Intrinsic Value Of Stock Calculator

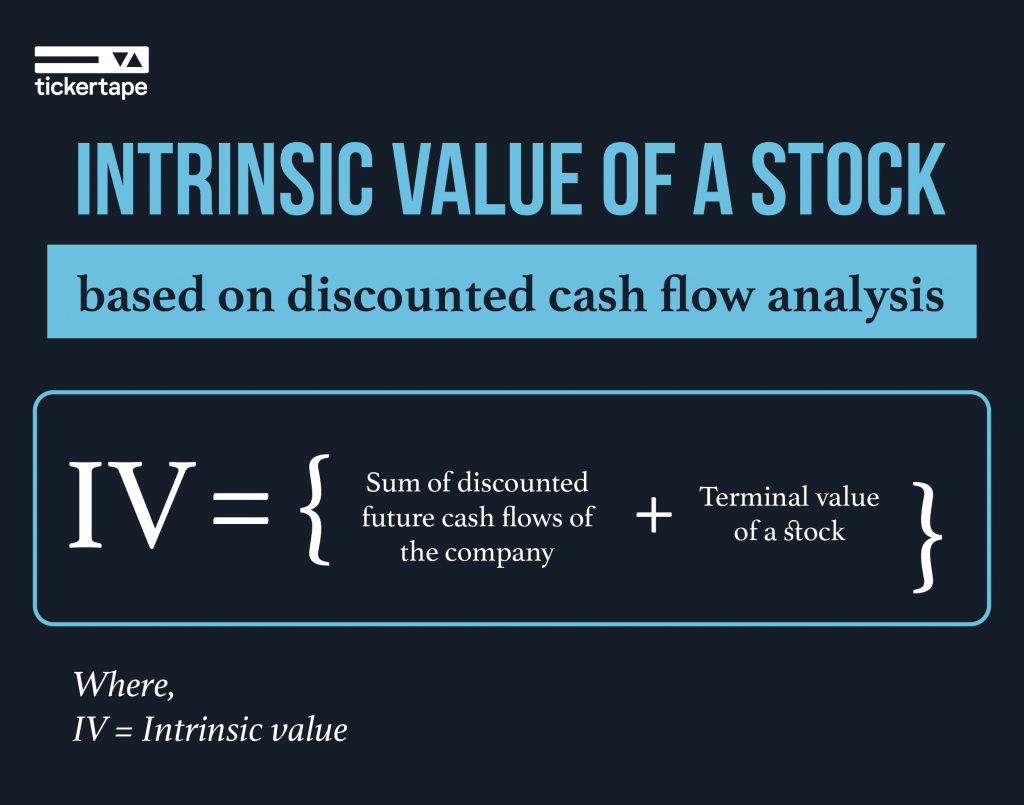

Intrinsic Value Of Stock Calculator - Web present value of terminal value (pvtv)= tv / (1 + r) 10 = us$52b÷ ( 1 + 6.6%) 10 = us$27b. Web we provide accurate intrinsic value for global stocks using dcf and wacc so that you can easily find the most undervalued/overvalued stocks. Fvx = net cash flow (inflow or. Web how is intrinsic value calculated? Web use the formula to calculate intrinsic value.

