How To Find Ytm In Excel

How To Find Ytm In Excel - Returns the yield on a security that pays periodic interest. To use this function, here are the steps: 35k views streamed 6 years ago. The settlement date, maturity date, rate, price, and redemption value. Since the yield to maturity represents the annualized return on a bond, you can also use the internal.

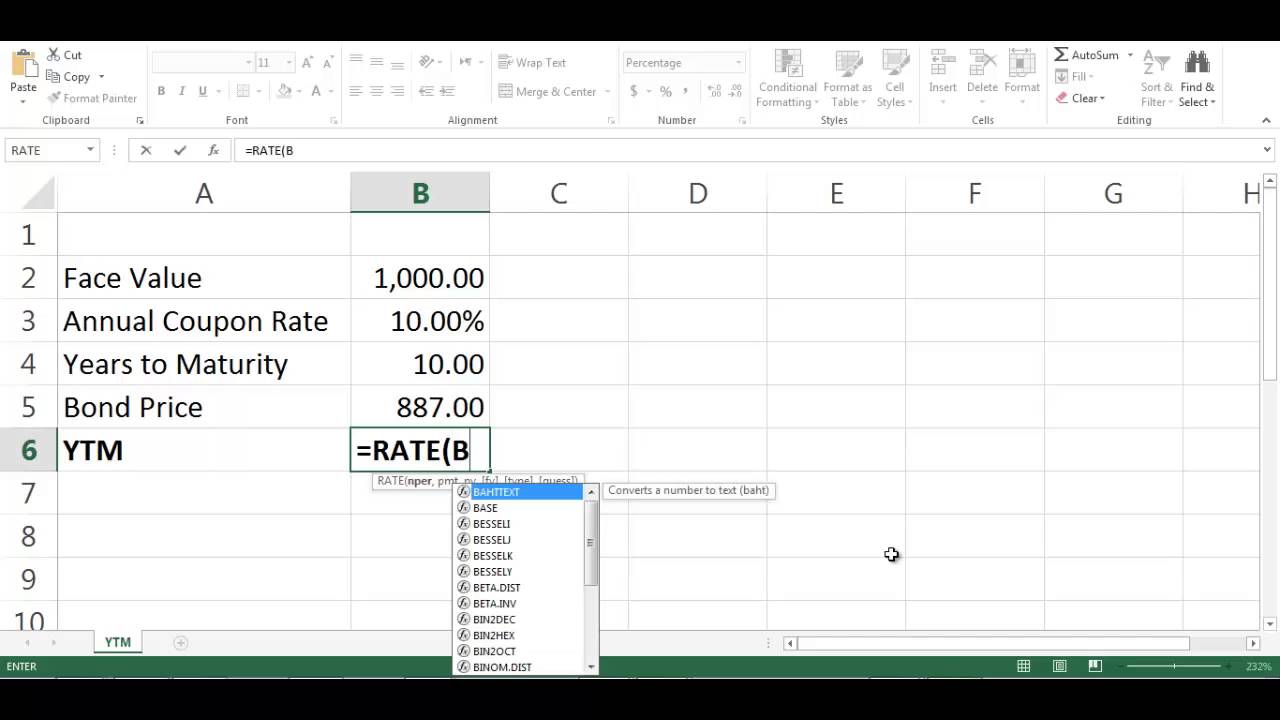

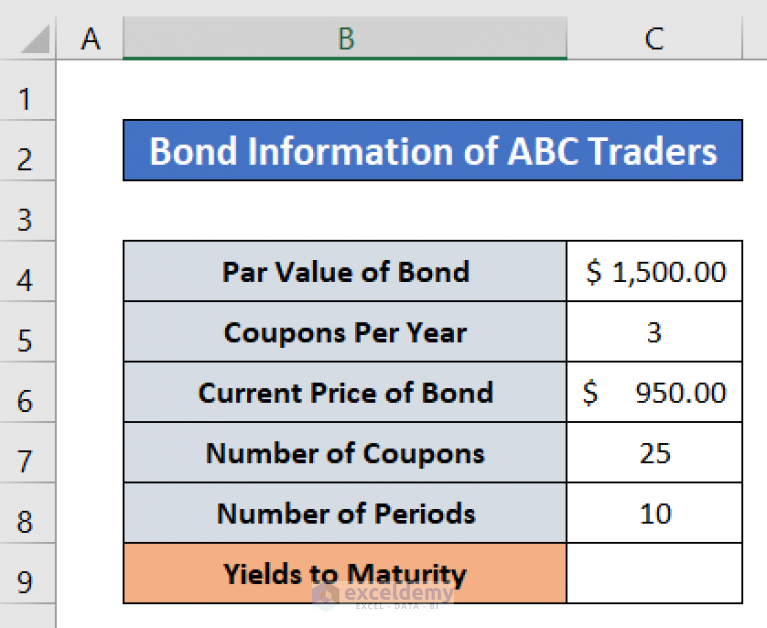

Web to calculate ytm in excel, use the yield function, which requires five arguments: Ytm is a key metric for investors that want to understand the expected rate of. Web below is the formula: