How To Calculate Payback In Excel

How To Calculate Payback In Excel - Web payback period = initial investment / annual cash flow. Discover the method to calculate payback period using excel, a fundamental financial metric used to assess the return on investment. This one is a simple countif formula. The formula used to calculate the payback period is: What is the discounted payback period?

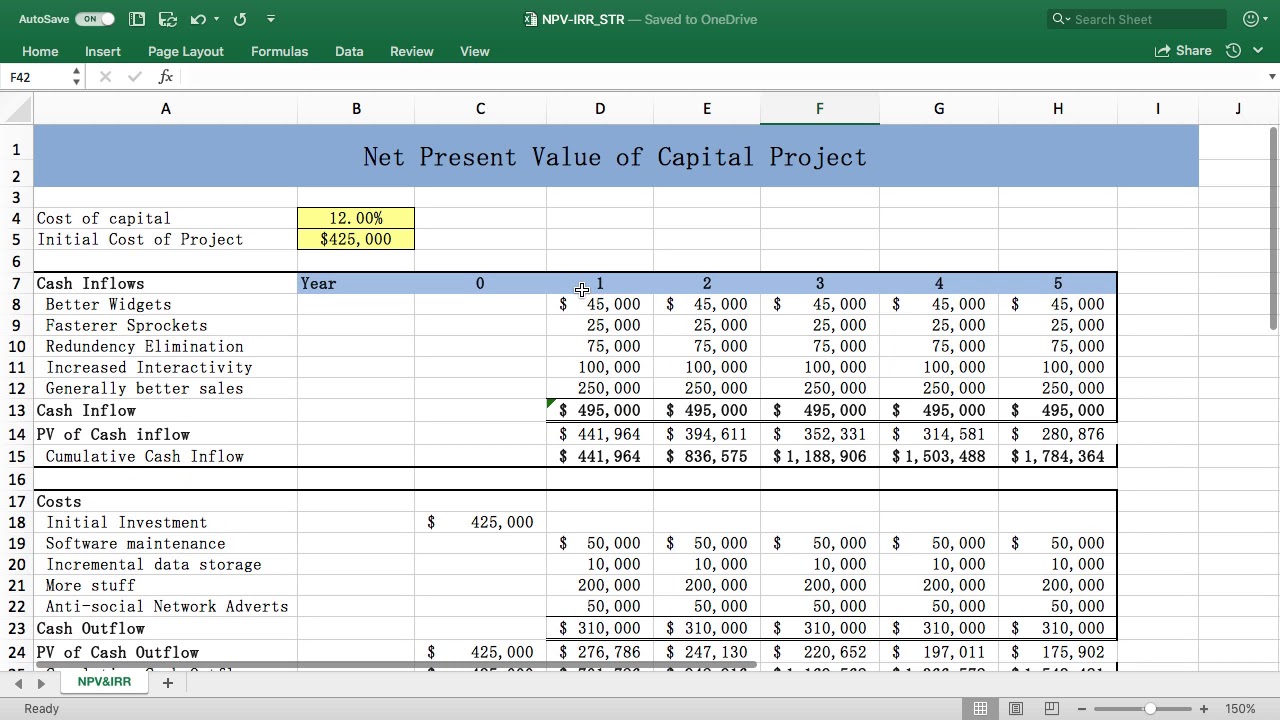

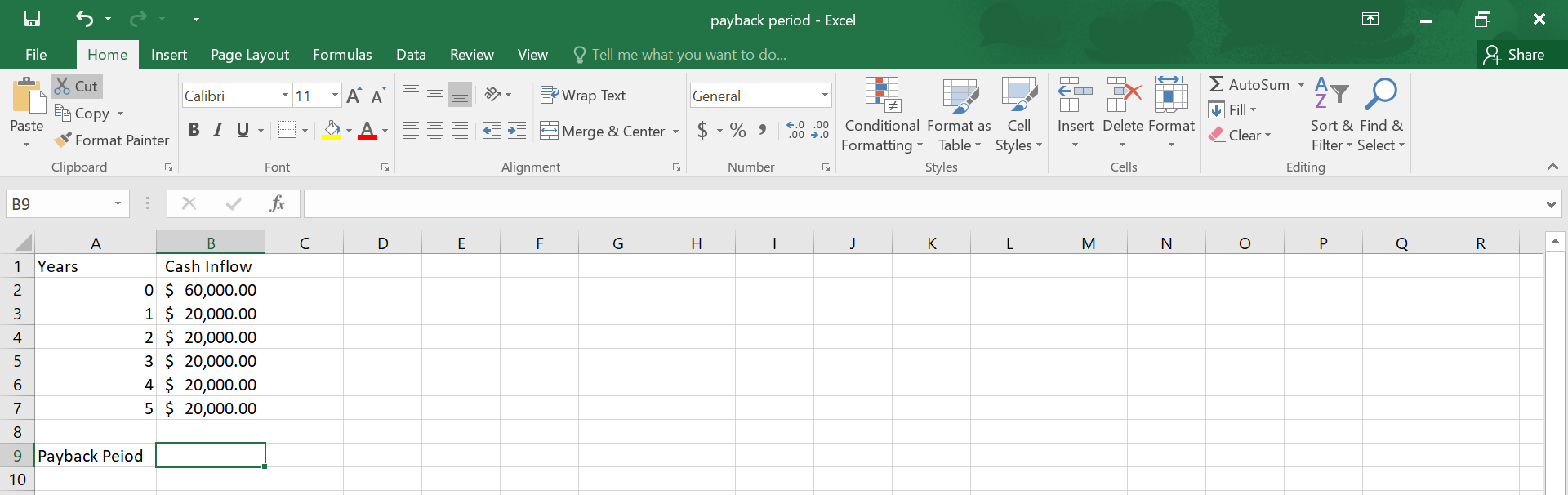

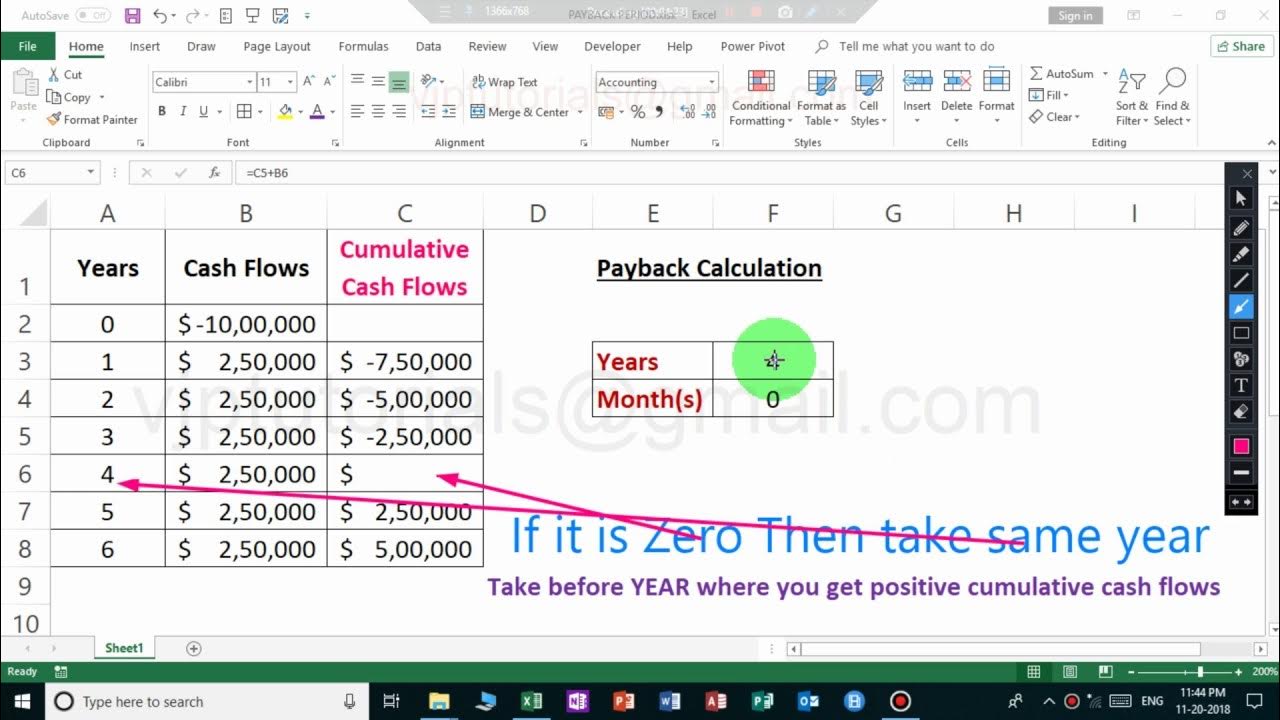

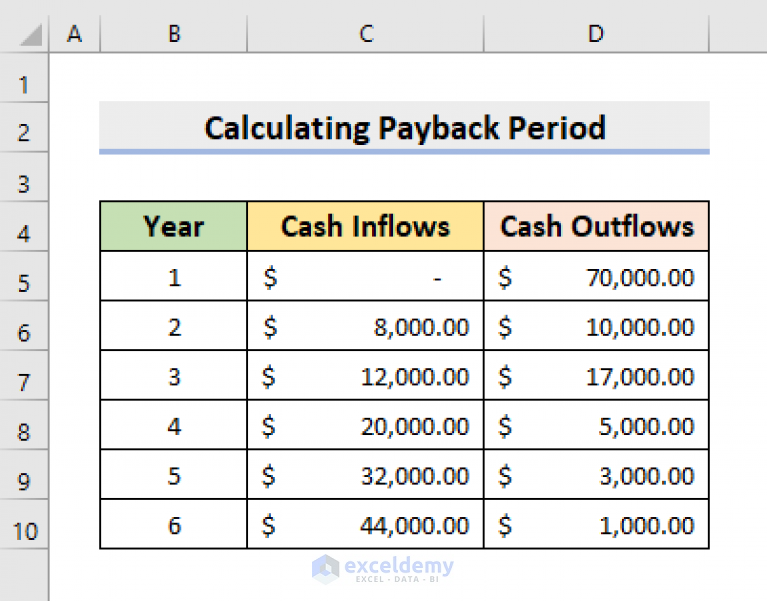

