Income Tax Calculator Puerto Rico

Income Tax Calculator Puerto Rico - Change state check date earnings gross pay gross pay method gross pay ytd pay frequency federal taxes (enter your w4 info) use 2020. On the next page, you will be able to add more details. Web visit paycheckcity.com for puerto rico hourly paycheck calculators, withholding calculators, tax calculators, payroll information, and more. We're proud to provide one of the most comprehensive free online tax calculators to our users. Web 21.7% tasa tributaria promedio 12.2% 87.8% pago neto 12.2% impuesto total ¿sabías que?

Share to facebook share to twitter share to linkedin waves of people are moving to puerto rico, including. The new w4 asks for a dollar amount. Web for tax years after 31 december 2019, an individual's total tax will be 95% of one's total tax determined (regular tax plus gradual adjustment) if gross income. Puerto rico cities and/or municipalities don't have a city sales tax. Web the annual wage calculator is updated with the latest income tax rates in puerto rico for 2024 and is a great calculator for working out your income tax and salary after tax. Web 5 rows to calculate your income tax: On the next page, you will be able to add more details.

Tax Brackets Calculator estimate your taxes

Calculate net paycheck, state and federal taxes, estimate salary in puerto rico puerto rico paycheck calculator payroll check calculator is. Enter an amount for dependents.the old w4 used to ask for the number of dependents. The individual income tax rate in puerto rico is progressive and ranges from 0% to 33% depending on your income..

Guide to Tax in Puerto Rico

Change state check date earnings gross pay gross pay method gross pay ytd pay frequency federal taxes (enter your w4 info) use 2020. Web for tax years after 31 december 2019, an individual's total tax will be 95% of one's total tax determined (regular tax plus gradual adjustment) if gross income. Web puerto rico salary.