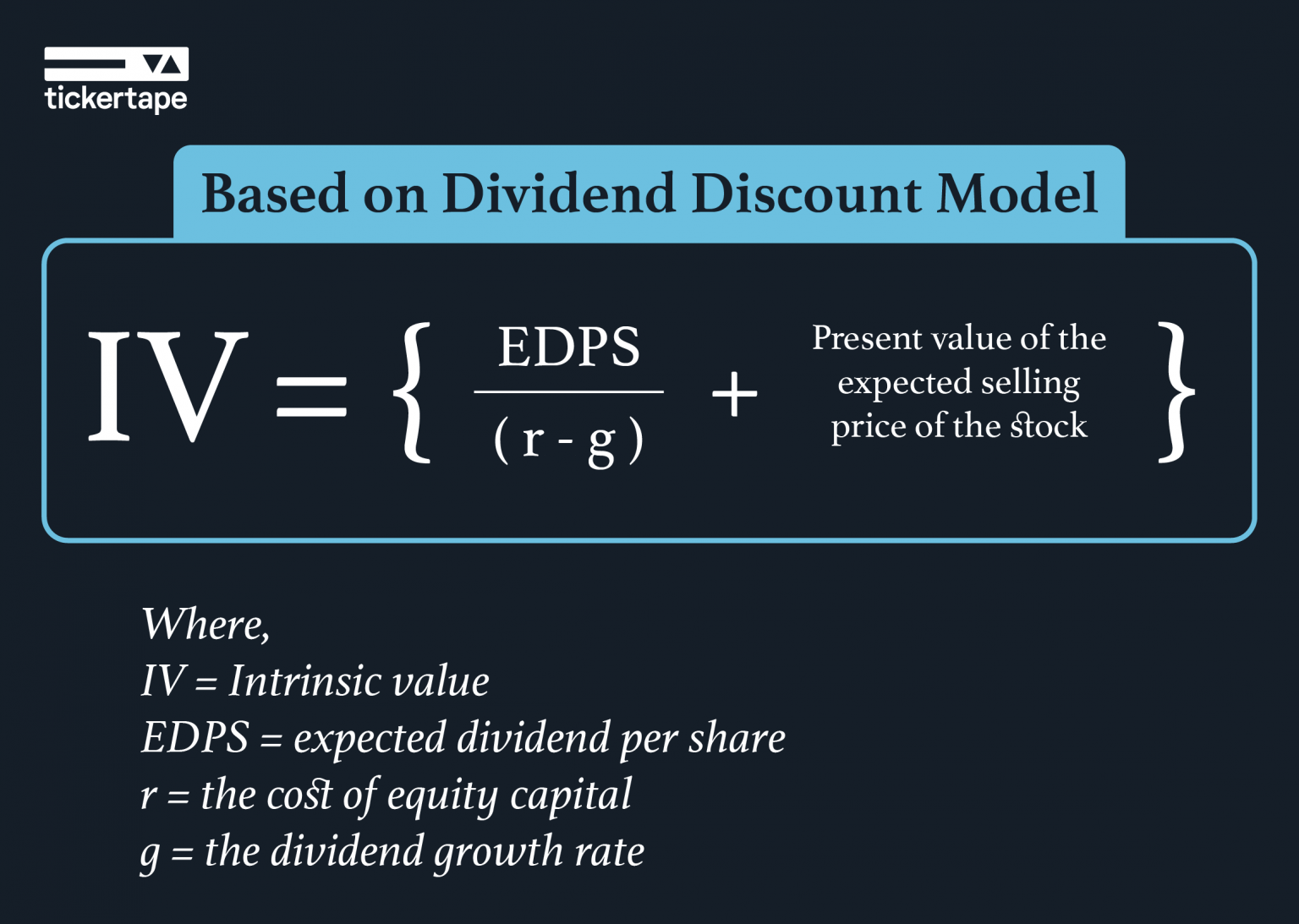

Insert earnings per share and revenue growth to receive an estimate of the intrinsic value of. Fvx = net cash flow (inflow or. R is the rate of return. Web intrinsic value = (cf1)/ (1 + r)^1 + (cf2)/ (1 + r)^2 + (cf3)/ (1 + r)^3 +. Web intrinsic value of share meaning is a true value, based on its underlying fundamentals, such as its assets, earnings, and growth prospects. Nerdwallet.com has been visited by 1m+ users in the past month Learn how to use it.

