Illinois Teacher Pension Calculator

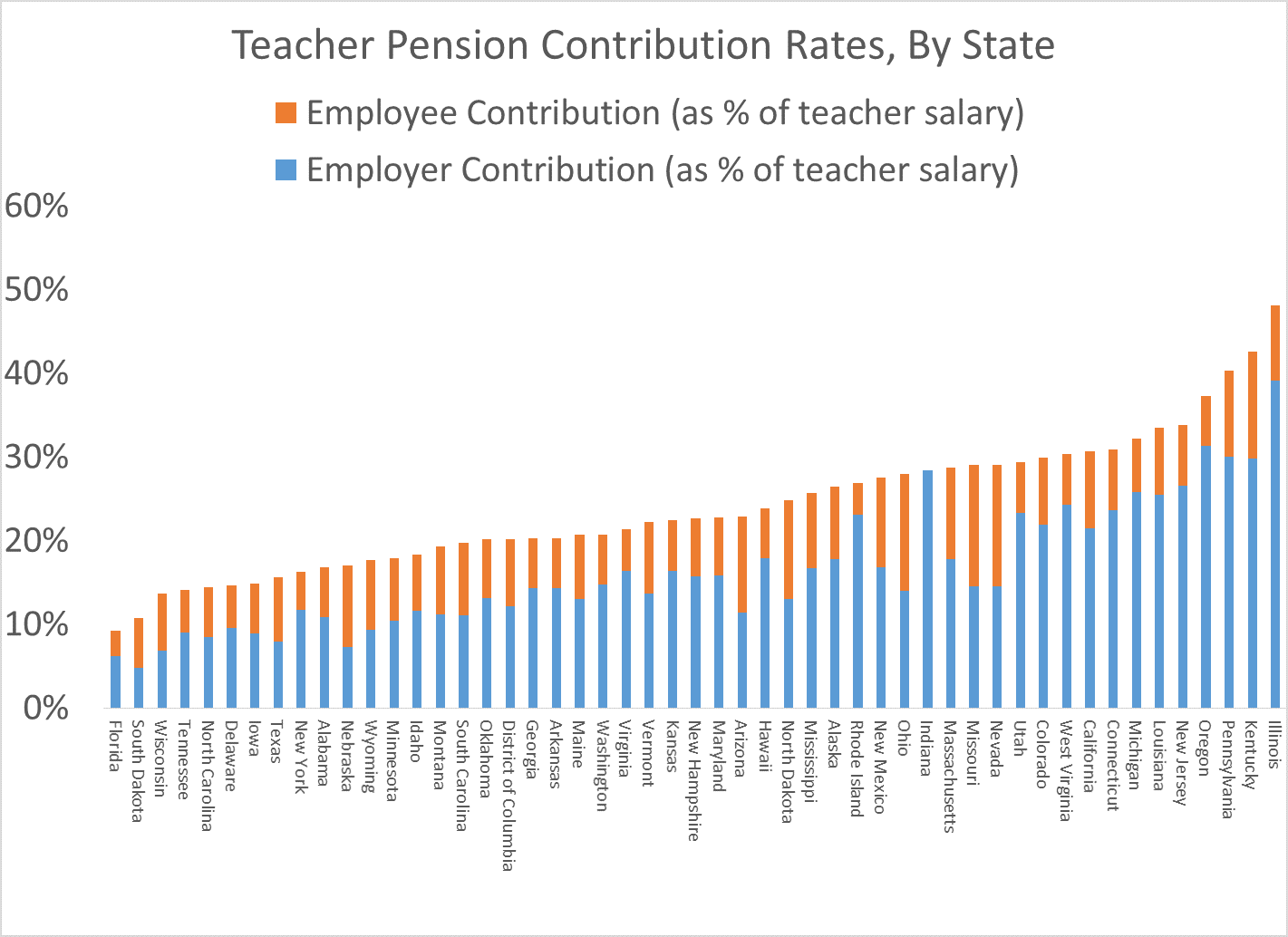

Illinois Teacher Pension Calculator - Web the data come from each state's annual comprehensive financial report. Web any age, when your age (years & whole months) plus years of service credit (years & whole months) equal 85 years (1020 months) ( rule of 85 ). Only) print an insurance premium confirmation letter. Employer contribution for member benefit increase: $38,461.54 x 0.58% = $223.08.

