How To Compute Effective Interest Rate In Excel

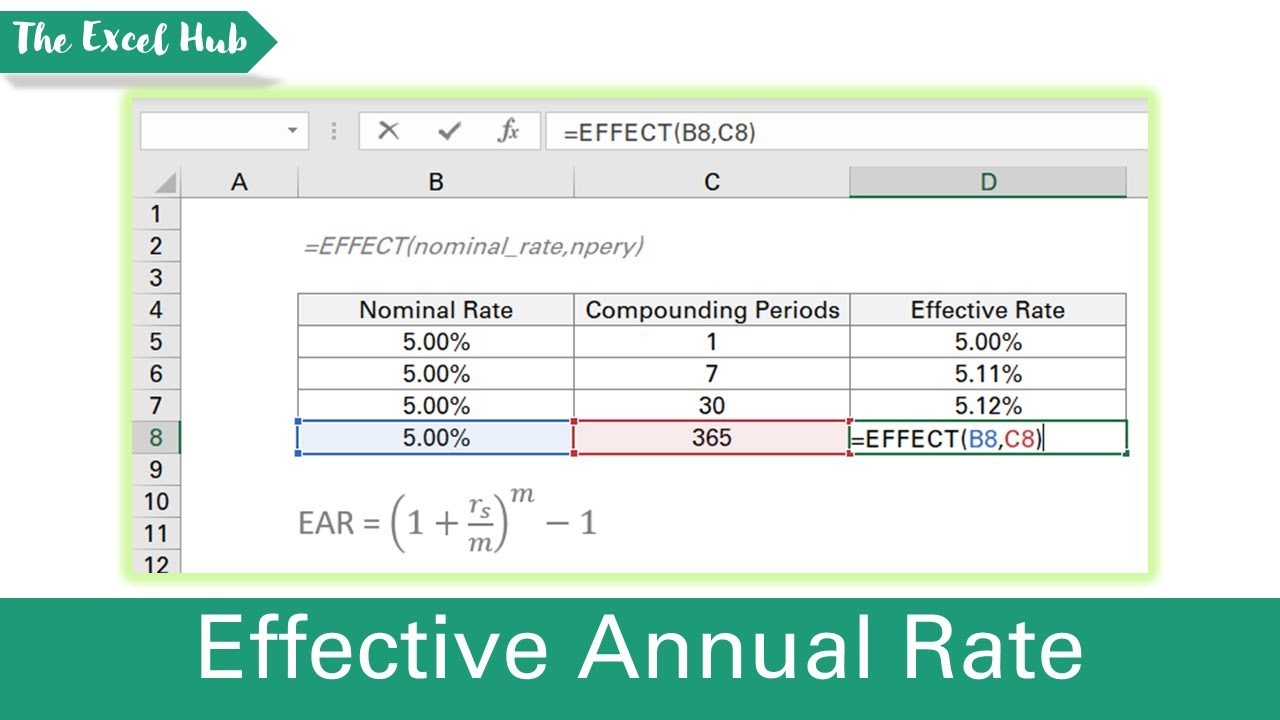

How To Compute Effective Interest Rate In Excel - Calculating the effective annual rate (ear) is crucial in financial analysis as it provides the true annual interest rate when compounding is taken into account. Effect(nominal_rate, npery) the effect function syntax has the following arguments: Familiarize yourself with the concept of an effective interest rate. Web this article describes the formula syntax and usage of the effect function in microsoft excel. Suppose you want to figure out the effective interest rate (apy) from a 12% nominal rate (apr) loan that has monthly compounding.

Suppose you want to figure out the effective interest rate (apy) from a 12% nominal rate (apr) loan that has monthly compounding. In this excel tutorial, we will walk you through the steps to calculate ear in excel, equipping you with the skills to make more informed financial decisions. It takes into account the effect of compounding interest, which is left out of the nominal or stated interest rate. Web excel is a powerful tool for calculating the effective interest rate, as it can easily handle complex formulas and provide immediate results. Web the interest rate calculator determines real interest rates on loans with fixed terms and monthly payments. To calculate the interest on investments instead, use. Notice that we have the nominal interest rate (apr) in cell b1 and the number of payment periods in cell b2.

