How To Calculate Wacc In Excel

How To Calculate Wacc In Excel - Re = cost of equity (required rate of return) = (equity / total capital) * cost of equity + (debt / total capital) * cost of debt. In this video, i take you step by step on how to calculate the weighted average cost of capital in excel. D = cost of debt. V = total capitalization (equity plus debt at market values) coe = cost of equity.

D/v = percentage of capital that is debt. Before you begin the wacc calculation on excel, you will need to gather some essential information. V is the total market value of the company (e + d) e/v is the weightage of the equity. How to calculate beta (systematic risk) industry beta approach. 16k views 2 years ago excel training for finance students. D/v = debt to total capitalization ratio. Re is the cost of equity.

How to Calculate WACC in Excel Sheetaki

V = total capitalization (equity plus debt at market values) coe = cost of equity. V = total value of capital (equity plus debt) e/v = percentage of capital that is equity. 88k views 6 years ago excel tutorials. Web how to calculate cost of equity ratio. How to calculate beta (systematic risk) industry beta.

How to Calculate the WACC in Excel WACC Formula Earn & Excel

In this video, i take you step by step on how to calculate the weighted average cost of capital in excel. We will use excel to go over the wa. V = total value of capital (equity plus debt) e/v = percentage of capital that is equity. This model is essential for financial analysis and.

How to Calculate WACC in Excel Sheetaki

28k views 2 years ago #financialmodeling #excel #wacc. V = total value of capital (equity plus debt) e/v = percentage of capital that is equity. Web wacc= (we x ke) + (wd x kd) below is the explanation of arguments used in the formula given above: Web you can calculate wacc in excel by using.

How to Calculate WACC in Excel Sheetaki

The biggest challenge is sourcing the correct data to plug into the model. 16k views 2 years ago excel training for finance students. E = market value of the firm’s equity ( market cap) d = market value of the firm’s debt. 📈 need help with a project? V = total value of capital (equity.

How to Calculate WACC in Excel Sheetaki

Web the wacc can be used as the discount rate when calculating the value of a company. Rd is the cost of debt. D/v = percentage of capital that is debt. V is the market value of the company’s capital structure (the sum of its equity and debt). 28k views 2 years ago #financialmodeling #excel.

How to Calculate WACC in Excel (with Easy Steps) ExcelDemy

V = total capitalization (equity plus debt at market values) coe = cost of equity. Web the formula for wacc is as follows: Web ryan o'connell, cfa, frm explains how to calculate weighted average cost of capital (wacc) using excel. Assessing project risk a company can use the wacc to evaluate whether an internal project.