Request a pension income verification (retired mbrs. Tier 2 pensions on january 1, 2011, the illinois legislature established two sets of pension eligibility requirements. If any of the information entered differs. Web applying for retirement this is an exciting time for you. Web the secure session will automatically end after 20 minutes of inactivity. If you are a teacher in one. Web created by the illinois general assembly in 1939, the teachers’ retirement system of the state of illinois (trs) provides retirement, disability and death benefits for certified.

Illinois Teachers’ Retirement System looks to lower its expected

Tier 2 pensions on january 1, 2011, the illinois legislature established two sets of pension eligibility requirements. Annuity & life insuranceretirement products.annuity & life insurance.learn more today. $38,461.54 x 0.58% = $223.08. Request a pension income verification (retired mbrs. Web the secure session will automatically end after 20 minutes of inactivity. * tier 2 members.

Teachers pension calculator CiaranBlaine

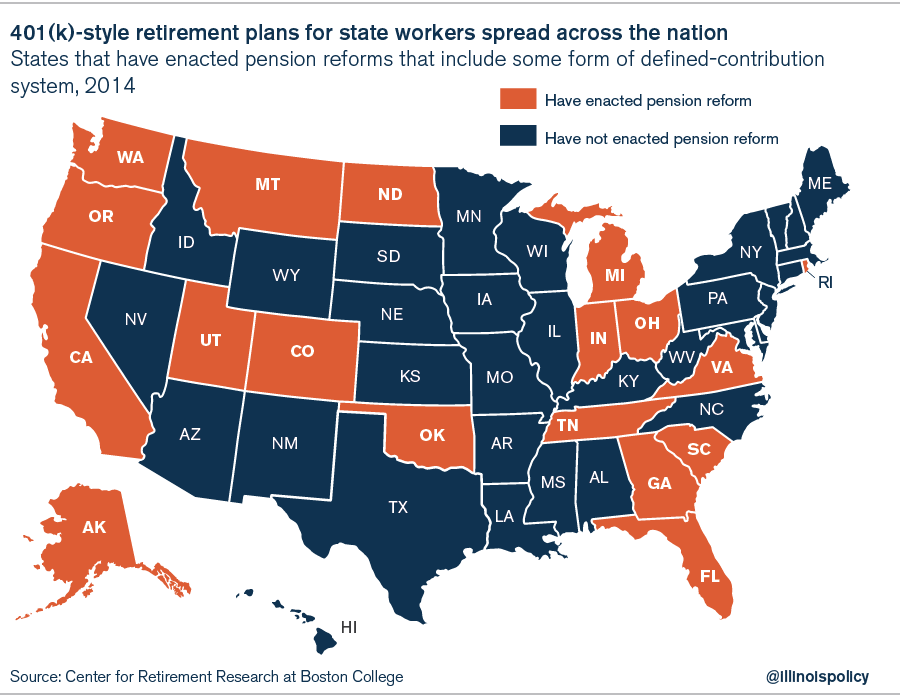

Kentucky (some school districts) louisiana ; Web the secure session will automatically end after 20 minutes of inactivity. Only) print an insurance premium confirmation letter. Employer contribution for member benefit increase: Web the data come from each state's annual comprehensive financial report. Annuity & life insuranceretirement products.annuity & life insurance.learn more today. Enter your basic.

