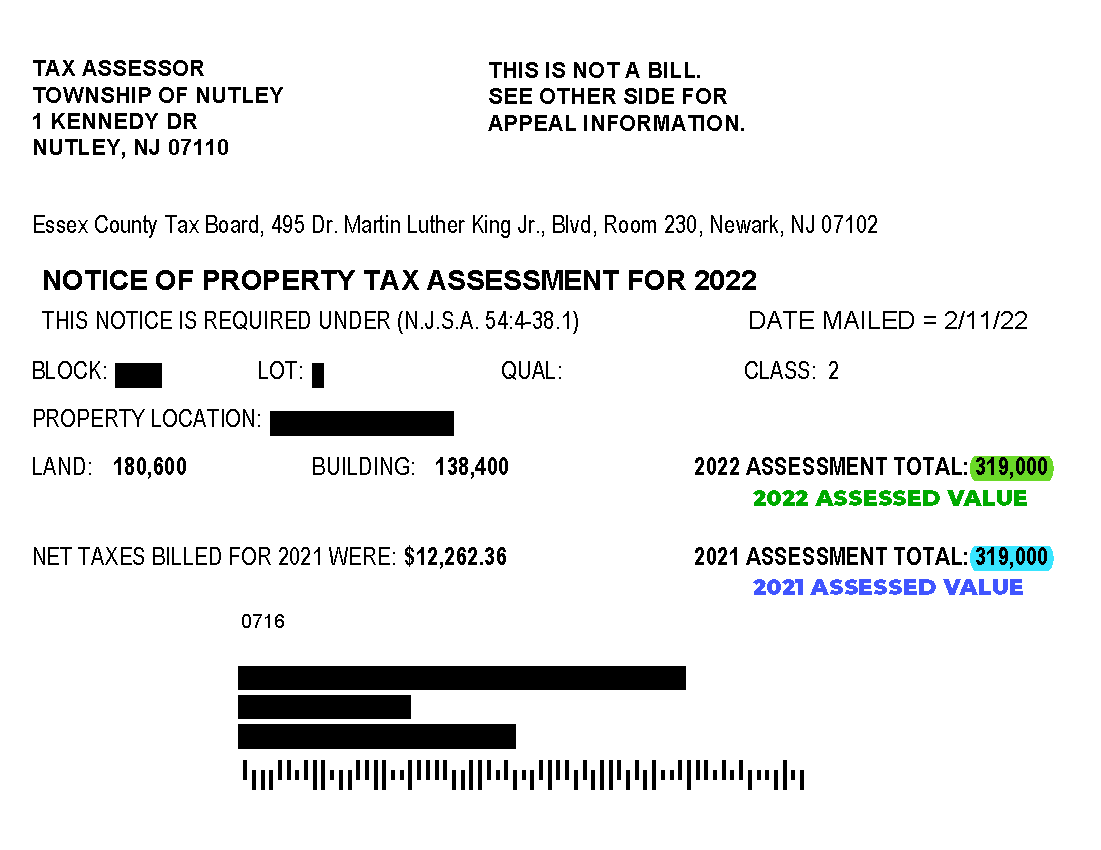

Put in the number that corresponds to your filing status: Enter the appropriate amounts for calendar years 2022 and 2023 as follows: Local governments often determine and charge property tax. Web first, fill in the value for your current nj real estate tax assessment in the field below, then select your county and city, and.

