How To Find Compound Interest In Excel

How To Find Compound Interest In Excel - Cell c5 contains the original principal (present value). Make sure to input all the values in the appropriate cells. Web using excel fv function to calculate compound interest. Calculate the simple growth rate (sgr) and compound annual growth rate (cagr) of the country’s gdp over the decade. Web to calculate compound interest in excel, you can use the fv function.

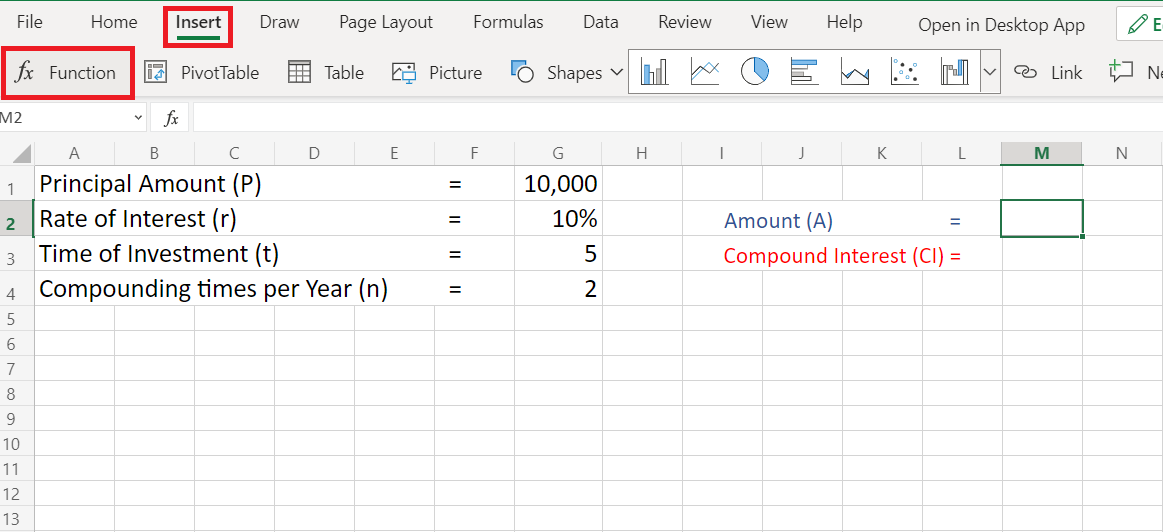

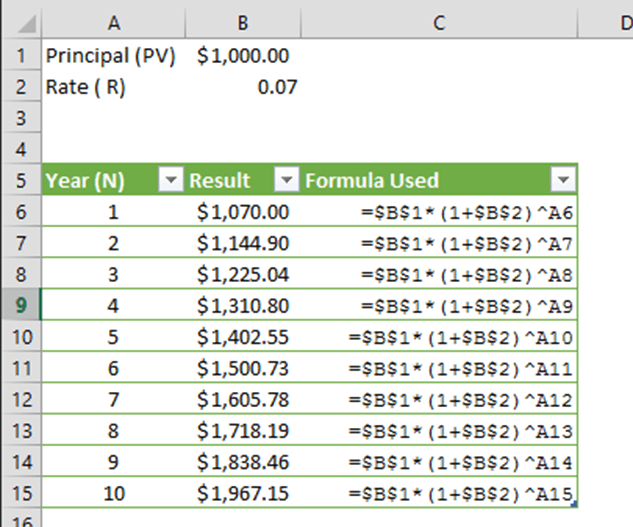

We’ll have to multiply this value with the interest rate. You can find the compounded interest rate given an annual interest rate and a dollar amount. Suppose you invest usd 1000 in a bank account that promises to give you 10% return at the end of the year. This means we can further generalize the compound interest formula to: =b1* (1+b2/b4)^ (b4*b3) you will get the future value using the compound interest formula when you press “enter” 👍. For example, let's say you have. The compound interest formula reduces to =10000*(1+0.04/4)^(4*15), =10000*(1.01)^60

Calculate compound interest Excel formula Exceljet

Then, raise that figure to the power of the number of days you want to compound for. R = annual interest rate. It differs from simple interest, where only the principal amount is used to calculate the interest. Web to calculate compound interest in excel, you can use the fv function. Web using the general.

How to Use Compound Interest Formula in Excel Sheetaki

P' is the gross amount (after the interest is applied). As with all excel formulas, instead of typing the numbers directly into your compound interest formula, you can use references to cells containing numbers. This formula looks more complex than it. Cell c5 contains the original principal (present value). Simple interest is the interest we.