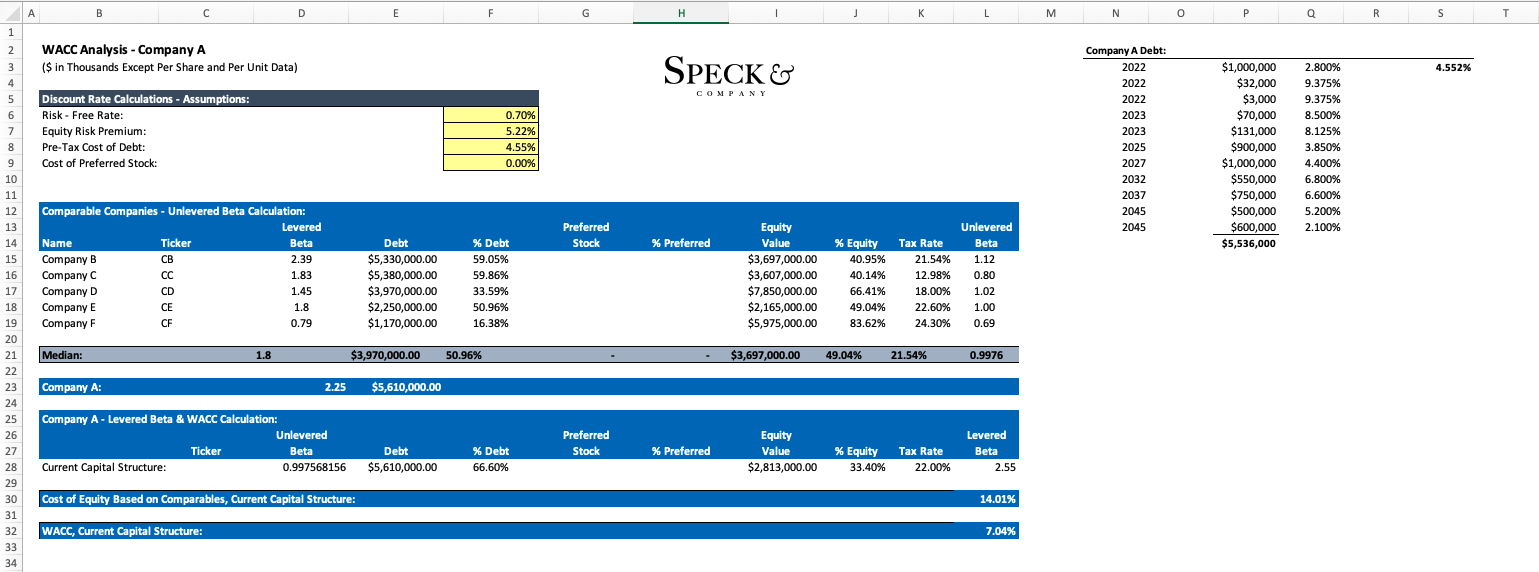

How to Calculate WACC in Excel Speck & Company

D/v = debt to total capitalization ratio. V = total capitalization (equity plus debt at market values) coe = cost of equity. E is the market value of the company’s equity. D = market value of debt capital. The biggest challenge is sourcing the correct data to plug into the model. Web wacc can be.

How to Calculate WACC in Excel Sheetaki

E = cost of equity. In this video, i take you step by step on how to calculate the weighted average cost of capital in excel. How to calculate beta (systematic risk) industry beta approach. P = cost of preferred stock/equity. E is the market value of the company’s equity. T is the corporate tax.

How to Calculate WACC in Excel Sheetaki

= (equity / total capital) * cost of equity + (debt / total capital) * cost of debt. D = market value of debt capital. In this video, i take you step by step on how to calculate the weighted average cost of capital in excel. Assessing project risk a company can use the wacc.

