Implied Volatility Calculator

Implied Volatility Calculator - Web implied volatility is the market's forecast of a likely movement in a security's price based on certain predictive factors. Web the implied volatility calculator produces a volatility surface for the entire option chain: Calculate showcases the expected movement of the underlying stock. Black scholes model assumes that option price can. Web by using the implied volatility calculator, you can easily calculate the implied volatility by entering the values of the spot price, strike price, interest rate, option price, expiry.

An estimate is only as good as the inputs used. Enhanced machine learninganalytics as a servicefull opra universeconstant maturities This iterative process considers factors such. Web using the calculator will show the exact volatility of the price you choose to trade at. Finpricing provide analytic tools for deriving implied volatiity from market quoted option prices. The new price of the option is $2.6. If so, you can try it out as well.

27+ Implied Volatility Calculator KhalidKalum

Calculate showcases the expected movement of the underlying stock. Therefore, it is called implied volatility. Web calculate the implied volatility of an option based on its price, strike, interest rate, dividend yield and expiration date. A matrix showing the implied volatility by strike by expiry month. If so, you can try it out as well..

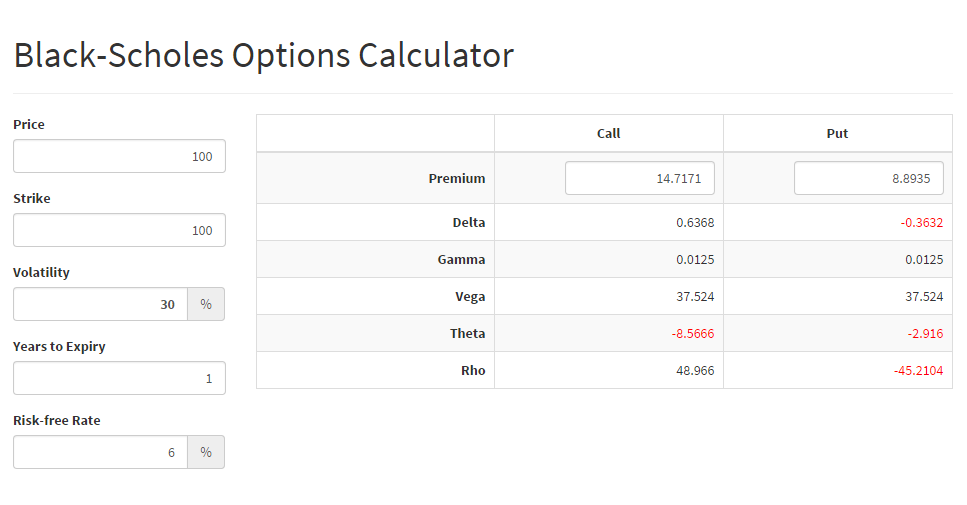

BlackScholes & Implied Volatility Options Calculator Online — Options

Web the calculation of implied volatility involves trial and error until the model's output matches the observed option price. This iterative process considers factors such. An estimate is only as good as the inputs used. Put your email below and. Web implied volatility is the market's forecast of a likely movement in a security's price.

