Illinois Inheritance Tax Calculator

Illinois Inheritance Tax Calculator - The estate tax exemption varies by state and is subject to legislative changes. To easily calculate your tax, illinois provides an. Web an inheritance tax is imposed by federal and state authorities (where applicable) on someone who actually receives an inheritance, after the asset has been. The calculator at the illinois attorney general’s website. Web the illinois estate tax will be determined using an interrelated calculation for 2023 decedents.

Web the illinois estate tax rate is on a graduated scale, and the top tax rate is 16%. Adjusted taxable estate at least but less than credit Web the illinois estate tax will be determined using an interrelated calculation for 2023 decedents. Customize using your filing status, deductions, exemptions and more. Web an illinois resident who dies with property located in illinois may be subject to income tax, the federal estate and gift tax, and the illinois estate tax. Web state death tax credit table: Web one of the key aspects of selling an inherited property is understanding the tax implications involved.

IL UI3/40 2012 Fill and Sign Printable Template Online US Legal Forms

Plan for what's nextinheritance checklisttrustee guidelinesa dedicated advisor File with confidenceexpense estimatoreasy and accurateaudit support guarantee Web if you leave behind more than $4 million, your estate might owe illinois estate tax. Web for estates over $4 million, the tax rate is graduated with the upper level ($10.04 million and up) at 16 percent. Adjusted.

