Imputed Income On Life Insurance Calculator

Imputed Income On Life Insurance Calculator - You can determine the “value“ by multiplying the number of $1,000 units of insurance coverage over $50,000 (rounded to the nearest. Once the imputed income value of the life insurance more than. Fortunately for employees, the imputed income from a group term life insurance policy exceeding $50,000 is relatively straightforward to. Web take the $10,000 and divide by $1,000 which is 10 and times that by 23 cents which is $2.30 per month. Web how to calculate your life insurance imputed income.

Web take the $10,000 and divide by $1,000 which is 10 and times that by 23 cents which is $2.30 per month. Newyorklife.com has been visited by 100k+ users in the past month Amount in the space provided and click on the. Web let’s explore how to calculate imputed income in the context of a basic life insurance plan. Imputed income calculation with a basic life. Web the “value” is referred to as imputed income. Even though you do not.

Life Insurance Imputed How it Works and Benefits?

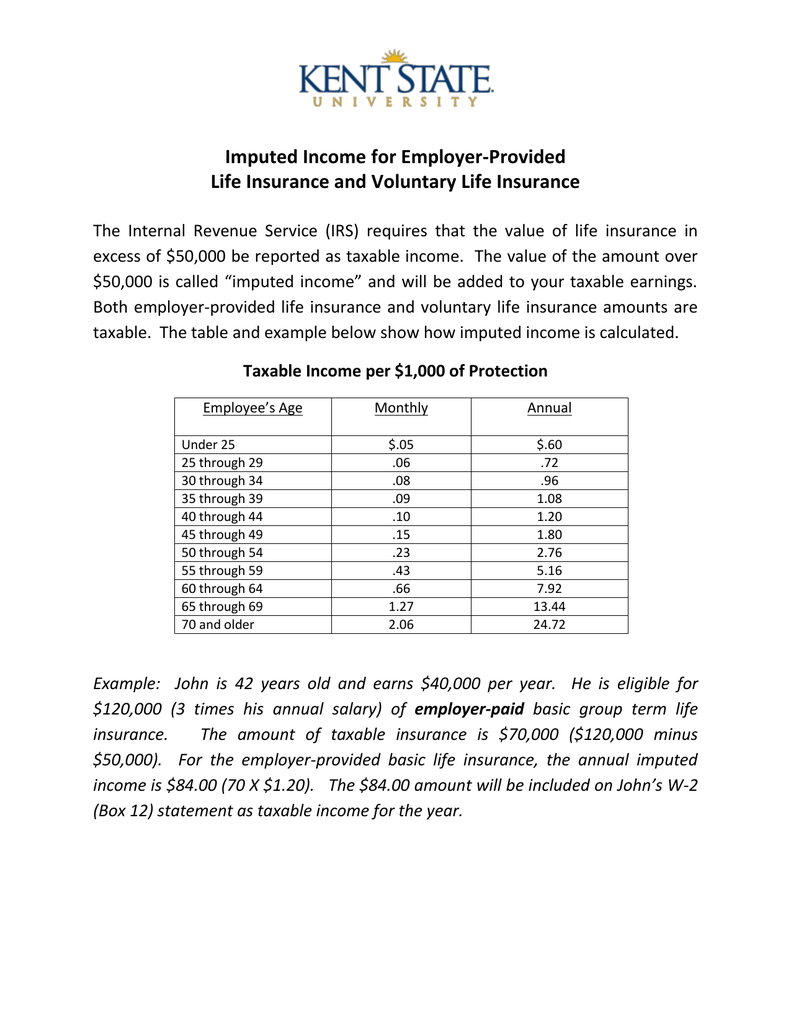

Estimate the potential taxes applied to group term life, based on your age and amount of insurance in excess of $50,000. It’s lumped in with regular income on official documents and taxed. Web your base salary = $100,000 per year value of life insurance is $250,000 ($100,000 x 2.5 = $250,000) your age = 45.

Imputed Life Insurance What You Need To Know

Web take the $10,000 and divide by $1,000 which is 10 and times that by 23 cents which is $2.30 per month. Web let’s explore how to calculate imputed income in the context of a basic life insurance plan. $5.75 x 12 months = $69 imputed income Web you might have recently read a report.

Basic Life Insurance Imputed Financial Report

Web if you’re processing payroll manually, here’s an example of how you would calculate imputed income on a pay stub: Employers are responsible for calculating their employees’ group term life imputed income and. $5.75 x 12 months = $69 imputed income It’s lumped in with regular income on official documents and taxed. Web life imputed.

What Is Imputed Payroll Definition and Examples

Retirement system death benefit format: Web the amount of income to be included will be calculated using an irs premium table or a calculator. Even though you do not. How to calculate imputed income by hand. Web how to calculate your life insurance imputed income. If your employer provides an hra that qualifies as. ($25,000.

Imputed for EmployerProvided Life Insurance and Voluntary Life

Web take the $10,000 and divide by $1,000 which is 10 and times that by 23 cents which is $2.30 per month. Web for 2022, health fsas are subject to a $2,850 limit on a salary reduction contribution. Web $50,000 / $1,000 = 50 50 * $ 0.15 = $7.50 per month calculate the total.