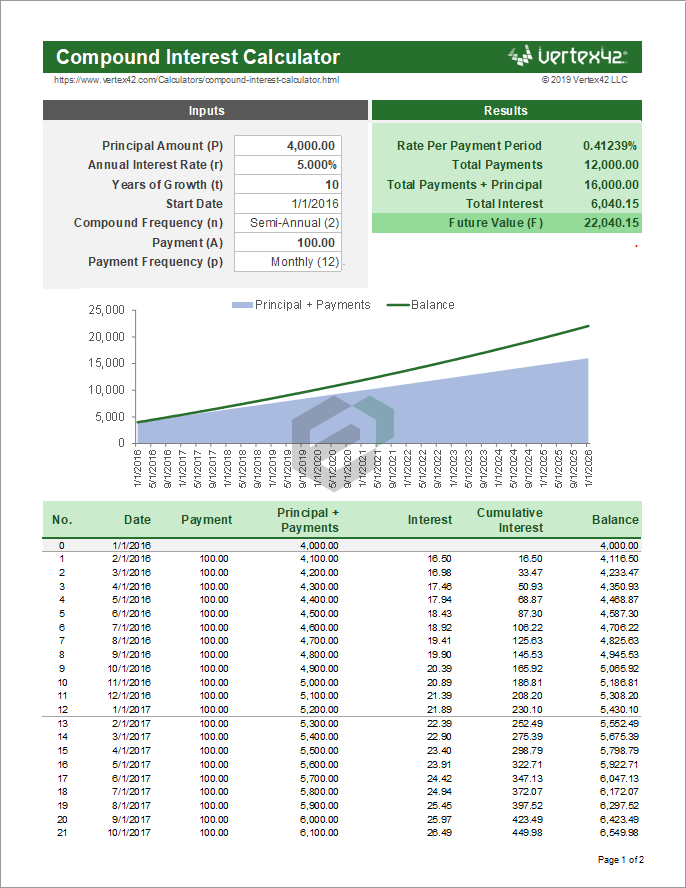

Compound Interest Calculator Template in Excel & Spreadsheet

Where, i = calculated simple interest. R = nominal annual interest rate (decimal) n = number of compounding periods per year. Compound interest is commonly used in financial institutions like banks and investment companies. =100* (1+.08/2)^ (2*3) the example returns $126.53. R is the annual interest rate. P = number of payment periods per year..

How to Calculate Compound Interest In Excel? Techyuga

Web to begin your calculation, take your daily interest rate and add 1 to it. Web use the excel formula = p*(1+r/t)^(n*t) to calculate compound interest in excel. We can also use the fv function to find the compounded value. N = number of periods. If interest is compounded quarterly, then t =4. Web a.

How to Calculate Compound Interest in Excel? QuickExcel

Rate = rate per payment period. If interest is compounded quarterly, then t =4. As with all excel formulas, instead of typing the numbers directly into your compound interest formula, you can use references to cells containing numbers. Simple interest vs compound interest. Nper = total number of payment periods. P(1+r/t) (n*t) here, t is.

How to Make a Compound Interest Calculator in Microsoft Excel by

This means we can further generalize the compound interest formula to: Then, raise that figure to the power of the number of days you want to compound for. This example assumes that $1000 is invested for 10 years at an annual interest rate of 5%, compounded monthly. R is the interest rate. Mathematical compound interest.

How to Calculate Monthly Compound Interest in Excel Statology

Number of compounding periods per year. Simple interest vs compound interest. Where, i = calculated simple interest. Cell c5 contains the original principal (present value). So at the end of year 1, you get usd 1100 (1000+100). P(1+r/t) (n*t) here, t is the number of compounding periods in a year. Select cell c12 and insert.

How to calculate compound interest in Excel

Web compound interest is a type of interest that is added to the principal amount, and then the interest is calculated on the new amount. For example, if in 5 years you invest $100 at a rate of 5%. Web to calculate compound interest in excel, you can use the fv function. In the first.

Finance Basics 2 Compound Interest in Excel YouTube

R = nominal annual interest rate (decimal) n = number of compounding periods per year. The gdp of a country was $1.5 trillion in 2010 and increased to $2.5 trillion in 2020. T is the number of years. Simple interest is the interest we all know. R = annual interest rate. We’ll have to multiply.

How to Use Compound Interest Formula in Excel Sheetaki

P' is the gross amount (after the interest is applied). R = nominal annual interest rate (decimal) n = number of compounding periods per year. T is the number of years. This means we can further generalize the compound interest formula to: Web how much will your investment be worth after 15 years at an.

How To Find Compound Interest In Excel Number of compounding periods per year. Compound interest is commonly used in financial institutions like banks and investment companies. Suppose you invest usd 1000 in a bank account that promises to give you 10% return at the end of the year. Then the calculated simple interest will be, i = $100*5/100*5, that is $25. Which gives the result 121.6652902.

Simple Interest Vs Compound Interest.

Web compound interest is interest that's calculated both on the initial principal of a deposit or loan, and on all previously accumulated interest. Suppose you invest usd 1000 in a bank account that promises to give you 10% return at the end of the year. This formula looks more complex than it. Web all we have to do is to select the correct cell references.

N Is The Number Of Times The Interest Is Compounded In A Year.

Web using excel fv function to calculate compound interest. Let me take a simple example to explain it. We can also use the fv function to find the compounded value. The following example uses the general equation:

Then The Calculated Simple Interest Will Be, I = $100*5/100*5, That Is $25.

If the investment is compounded daily, then we can use 365 for n: T is the total time (in years) in which compound interest is applied. Open a new spreadsheet and enter the required values. In the first year, you will get $10000*10% which is $1000, and in the second year, ($10000+$1000)*10% =.

Future Value = P* (1+ R)^ N.

So at the end of year 1, you get usd 1100 (1000+100). Rate = rate per payment period. Web i = pnr. It differs from simple interest, where only the principal amount is used to calculate the interest.