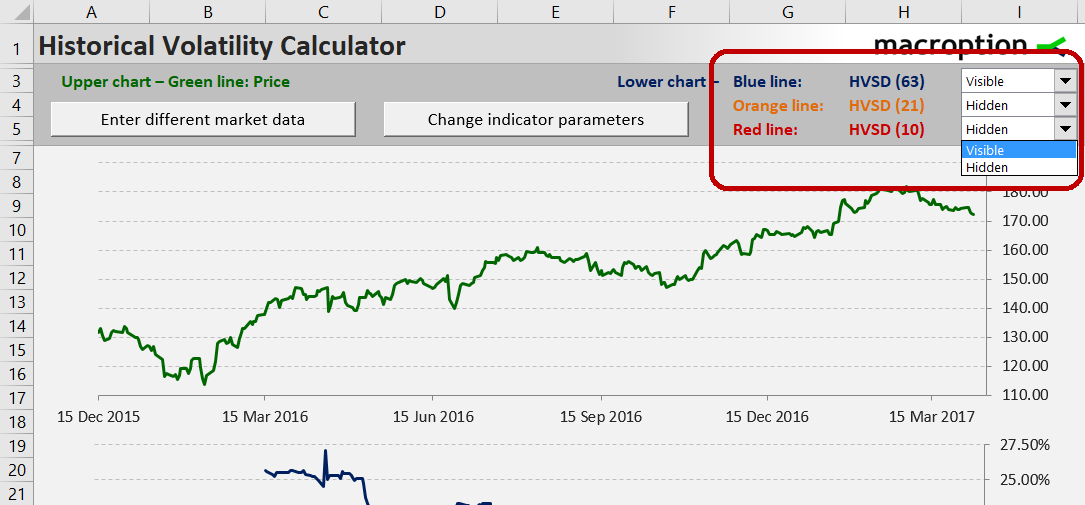

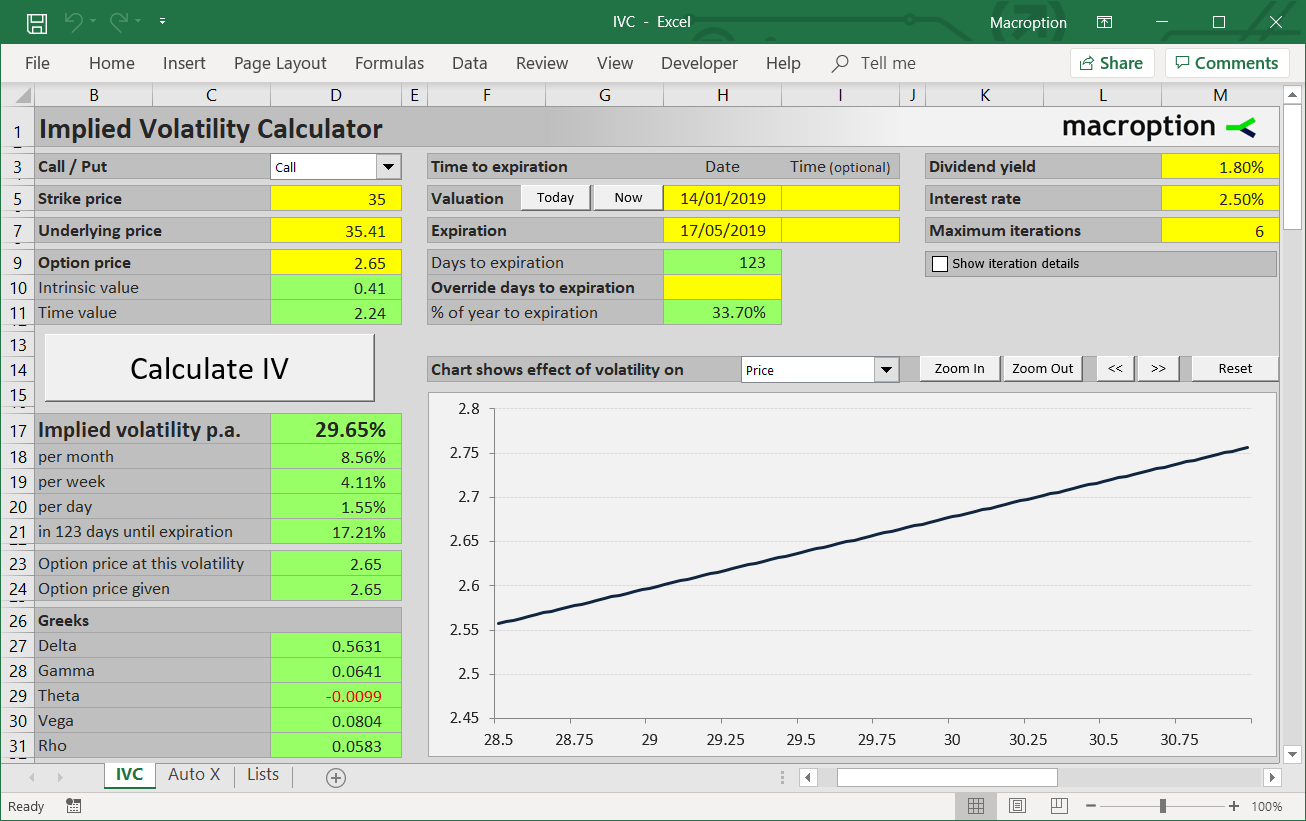

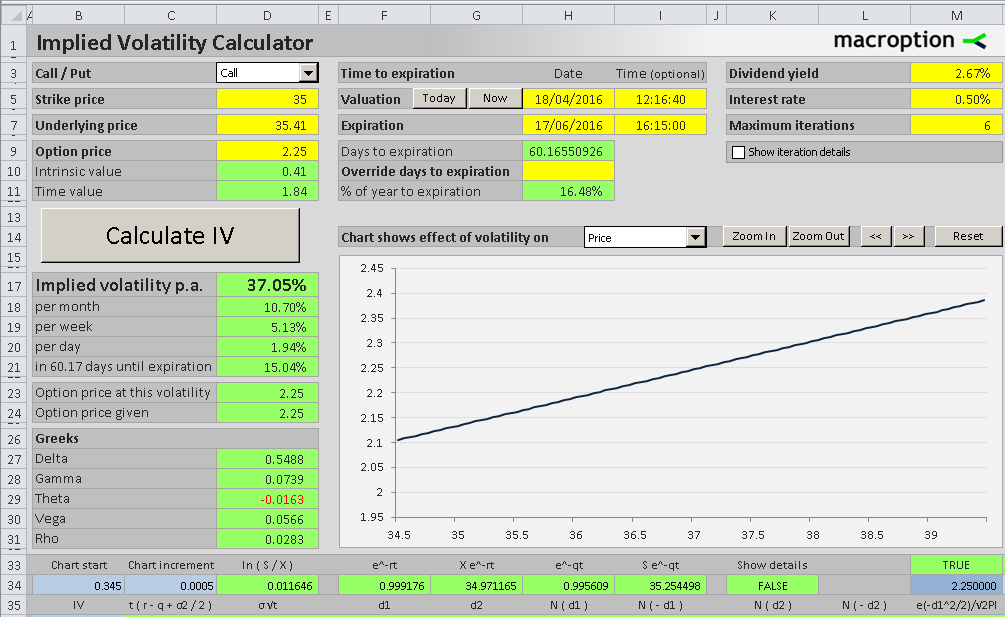

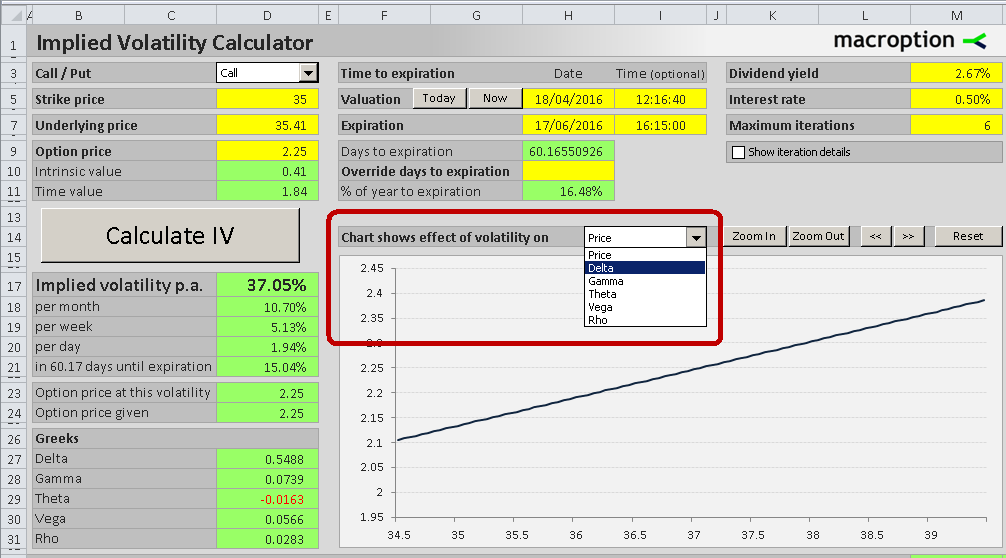

Implied Volatility Calculator Macroption

Web implied volatility is the market's forecast of a likely movement in a security's price based on certain predictive factors. Implied volatility is largely associated. Web one tool is implied volatility, a calculation that can give you insight as to how a stock’s volatility might change over time. The list is divided according to the.

Implied Volatility & Expected Range Using Confidence Levels Options

Web implied volatility is the market's forecast of a likely movement in a security's price based on certain predictive factors. Web this solution is the expected volatility implied by the option price. Calculate showcases the expected movement of the underlying stock. A matrix showing the implied volatility by strike by expiry month. Given a number.

Implied Volatility Calculator Macroption

Therefore, it is called implied volatility. Web with the options monitor, powered by ivolatility, explore quotes for stocks, etfs and indexes, while viewing a variety of key options data, including delta, implied volatility,. This iterative process considers factors such. Web implied volatility calculator option type underlying price exercise price days until expiration interest rate %.