How to Calculate Effective Interest Rate Using Excel ToughNickel

Here we discuss how to calculate effective interest rates along with practical examples. Web enter the formula =effect (nominal_interest_rate, npery), where nominal_interest_rate is the annual nominal interest rate and npery is the number of compounding periods per year. What is the effective rate of the loan? Web this article describes the formula syntax and usage.

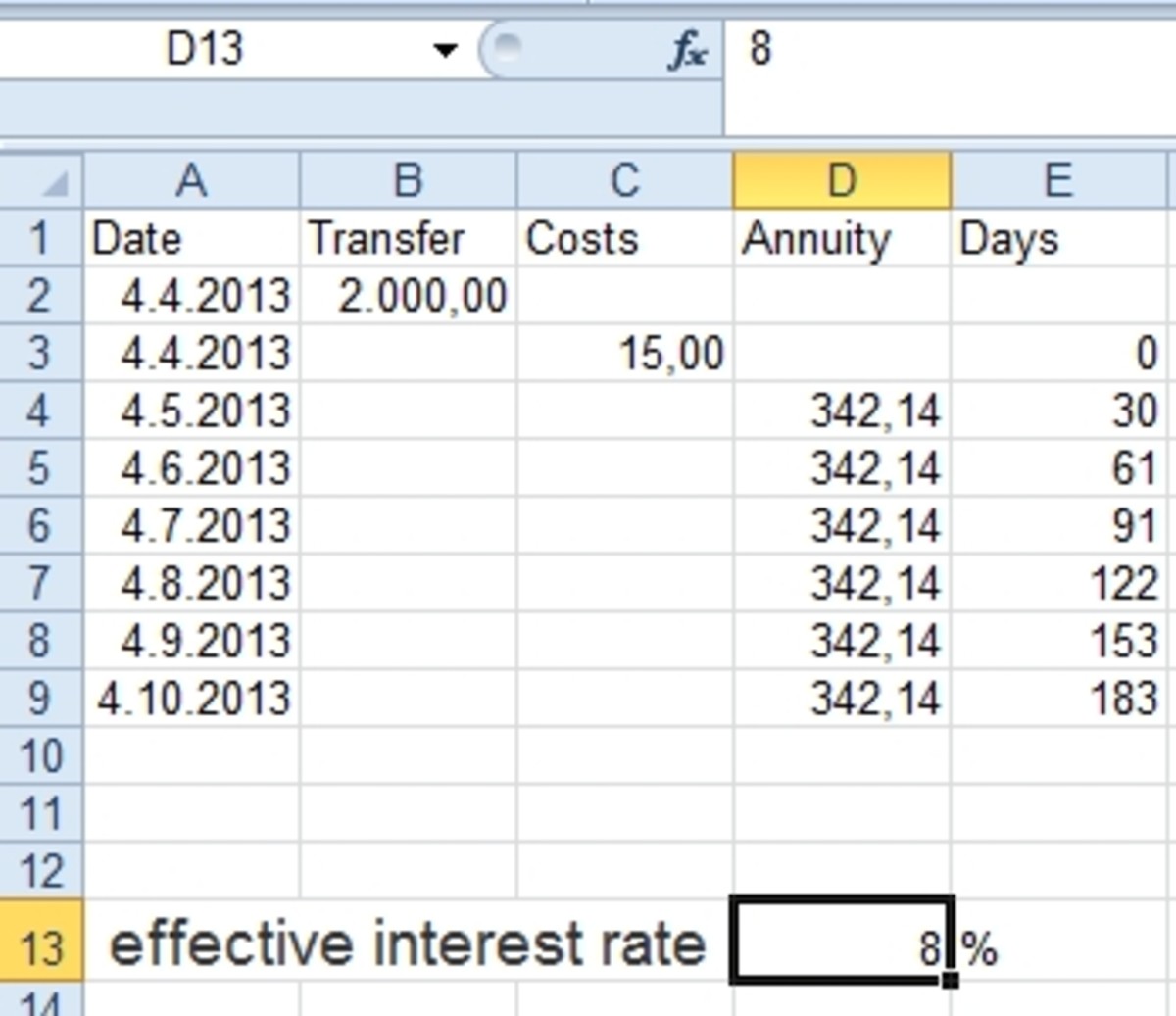

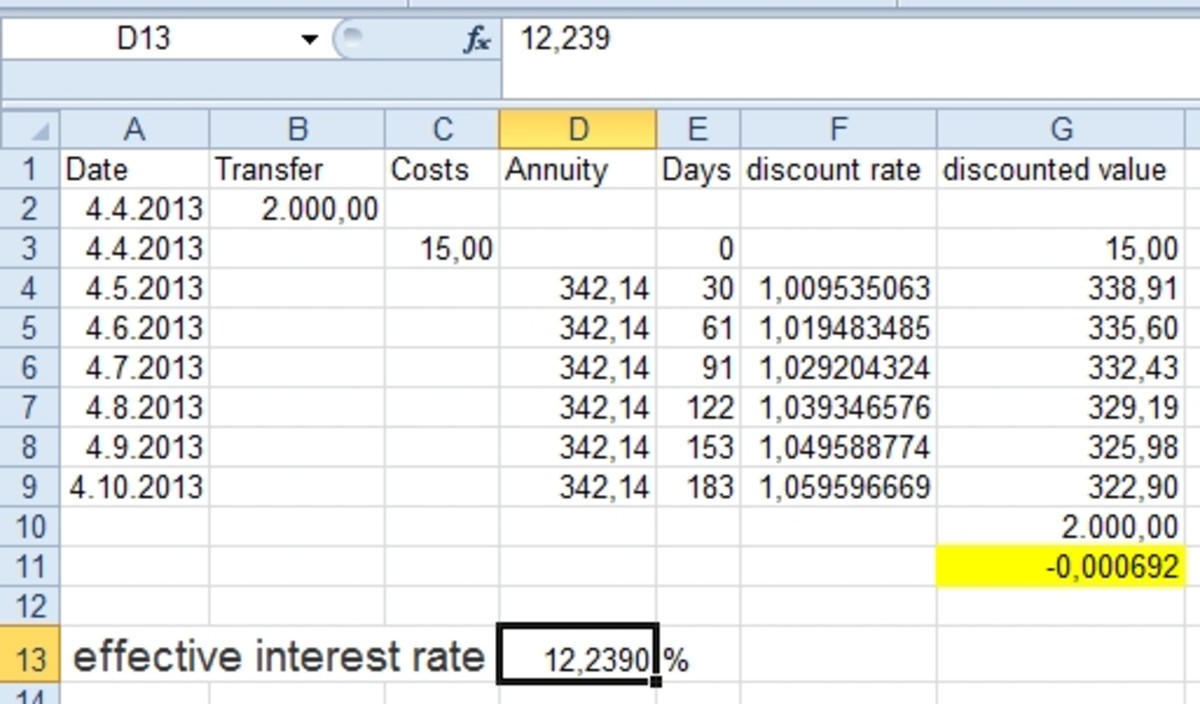