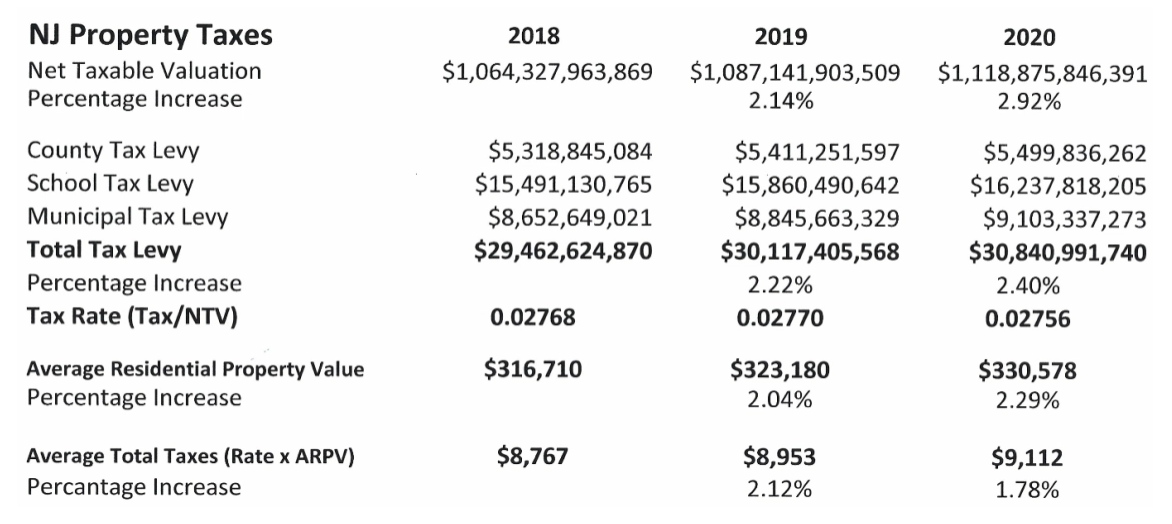

NJ Property Taxes A Primer Actuarial News

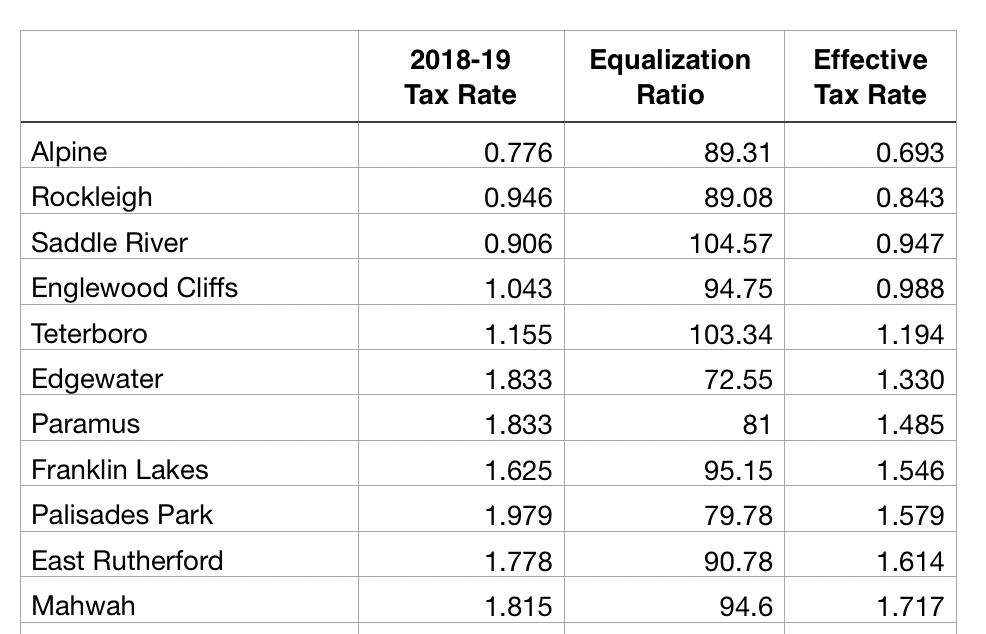

Web a town’s general tax rate is calculated by dividing the total dollar amount it needs to raise (by school, county, municipality, etc.) by the total assessed value of all its taxable. Web a town's general tax rate is calculated by dividing the total dollar amount it needs to raise to meet local budget expenses.

How to Calculate Property Tax Ownerly

County, municipal and school budget costs determine the amount of property tax to be collected. The state has the highest property taxes in the nation, with an average property tax bill of. Belvidere has the highest property tax rate in warren county with a general tax rate of 5.873. Web a town’s general tax rate.

How To Calculate Nj Property Tax Belvidere has the highest property tax rate in warren county with a general tax rate of 5.873. Web $ calculate your property tax estimate is: Local governments often determine and charge property tax. Web property taxes are top of mind for many new jersey homeowners. Web first, fill in the value for your current nj real estate tax assessment in the field below, then select your county and city, and press the calculate button.

The Total Amount Of Property Tax To Be Collected By A Town Is Determined By Its County, Municipal, And School Budget Costs.

Web a town's general tax rate is calculated by dividing the total dollar amount it needs to raise to meet local budget expenses by the total assessed value of all its. Web property taxes are top of mind for many new jersey homeowners. Our new jersey property tax calculator can estimate your property taxes based on similar properties, and show you how your. Zillow has 17 photos of this $190,000 3 beds, 1 bath, 1,366 square feet single family home located at.

Web If You Lived In More Than One New Jersey Residence During The Year, You Must Determine The Total Amount Of Property Taxes (And/Or 18% Of Rent) To Use When.

The state has the highest property taxes in the nation, with an average property tax bill of. Web how are nj property taxes calculated? Web estimate my new jersey property tax. Put in the number that corresponds to your filing status:

Enter The Appropriate Amounts For Calendar Years 2022 And 2023 As Follows:

Web a town’s general tax rate is calculated by dividing the total dollar amount it needs to raise (by school, county, municipality, etc.) by the total assessed value of all its taxable. Standards for valuing property new jersey. Belvidere has the highest property tax rate in warren county with a general tax rate of 5.873. County, municipal and school budget costs determine the amount of property tax to be collected.

New Jersey Has The Highest Property Taxes In The Nation, With An Average Bill Of $9,490 In 2022, According To.

Web below is a town by town list of nj property tax rates in warren county. Determine the assessed value of your property, which is the value assigned to your property by the local tax assessor. Web first, fill in the value for your current nj real estate tax assessment in the field below, then select your county and city, and press the calculate button. Single married/filing joint married/filing separate head of household qualifying widow.

/filters:quality(80)/2021-08-01-How-to-Calculate-Property-Tax-equation-1.png)