It can be calculated from even or uneven cash flows. Pp = initial investment / cash flow. Enter financial data in your excel worksheet. Written by rubayed razib suprov. Web setting up an excel spreadsheet with the necessary formulas is a helpful tool for calculating the payback period. Discounted payback period example calculation. This marks the breakeven point and sets the stage for determining the payback period.

How to Calculate Payback Period in Excel? QuickExcel

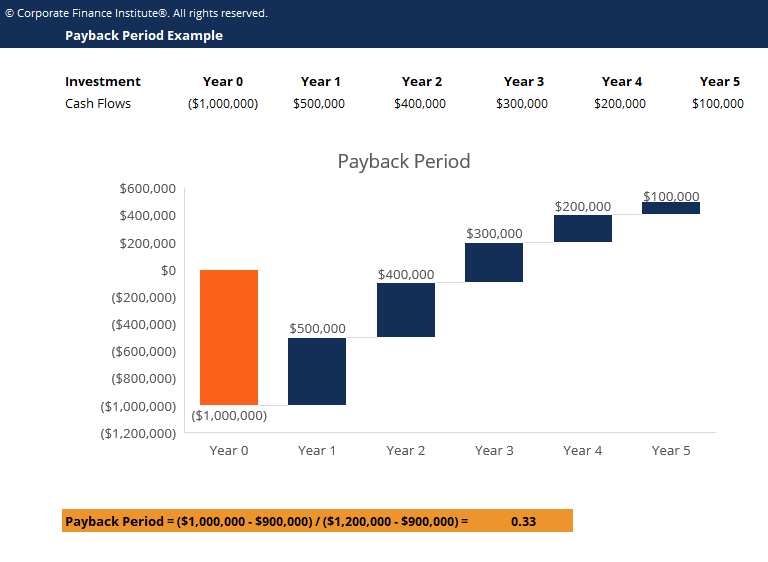

Dive into your excel sheet to identify the point where cumulative cash flows turn positive. Web written by durjoy paul. Formula for payback period = initial investment/net annual cash. Discounted payback period example calculation. In other words, it takes about 2.67 months for the profit from a new customer to cover the cost of acquiring.

How to Calculate Accounting Payback Period or Capital Budgeting Break

Web when the cash flow remains constant every year after the initial investment, the payback period can be calculated using the following formula: Web in simple terms, it refers to the time taken by a project to reach a level where there is no loss no profit i.e. For example, if you invested $10,000 in.