Group Term Life Insurance Imputed

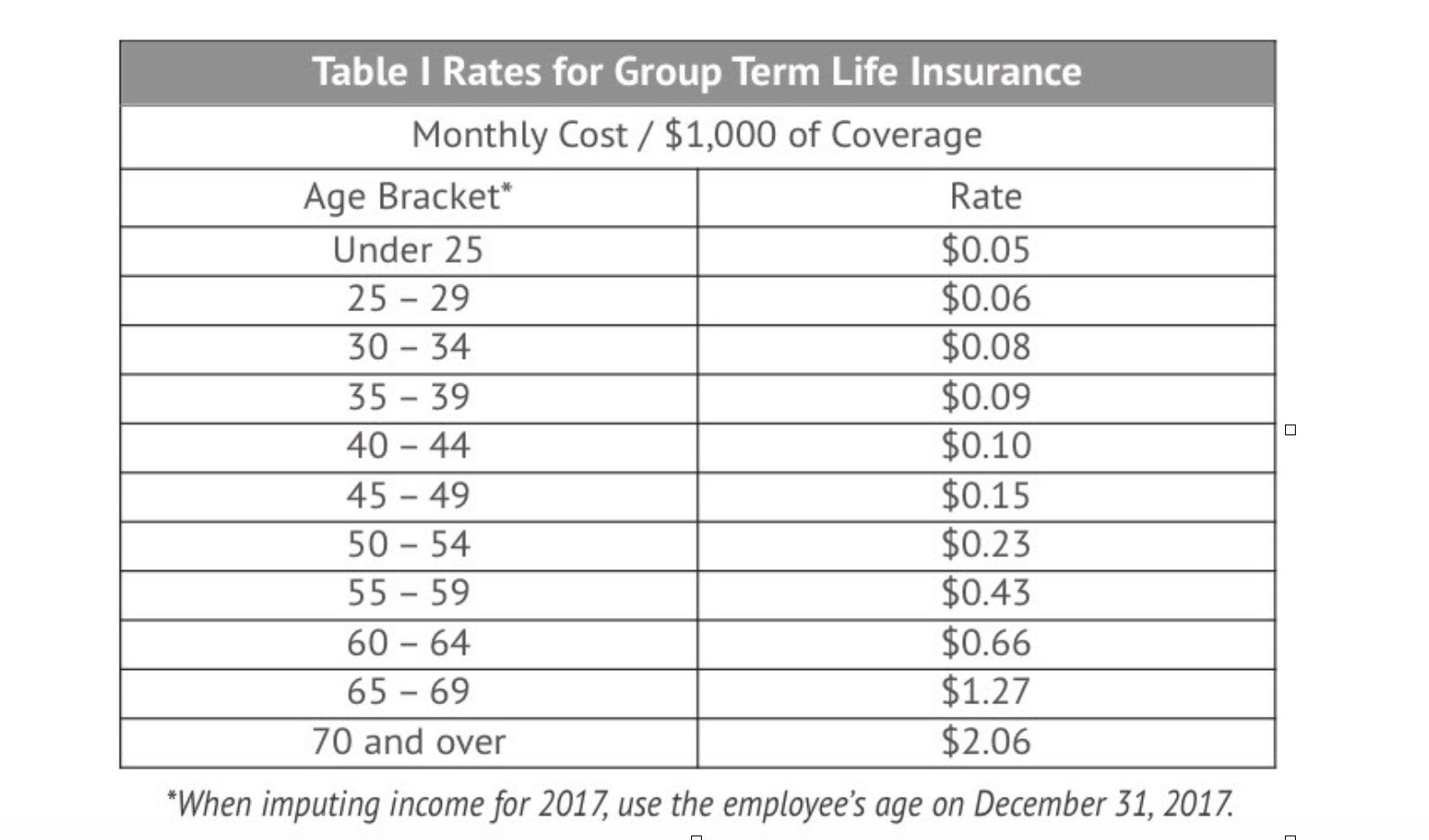

The imputed cost of coverage in excess of $50,000 must be included. If your employer provides an hra that qualifies as. Imputed income calculation with a basic life. The imputed income value is determined by your age and the irs schedule below. This is by far the hardest part in determining how much you'll need.

Automatically calculate imputed tax on life insurance in

Web get help calculating your imputed income. The imputed income value is determined by your age and the irs schedule below. This is by far the hardest part in determining how much you'll need in retirement. Fortunately for employees, the imputed income from a group term life insurance policy exceeding $50,000 is relatively straightforward to..

