How To Record Construction Draws In Quickbooks

How To Record Construction Draws In Quickbooks - 453k views 3 years ago. Web click the plus ( +) icon. This account will be used to track all of the money that is being loaned to the construction company. These reports help you monitor project costs, identify potential issues, and make informed decisions to optimize your construction business. Web do i categorize a construction draw received as income?

These are typically split up into. Thus in that case you can add the interest. Find a transaction on the list. Web 29k views 6 months ago. This budget will track all of the expenses associated with the construction project. Use your gear (⚙️) icon and choose chart of accounts. Your owner's draw account is the cumulative total of all draws you have taken out of the business since day 1.

how to take an owner's draw in quickbooks Masako Arndt

Web you can record construction costs by debiting construction from the processing system and crediting construction in progress or cash. To do this, go to the lists menu and click on chart of accounts. Web how do you record a construction draw, i know that you record the total draw as loan payable, but what.

Construction Estimating Construction Estimating Quickbooks

453k views 3 years ago. A construction loan draw schedule is a detailed payment plan for the construction project. In the detail type field, select owner’s equity. Web click the plus ( +) icon. Select other current asset for the account type. Click the account button, and then select new. Select business if the transaction.

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

Web track sales & sales tax. Web do i categorize a construction draw received as income? Web 29k views 6 months ago. Another way is to create a construction loan account and then add the loan as an asset. Go to the transactions menu. Web quickbooks, the renowned accounting software, offers a reliable solution for.

