How To Calculate Travel Expenses For Work

How To Calculate Travel Expenses For Work - Web employers should first determine where an employee’s tax home is and then determine whether the travel expenses are deductible. Web creating an itemized list of all travel expenses is the first step in accurately calculating travel expenses for work. Tc = t + h + f + m + o where: Travelmath provides an online cost calculator to help you determine the cost of driving between cities. Customer supportcase studiesfully integratedmaintain compliance

$27,700 for married couples filing jointly or qualifying. When filing taxes, your travel expenses are the costs associated with travel that a business can generally deduct. Decide on the employee payment method. Web solved • by turbotax • 5175 • updated november 30, 2023. Tc represents the total cost of the business trip. The process of calculating work travel expenses requires several steps. The standard deduction for 2023 is:

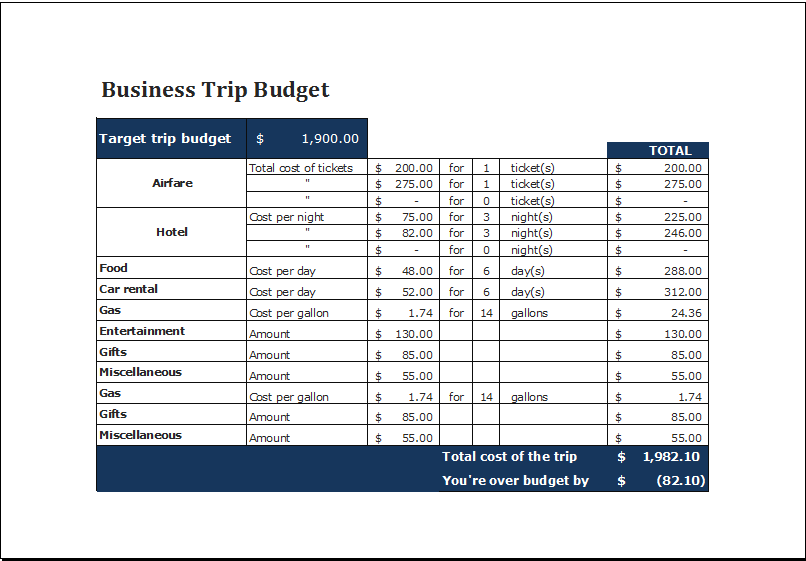

Travel Expense Templates charlotte clergy coalition

Web thanks to the government guidance on determining per diem, the process for calculating per diem is fairly simple: To claim mileage for traveling. Mileage rate x miles driven: Travelmath provides an online cost calculator to help you determine the cost of driving between cities. $13,850 for single or married filing separately. Tc = t.

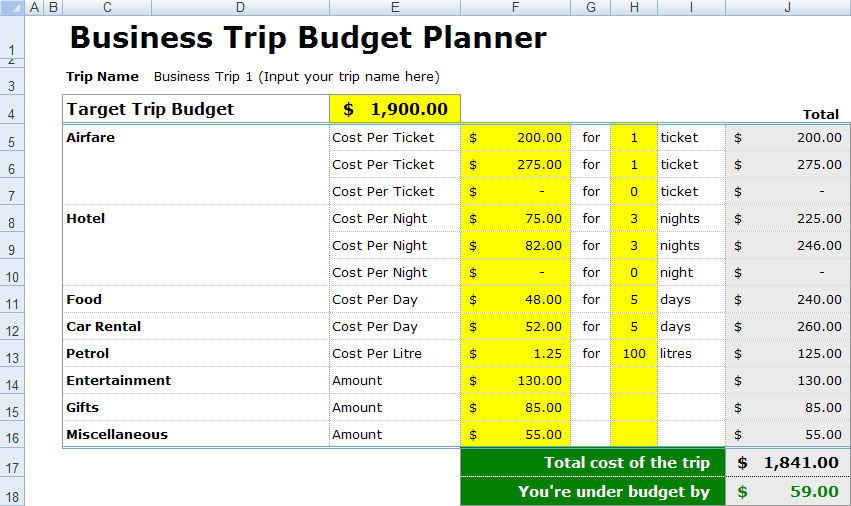

EXCEL of Travel Expenses Report.xls WPS Free Templates

Total the costs how to determine a vacation budget when you estimate travel costs ahead of time, it’s easier to make vacation. Web this article teaches you all about travel expenses, how to bill business trips correctly, and what the four types of travel expenses are. Additionally, any training requested by the. Easy and efficientaccess.