Web the first step in finding the yield to maturity in excel is to use the rate function. Settlement date, maturity date, issue date, rate, price per $100 face value (pr), and day. You’ll need to use the following formula: How to use =rate in.

Calculating bond’s yield to maturity using excel YouTube

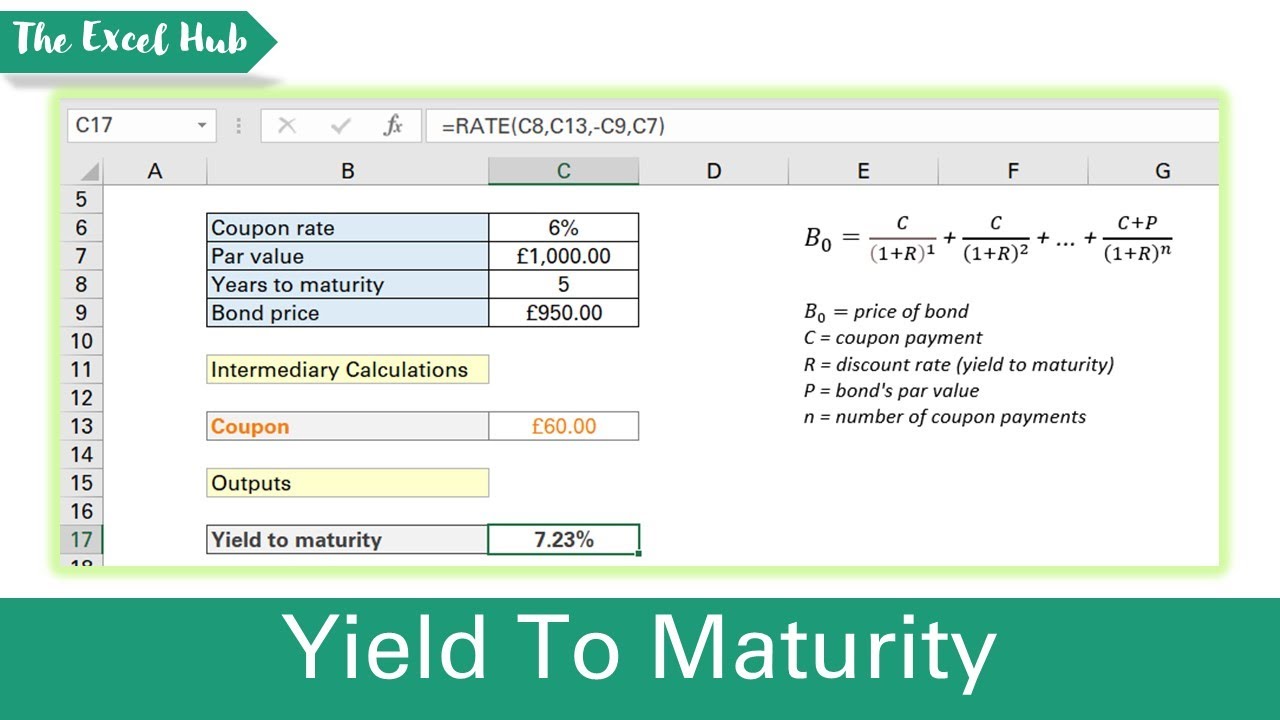

The formula to price a traditional bond is: Fv = it appears as a face value. =ytm(n,c1:cn,p,fv) where n is the number of periods,. How to use =rate in. To use this function, here are the steps: C = it appears as an annual coupon amount. This function calculates the yield to maturity of a.