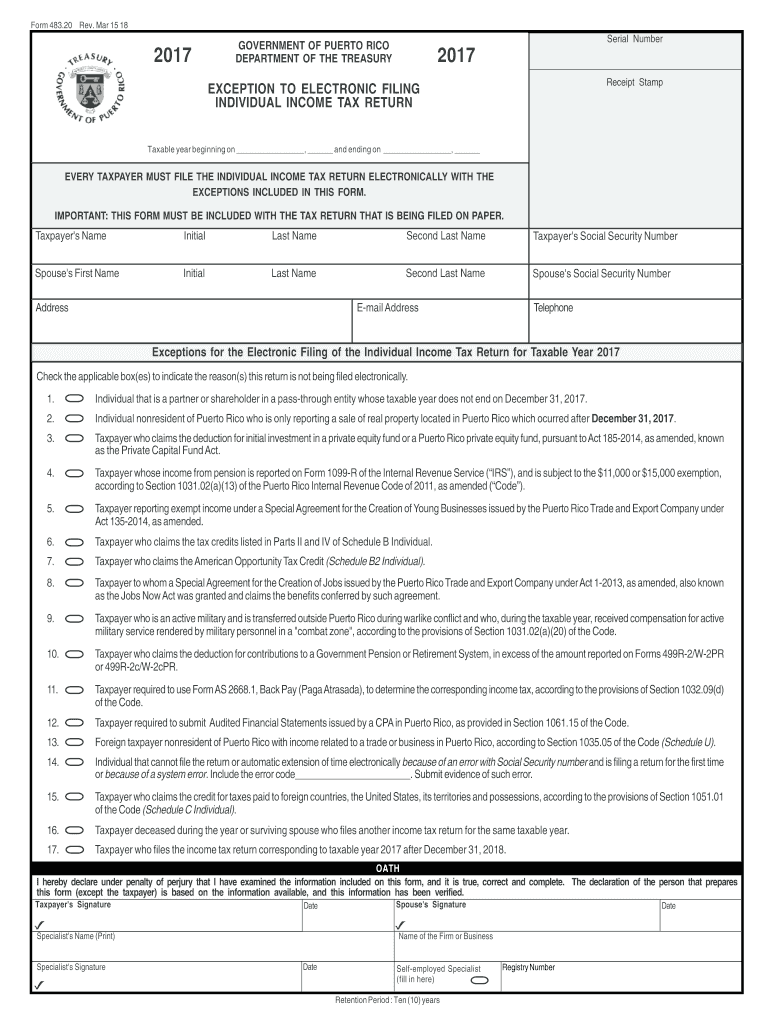

Puerto Rico Tax Return 482 in English 20172024 Form Fill Out and

Web you can use our free puerto rico income tax calculator to get a good estimate of what your tax liability will be come april. On the next page, you will be able to add more details. Web for tax years after 31 december 2019, an individual's total tax will be 95% of one's total.

Guide to Tax in Puerto Rico

Stay informedclient portaltax filingexclusive content Web visit paycheckcity.com for puerto rico hourly paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Web use this puerto rico gross pay calculator to gross up wages based on net pay. ¿cuánto ganaría por hora con un salario anual de $30,000? Every 2024 combined rates mentioned above. Change.

How to Claim Puerto Rico Tax Benefits

Web 21.7% tasa tributaria promedio 12.2% 87.8% pago neto 12.2% impuesto total ¿sabías que? Determine which income range you fall into. Web for tax years after 31 december 2019, an individual's total tax will be 95% of one's total tax determined (regular tax plus gradual adjustment) if gross income. Web 5 rows to calculate your.

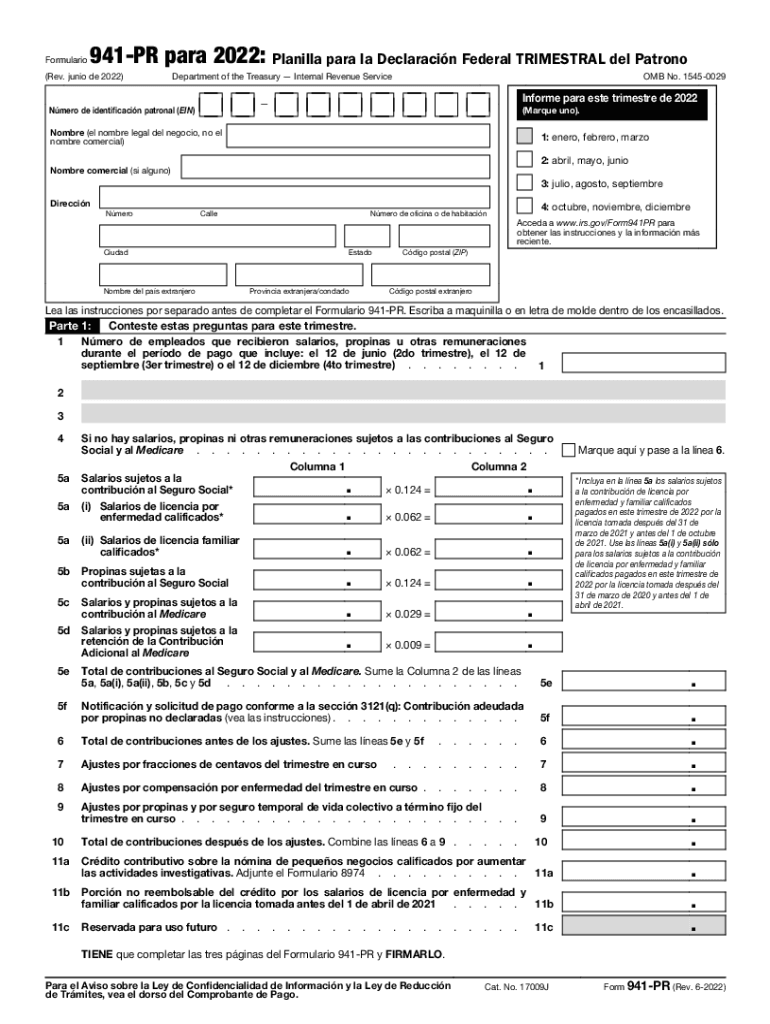

⊛ Formulario 1040 PR en Puerto Rico【2023

How many income tax brackets are there in puerto rico? ¿cuánto ganaría por hora con un salario anual de $30,000? On the next page, you will be able to add more details. Web 21.7% tasa tributaria promedio 12.2% 87.8% pago neto 12.2% impuesto total ¿sabías que? Web puerto rico payroll calculator :: Calculate net paycheck,.

