Intrinsic Value Stock Calculator

Intrinsic Value Stock Calculator - Web 10 25 50 search query you can customize the query below: + (cfn)/ (1 + r)^n where: By discounting future cash flows to their present. Web intrinsic value of share meaning is a true value, based on its underlying fundamentals, such as its assets, earnings, and growth prospects. Web rgv = intrinsic value.

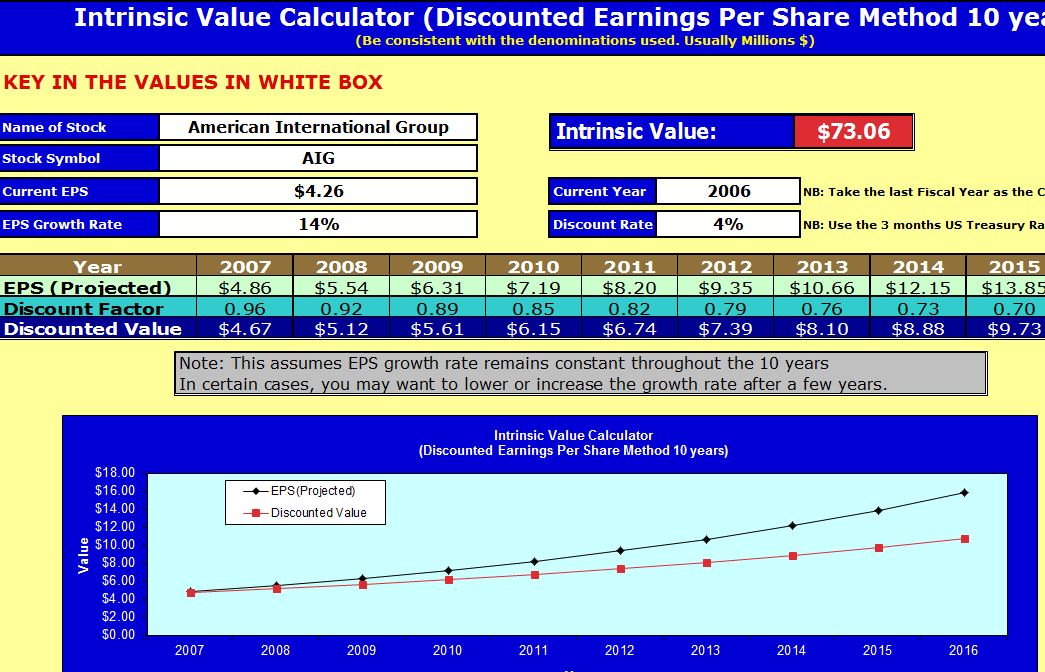

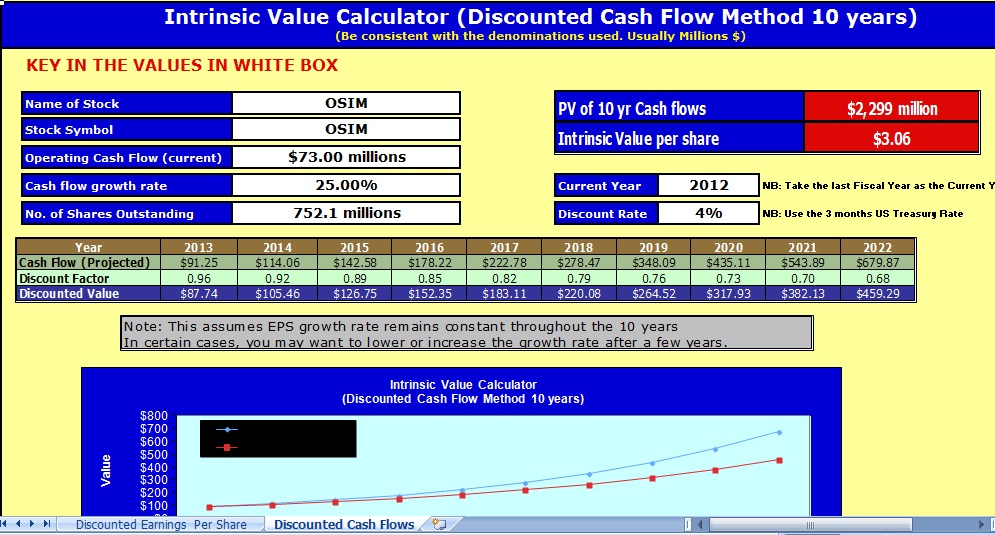

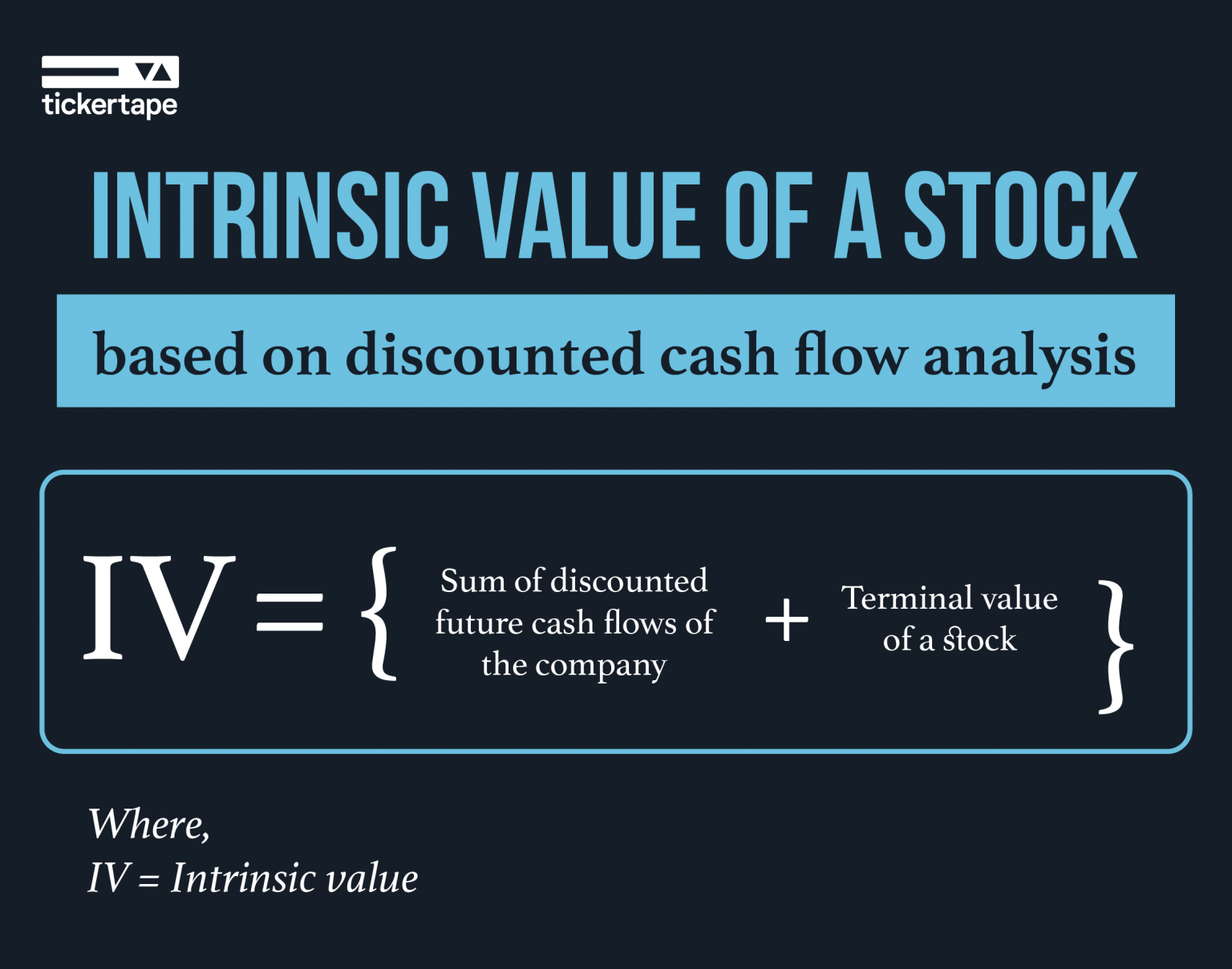

Web intrinsic value of share meaning is a true value, based on its underlying fundamentals, such as its assets, earnings, and growth prospects. Web use the intrinsic value calculator to determine the approximate intrinsic value of growth stocks. To calculate the intrinsic value of a stock, we use two valuation methods: Web intrinsic value formula calculates a company’s worth by determining the present value of its future free cash flows to equity. Web this calculator can be used to determine the intrinsic value of a common stock, or equity, which is a technique pioneered by benjamin graham about one hundred years ago. R is the rate of return. Web fact checked by suzanne kvilhaug what is intrinsic value?

What is Intrinsic Value of Share? Download A Calculator StockManiacs