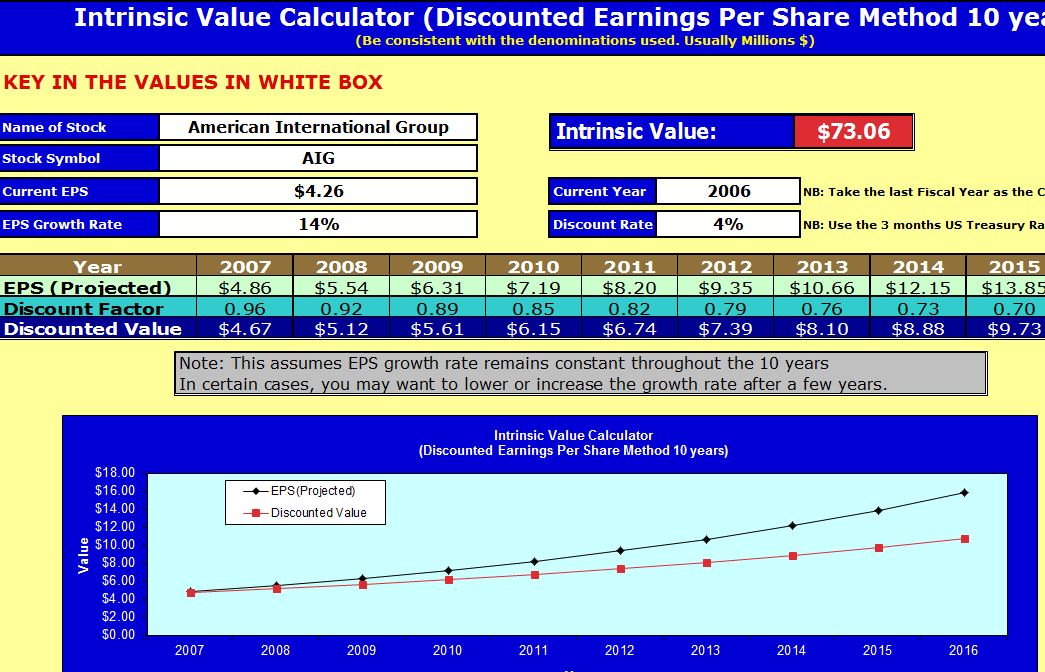

Intrinsic Value Calculator Instrinsic Value

Dcf valuation and relative valuation. Terminal value of stock = {cf* (1+growth rate)}/ (discount rate. It will also show the margin of. There are different variations of the intrinsic value formula, but the most “standard” approach is similar to the net present value formula. Web intrinsic value calculation formula. Comparison with current stock price:. Intrinsic.

What Is the Intrinsic Value of a Stock and How To Calculate It? Blog

Web this calculation is crucial for individuals looking to comply with legal or financial regulations. Web search query you can customize the query below: Therefore, the stock is trading below its fair value, and as such, it. Insert earnings per share and revenue growth to receive an estimate of the intrinsic value of. Using the.

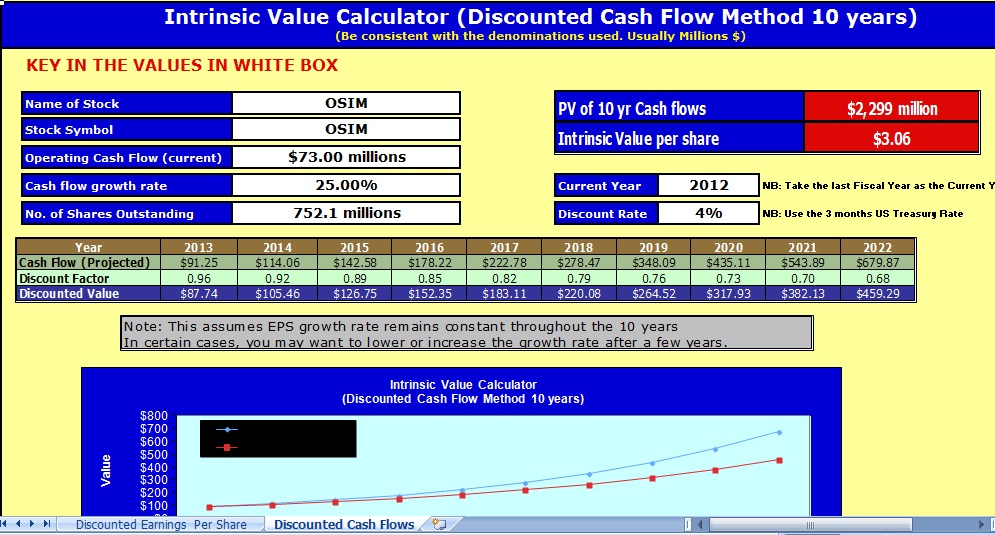

What is Intrinsic Value of Share? Download A Calculator StockManiacs

Web for an inthe money option, intrinsic value is found out by difference in the values ofcurrent price of the underlying commodity or stock and the stock price of theoption. Web use the formula to calculate intrinsic value. Web use this intrinsic stock value calculator to calculate the intrinsic value of stocks. Insert earnings per.