How to Calculate Effective Interest Rate and Discount Rate Using Excel

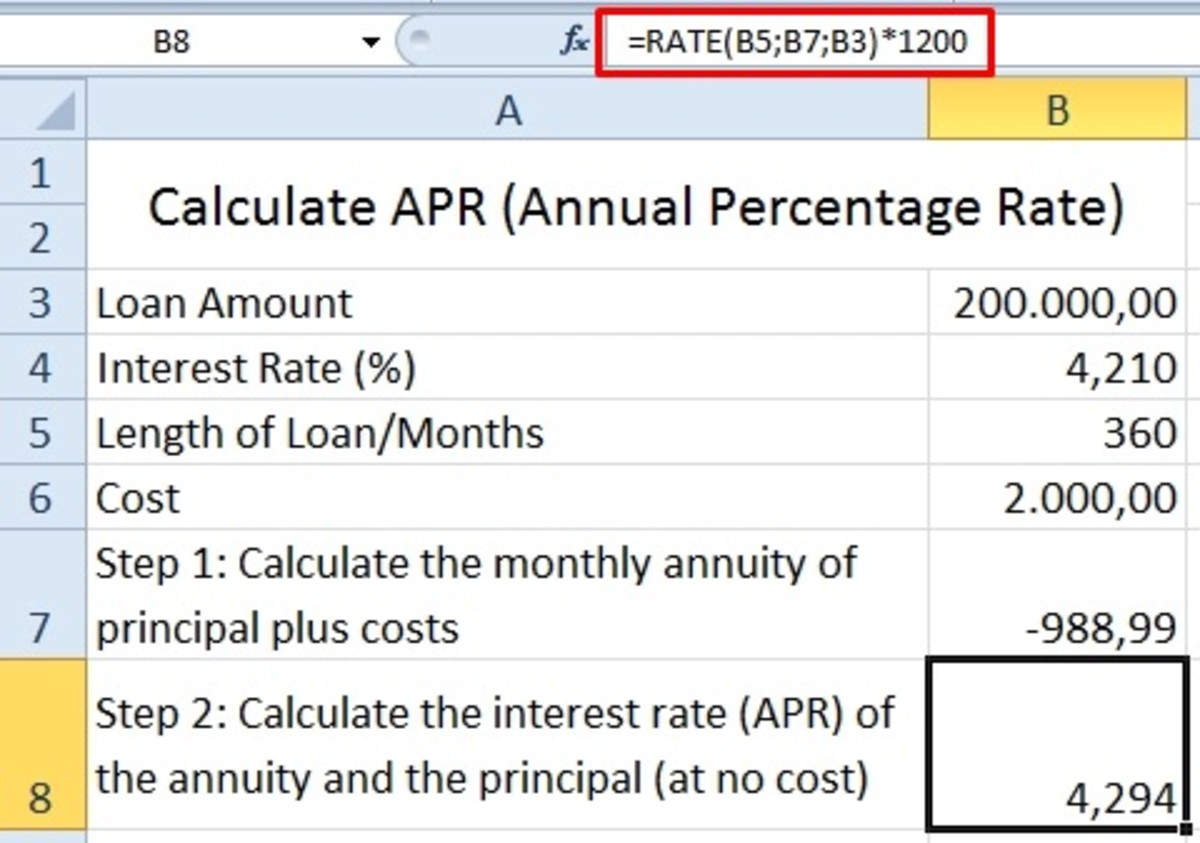

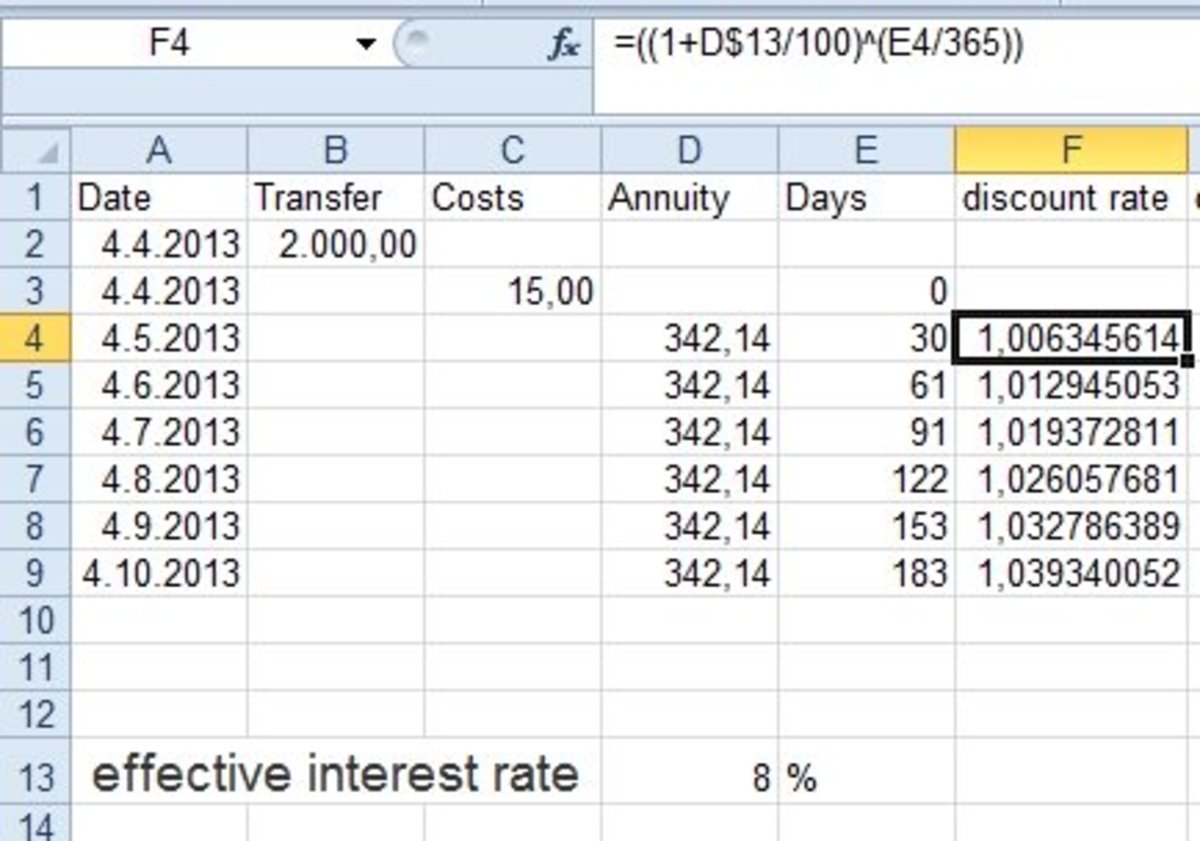

Web calculation of the effective interest rate on the loan, leasing and government bonds is performed using the functions effect, irr, xirr, fv, etc. Web follow any of the below methods to calculate the effective interest rate on bonds using excel. Then we will go for the effect function to calculate the effective interest. Effective.

How to calculate effective interest rate in excel The Tech Edvocate

Now, let’s see how to calculate the effective interest rate. Web this is a guide to the effective interest rate formula. Let’s play around with the effective annual interest rate in excel, to understand the ear concept and see the impact of the effective rate versus. Web the interest rate calculator determines real interest rates.

How to Calculate Effective Interest Rate in Excel with Formula

Notice that we have the nominal interest rate (apr) in cell b1 and the number of payment periods in cell b2. Firstly, we will use an excel formula to calculate the effective interest formula. Then we will go for the effect function to calculate the effective interest. Web we can also use the effect function.

How to Calculate Effective Interest Rate and Discount Rate Using Excel

What is the effective rate of the loan? In the example shown, the formula in d5, copied down, is: Let’s play around with the effective annual interest rate in excel, to understand the ear concept and see the impact of the effective rate versus. =effect(c4,c5) after that, press enter to get the output. Web to.