Implied Volatility Calculator Macroption

Web implied volatility is a metric used by investors to estimate a security’s price fluctuation (volatility) in the future and it causes option prices to inflate or deflate as. Enhanced machine learninganalytics as a servicefull opra universeconstant maturities Web to help you plan your investing, here is a list of today’s major earnings and their.

Calculating the Implied Volatility of an Option with Excel (or Google

Use the calculator to estimate the risk of trading options and. Web implied volatility calculator option type underlying price exercise price days until expiration interest rate % dividend yield % market price implied volatility implied. Enhanced machine learninganalytics as a servicefull opra universeconstant maturities It is used to price options contracts and to. Web implied.

How To Calculate Implied Volatility In Your Spreadsheet · Market Data

Web this solution is the expected volatility implied by the option price. Web implied volatility is the market's forecast of a likely movement in a security's price based on certain predictive factors. Web to help you plan your investing, here is a list of today’s major earnings and their implied moves. A matrix showing the.

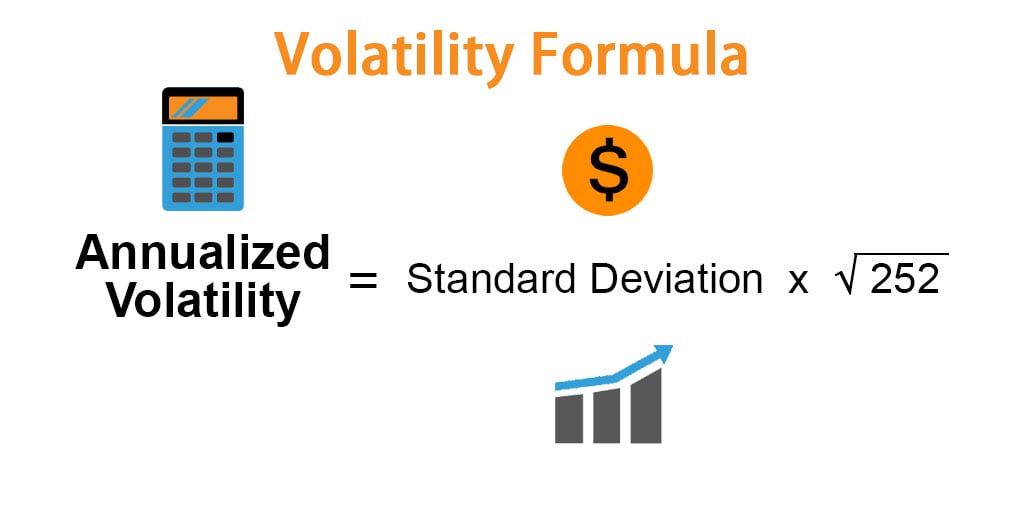

Volatility Formula Calculator (Examples With Excel Template)

A matrix showing the implied volatility by strike by expiry month. Web the implied volatility calculator produces a volatility surface for the entire option chain: Black scholes model assumes that option price can. An estimate is only as good as the inputs used. Web implied volatility is a metric used by investors to estimate a.