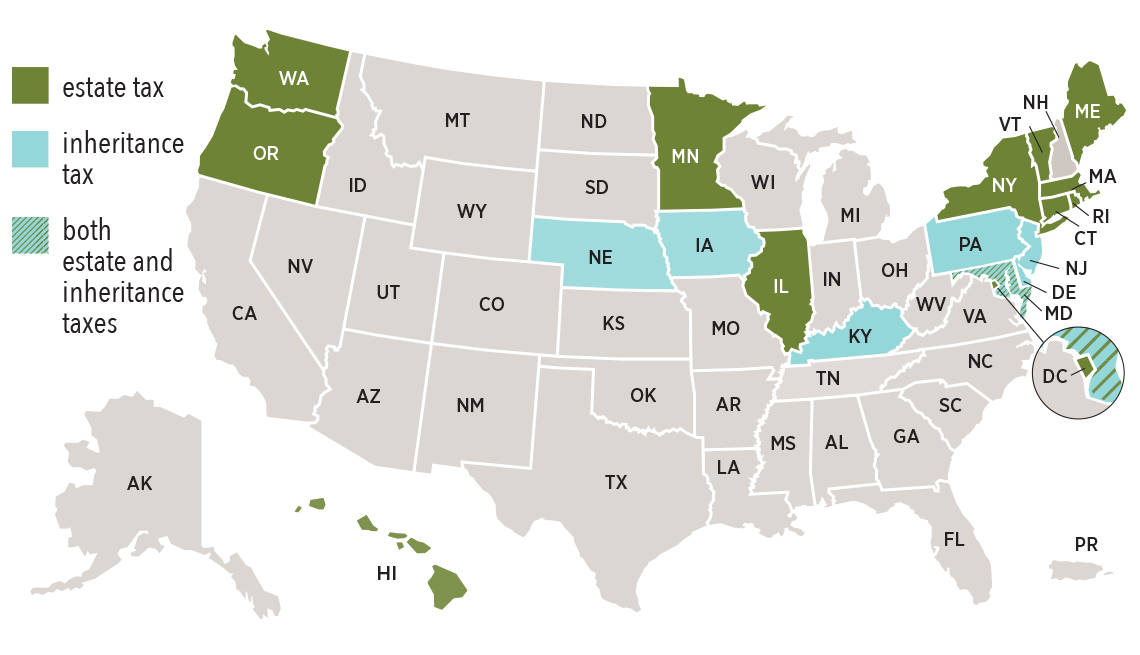

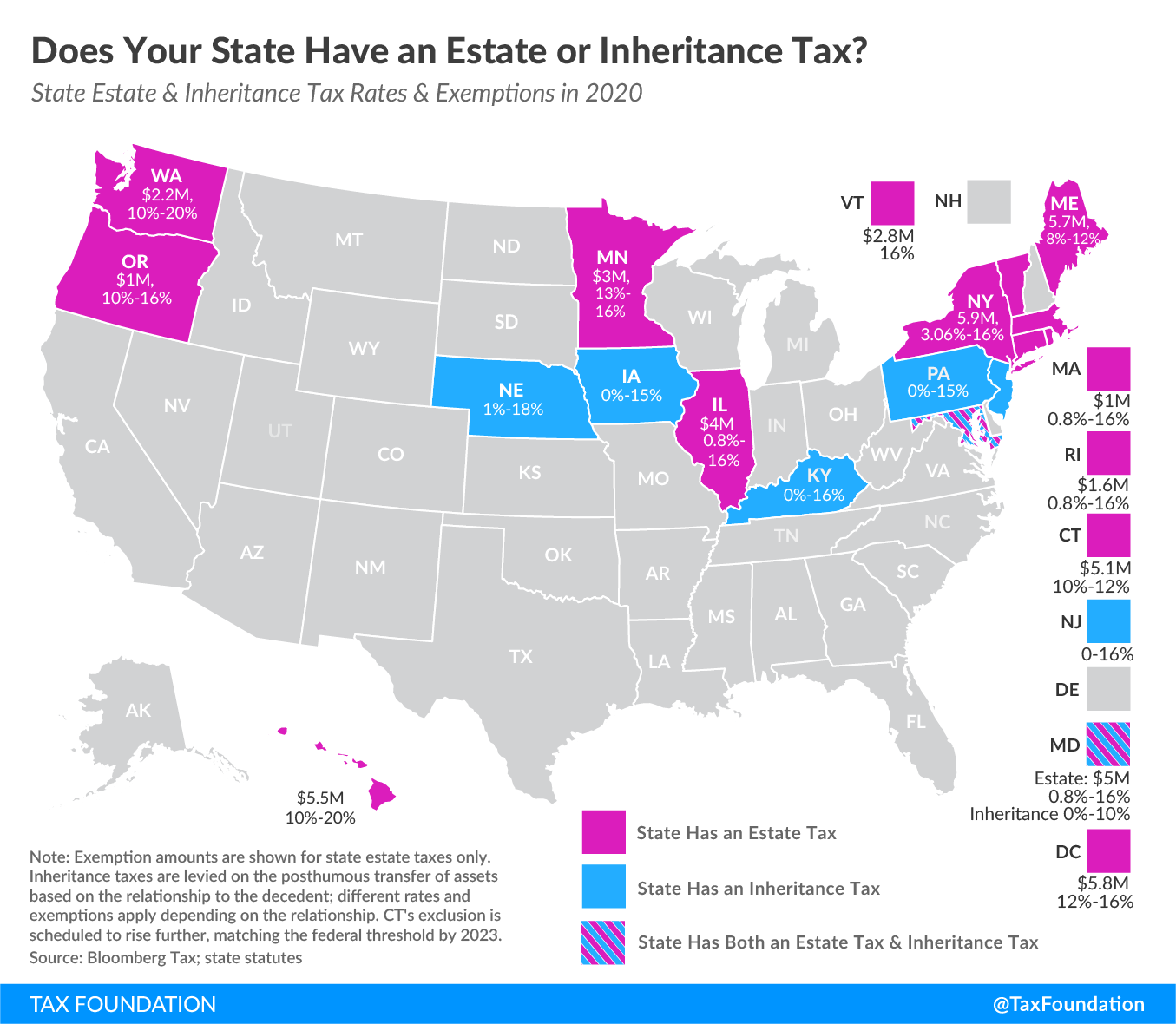

Understanding Estate & Inheritance Taxes in Illinois and Missouri

Plan for what's nextinheritance checklisttrustee guidelinesa dedicated advisor If you're a resident of illinois and leave behind more than $4 million (for. Web the illinois estate tax rate is on a graduated scale, and the top tax rate is 16%. Web use our illinois inheritance tax calculator to estimate inheritance tax on an estate. Web.

17 States With Estate Taxes or Inheritance Taxes

If you're a resident of illinois and leave behind more than $4 million (for. Web state death tax credit table: Web generally, there will be an estate tax exemption, where estates under a certain set amount will not be subject to a tax. To easily calculate your tax, illinois provides an. You will only have.