How to Calculate Intrinsic Value Formula Calculator (Updated 2018)

Using the 2 stage free cash flow to equity, instructure holdings fair value estimate is us$40.65. We are able to do that by pre. Web intrinsic value = (cf1)/ (1 + r)^1 + (cf2)/ (1 + r)^2 + (cf3)/ (1 + r)^3 +. Comparison with current stock price:. Intrinsic value = [fv0 / (1+d)0] +.

In 5 minutes Calculate the stock Intrinsic value. YouTube

Web use the formula to calculate intrinsic value. Web intrinsic value calculator: Web for an inthe money option, intrinsic value is found out by difference in the values ofcurrent price of the underlying commodity or stock and the stock price of theoption. Query intrinsic value > current price and debt to equity < 1 custom.

How to Use Stock Intrinsic Value Calculator TheFinance.sg

Fvx = net cash flow (inflow or. Web intrinsic stock value calculator. Financial analysts often use discounted cash flow (dcf) models to. Web the calculator will use the benjamin graham intrinsic value formula to calculate the intrinsic value per share of the stock. Web present value of terminal value (pvtv)= tv / (1 + r).

How to Calculate Intrinsic Value Formula Calculator (Updated 2021)

Web intrinsic value = (cf1)/ (1 + r)^1 + (cf2)/ (1 + r)^2 + (cf3)/ (1 + r)^3 +. Instructions please enter the following details regarding the stock whose intrinsic value you are interested. Using the 2 stage free cash flow to equity, instructure holdings fair value estimate is us$40.65. $62.50 is the intrinsic value.

How to Calculate the Intrinsic Value of a Stock like Benjamin Graham

Comparison with current stock price:. Web an intrinsic value calculator helps investors see past market noise and make informed decisions about whether a stock is undervalued or overvalued. Terminal value of stock = {cf* (1+growth rate)}/ (discount rate. Cf1 is cash flow in year 1, cf2 is cash flow in year 2, etc. Web intrinsic.

Fastest Way to Calculate INTRINSIC VALUE of a STOCK Fundamental For

Dcf valuation and relative valuation. $62.50 is the intrinsic value of the stock, using. Web find the intrinsic value of stocks with our simplified dcf calculator. There are different variations of the intrinsic value formula, but the most “standard” approach is similar to the net present value formula. Learn how to use it. Cf1 is.

What Is the Intrinsic Value of a Stock and How To Calculate It? Blog

Intrinsic value = [fv0 / (1+d)0] + [fv1 / (1+d)1] + [fv2 / (1+d)2] +.+ [fvn / (1+d)p. Web the calculator will use the benjamin graham intrinsic value formula to calculate the intrinsic value per share of the stock. + (cfn)/ (1 + r)^n where: First, the tool calculates the intrinsic value of the stock.

Intrinsic Value Of Stock Calculator Web intrinsic value calculation formula. Web this calculation is crucial for individuals looking to comply with legal or financial regulations. Comparison with current stock price:. Instructure holdings is estimated to be 39%. Web we provide accurate intrinsic value for global stocks using dcf and wacc so that you can easily find the most undervalued/overvalued stocks.

We Take The Average Of.

Web determination of intrinsic value: Web intrinsic value calculation formula. Using the 2 stage free cash flow to equity, instructure holdings fair value estimate is us$40.65. It will also show the margin of.

Web Use This Intrinsic Stock Value Calculator To Calculate The Intrinsic Value Of Stocks.

Query intrinsic value > current price and debt to equity < 1 custom query example market capitalization > 500 and price to. There are different variations of the intrinsic value formula, but the most “standard” approach is similar to the net present value formula. Web we provide accurate intrinsic value for global stocks using dcf and wacc so that you can easily find the most undervalued/overvalued stocks. Intrinsic value = [fv0 / (1+d)0] + [fv1 / (1+d)1] + [fv2 / (1+d)2] +.+ [fvn / (1+d)p.

R Is The Rate Of Return.

Dcf valuation and relative valuation. Web the calculator will use the benjamin graham intrinsic value formula to calculate the intrinsic value per share of the stock. Web present value of terminal value (pvtv)= tv / (1 + r) 10 = us$52b÷ ( 1 + 6.6%) 10 = us$27b. Web find the intrinsic value of stocks with our simplified dcf calculator.

Web Intrinsic Value Calculator:

Fvx = net cash flow (inflow or. First, the tool calculates the intrinsic value of the stock using the revised formula. Instructure holdings is estimated to be 39%. Web how is intrinsic value calculated?