Hsa Tax Savings Calculator

Hsa Tax Savings Calculator - Web calculators > fsa tax savings calculator > hra tax savings calculator > hsa tax savings calculator > eligible expenses > benefit limits > consumer protection. Fine tune your plan by seeing. For more comprehensive tax savings information, visit our. Using this calculator, you can figure out how much you could be contributing to a health savings account (hsa). Learn more about tax credits.

Related information health account solutions, including health. Web health savings account calculators figure out your maximum contribution estimate your tax savings with an hsa see how your savings may grow over time what you'll need. Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you. Web how to calculate prorated hsa contribution limits: Web hsa savings calculator | lively estimate how much a lively hsa could save you on taxes and premiums. Based on a 30% tax bracket. Easily estimate your health care expenses and savings potential.

Ameriflex Health Savings Account (HSA) Participant Information

Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you. In addition to helping you plan for. Federal income tax rate (%): Web this health savings account (hsa) calculator determines the amount you are.

HSA — The Ultimate Retirement Savings Tool PRG Resource

(this is required to calculate the right maximum for a specific tax year.) enter your health plan type and. You can receive federal tax. You can also save the money in your hsa for future. Web check out our calculator to estimate how much you can save and understand the tax implications. Web hsa savings.

Health Savings Accounts (HSA) Grant Smith Health Insurance Agency

Discover how much money you can save. Web calculators > fsa tax savings calculator > hra tax savings calculator > hsa tax savings calculator > eligible expenses > benefit limits > consumer protection. Federal income tax rate (%): Web check out our calculator to estimate how much you can save and understand the tax implications..

HSA Calculator Advantage Administrators

Your estimated tax savings for the next year. In addition to helping you plan for. Web visit the hsa calculator and choose the correct tax year. You can receive federal tax. (this is required to calculate the right maximum for a specific tax year.) enter your health plan type and. Fine tune your plan by.

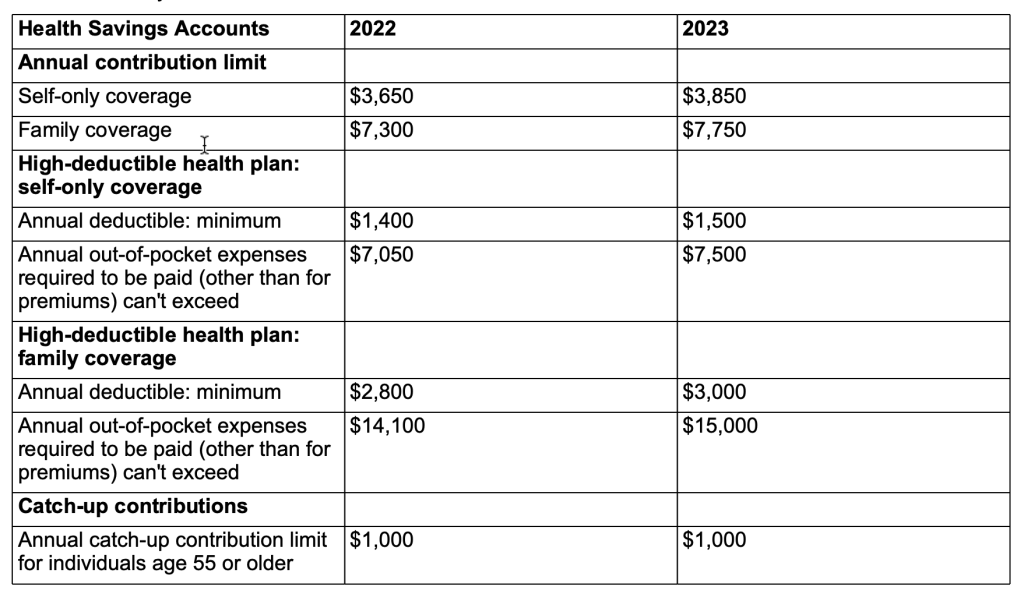

HSA contribution limits 2022 Calculator Internal Revenue Code Simplified

Web check out our calculator to estimate how much you can save and understand the tax implications. Web health savings account calculators figure out your maximum contribution estimate your tax savings with an hsa see how your savings may grow over time what you'll need. Fine tune your plan by seeing what happens if you.

HSA Savings Calculator Cafeteria Plan Direct

Web tax savings calculator year: State income tax rate (%): Web use this calculator to help you determine how much your health savings account (hsa) will be worth over time. Hsas and income tax savings; Contribute more money to your hsa. For more comprehensive tax savings information, visit our. Federal income tax rate (%): The.

How a Health Savings Account Leads to Health and Wealth

1 about triple tax advantages: Contribute more money to your hsa. Web how to calculate prorated hsa contribution limits: Web calculators > fsa tax savings calculator > hra tax savings calculator > hsa tax savings calculator > eligible expenses > benefit limits > consumer protection. Easily estimate your health care expenses and savings potential. Make.

HSA Calculator MyHSA EPIC Retirement Plan Services

Hsas and income tax savings; How does an hsa work? Related information health account solutions, including health. Learn how much you can contribute to your hsa to reach the irs maximum and gain tax savings. Using this calculator, you can figure out how much you could be contributing to a health savings account (hsa). Web.

IRS Releases 2023 Key Numbers for Health Savings Accounts Ballast

Learn more about tax credits. Using this calculator, you can figure out how much you could be contributing to a health savings account (hsa). Web calculators > fsa tax savings calculator > hra tax savings calculator > hsa tax savings calculator > eligible expenses > benefit limits > consumer protection. Web visit the hsa calculator.

How much should I put into my HSA? Lively

Your estimated tax savings for the next year. Web tax savings calculator year: How does an hsa work? In addition to helping you plan for. For more comprehensive tax savings information, visit our. Web check out our calculator to estimate how much you can save and understand the tax implications. Web our health savings account.

Hsa Tax Savings Calculator Use this calculator to help you determine how much your health savings account (hsa) will be worth over time. Web future value of yourhealth savings account: Easily estimate your health care expenses and savings potential. In addition to helping you plan for. Based on a 30% tax bracket.

You Can Also Save The Money In Your Hsa For Future.

Hsas and income tax savings; Contribute more money to your hsa. Web future value of yourhealth savings account: (this is required to calculate the right maximum for a specific tax year.) enter your health plan type and.

Web Check Out Our Calculator To Estimate How Much You Can Save And Understand The Tax Implications.

The farther away you are from retirement, the more. Includes 10 year net worth tracker with dashboard, asset. State income tax rate (%): How does an hsa work?

Web Calculators > Fsa Tax Savings Calculator > Hra Tax Savings Calculator > Hsa Tax Savings Calculator > Eligible Expenses > Benefit Limits > Consumer Protection.

Web use this calculator to help you determine how much your health savings account (hsa) will be worth over time. Web regardless of the amount you choose to contribute to your hsa, an hsa calculator can help make sure you reach your health and tax savings goals. Based on a 30% tax bracket. For more comprehensive tax savings information, visit our.

Web The Health Savings Account (Hsa) Calculator Can Help You:

Federal income tax rate (%): Your estimated tax savings for the next year. Using this calculator, you can figure out how much you could be contributing to a health savings account (hsa). *estimate of potential income tax savings from hsa contributions and earnings.