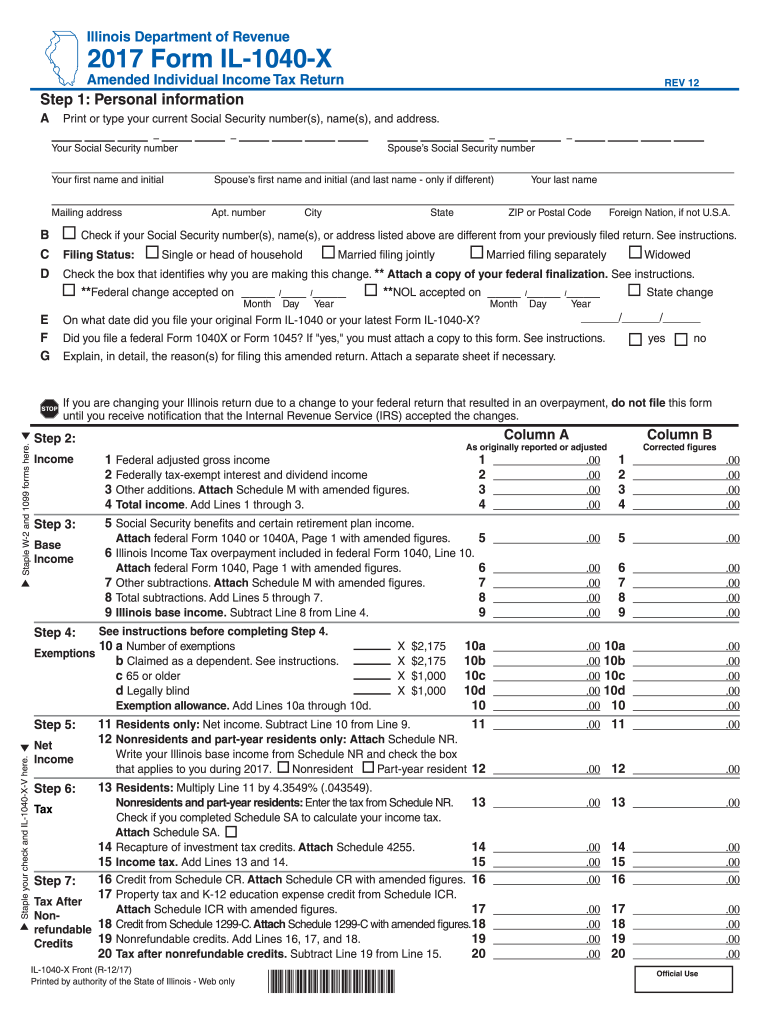

Il 1040 instructions Fill out & sign online DocHub

If you're a resident of illinois and leave behind more than $4 million (for. Web use our illinois inheritance tax calculator to estimate inheritance tax on an estate. To easily calculate your tax, illinois provides an. The estate tax exemption varies by state and is subject to legislative changes. Plan for what's nextinheritance checklisttrustee guidelinesa.

