Inflation Adjusted Retirement Calculator

Inflation Adjusted Retirement Calculator - Retirement period in months = 240 months. Investment results initial investment ( pv) $66,973.58 future value ( fv) actual ending account balance $124,920.34 target return fv adjusted for inflation. Filing status and federal income tax rates on taxable income for 2023 *. Let’s assume that a retiree requires $50,000 for the first year of. Web the inflation calculator below can help you calculate future values based on an assumption of the annual inflation rate.

To convert the purchasing power of the u.s. Web the inflation calculator utilizes historical consumer price index (cpi) data from the u.s. The year after that, $5,306. What is the rule of 25? Web with 2% inflation, the next year you would spend $5,100 per month. Even with just a 2% annual price increase,. Retirement period in months = 240 months.

Inflation adjusted retirement calculator KristianMakin

Web planning for inflation helps maintain the same living standard over retirement years. Let’s assume that a retiree requires $50,000 for the first year of. The historic spike in inflation could be reversed gradually, but it. This is especially helpful for retirement planning. Web inflation and retirement income calculator whether you’re retired or just starting.

Retirement Calculator How It Works YouTube

Web with 2% inflation, the next year you would spend $5,100 per month. This simple retirement calculator helps to estimate retirement income. Web inflation is an economic phenomenon that refers to a general increase in the prices of goods and services over time. Web for example, if your current income is $50,000 per year and.

Retirement Calculator With Inflation Check How Much You Need To Save

5=interest rate (compounded annually) 3.5=inflation rate; Answer 6 simple questions to get your score. Web this calculator figures the amount of retirement savings you need in order to withdraw a specified amount each discover the comprehensive wealth planning process proven. The year after that, $5,202. Web inflation is an economic phenomenon that refers to a.

How To Calculate Inflation Rate For Retirement Planning Haiper

The year after that, $5,306. This is especially helpful for retirement planning. Balancing risk and returndedicated teamsexpertise at your sideclient centric Web for example, if your current income is $50,000 per year and you assume a 4.0% inflation figure, in 30 years you would need the equivalent of $162,170 to maintain the same. Web inflation.

Inflation Calculator

Web with 2% inflation, the next year you would spend $5,100 per month. All numbers are adjusted for inflation using today's dollars. Web inflation is an economic phenomenon that refers to a general increase in the prices of goods and services over time. Filing status and federal income tax rates on taxable income for 2023.

FREE 11+ Sample Inflation Calculator Templates in MS Word PDF

Investment results initial investment ( pv) $66,973.58 future value ( fv) actual ending account balance $124,920.34 target return fv adjusted for inflation. Web the inflation calculator below can help you calculate future values based on an assumption of the annual inflation rate. Web for example, if your current income is $50,000 per year and you.

Part 2 The Inflation Adjusted Retirement Calculator elmads

It is a crucial indicator of the economy's health and is. Web the inflation calculator utilizes historical consumer price index (cpi) data from the u.s. Web with 2% inflation, the next year you would spend $5,100 per month. 5=interest rate (compounded annually) 3.5=inflation rate; The historic spike in inflation could be reversed gradually, but it..

How To Calculate Inflation For Retirement? Retire Gen Z

Let’s assume that a retiree requires $50,000 for the first year of. 5=interest rate (compounded annually) 3.5=inflation rate; What is the rule of 25? Web for example, if your current income is $50,000 per year and you assume a 4.0% inflation figure, in 30 years you would need the equivalent of $162,170 to maintain the.

How To Calculate Inflation For Retirement? Retire Gen Z

Web the inflation calculator below can help you calculate future values based on an assumption of the annual inflation rate. The year after that, $5,306. Web planning for inflation helps maintain the same living standard over retirement years. 2,702,947.50 or 2702947.5=amount saved at time of retirement; Answer 6 simple questions to get your score. Filing.

