Illinois Death Tax Calculator

Illinois Death Tax Calculator - An illinois resident who dies with property located in illinois may be subject to income tax, the federal estate and gift tax, and the illinois estate tax. Illinois is among them, and there is a. Web state death tax credit table: They’re 2 different things but very few people have to worry about. Intuit.com has been visited by 1m+ users in the past month

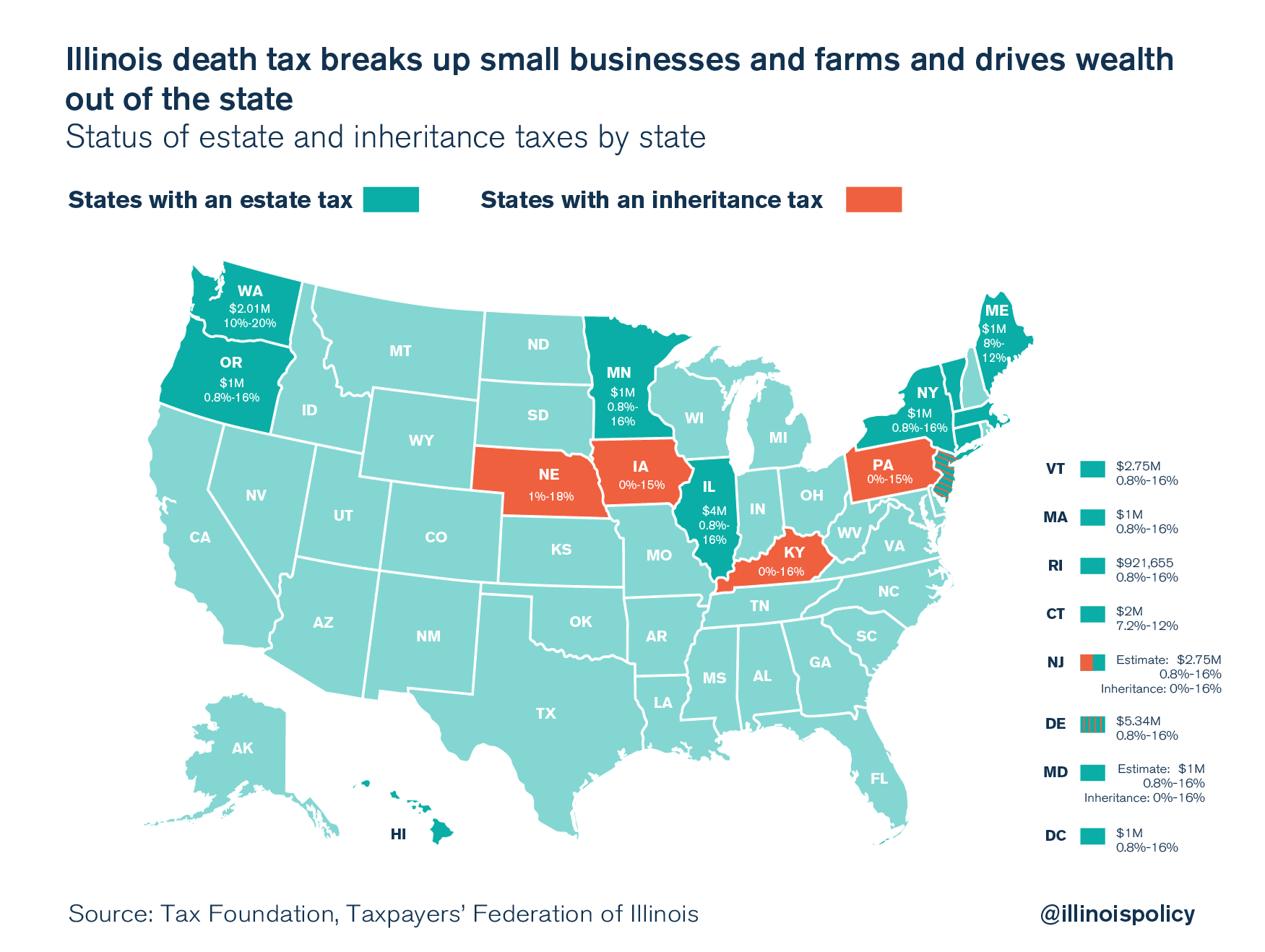

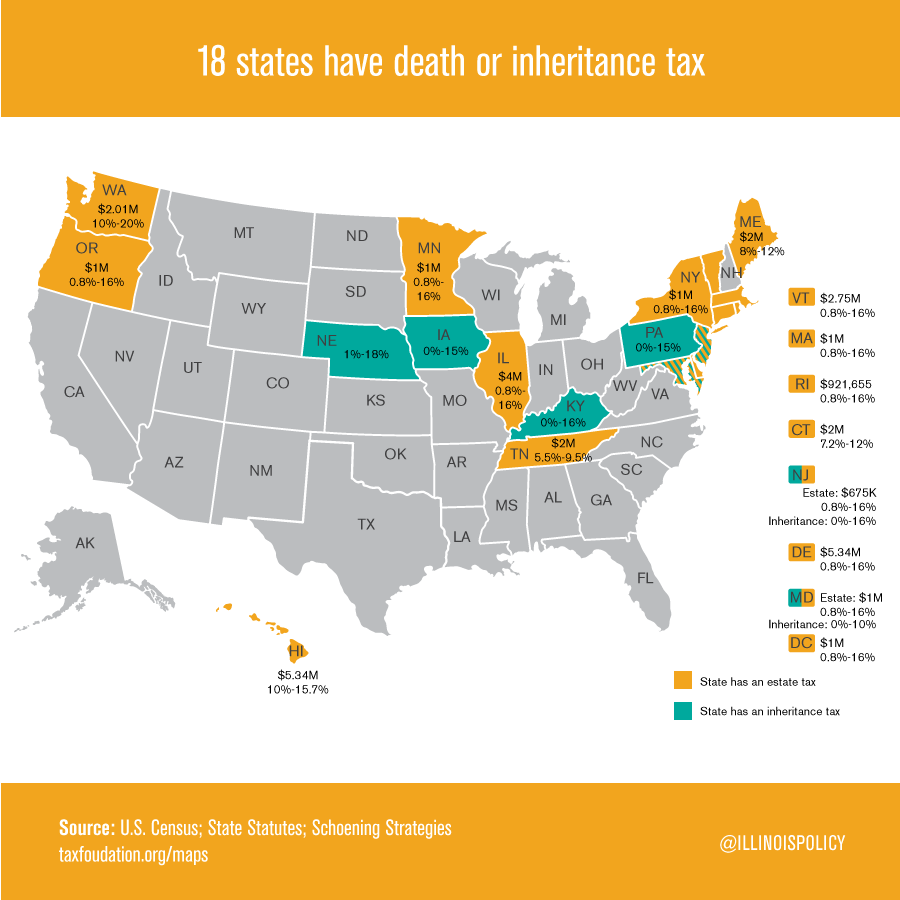

You will only have taxes owed if your whole estate is over the threshold of $4. Web the tax, often referred to as the death tax, is currently issued on net assets assessed at $4 million or higher and is subject to a tax ranging from 0.8% to 16%. It is important to note that the illinois exemption is not portable between. Web the illinois estate tax rate is on a graduated scale, and the top tax rate is 16%. Requests should be filed within 9 months of date of death. Web honest and open government. Web if you're a resident of illinois and leave behind more than $4 million (for deaths occurring in 2024), your estate might have to pay illinois estate tax.