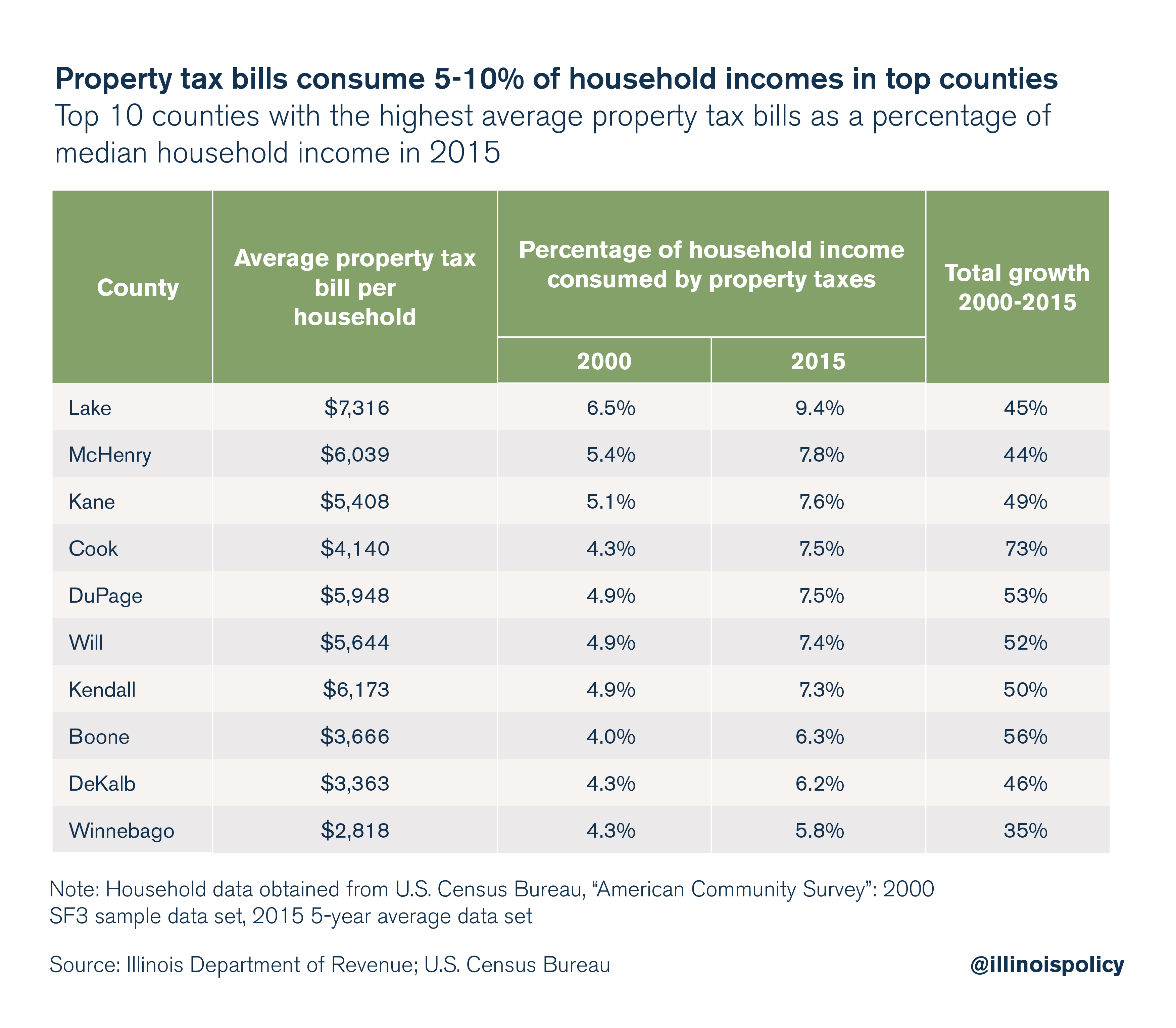

Property taxes grow faster than Illinoisans’ ability to pay for them

The calculator at the illinois attorney general’s website. Web the following chart shows the marginal illinois estate tax rate, in increments of $250,000, for estates between $4 million and $11.5 million: Web the illinois estate tax rate is on a graduated scale, and the top tax rate is 16%. If you're a resident of illinois.

17 States that Charge Estate or Inheritance Taxes Alhambra Investments

Web an inheritance tax is imposed by federal and state authorities (where applicable) on someone who actually receives an inheritance, after the asset has been. Web the illinois estate tax rate is on a graduated scale, and the top tax rate is 16%. Web find out how much you'll pay in illinois state income taxes.