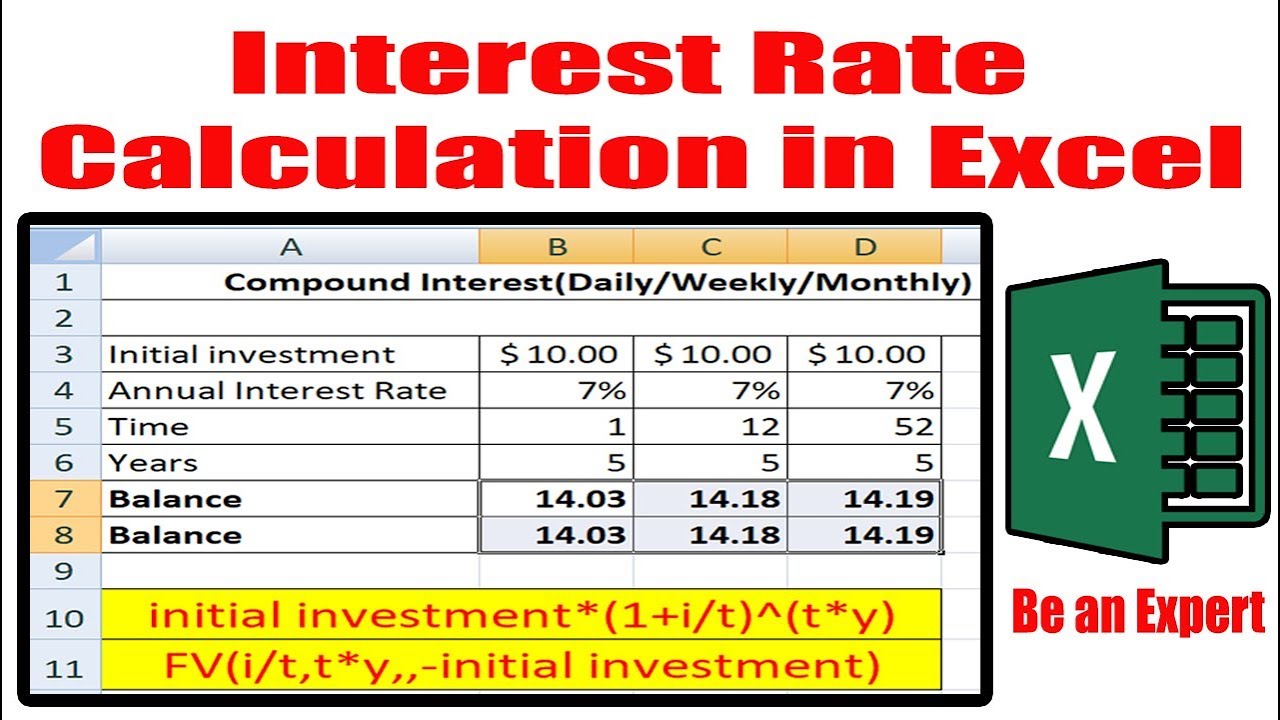

Interest Rate Calculation in Excel YouTube

() npery is the number of compounding periods per year. Web this article describes the formula syntax and usage of the effect function in microsoft excel. Now, let’s see how to calculate the effective interest rate. Web use excel’s effect formula. Web the function calculates by iteration and can have no or more than one.