Illinois Teachers’ Retirement System Bring More to Your Future with the

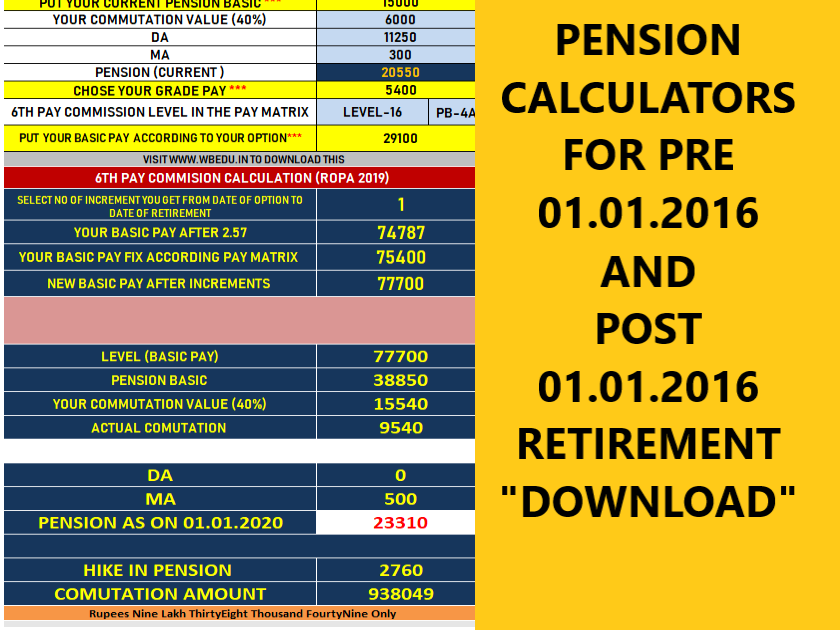

Web in general, the longer a teacher has worked and the higher her salary, the higher her pension will be. The retirement process begins with you. You have new experiences waiting. Employer contribution for member benefit increase: Web the calculator below can help you estimate your monthly ctpf pension income at retirement. Web as an.

Unpaid sick leave spikes Illinois teachers’ pension benefits Illinois

Web as an illinois teacher, you contribute 9.4% of your monthly salary to a defined benefit plan that provides lifetime retirement benefits for you and your fellow teachers. The retirement process begins with you. Only) print an insurance premium confirmation letter. * tier 2 members may retire at age 62 with at least 10 years.