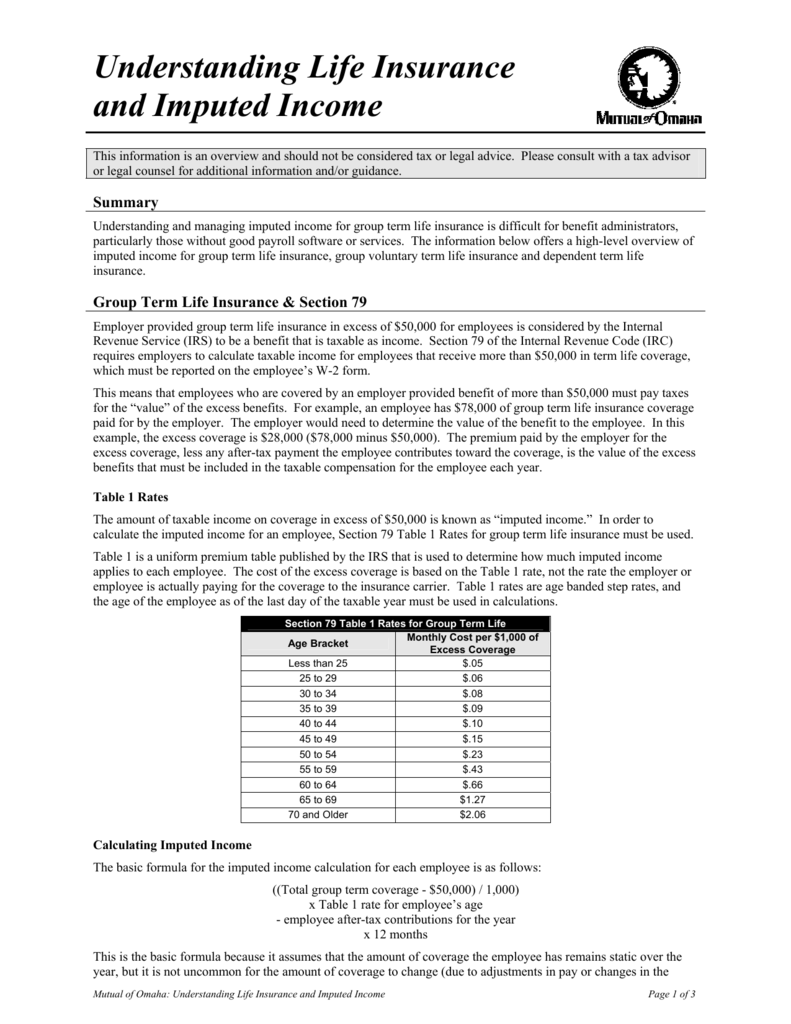

Understanding Life Insurance and Imputed

Web life imputed income calculator. Imputed income calculation with a basic life. Fortunately for employees, the imputed income from a group term life insurance policy exceeding $50,000 is relatively straightforward to. ($25,000 / $1,000) x.23 = $5.75; Web how to calculate imputed income. Once you’ve identified which fringe benefits the irs would classify as imputed.

GoLocalProv Smart Benefits Imputed for Group Term Life Insurance

Even though you do not. Employers are responsible for calculating their employees’ group term life imputed income and. Amount in the space provided and click on the. Web for 2022, health fsas are subject to a $2,850 limit on a salary reduction contribution. Web imputed income is the cash value of any fringe benefits an.

HR Fast Facts Imputed for GroupTerm Life Insurance Workest

It’s lumped in with regular income on official documents and taxed. ($25,000 / $1,000) x.23 = $5.75; Under the irs tax laws, you are required to pay income taxes on the premiums your employer pays if the value of your company life insurance is in excess of $50,000. Even though you do not. $5.75 x.

Imputed Income On Life Insurance Calculator Web the “value” is referred to as imputed income. How to calculate imputed income by hand. Employers are responsible for calculating their employees’ group term life imputed income and. Newyorklife.com has been visited by 100k+ users in the past month Once the imputed income value of the life insurance more than.

Even Though You Do Not.

Web there are no tax consequences if the total amount of such policies does not exceed $50,000. It’s lumped in with regular income on official documents and taxed. The imputed income value is determined by your age and the irs schedule below. Shannon’s weekly pay is $1,250.

Once The Imputed Income Value Of The Life Insurance More Than.

$5.75 x 12 months = $69 imputed income Under the irs tax laws, you are required to pay income taxes on the premiums your employer pays if the value of your company life insurance is in excess of $50,000. Web your base salary = $100,000 per year value of life insurance is $250,000 ($100,000 x 2.5 = $250,000) your age = 45 (see the chart below to determine the per month multiplier). Fortunately for employees, the imputed income from a group term life insurance policy exceeding $50,000 is relatively straightforward to.

The Imputed Cost Of Coverage In Excess Of $50,000 Must Be Included.

Web monthly imputed income: Web life imputed income calculator. ($25,000 / $1,000) x.23 = $5.75; Web the amount of income to be included will be calculated using an irs premium table or a calculator.

Web Life Imputed Income Calculator.

Employers are responsible for calculating their employees’ group term life imputed income and. Web $50,000 / $1,000 = 50 50 * $ 0.15 = $7.50 per month calculate the total imputed income for an employee by multiplying the monthly cost by the number of full. Educational assistance and tuition educational assistance (where companies compensate employees. Amount in the space provided and click on the.