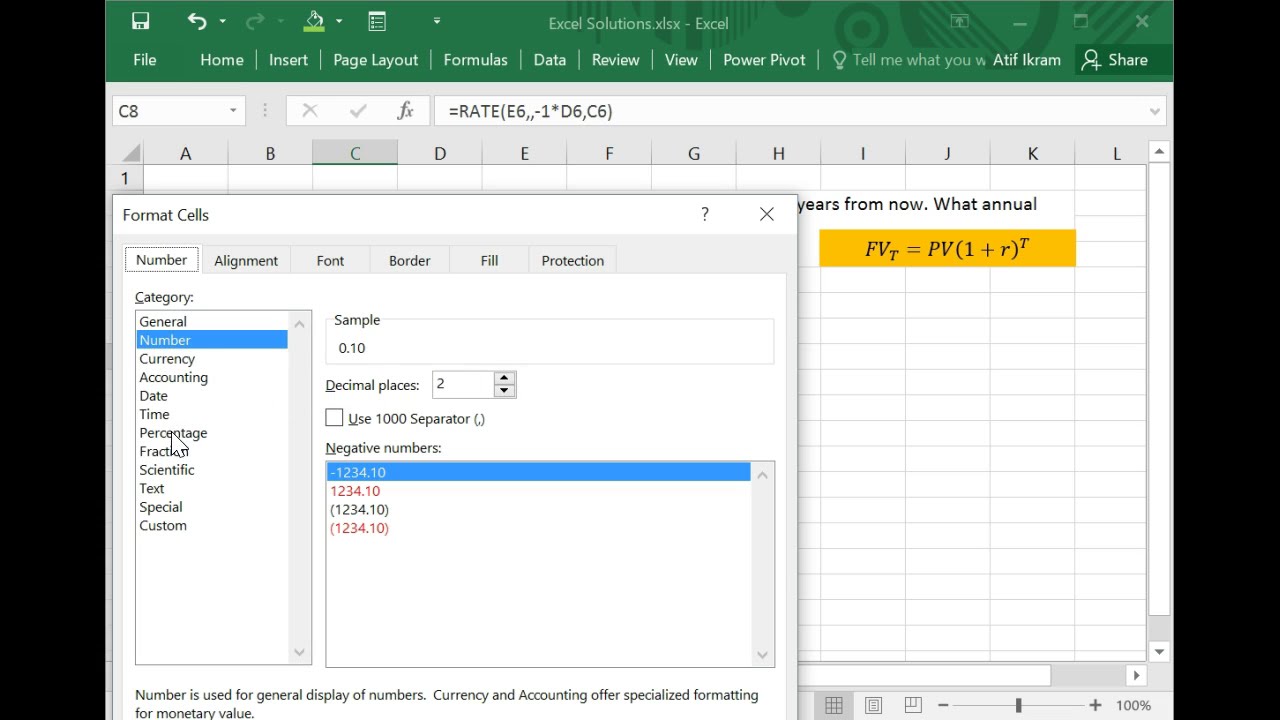

How to Calculate the Interest Rate (=RATE) in MS Excel YouTube

Now, let’s see how to calculate the effective interest rate. In order to calculate the effective interest rate: Accurate data input is essential for obtaining reliable results when. Web use excel’s effect formula. You have set up your excel worksheet to look like the one below. Rate (nper, pmt, pv, [fv], [type], [guess]) where: In.

Effective Interest Rate Method Excel Template (Free) ExcelDemy

In this excel tutorial, we will walk you through the steps to calculate ear in excel, equipping you with the skills to make more informed financial decisions. Web follow any of the below methods to calculate the effective interest rate on bonds using excel. This effective annual interest rate calculator helps you calculate the ear.

