How To Calculate Tax On Sale Of Commercial Property

How To Calculate Tax On Sale Of Commercial Property - Web five steps to estimating property taxes. Web how to calculate tax on sale of commercial property. Web income tax brackets are as follows: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Web this calculator will help you estimate your capital gains tax exposure and the net proceeds from the sale of your asset (investment property or otherwise).

Web to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). So, you can deduct the entire loss amount from income. Web in 2023, that threshold is $12.92 million or $25.84 million for married couples. Web five steps to estimating property taxes. You can only deduct $3,000 of net. Your income determines your capital gains tax rates.

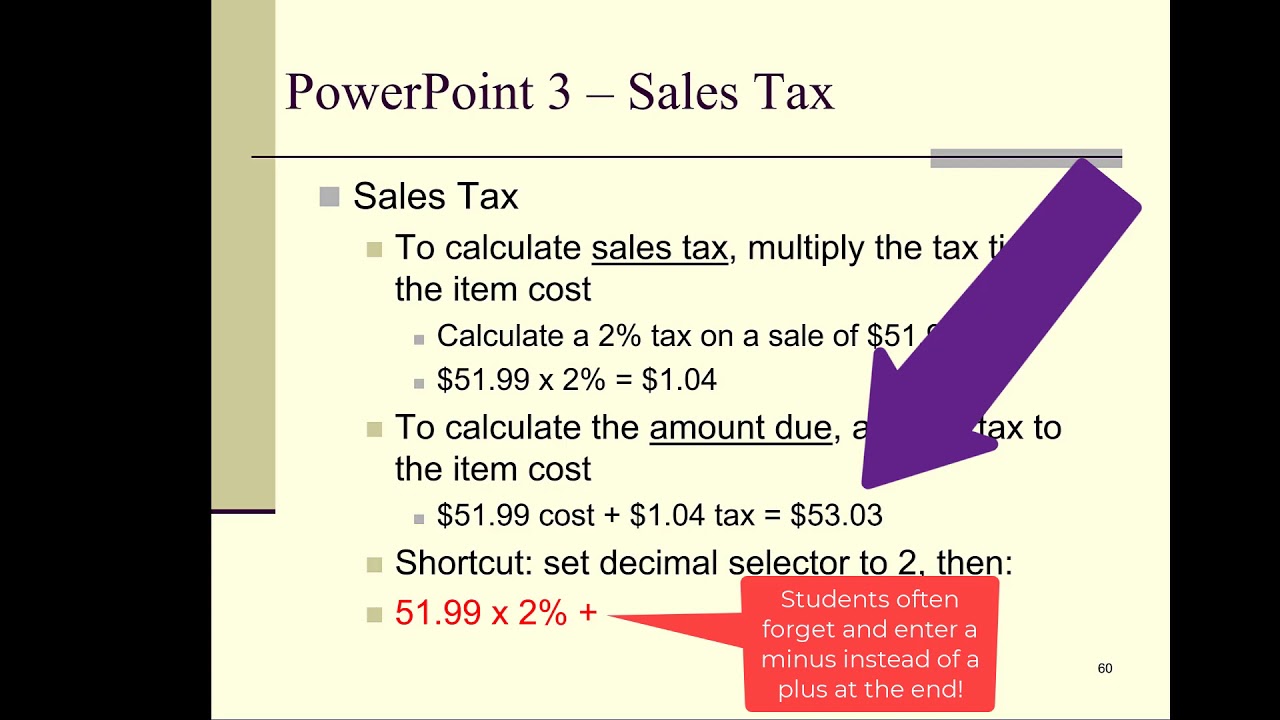

How to Calculate Sales Tax Wiki Taxes English

Your income determines your capital gains tax rates. So, you can deduct the entire loss amount from income. Web the formula for calculating cgt involves subtracting the adjusted basis from the net sale price and applying the appropriate tax rate. You can only deduct $3,000 of net. Web how to calculate tax on sale of.

How to Calculate Property Taxes

Web in this video i have explained how to save tax on capital gains arising from sale of commercial house property and the below frequently asked questions.1.how. As with all other tax brackets, the government only taxes the amount that exceeds this. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington.

How to Estimate Commercial Real Estate Property Taxes FNRP

Web five steps to estimating property taxes. Determine the property’s current assessed value. 10%, 12%, 22%, 24%, 32%, 35% and 37%. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Web to calculate capital gains taxes on real estate, you need to subtract the original purchase price, or cost basis, from the net profits obtained from.

How to Calculate Sales Tax on a Desktop Calculator YouTube

Web this calculator will help you estimate your capital gains tax exposure and the net proceeds from the sale of your asset (investment property or otherwise). Web to calculate capital gains taxes on real estate, you need to subtract the original purchase price, or cost basis, from the net profits obtained from the sale of.