How To Calculate Payback Period In Excel Using Formula

The payback period helps us to calculate the time taken to recover the initial cost of investment without considering the time value of money. Excel offers advanced tools to refine your payback period analysis. Refining your analysis with excel tools. The above screenshot gives you the formulae that i have used to determine the payback.

How to Calculate Payback Period in Excel.

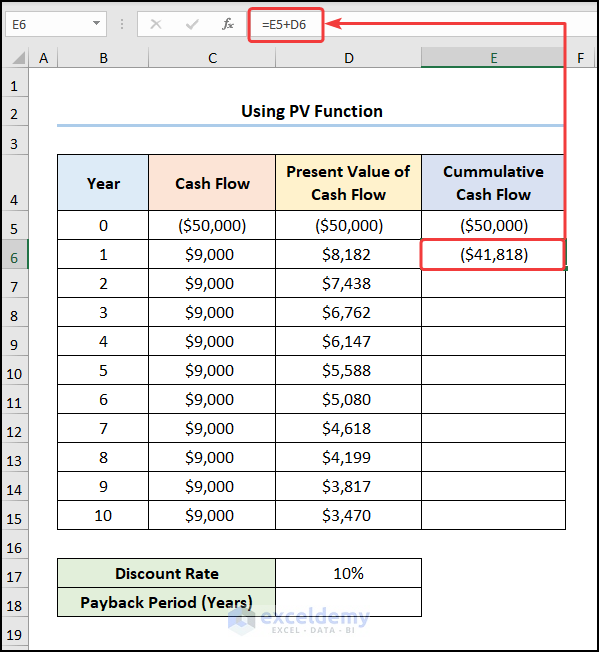

Written by rubayed razib suprov. For example, if you invested $10,000 in a business that gives you $2,000 per year, the payback period is $10,000 / $2,000 = 5. Calculate the cac payback period: Open excel and create a new workbook. Learn how to calculate it with. Using pv function to calculate discounted payback period..

How to calculate PAYBACK PERIOD in MS Excel Spreadsheet 2019 YouTube

Web how to calculate the payback period in excel sheet with formula? Calculate the net/ cumulative cash flow. This one is a simple countif formula. Dive into your excel sheet to identify the point where cumulative cash flows turn positive. Calculate the cac payback period: Discounted payback period example calculation. Use conditional formatting to highlight.