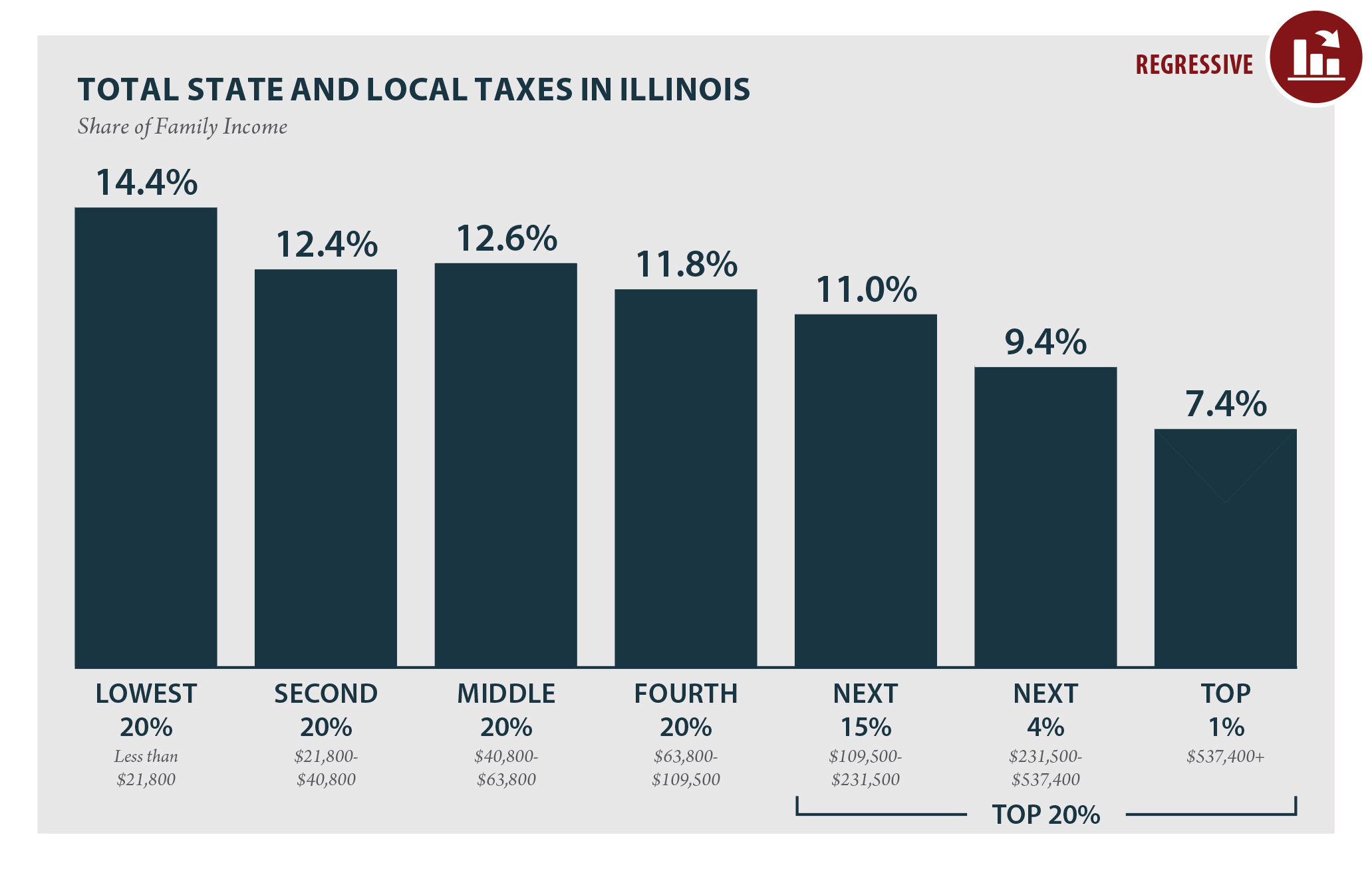

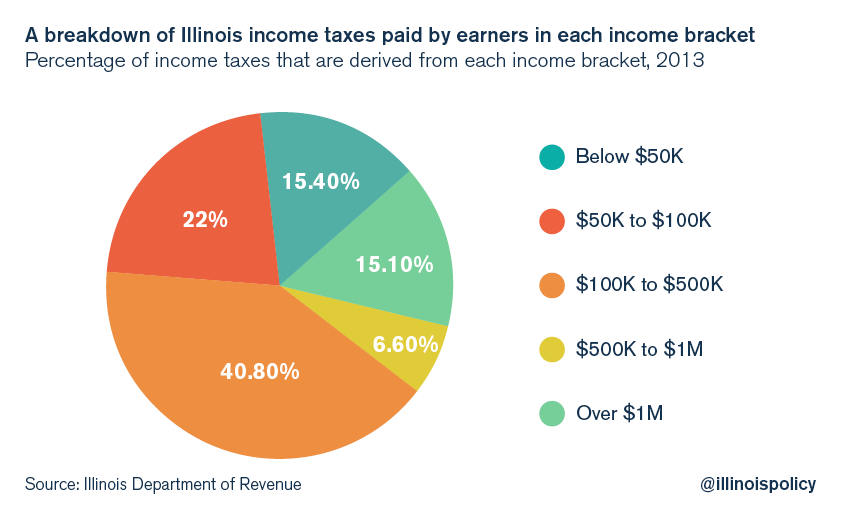

Illinois Who Pays? 6th Edition ITEP

You will only have taxes owed if your whole estate is over the threshold of $4. Adjusted taxable estate at least but less than credit: It is important to note that the illinois exemption is not portable between. Web on top of a federal inheritance tax of up to 40%, 12 states and the district.

State Tax Rates and Brackets, 2021 Tax Foundation

Web the illinois estate tax rate is on a graduated scale, and the top tax rate is 16%. Web the calculator at the illinois. Web the calculator at the illinois attorney general’s website (www.illinoisattorneygeneral.gov) may be used for this computation. To determine tax due, insert the amounts from lines 3. You will only have taxes.

State Death Tax Chart Revised October 24, 2016 Family Enterprise USA

Web on top of a federal inheritance tax of up to 40%, 12 states and the district of columbia impose their own 'death taxes.'. Web answer first, it’s important to distinguish between estate taxes, and inheritance taxes. Learn about the difference between estate and. Web for decedents dying prior to 2023, see the instruction fact.

Federal tax changes could pressure Illinois to repeal death tax

Web the calculator at the illinois attorney general’s website (www.illinoisattorneygeneral.gov) may be used for this computation. Web illinois earned income tax credit (eitc) the illinois earned income tax credit (eitc) is a benefit for working people with low to moderate income that reduces the amount of tax. They’re 2 different things but very few people.

Death Taxes Definition, Limits, Calculation, Pros & Cons, How to Avoid It

Web for married couples who have used ab trust planning to reduce their federal estate tax bill, an illinois death tax may be due on the b trust after the first spouse’s. Web answer first, it’s important to distinguish between estate taxes, and inheritance taxes. Web state death tax credit table: They're paid by the.

Illinois tax calculator with tax rates Internal Revenue Code

They're paid by the estate of the person who died before assets are distributed. Web the calculator can provide the amount of illinois estate tax due for different size estates. Web on top of a federal inheritance tax of up to 40%, 12 states and the district of columbia impose their own 'death taxes.'. The.