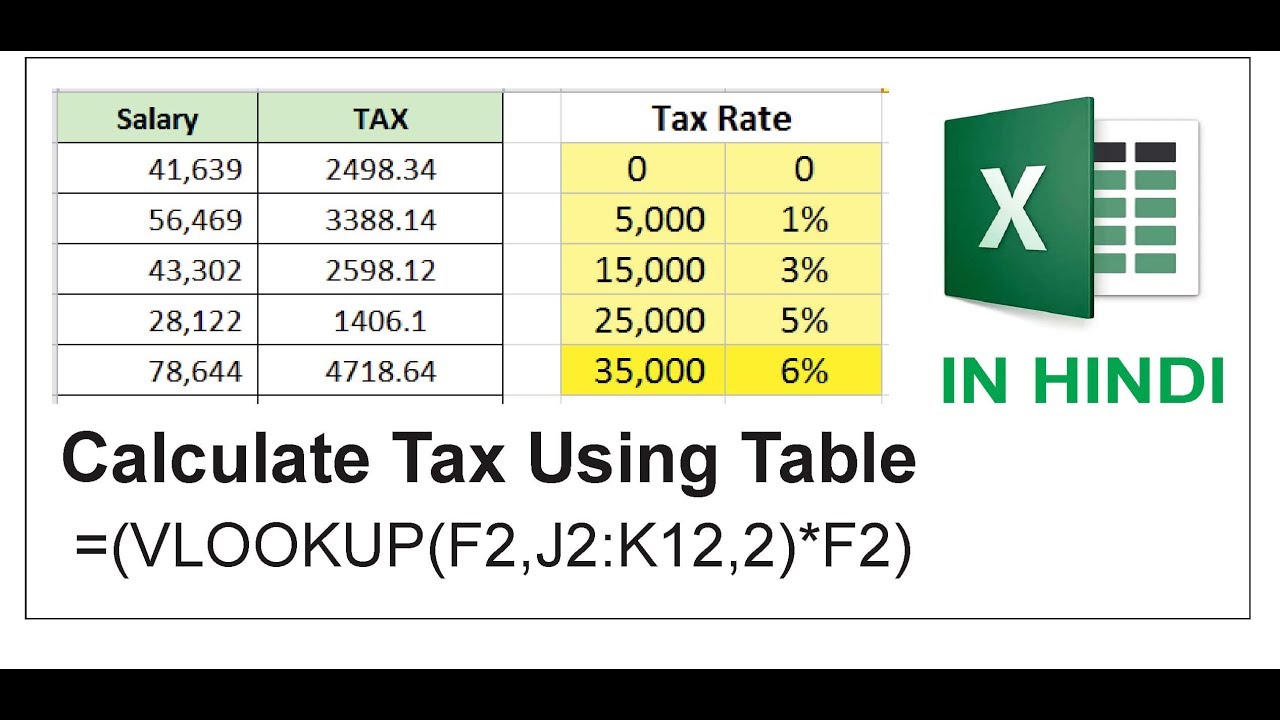

Calculate Sales Tax in Excel using Vlookup formula YouTube

Learn about tax implications, gain, and loss determination. So, you can deduct the entire loss amount from income. Web capital gains taxes are calculated as a percentage of the profit you make when you sell a commercial property. Commercial real estate is a “capital. Property taxes vary by state, and they can vary quite. Your.

4 Ways to Calculate Sales Tax wikiHow

Web in 2023, that threshold is $12.92 million or $25.84 million for married couples. Web the irs has what’s called the cost recovery tax, and that’s where they calculate the total depreciation, and then they ask you to pay 25% of that back, at the time of sale. Web to calculate commercial property tax, you.

How to Calculate Sales Tax in Excel Tutorial YouTube

You can only deduct $3,000 of net. Your income determines your capital gains tax rates. Commercial real estate is a “capital. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Web how to calculate tax on sale of commercial property. Web to calculate commercial property tax, you must be aware of your local and state tax.

Capital Gain Tax on Sale of Property Short Term and Long Term Capital

Web every one to five years, depending on the commercial property’s county, assessors will calculate the value of commercial real estate and use a mill levy to ensure the correct. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Commercial real estate is a “capital..

How To Calculate Sales Tax On Calculator Easy Way YouTube

Strategies for reducing or deferring cgt. Determine the property’s current assessed value. So, you can deduct the entire loss amount from income. Web navigate the complexities of commercial property tax calculations with ease. Web every one to five years, depending on the commercial property’s county, assessors will calculate the value of commercial real estate and.

4 Ways to Calculate Sales Tax wikiHow

Web income tax brackets are as follows: Learn about tax implications, gain, and loss determination. Web to calculate commercial property tax, you must be aware of your local and state tax amounts. So, you can deduct the entire loss amount from income. 10%, 12%, 22%, 24%, 32%, 35% and 37%. Web when calculating your capital.

How To Calculate Tax On Sale Of Commercial Property Web navigate the complexities of commercial property tax calculations with ease. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. So, you can deduct the entire loss amount from income. Your income determines your capital gains tax rates.

Web In 2023, That Threshold Is $12.92 Million Or $25.84 Million For Married Couples.

A property’s assessed value is the basis for the property. Web capital gains taxes are calculated as a percentage of the profit you make when you sell a commercial property. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Learn about tax implications, gain, and loss determination.

Web Five Steps To Estimating Property Taxes.

Web in this video i have explained how to save tax on capital gains arising from sale of commercial house property and the below frequently asked questions.1.how. 10%, 12%, 22%, 24%, 32%, 35% and 37%. Web the formula for calculating cgt involves subtracting the adjusted basis from the net sale price and applying the appropriate tax rate. Strategies for reducing or deferring cgt.

A Tax Is A Mandatory.

10%, 12%, 22%, 24%, 32%, 35%, and 37%. Vide the finance bill, 2023, it is proposed to impose a limit on the. Web income tax brackets are as follows: The tax on the sale of commercial property is calculated by taking the sale price of the property and.

Determine The Property’s Current Assessed Value.

Web when calculating your capital gain, you must first calculate your “basis” in the capital asset before subtracting it from the sales proceeds to determine the tax owed. Web how to calculate tax on sale of commercial property. As with all other tax brackets, the government only taxes the amount that exceeds this. It was updated in 2013.