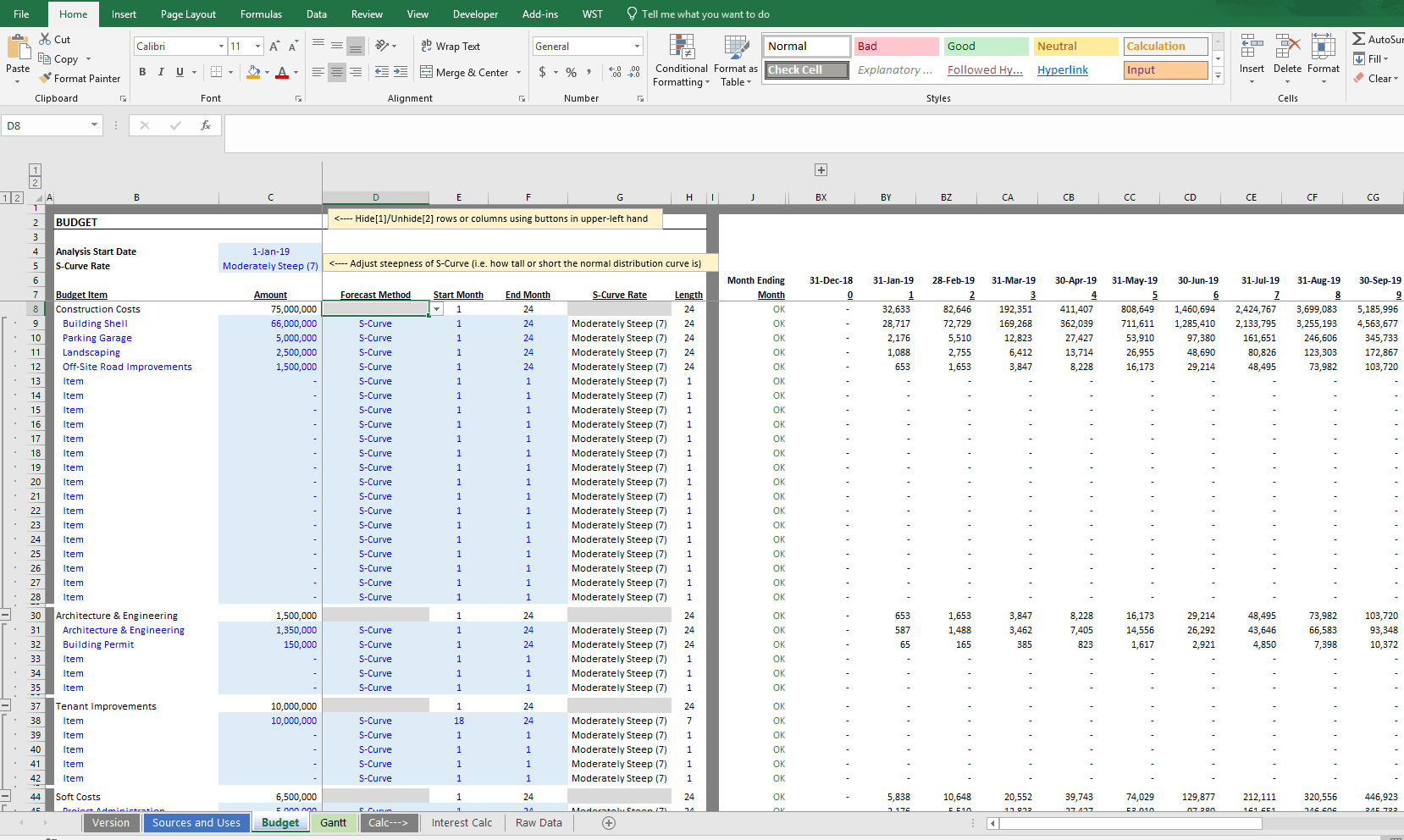

Tutorial Construction Draw and Interest Calculation Model

It all starts with the draw schedule. Second, the construction company will need to set up a construction budget. This account will be used to track all of the money that is being loaned to the construction company. Web by recording construction draws in quickbooks, you can generate accurate financial reports, including profit and loss.

how to take an owner's draw in quickbooks Masako Arndt

These reports help you monitor project costs, identify potential issues, and make informed decisions to optimize your construction business. Then, as you incur additional costs, record them as journal entries to the asset account. For the account name, you can put work in progress. This budget will track all of the expenses associated with the.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Web 29k views 6 months ago. And when you actually write a check for these Your owner's draw account is the cumulative total of all draws you have taken out of the business since day 1. To do this, create an asset account and enter the construction costs as the account’s starting balance. Use your.

QuickBooks Enterprise Construction Cost Estimating, Job Costing

Oc is the total of your contributions plus your retained earnings minus your draws. Web 29k views 6 months ago. Web the procedure described here for handling work in progress (wip) or construction in progress (cip) in quickbooks assumes that all revenue and costs will be tracked as assets (for costs) and liabilities (for revenues).