941 pr 2022 Fill out & sign online DocHub

Share to facebook share to twitter share to linkedin waves of people are moving to puerto rico, including. The new w4 asks for a dollar amount. Web puerto rico 2019 income tax calculator 2023 income tax rates and thresholds 2022 income tax rates and thresholds 2021 income tax rates and thresholds 2020. Web for tax.

Top 20 puerto rico tax calculator 2022

You can use this tax. Web you can use our free puerto rico income tax calculator to get a good estimate of what your tax liability will be come april. This income tax calculator can help estimate your average income tax rate and your take home pay. Affordable pricingminimize filing errorsreduce your audit riskreal savings.

New Puerto Rico Act 20 & 22 Tax Incentive Calculator for Businesses and

This income tax calculator can help estimate your average income tax rate and your take home pay. The new w4 asks for a dollar amount. The individual income tax rate in puerto rico is progressive and ranges from 0% to 33% depending on your income. Web you can use our free puerto rico income tax.

Puerto Rico Tax Calculator Online

The income tax system in puerto rico has. Web the annual wage calculator is updated with the latest income tax rates in puerto rico for 2022 and is a great calculator for working out your income tax and salary after tax. The individual income tax rate in puerto rico is progressive and ranges from 0%.

Income Tax Calculator Puerto Rico Web puerto rico payroll calculator :: Web if you qualify for an act 60 decree, it includes a 4% income tax rate, a 75% discount on property tax, and no tax on capital gains accrued while on the island. The new w4 asks for a dollar amount. Web state & date state puerto rico. Calculate net paycheck, state and federal taxes, estimate salary in puerto rico puerto rico paycheck calculator payroll check calculator is.

Calculate Your Income Tax In Puerto Rico, Salary Deductions In Puerto Rico And Compare Salary After Tax For Income Earned In Puerto.

Web 21.7% tasa tributaria promedio 12.2% 87.8% pago neto 12.2% impuesto total ¿sabías que? Puerto rico cities and/or municipalities don't have a city sales tax. Share to facebook share to twitter share to linkedin waves of people are moving to puerto rico, including. Web if you qualify for an act 60 decree, it includes a 4% income tax rate, a 75% discount on property tax, and no tax on capital gains accrued while on the island.

Web 5 Rows To Calculate Your Income Tax:

¿cuánto ganaría por hora con un salario anual de $30,000? Web state & date state puerto rico. Web the monthly wage calculator is updated with the latest income tax rates in puerto rico for 2024 and is a great calculator for working out your income tax and salary after tax. Web puerto rico payroll calculator ::

Web For Tax Years After 31 December 2019, An Individual's Total Tax Will Be 95% Of One's Total Tax Determined (Regular Tax Plus Gradual Adjustment) If Gross Income.

Enter an amount for dependents.the old w4 used to ask for the number of dependents. How many income tax brackets are there in puerto rico? Web puerto rico 2019 income tax calculator 2023 income tax rates and thresholds 2022 income tax rates and thresholds 2021 income tax rates and thresholds 2020. Determine which income range you fall into.

Calculate Net Paycheck, State And Federal Taxes, Estimate Salary In Puerto Rico Puerto Rico Paycheck Calculator Payroll Check Calculator Is.

Here’s how to calculate it: Change state check date earnings gross pay gross pay method gross pay ytd pay frequency federal taxes (enter your w4 info) use 2020. The new w4 asks for a dollar amount. Stay informedclient portaltax filingexclusive content