Download a free Travel Budget Worksheet for Excel to help you plan your

To claim mileage for traveling. What are travel expenses for. You can deduct up to 60% of your. When filing taxes, your travel expenses are the costs associated with travel that a business can generally deduct. Web the formula to calculate the total cost (tc) of a business trip is as follows: You can use.

Travel Expenses Definition, Business Examples, Reimbursement

This list should include all costs associated with. Web solved • by turbotax • 5175 • updated november 30, 2023. Actual cost or per diem rate: The process of calculating work travel expenses requires several steps. For tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business,.

How to Calculate Your Travel Expenses Properly TheTravelBlog

Mileage rate x miles driven: Web expense amount method of calculation; There are two main ways in which you can pay for expenses: Web listing the steps of calculating work travel expenses. $13,850 for single or married filing separately. Some might be more relevant than others, but having a list enables you to develop a.

Business Trip Budget Spreadsheet Free Download

$27,700 for married couples filing jointly or qualifying. When filing taxes, your travel expenses are the costs associated with travel that a business can generally deduct. T is the cost of. You need to leave your tax home your tax home is the locale where your business is based. The standard deduction for 2023 is:.

How to Calculate Travel Expenses for Businesses TravelPerk

Join 75 million userscustomize your quotesawesome and free support Web to deduct your expenses for driving to receive medical care, you can choose between standard mileage rates or actual costs. Refer to irs guidelines a company typically offers. Actual cost or per diem rate: The first step to estimating and calculating business travel expenses is.

Claim Work Travel Expenses This Can Boost Your Tax Refund

What are travel expenses for. Web estimate travel expenses: Refer to irs guidelines a company typically offers. Decide on the employee payment method. Ask employees to pay them upfront using their personal bank/credit card. The process of calculating work travel expenses requires several steps. You can deduct up to 60% of your. Additionally, any training.

Travel Expense Calculator for EXCEL Word & Excel Templates

Tc represents the total cost of the business trip. What are travel expenses for. Web how travel expenses work. Refer to irs guidelines a company typically offers. For tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. Traveling for work isn’t technically a.

Travel Expense Calculator Template 4 Free Templates in PDF, Word

Web creating an itemized list of all travel expenses is the first step in accurately calculating travel expenses for work. As of april 2023, there is a flat rate of 78 cents. You can use this data to figure out a. The first step to estimating and calculating business travel expenses is to list potential.

How To Calculate Travel Expenses For Work You can use this data to figure out a. Web expense amount method of calculation; Additionally, any training requested by the. The process of calculating work travel expenses requires several steps. As of april 2023, there is a flat rate of 78 cents.

$13,850 For Single Or Married Filing Separately.

Web how travel expenses work. There are two main ways in which you can pay for expenses: This list should include all costs associated with. You need to leave your tax home your tax home is the locale where your business is based.

Web This Article Teaches You All About Travel Expenses, How To Bill Business Trips Correctly, And What The Four Types Of Travel Expenses Are.

You can use this data to figure out a. Web creating an itemized list of all travel expenses is the first step in accurately calculating travel expenses for work. The process of calculating work travel expenses requires several steps. Customer supportcase studiesfully integratedmaintain compliance

Mileage Rate X Miles Driven:

Additionally, any training requested by the. Web method 1 calculating your travel budget download article 1 keep track of your costs so they’re organized. Web estimate travel expenses: When filing taxes, your travel expenses are the costs associated with travel that a business can generally deduct.

Ask Employees To Pay Them Upfront Using Their Personal Bank/Credit Card.

$27,700 for married couples filing jointly or qualifying. Web the formula to calculate the total cost (tc) of a business trip is as follows: For tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. Web to deduct your expenses for driving to receive medical care, you can choose between standard mileage rates or actual costs.