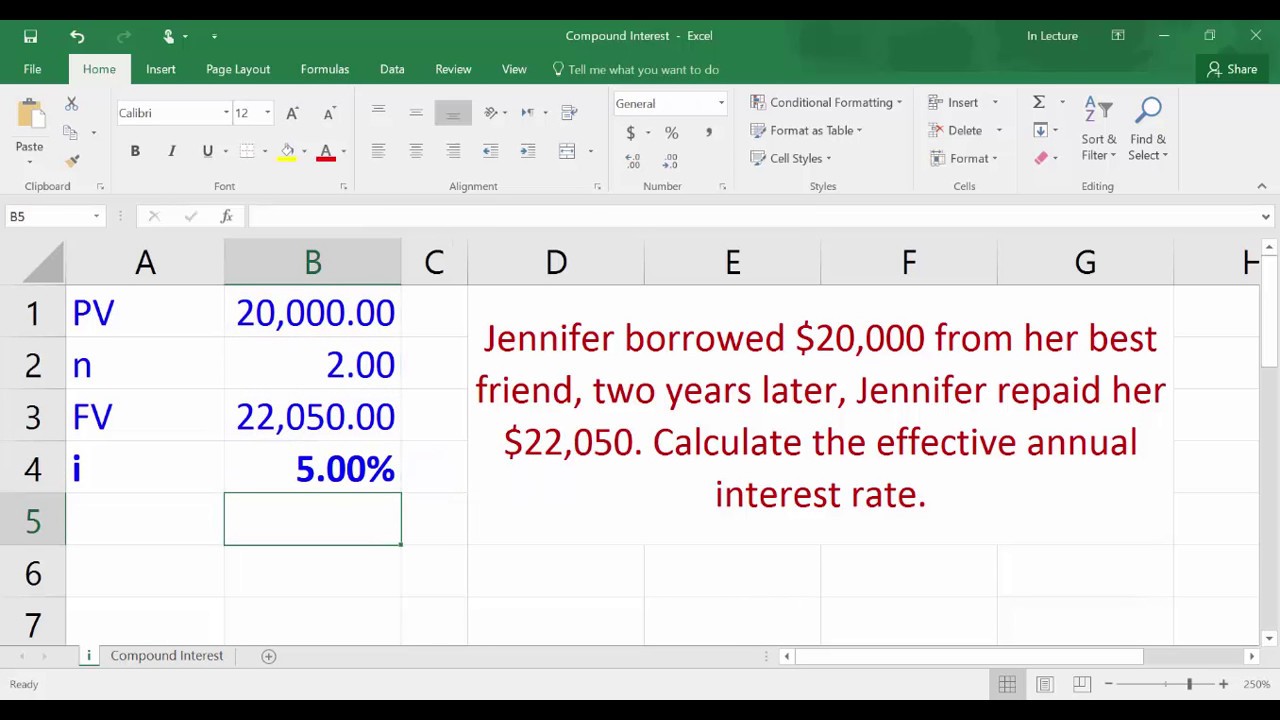

Compound Interest Calculating effective interest rate using Excel YouTube

Web here i show you how to calculate the effective interest rate and the discount rate. Accurate data input is essential for obtaining reliable results when. Web the function calculates by iteration and can have no or more than one solution. Go to c6 and write down the following formula. Effective annual interest rate is.

How to Calculate Effective Interest Rate Using Excel ToughNickel

To calculate the interest on investments instead, use. Web in this article, we will learn 3 ways to calculate the effective interest rate of investment in excel with the proper formula. Web the effect function calculates the effective annual interest rate, given a nominal interest rate and the number of compounding periods per year. Cibc.

How To Compute Effective Interest Rate In Excel To calculate the interest on investments instead, use. Web the function calculates by iteration and can have no or more than one solution. Step 2) as the nper argument, give the number of years for loan repayment. • in excel, you use the function effect. Web in this article, we will learn 3 ways to calculate the effective interest rate of investment in excel with the proper formula.

() Npery Is The Number Of Compounding Periods Per Year.

Finally, we will use an effective interest rate calculator. Offer examples to illustrate the calculation process. Let’s now find the interest rate implicit in it. Rate (nper, pmt, pv, [fv], [type], [guess]) where:

Web To Calculate The Effective Annual Interest Rate, When The Nominal Rate And Compounding Periods Are Given, You Can Use The Effect Function.

Web you know the present value of the loan ($1000) and the periodic payments to be made against it ($300 per year). Web in this article, we will learn 3 ways to calculate the effective interest rate of investment in excel with the proper formula. Effect(nominal_rate, npery) the effect function syntax has the following arguments: To calculate the interest on investments instead, use.

Here We Discuss How To Calculate Effective Interest Rates Along With Practical Examples.

Web we can also use the effect function in excel to calculate the effective rate. Effective annual interest rate is the interest rate actually earned due to compounding. Web excel is a powerful tool for calculating the effective interest rate, as it can easily handle complex formulas and provide immediate results. Web use excel’s effect formula.

=Effect(C4,C5) After That, Press Enter To Get The Output.

What is the effective rate of the loan? The effective interest rate describes the full cost of borrowing. Step 1) begin writing the rate function. Notice that we have the nominal interest rate (apr) in cell b1 and the number of payment periods in cell b2.