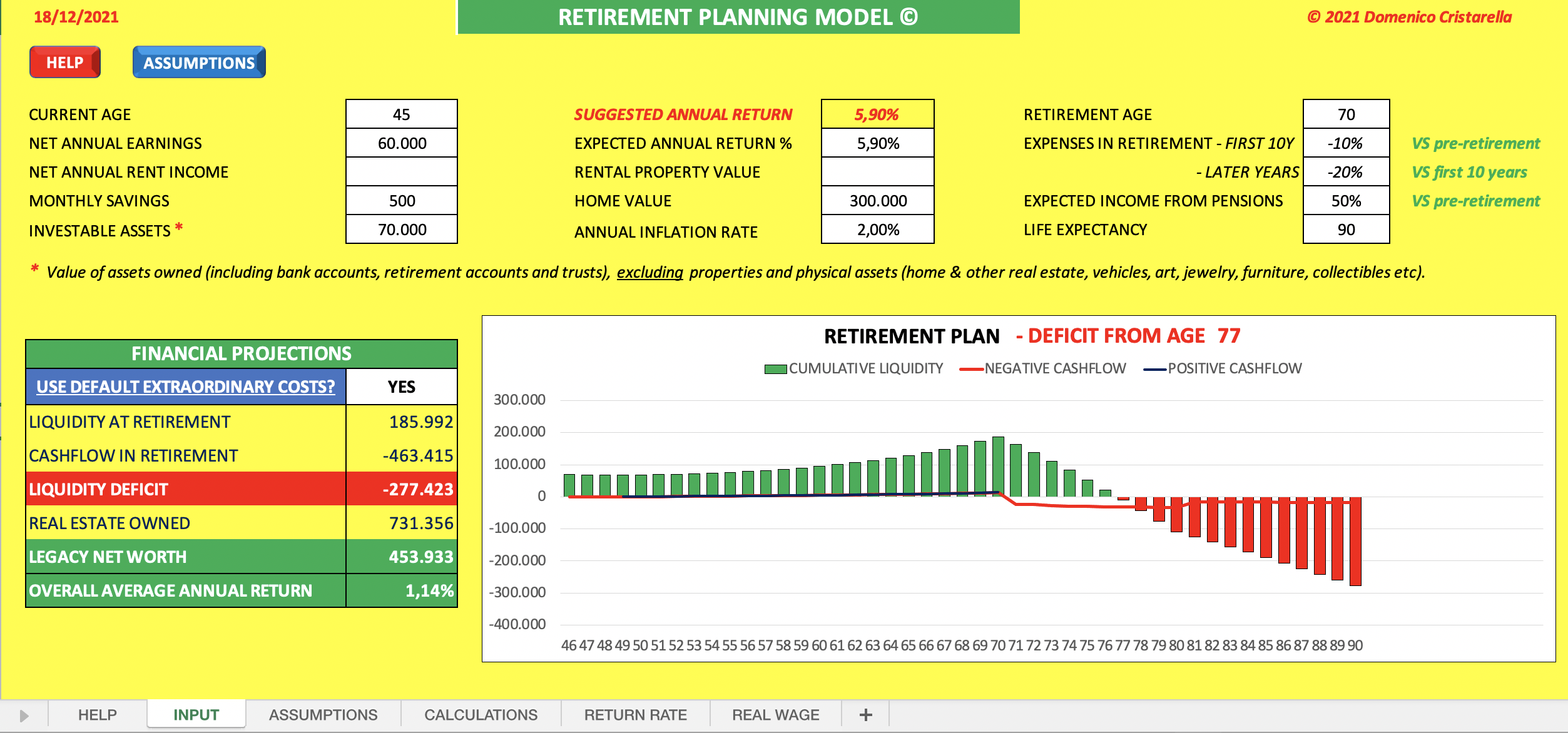

EXCEL of Retirement Calculator for HR.xlsx WPS Free Templates

All numbers are adjusted for inflation using today's dollars. Taxes are not taken into account. Even with just a 2% annual price increase,. Let’s assume that a retiree requires $50,000 for the first year of. The year after that, $5,306. Web the inflation calculator below can help you calculate future values based on an assumption.

Inflation Adjusted Retirement Calculator The year after that, $5,306. Investment results initial investment ( pv) $66,973.58 future value ( fv) actual ending account balance $124,920.34 target return fv adjusted for inflation. Let’s assume that a retiree requires $50,000 for the first year of. Retirement period in months = 240 months. To convert the purchasing power of the u.s.

Let’s Assume That A Retiree Requires $50,000 For The First Year Of.

Even with just a 2% annual price increase,. Web inflation is an economic phenomenon that refers to a general increase in the prices of goods and services over time. Web planning for inflation helps maintain the same living standard over retirement years. This is especially helpful for retirement planning.

Taxes Are Not Taken Into Account.

Investment results initial investment ( pv) $66,973.58 future value ( fv) actual ending account balance $124,920.34 target return fv adjusted for inflation. All numbers are adjusted for inflation using today's dollars. Balancing risk and returndedicated teamsexpertise at your sideclient centric With an approximate budget and your safe withdrawal rate, you have everything you need to determine the exact amount you'll.

Web For Example, If Your Current Income Is $50,000 Per Year And You Assume A 4.0% Inflation Figure, In 30 Years You Would Need The Equivalent Of $162,170 To Maintain The Same.

(20 years *12) pmt = inflation adjusted. Web the inflation calculator below can help you calculate future values based on an assumption of the annual inflation rate. Web getty rising inflation has spooked the stock market and investors throughout the u.s. 2,702,947.50 or 2702947.5=amount saved at time of retirement;

Web The Inflation Calculator Utilizes Historical Consumer Price Index (Cpi) Data From The U.s.

What is the rule of 25? The historic spike in inflation could be reversed gradually, but it. To convert the purchasing power of the u.s. The year after that, $5,306.