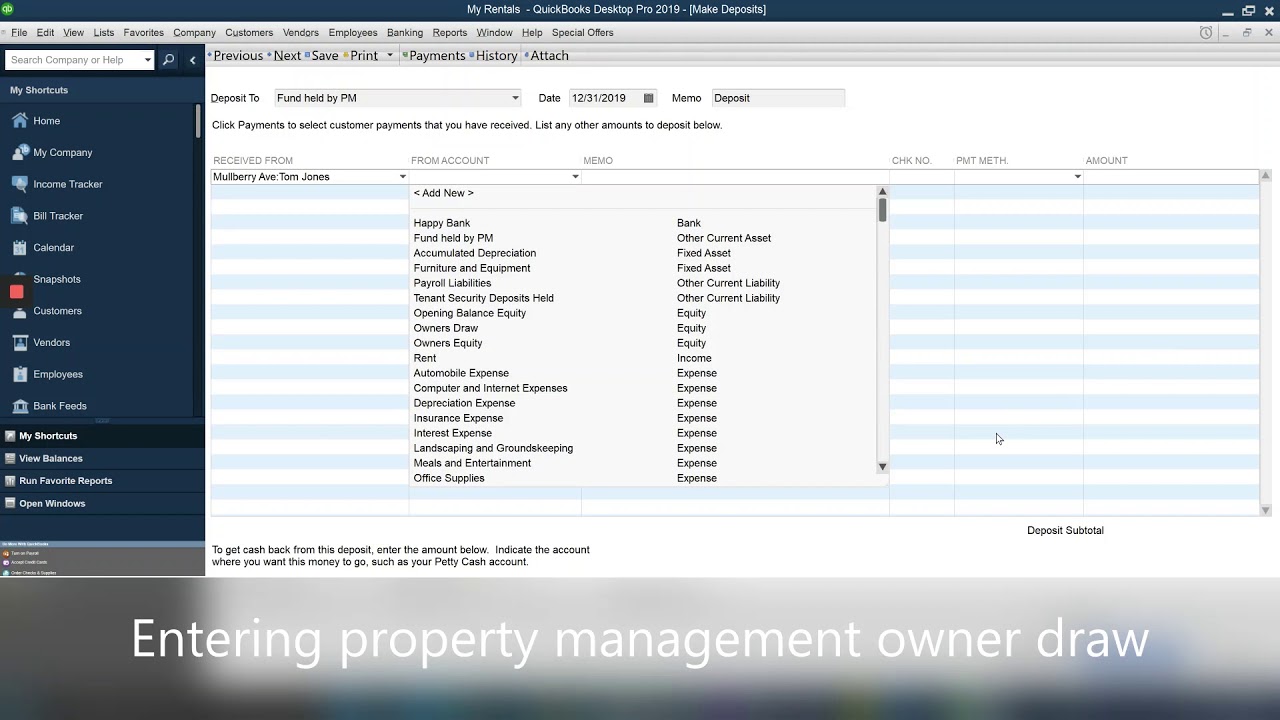

How to enter the property management owner draw to QuickBooks YouTube

For the account name, you can put work in progress. And when you actually write a check for these Then, click on the account button and select new. Web enroll to real estate accounting bootcamp: A construction loan draw schedule is a detailed payment plan for the construction project. Web 29k views 6 months ago..

Construction Draws Accounting

And when you actually write a check for these Find a transaction on the list. Web currently, the only way i can see to make qb automate the monthly construction loan draw process is to upgrade to enterprise edition of qb and buy crystal reports. Another way is to create a construction loan account and.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Go to lists at the top menu bar and click on chart of accounts. Web the first method is to create an owner’s draw account in quickbooks. Find a transaction on the list. If you are using quickbooks for your construction accounting, you will want to make sure that you are recording your construction loans.

How To Record Construction Draws In Quickbooks Web how do you record a construction draw, i know that you record the total draw as loan payable, but what about the expenses that make up that total? Web in quickbooks, you can capitalize construction costs by recording them as assets. Web first, they will need to set up a construction loan account with their bank. In this review, we will explore the positive aspects and benefits of using quickbooks to record construction draws, along with the ideal conditions for its implementation. Another way is to create a construction loan account and then add the loan as an asset.

Select Business If The Transaction Was For Business, Or Select Personal For Personal.

And when you actually write a check for these Web how do you record a construction draw, i know that you record the total draw as loan payable, but what about the expenses that make up that total? Another way is to create a construction loan account and then add the loan as an asset. Web currently, the only way i can see to make qb automate the monthly construction loan draw process is to upgrade to enterprise edition of qb and buy crystal reports.

Web You Can Record Construction Costs By Debiting Construction From The Processing System And Crediting Construction In Progress Or Cash.

I'd also recommend reaching out to an accountant to help you choose the right account. Web by recording construction draws in quickbooks, you can generate accurate financial reports, including profit and loss statements, balance sheets, and cash flow summaries. Thus in that case you can add the interest. This budget will track all of the expenses associated with the construction project.

Once Done, Select Save And Close.

Oc is the total of your contributions plus your retained earnings minus your draws. Use your gear (⚙️) icon and choose chart of accounts. Those 3 accounts should be closed to oc at year. (qualified assets as they call it).

These Reports Help You Monitor Project Costs, Identify Potential Issues, And Make Informed Decisions To Optimize Your Construction Business.

Web click the plus ( +) icon. Create an account go to the lists menu, and select chart of accounts. Second, the construction company will need to set up a construction budget. I flipped a property and used a hard money lender.