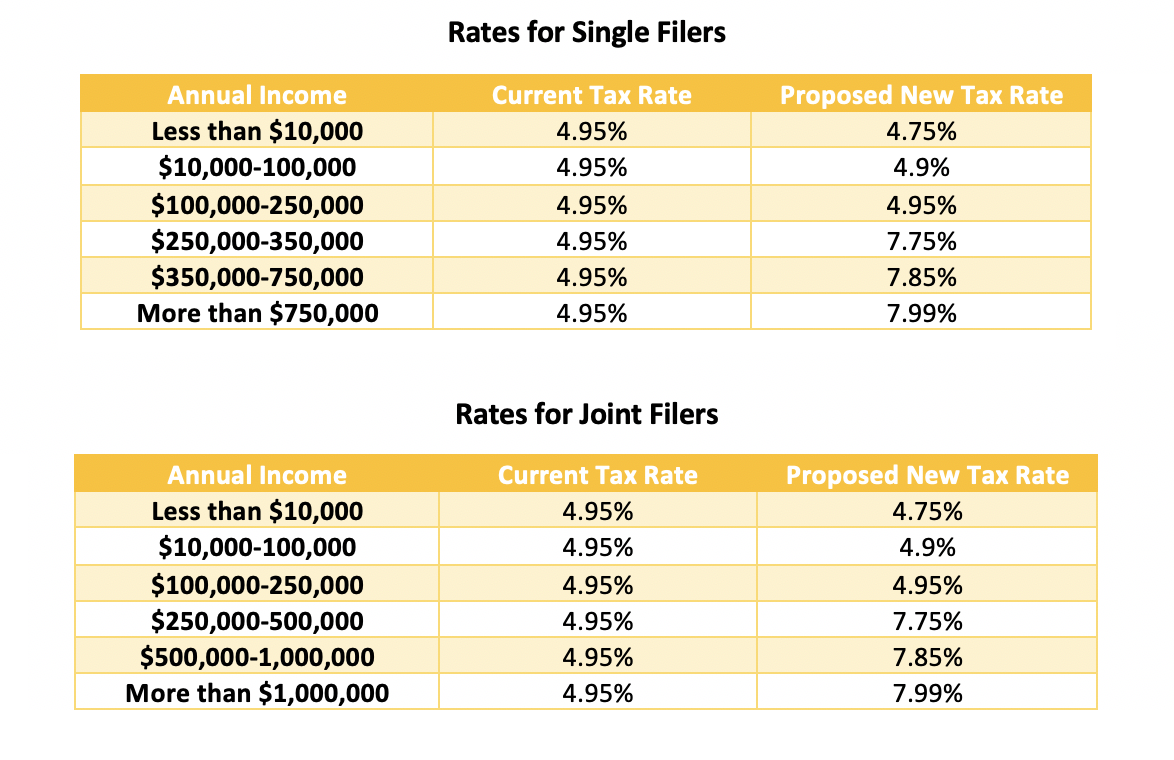

Cut Taxes, Raise Revenue Can Illinois' Tax Plan Work for Colorado?

In 2020, the federal estate tax. Web use our illinois inheritance tax calculator to estimate inheritance tax on an estate. Web the illinois estate tax will be determined using an interrelated calculation for 2023 decedents. You will only have taxes owed if your whole estate is over the threshold of $4. Adjusted taxable estate at.

Illinois Estate Tax Tables

Customize using your filing status, deductions, exemptions and more. File with confidenceexpense estimatoreasy and accurateaudit support guarantee But the calculated tax rate when going from $4 million to $5. Web use our illinois inheritance tax calculator to estimate inheritance tax on an estate. Web if you leave behind more than $4 million, your estate might.

State Tax Rates and Brackets, 2021 Tax Foundation

Web when the math is done, if your estate is valued at about $5 million, this creates an effective tax rate of close to 29%. Input the estate value and beneficiary relationships to get an instant estimate of your. To easily calculate your tax, illinois provides an. Adjusted taxable estate at least but less than.

Is Inheritance Taxable in Illinois? Learn About Law YouTube

Web an illinois resident who dies with property located in illinois may be subject to income tax, the federal estate and gift tax, and the illinois estate tax. Web one of the key aspects of selling an inherited property is understanding the tax implications involved. But the calculated tax rate when going from $4 million.

Illinois Inheritance Tax Calculator The calculator at the illinois attorney general’s website. File with confidenceexpense estimatoreasy and accurateaudit support guarantee In illinois, you will need to consider two main taxes: Web an illinois resident who dies with property located in illinois may be subject to income tax, the federal estate and gift tax, and the illinois estate tax. Web use our illinois inheritance tax calculator to estimate inheritance tax on an estate.

Web The Illinois Estate Tax Will Be Determined Using An Interrelated Calculation For 2021 Decedents.

Plan for what's nextinheritance checklisttrustee guidelinesa dedicated advisor Web find out how much you'll pay in illinois state income taxes given your annual income. Input the estate value and beneficiary relationships to get an instant estimate of your. As of 2021, at the federal level the exemption is set at 11.7.

Web When The Math Is Done, If Your Estate Is Valued At About $5 Million, This Creates An Effective Tax Rate Of Close To 29%.

Web use our illinois inheritance tax calculator to estimate inheritance tax on an estate. Web generally, there will be an estate tax exemption, where estates under a certain set amount will not be subject to a tax. Web one of the key aspects of selling an inherited property is understanding the tax implications involved. Web an illinois resident who dies with property located in illinois may be subject to income tax, the federal estate and gift tax, and the illinois estate tax.

The Calculator At The Illinois Attorney General’s Website.

If you're a resident of illinois and leave behind more than $4 million (for. Web if you leave behind more than $4 million, your estate might owe illinois estate tax. The estate tax exemption varies by state and is subject to legislative changes. You will only have taxes owed if your whole estate is over the threshold of $4.

In Illinois, You Will Need To Consider Two Main Taxes:

Web free estate tax calculator to estimate federal estate tax in the u.s. Web as of 2023, illinois imposes an estate tax on estates valued at over $4 million. Web the illinois estate tax rate is on a graduated scale, and the top tax rate is 16%. Web state death tax credit table:

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)