How to Calculate the WACC in Excel WACC Formula Earn & Excel

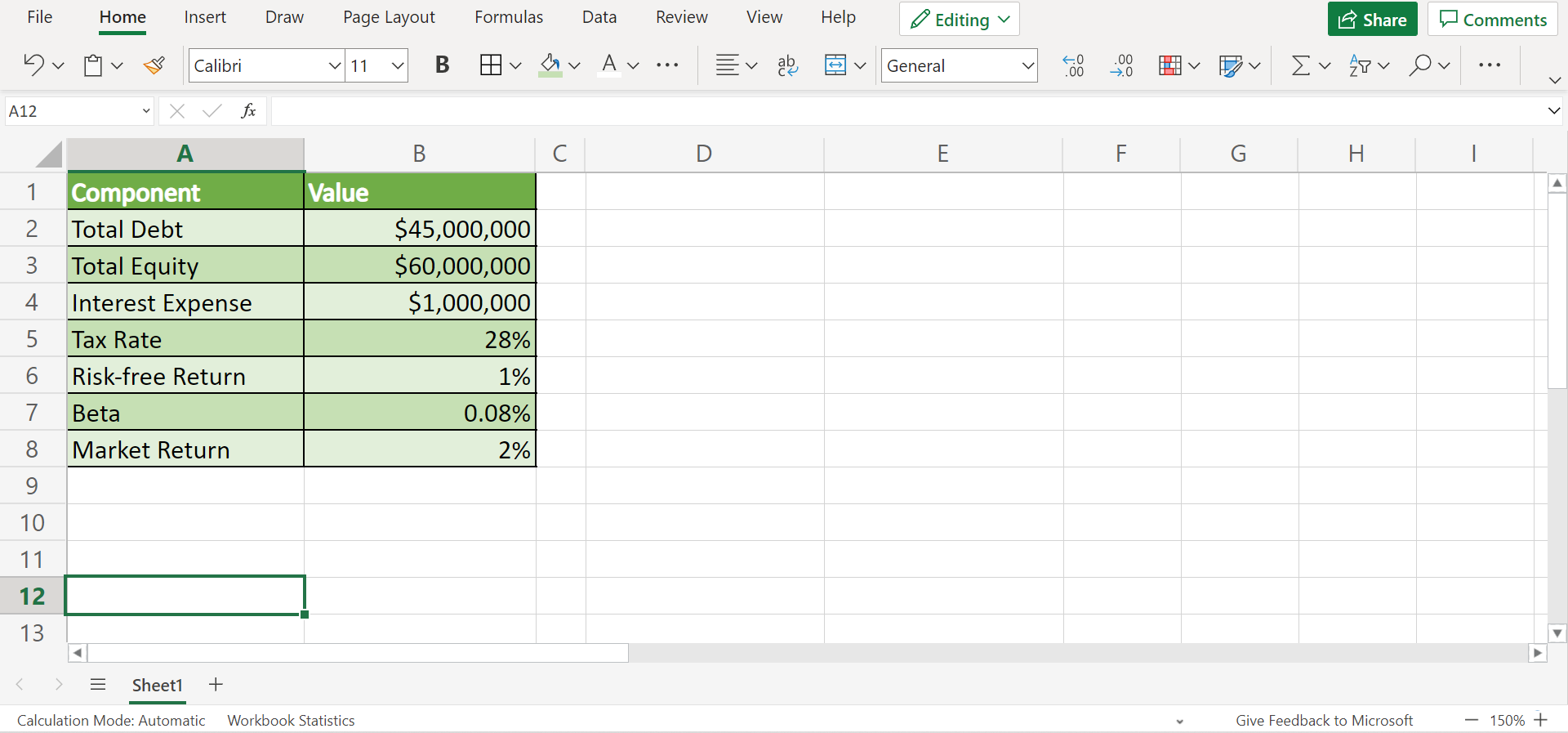

Combine components to determine the discount rate. D/v is the weightage of the debt. D is the market value of the company’s debt. Web in excel, you can use the following steps to calculate wacc based on the provided dataset: E = market value of the firm’s equity ( market cap) d = market value.

How To Calculate Wacc In Excel V is the total market value of the company (e + d) e/v is the weightage of the equity. V is the market value of the company’s capital structure (the sum of its equity and debt). P = cost of preferred stock/equity. Rd is the cost of debt. The real difficulty is determining the right inputs with limited time.

Rd Is The Cost Of Debt.

D/v is the weightage of the debt. E = market value of the firm’s equity (market cap) d = market value of the firm’s debt. V = total value of capital (equity plus debt) e/v = percentage of capital that is equity. V is the market value of the company’s capital structure (the sum of its equity and debt).

E = Cost Of Equity.

Understanding the cost of capital is vital for businesses and investors alike. Web wacc is calculated with the following equation: The real difficulty is determining the right inputs with limited time. Web how to calculate cost of equity ratio.

D/V = Percentage Of Capital That Is Debt.

Re is the cost of equity. 📈 need help with a project? Web the wacc formula is: 28k views 2 years ago #financialmodeling #excel #wacc.

V = Total Capitalization (Equity Plus Debt At Market Values) Coe = Cost Of Equity.

In this video, i take you step by step on how to calculate the weighted average cost of capital in excel. D = market value of debt capital. V = total value of capital (equity plus debt) e/v = percentage of capital that is equity. T is the corporate tax rate.