How to Make a Yield to Maturity Calculator in Excel ExcelDemy

This function calculates the yield to maturity of a bond based on its par value, price, coupon. C = annual coupon payment f = face value of the bond p = price paid for the bond n = number of years to maturity. To use this function, here are the steps: Since the yield to.

Calculate The Yield To Maturity Of A Bond In Excel YouTube

=yield (f4, f7 ,f15,f12, f8 ,f14) the implied yield to. Since the yield to maturity represents the annualized return on a bond, you can also use the internal. Ytm is a key metric for investors that want to understand the expected rate of. Returns the yield on a security that pays periodic interest. This function.

How to Calculate YTM of a Bond in Excel (4 Suitable Methods)

Web this article describes the formula syntax and usage of the yield function in microsoft excel. To use this function, here are the steps: The formula to price a traditional bond is: Web with your excel sheet set up, calculating ytm is straightforward. Web the inputs entered in our yield function formula to compute the.

How to calculate YTM in Excel Basic Excel Tutorial

Settlement date, maturity date, issue date, rate, price per $100 face value (pr), and day. You’ll need to use the following formula: Fv = it appears as a face value. Web to calculate ytm in excel, use the yieldmat function. To use this function, here are the steps: Web with all these values available, excel.

How to Calculate YTM of a Bond in Excel (4 Suitable Methods)

Web the first step in finding the yield to maturity in excel is to use the rate function. How to use =rate in ms excel to calculate ytm for bonds. Settlement date, maturity date, issue date, rate, price per $100 face value (pr), and day. Web with your excel sheet set up, calculating ytm is.

Calculate The YTM Of A Bond With Semi Annual Coupon Payments In Excel

Returns the yield on a security that pays periodic interest. Web the yield to maturity (ytm) is calculated by the following formula: Web below is the formula: The formula to price a traditional bond is: To use this function, here are the steps: You’ll need to use the following formula: How to calculate the yield.

How to Calculate Yield to Maturity Excel YTM YIELDMAT Function Earn

Web to calculate ytm in excel, use the yieldmat function. =yield (f4, f7 ,f15,f12, f8 ,f14) the implied yield to. Returns the yield on a security that pays periodic interest. =ytm(n,c1:cn,p,fv) where n is the number of periods,. Settlement date, maturity date, issue date, rate, price per $100 face value (pr), and day. The settlement.

Finding Yield to Maturity using Excel YouTube

How to calculate the yield to maturity with the irr function. Web to calculate ytm in excel, use the yield function, which requires five arguments: How to use =rate in ms excel to calculate ytm for bonds. 35k views streamed 6 years ago. Web to calculate ytm in excel, use the yieldmat function. Web the.

How to calculate YTM in Excel Basic Excel Tutorial

To use this function, here are the steps: Fv = it appears as a face value. The settlement date, maturity date, rate, price, and redemption value. Settlement date, maturity date, issue date, rate, price per $100 face value (pr), and day. Ytm is a key metric for investors that want to understand the expected rate.

How To Find Ytm In Excel Web with all these values available, excel will calculate for you the ytm value using the rate function. This function calculates the yield to maturity of a bond based on its par value, price, coupon. 35k views streamed 6 years ago. The formula to price a traditional bond is: Ytm is a key metric for investors that want to understand the expected rate of.

Web To Calculate Ytm In Excel, Use The Yieldmat Function.

How to use =rate in. =yield (f4, f7 ,f15,f12, f8 ,f14) the implied yield to. To use this function, here are the steps: Since the yield to maturity represents the annualized return on a bond, you can also use the internal.

The Settlement Date, Maturity Date, Rate, Price, And Redemption Value.

Fv = it appears as a face value. Settlement date, maturity date, issue date, rate, price per $100 face value (pr), and day. Returns the yield on a security that pays periodic interest. 35k views streamed 6 years ago.

How To Calculate The Yield To Maturity With The Irr Function.

You’ll need to use the following formula: Web with all these values available, excel will calculate for you the ytm value using the rate function. Web the first step in finding the yield to maturity in excel is to use the rate function. Web with your excel sheet set up, calculating ytm is straightforward.

Web To Calculate Ytm In Excel, Use The Yield Function, Which Requires Five Arguments:

This function calculates the yield to maturity of a bond based on its par value, price, coupon. The formula to price a traditional bond is: Web specifically i show how students can use =rate and =irr functions in excel to calculate the yield of a bond making annual coupon payments, and then a bond. Web below is the formula: