How To Calculate Zakat On 401K

How To Calculate Zakat On 401K - The 401 (k) plan is made of two parts: First, the plethora of scholarly views. Web please see the answer below as written by shaykh faraz rabbani: Since an owner of growing wealth must pay zakat on it, the question is (1) are these permissible forms of. Web to calculate zakat, add the employee’s contribution and the vested employer’s contribution, and deduct any penalties, taxes, and administrative fees to get the.

Web 💍 own gold or silver (e.g. Zaid’s 401 (k) account, which he has had for six years, holds a $100,000 balance (b). Web islamicfinder online zakat calculator 2024 provides you a step by step method to calculate zakat on your assets. Web the detailed answer on calculating zakat on stocks and investments. Let’s illustrate why with the following examples:. Access to advisorsadvice & guidance Web set it and collect blessings from allah (swt) for the khayr you're supporting without thinking about it.

How should I Calculate Zakat? Hidaya Foundation

Coins, jewelry, utensils) 📈 own financial instruments (e.g. Access to advisorsadvice & guidance Web $1,648 (gold price per troy oz) x 2.73295 t oz = $4,503.90 so, if all your cash equivalent holdings for the zakat period equal or exceed this amount, you must pay 2.5% of your. Zakah brochure from their wealth, take alms.

How to Calculate Zakat A Really Simple Guide YouTube

Web islamicfinder online zakat calculator 2024 provides you a step by step method to calculate zakat on your assets. Web do i need to pay zakat on money invested into 401k plan? First, the plethora of scholarly views. Zakah on 401k and retirement plans and benefits; Web the detailed answer on calculating zakat on stocks.

Zakat Calculator How to Calculate Zakat Islamic Relief UK

Beagle 653 subscribers subscribe 2 share 590 views 1 year ago 401 (k) tips learn more about this topic at. Web to help, we can calculate zakat donations on behalf of investors in affiliated accounts. Stocks, funds, crypto) 📊 own special financial accounts (ira, 401k, esa, hsa, 529) 🏘️ own real. Web we’ll use a.

A Beginner’s Guide On How to Calculate Zakat Just for You What a

Coins, jewelry, utensils) 📈 own financial instruments (e.g. Is zakat due on savings of masjid? Stocks, funds, crypto) 📊 own special financial accounts (ira, 401k, esa, hsa, 529) 🏘️ own real. Access to advisorsadvice & guidance Web please see the answer below as written by shaykh faraz rabbani: Since an owner of growing wealth must.

How to calculate Zakat? [simple guide with examples] 2023 HalalWorthy

Web many muslims have 401(k) accounts, and a common question arises yearly on how to calculate zakat on it, especially given two factors: Enter the value of nisab in your local currency. Zaid’s 401 (k) account, which he has had for six years, holds a $100,000 balance (b). Your total assets, minus your immediate debts.

A Beginner’s Guide On How to Calculate Zakat Just for You What a

When you arrange a direct rollover, the money goes straight from the 401 (k) to the ira provider and no taxes will be withheld or charged. First, the plethora of scholarly views. Web 💍 own gold or silver (e.g. Zakah on 401k and retirement plans and benefits; If yes, then is it due on the.

How to calculate zakat on 401(k)s? YouTube

Coins, jewelry, utensils) 📈 own financial instruments (e.g. Web to help, we can calculate zakat donations on behalf of investors in affiliated accounts. Web rather, the 401 k is going to have a 10% usually is a 10%, sometimes it's more than this, the 401k might have a 10% penalty, and therefore, if on paper,.

Zakat Calculator Calculate Your Zakat Correctly 100

Is zakat due on savings of masjid? Web many muslims have 401(k) accounts, and a common question arises yearly on how to calculate zakat on it, especially given two factors: Web is zakat due on mutual funds investments that are in a rrsp (registered retirement savings plan) account? Since an owner of growing wealth must.

Calculate Your Zakat the Right Way in 2023 Zameen Blog

Zaid’s 401 (k) account, which he has had for six years, holds a $100,000 balance (b). Web how to calculate zakat on 401 (k)s? First, the plethora of scholarly views. Stocks, funds, crypto) 📊 own special financial accounts (ira, 401k, esa, hsa, 529) 🏘️ own real. Zakah on 401k and retirement plans and benefits; Web.

Zakat Calculator How to Calculate Zakat » Nisab Value 2021 Crisis Aid

Stocks, funds, crypto) 📊 own special financial accounts (ira, 401k, esa, hsa, 529) 🏘️ own real. Web please see the answer below as written by shaykh faraz rabbani: Web many muslims have 401(k) accounts, and a common question arises yearly on how to calculate zakat on it, especially given two factors: Zaid’s 401 (k) account,.