How to Calculate the Payback Period With Excel

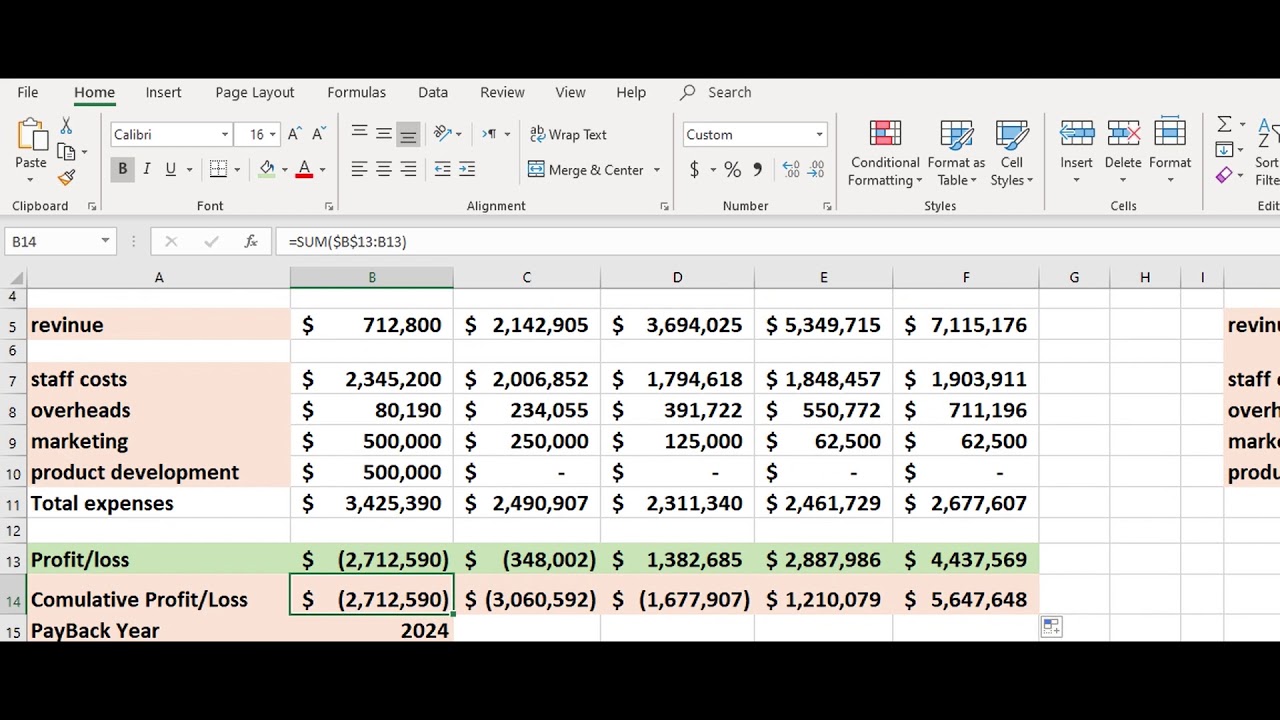

Interpreting the results of the payback period calculation can provide valuable insights for comparing investment options. Refining your analysis with excel tools. It counts all the number of negative cash flows in the cumulative cash flows line before it turns positive from years 2014 to 2020. The payback period is the amount of time needed.

How to Calculate Payback Period in Excel (With Easy Steps)

Label the columns for initial investment, cash flows, and cumulative cash flows. Discounted payback period example calculation. The payback period helps us to calculate the time taken to recover the initial cost of investment without considering the time value of money. Web to build a payback period calculation template in excel, follow these steps: How.

Using Excel to calculate the Payback Period YouTube

Discounted payback period example calculation. Web how to calculate the payback period in excel sheet with formula? Use conditional formatting to highlight the period in which the investment is recouped. Calculate the net/ cumulative cash flow. The payback period helps us to calculate the time taken to recover the initial cost of investment without considering.

How to Calculate Payback Period in Excel (With Easy Steps)

Web how to calculate the payback period in excel sheet with formula? Web if you just want to calculate the payback period using a simple formula and your cash flow / savings is the same every year, then simply dividing your total investment by that amount will suffice. Without any further ado, let’s get started.

How to Calculate Discounted Payback Period in Excel

Web in simple terms, it refers to the time taken by a project to reach a level where there is no loss no profit i.e. Payback period = initial investment ÷ cash flow per year Therefore, the cac payback period for the startup, given the assumptions, is approximately 2.67 months. For any business undertaking any.

How To Calculate Payback In Excel Web locating the breakeven point. Web calculating payback period in excel with uneven cash flows. Discounted payback period example calculation. Using pv function to calculate discounted payback period. Web use the =match() function in excel to determine the exact year in which the cumulative cash flow becomes positive.

Open Excel And Create A New Workbook.

The payback period is the amount of time needed to recover the initial outlay for an investment. By following these simple steps, you can easily calculate the payback period in excel. For any business undertaking any kind of decision, especially whether to make an investment in a new venture or reinvest in an old project, calculating the payback period can actually help a lot. Use conditional formatting to highlight the period in which the investment is recouped.

Web Use The =Match() Function In Excel To Determine The Exact Year In Which The Cumulative Cash Flow Becomes Positive.

In a third cell (e.g., c1 ), input the formula = (a1/b1)*100 to calculate the roi. Label the columns for initial investment, cash flows, and cumulative cash flows. Interpreting the results of the payback period calculation can provide valuable insights for comparing investment options. Learn how to calculate it with.

It Counts All The Number Of Negative Cash Flows In The Cumulative Cash Flows Line Before It Turns Positive From Years 2014 To 2020.

Therefore, the cac payback period for the startup, given the assumptions, is approximately 2.67 months. This article will show how to calculate the payback period with uneven cash flows. Written by rubayed razib suprov. Excel offers advanced tools to refine your payback period analysis.

In This Example, We’ll Type Cash Inflows And Cash Outflows Of 6 Years.

Using pv function to calculate discounted payback period. Then, it’s simply a matter of determining whether the number of years in the payback period is acceptable to you. Web locating the breakeven point. Calculate the net/ cumulative cash flow.