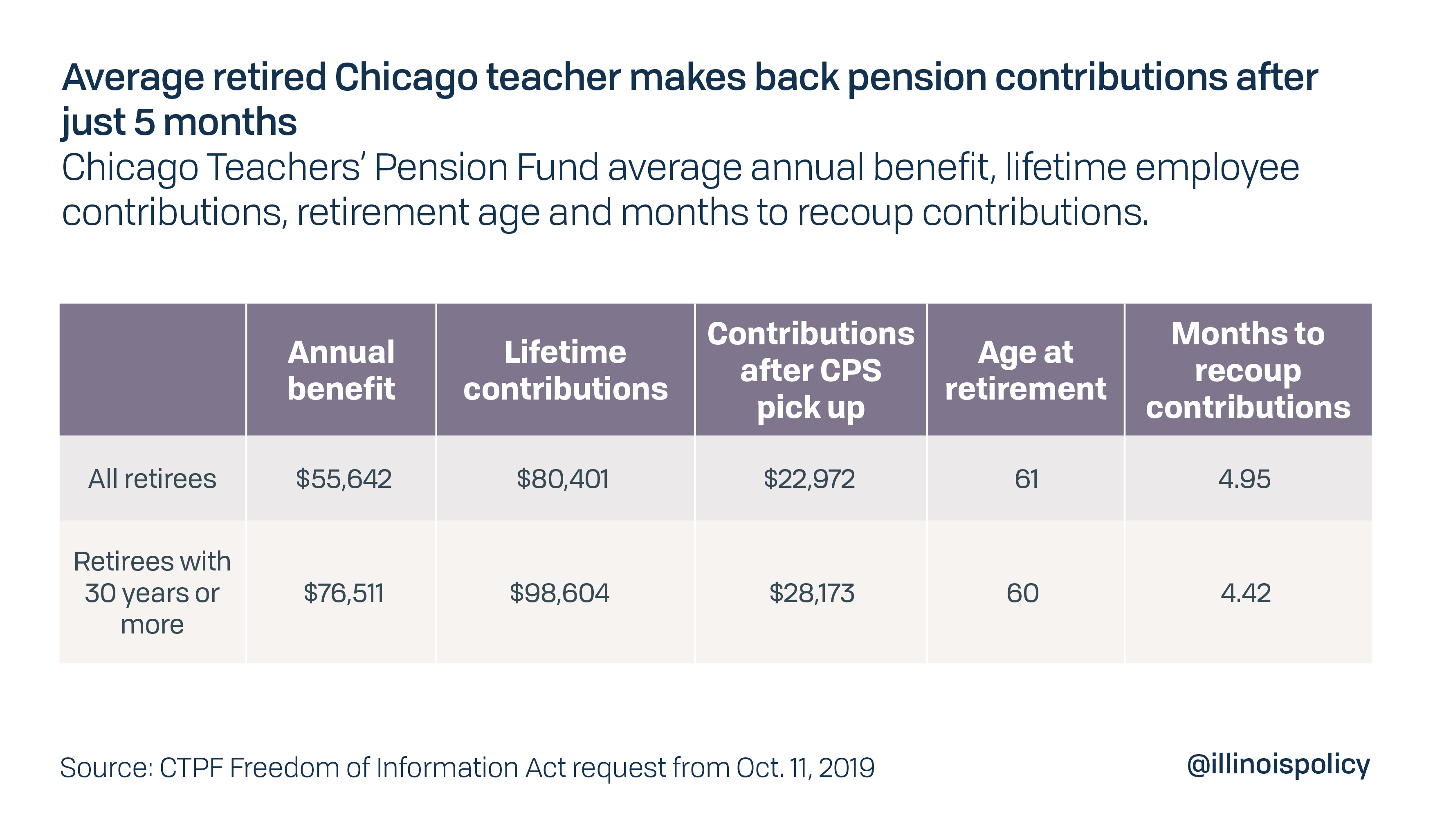

Chicago teachers recover pension contributions 5 months into retirement

Request a pension income verification (retired mbrs. Web any age, when your age (years & whole months) plus years of service credit (years & whole months) equal 85 years (1020 months) ( rule of 85 ). * tier 2 members may retire at age 62 with at least 10 years of service, but will. Only).

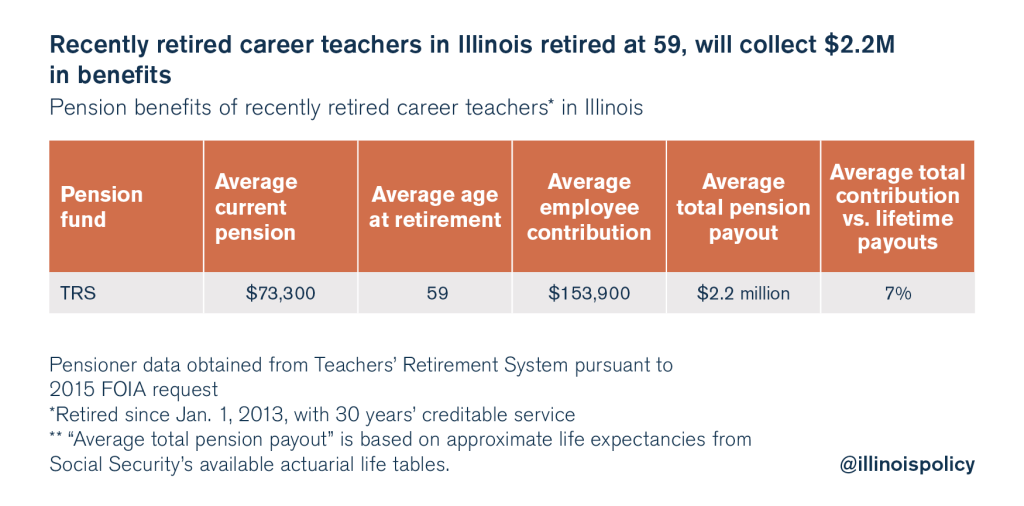

Teacher Pensions Blog

Web this calculator allows participants to calculate an unofficial estimated projection of a pension benefit based on information entered. Web in general, the longer a teacher has worked and the higher her salary, the higher her pension will be. In maryland, for example, the “average pension” for new teachers is $35,000. Request a pension income.

How Does a Teacher Pension Work? Estimate Your Benefit Educator FI

Tier 2 pensions on january 1, 2011, the illinois legislature established two sets of pension eligibility requirements. There is one more factor: Web tier 2 retirement eligibility table. Annuity & life insuranceretirement products.annuity & life insurance.learn more today. Web the secure session will automatically end after 20 minutes of inactivity. If any of the information.

Illinois' Teacher Pension Plans Deepen School Funding Inequities

Enter your basic retirement information: $38,461.54 x 9.0% = $3,461.54. Rhode island (some school districts) texas ; Members who joined ctpf or a. Only) print an insurance premium confirmation letter. * tier 2 members may retire at age 62 with at least 10 years of service, but will. Tier 2 pensions on january 1, 2011,.