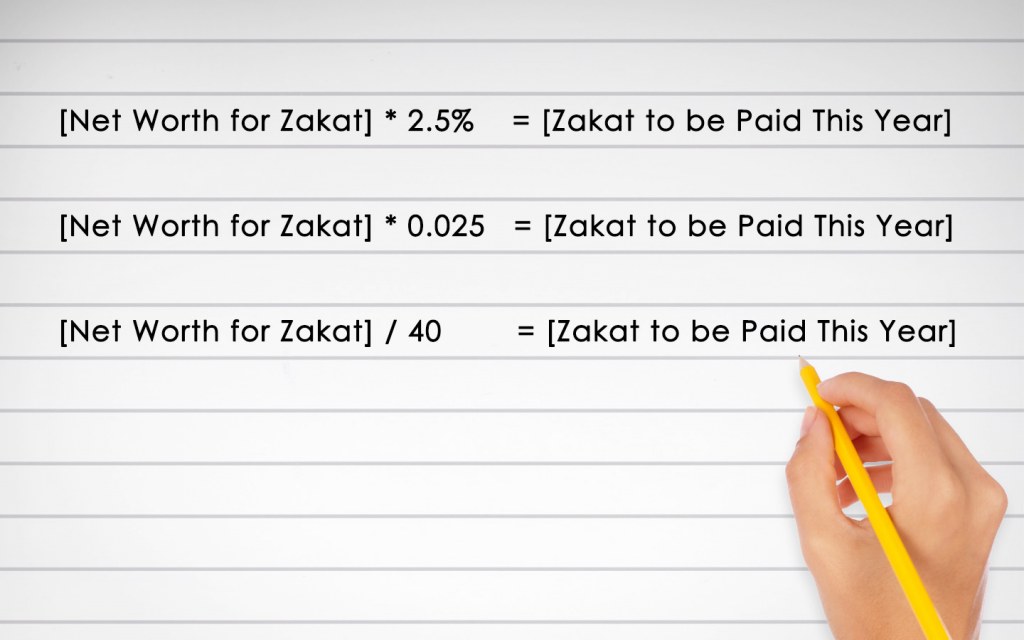

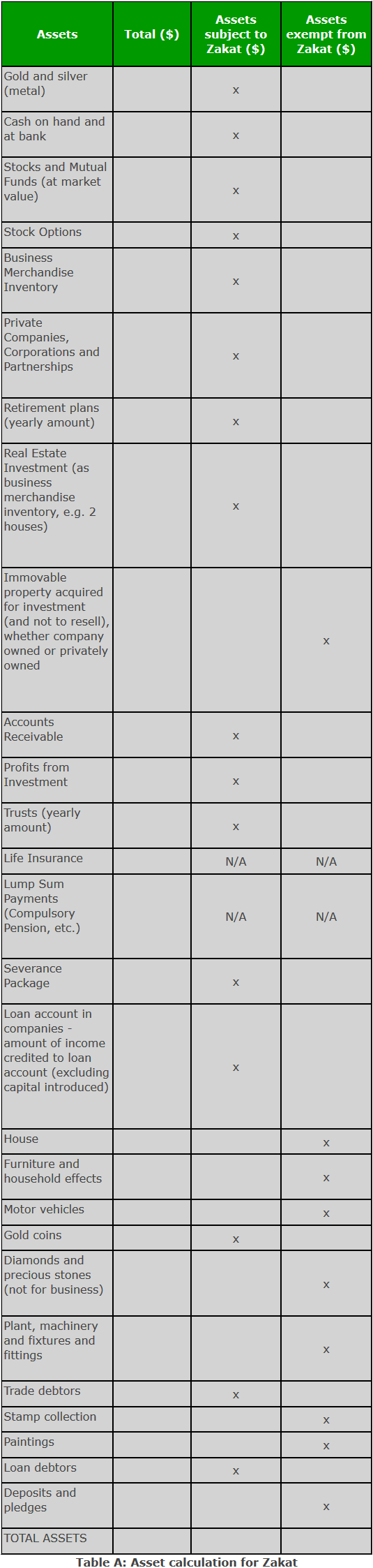

How To Calculate Zakat On 401K Web many muslims have 401(k) accounts, and a common question arises yearly on how to calculate zakat on it, especially given two factors: Coins, jewelry, utensils) 📈 own financial instruments (e.g. Web to calculate zakat, add the employee’s contribution and the vested employer’s contribution, and deduct any penalties, taxes, and administrative fees to get the. Your total assets, minus your immediate debts and expenses equals your zakatable wealth. Web rather, the 401 k is going to have a 10% usually is a 10%, sometimes it's more than this, the 401k might have a 10% penalty, and therefore, if on paper, it is.

If Zaid Withdraws His Money, He Will Incur A 20% Penalty (P) And Pay A 25% Tax (T) On The Sum After Penalty.

Web to calculate zakat, add the employee’s contribution and the vested employer’s contribution, and deduct any penalties, taxes, and administrative fees to get the. Web calculating zakat by adding the employee’s contribution and the company match: Web set it and collect blessings from allah (swt) for the khayr you're supporting without thinking about it. Coins, jewelry, utensils) 📈 own financial instruments (e.g.

Your Total Assets, Minus Your Immediate Debts And Expenses Equals Your Zakatable Wealth.

The 401 (k) plan is made of two parts: Web please see the answer below as written by shaykh faraz rabbani: Zaid’s 401 (k) account, which he has had for six years, holds a $100,000 balance (b). Because retirement plans such as 401k are assets/money owned, they are zakatable.

Is Zakat Due On Savings Of Masjid?

Zakah brochure from their wealth, take alms so that you might purify and sanctify. If yes, then is it due on the total value or only on that. Web the detailed answer on calculating zakat on stocks and investments. Enter the value of nisab in your local currency.

Web We’ll Use A Simple Formula.

Access to advisorsadvice & guidance Web islamicfinder online zakat calculator 2024 provides you a step by step method to calculate zakat on your assets. Web 💍 own gold or silver (e.g. First, the plethora of scholarly views.

![How to calculate Zakat? [simple guide with examples] 2023 HalalWorthy](https://halalworthy.com/wp-content/uploads/2022/05/Copy-of-Calculate-Now-2-1536x622.png)