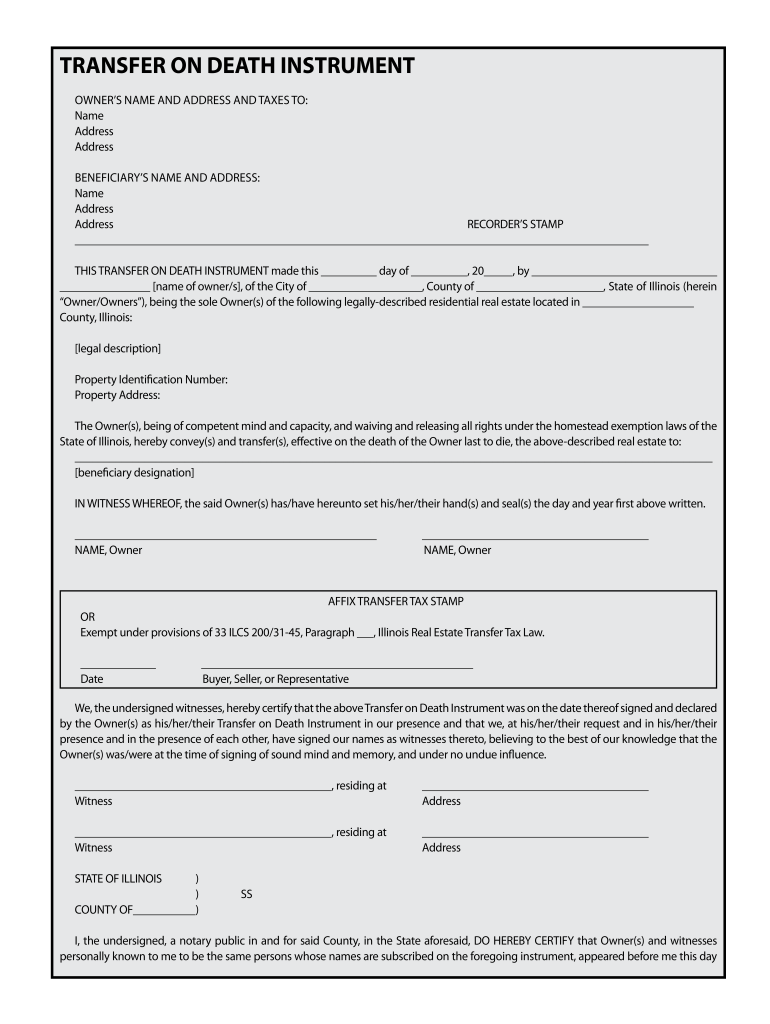

Transfer On Death Deed Illinois Form 20202022 Fill and Sign

Web for married couples who have used ab trust planning to reduce their federal estate tax bill, an illinois death tax may be due on the b trust after the first spouse’s. Web the calculator at the illinois attorney general’s website (www.illinoisattorneygeneral.gov) may be used for this computation. Web honest and open government. To determine.

Illinois lawmaker introduces bill to kill death tax

Web on top of a federal inheritance tax of up to 40%, 12 states and the district of columbia impose their own 'death taxes.'. Web learn how to calculate illinois estate tax based on the state's death tax credit, which is based on a federal law that has since been phased out. Web answer first,.

Free Illinois Transfer on Death Deed PDF Word eForms

Web to easily calculate your tax, illinois provides an online estate tax calculator. Requests should be filed within 9 months of date of death. Web illinois earned income tax credit (eitc) the illinois earned income tax credit (eitc) is a benefit for working people with low to moderate income that reduces the amount of tax..

Federal tax changes could pressure Illinois to repeal death tax

An illinois resident who dies with property located in illinois may be subject to income tax, the federal estate and gift tax, and the illinois estate tax. Web for married couples who have used ab trust planning to reduce their federal estate tax bill, an illinois death tax may be due on the b trust.

Illinois Death Tax Calculator Web any estate worth more than $4 million in 2023 could end up responsible for illinois estate taxes. An illinois resident who dies with property located in illinois may be subject to income tax, the federal estate and gift tax, and the illinois estate tax. Find out who gets taxed, how. Illinois is among them, and there is a. Web learn how to calculate illinois estate tax based on the state's death tax credit, which is based on a federal law that has since been phased out.

Web Find Out How Much You'll Pay In Illinois State Income Taxes Given Your Annual Income.

It is important to note that the illinois exemption is not portable between. Web estate tax is a tax on your right to transfer property at your death, the irs says. Adjusted taxable estate at least but less than credit: The tax rate will depend on how much the estate exceeds the.

Web Honest And Open Government.

To determine tax due, insert the amounts from lines 3. They’re 2 different things but very few people have to worry about. To determine tax due, insert the amounts from lines 3. An illinois resident who dies with property located in illinois may be subject to income tax, the federal estate and gift tax, and the illinois estate tax.

Web To Easily Calculate Your Tax, Illinois Provides An Online Estate Tax Calculator.

They're paid by the estate of the person who died before assets are distributed. Web answer first, it’s important to distinguish between estate taxes, and inheritance taxes. Web the calculator at the illinois. Web the tax, often referred to as the death tax, is currently issued on net assets assessed at $4 million or higher and is subject to a tax ranging from 0.8% to 16%.

You Will Only Have Taxes Owed If Your Whole Estate Is Over The Threshold Of $4.

Customize using your filing status, deductions, exemptions and more. Web learn how to calculate illinois estate tax based on the state's death tax credit, which is based on a federal law that has since been phased out. Web illinois earned income tax credit (eitc) the illinois earned income tax credit (eitc) is a benefit for working people with low to moderate income that reduces the amount of tax. Web the calculator at the illinois attorney general’s website (www.illinoisattorneygeneral.gov) may be used for this computation.