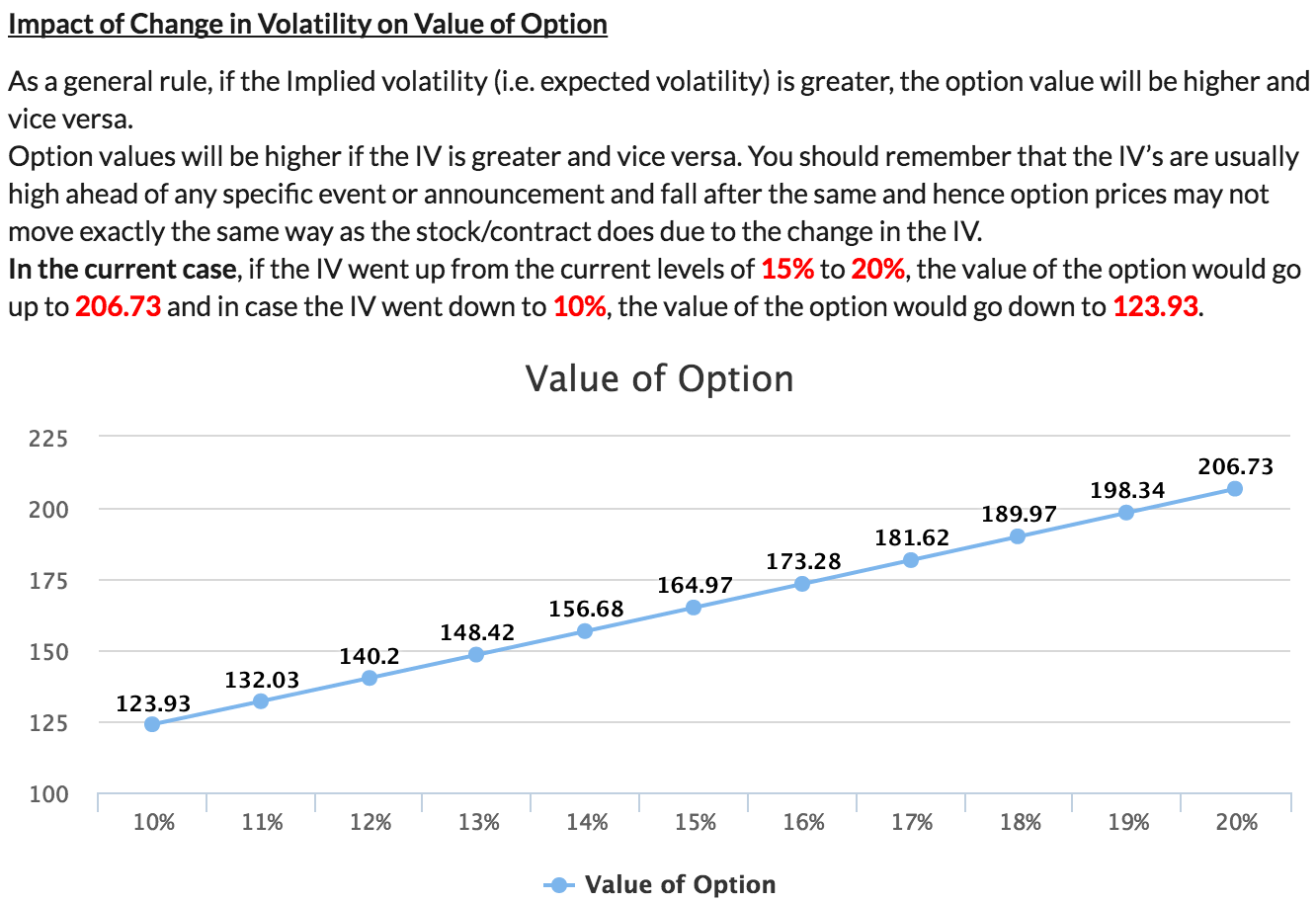

What is Implied Volatility Option Value Calculator Samco

Calculate showcases the expected movement of the underlying stock. An estimate is only as good as the inputs used. Web the calculation of implied volatility involves trial and error until the model's output matches the observed option price. One of the most important factors in determining accurate option prices. Web implied volatility calculator option type.

Implied Volatility Calculator Finpricing provide analytic tools for deriving implied volatiity from market quoted option prices. Web one tool is implied volatility, a calculation that can give you insight as to how a stock’s volatility might change over time. Web use this calculator to calculate implied volatility of an option, i.e., volatility implied by current market price of the option. One of the most important factors in determining accurate option prices. Given a number of market option quotes at different.

Web To Help You Plan Your Investing, Here Is A List Of Today’s Major Earnings And Their Implied Moves.

One of the most important factors in determining accurate option prices. Calculate showcases the expected movement of the underlying stock. Put your email below and. Black scholes model assumes that option price can.

Finpricing Provide Analytic Tools For Deriving Implied Volatiity From Market Quoted Option Prices.

A matrix showing the implied volatility by strike by expiry month. Web using the calculator will show the exact volatility of the price you choose to trade at. Web the calculation of implied volatility involves trial and error until the model's output matches the observed option price. Web implied volatility is the market's forecast of a likely movement in a security's price based on certain predictive factors.

If So, You Can Try It Out As Well.

Web this solution is the expected volatility implied by the option price. Web implied volatility is a metric used by investors to estimate a security’s price fluctuation (volatility) in the future and it causes option prices to inflate or deflate as. Implied volatility is largely associated. Enhanced machine learninganalytics as a servicefull opra universeconstant maturities

Web Calculate The Implied Volatility Of An Option Based On Its Price, Strike, Interest Rate, Dividend Yield And Expiration Date.

The new price of the option is $2.6. Therefore, it is called implied volatility. Web with the options monitor, powered by ivolatility, explore quotes for stocks, etfs and indexes, while viewing a variety of key options data, including delta, implied volatility,. An estimate is only as good as the inputs used.