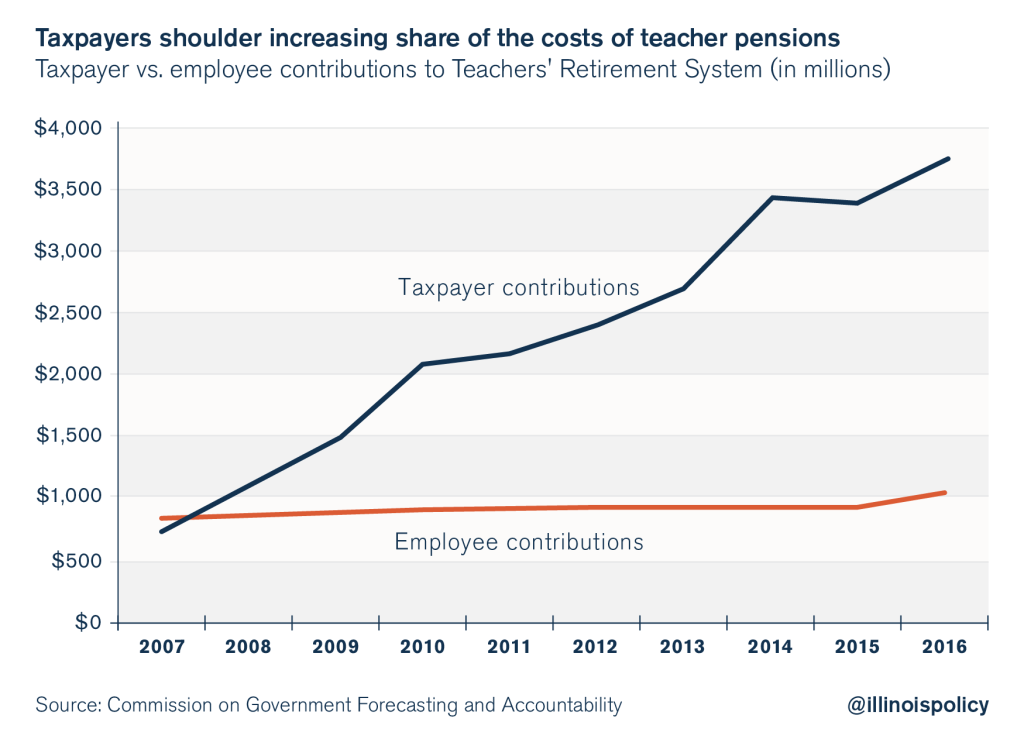

Illinois taxpayers on the hook for pension failures

In maryland, for example, the “average pension” for new teachers is $35,000. Web as an illinois teacher, you contribute 9.4% of your monthly salary to a defined benefit plan that provides lifetime retirement benefits for you and your fellow teachers. Enter your basic retirement information: $38,461.54 x 0.58% = $223.08. Web in 2018, the cap.

Teachers pension early retirement calculator Early Retirement

Members who joined ctpf or a. $38,461.54 x 0.58% = $223.08. You have new experiences waiting. $38,461.54 x 9.0% = $3,461.54. Web as an illinois teacher, you contribute 9.4% of your monthly salary to a defined benefit plan that provides lifetime retirement benefits for you and your fellow teachers. The retirement process begins with you..

Illinois Teacher Pension Calculator Web tier 1 vs. Web this calculator allows participants to calculate an unofficial estimated projection of a pension benefit based on information entered. Request a pension income verification (retired mbrs. Web in general, the longer a teacher has worked and the higher her salary, the higher her pension will be. $38,461.54 x 0.58% = $223.08.

Web In 2018, The Cap Stood At $113,645, The Average Teacher's Wage Was $71,845 And The Average Wage For Teachers At Retirement Age (65 And Up) Was $89, 994.

Web the secure session will automatically end after 20 minutes of inactivity. $38,461.54 x 0.58% = $223.08. If any of the information entered differs. Web created by the illinois general assembly in 1939, the teachers’ retirement system of the state of illinois (trs) provides retirement, disability and death benefits for certified.

Members Who Joined Ctpf Or A.

* tier 2 members may retire at age 62 with at least 10 years of service, but will. Web any age, when your age (years & whole months) plus years of service credit (years & whole months) equal 85 years (1020 months) ( rule of 85 ). Only) print an insurance premium confirmation letter. Your teaching career is almost complete.

Web This Calculator Allows Participants To Calculate An Unofficial Estimated Projection Of A Pension Benefit Based On Information Entered.

Rhode island (some school districts) texas ; Employer contribution for member benefit increase: Web the data come from each state's annual comprehensive financial report. In maryland, for example, the “average pension” for new teachers is $35,000.

Enter Your Basic Retirement Information:

You have new experiences waiting. Request a pension income verification (retired mbrs. $38,461.54 x 9.0% = $3,461.54. Web tier 1 vs.