Intrinsic value is a measure of what an asset is worth. Web financial analysts often use discounted cash flow (dcf) models to determine the fair value of a company's stock. We provide accurate intrinsic value for global stocks using dcf and wacc. Web rgv = intrinsic value. Where market value tells you the price other.

What Is the Intrinsic Value of a Stock and How To Calculate It? Blog

Query intrinsic value > current price and debt to equity < 1 custom query example market capitalization > 500. Instructions please enter the following details regarding the stock whose intrinsic value you are interested. Web intrinsic value of share meaning is a true value, based on its underlying fundamentals, such as its assets, earnings, and.

How to Calculate Intrinsic Value Formula Calculator (Updated 2021)

Web there are different variations of the intrinsic value formula, but the most “standard” approach is similar to the net present value formula. Insert earnings per share and revenue growth to receive an estimate of the intrinsic value of. By discounting future cash flows to their present. This measure is arrived at by means of.

Intrinsic Value Calculator Instrinsic Value

Web find the intrinsic value of stocks with our simplified dcf calculator. Fvx = net cash flow (inflow or. Web use the formula to calculate intrinsic value. $62.50 is the intrinsic value of the stock, using. Web intrinsic value formula calculates a company’s worth by determining the present value of its future free cash flows.

Intrinsic Value Calculator

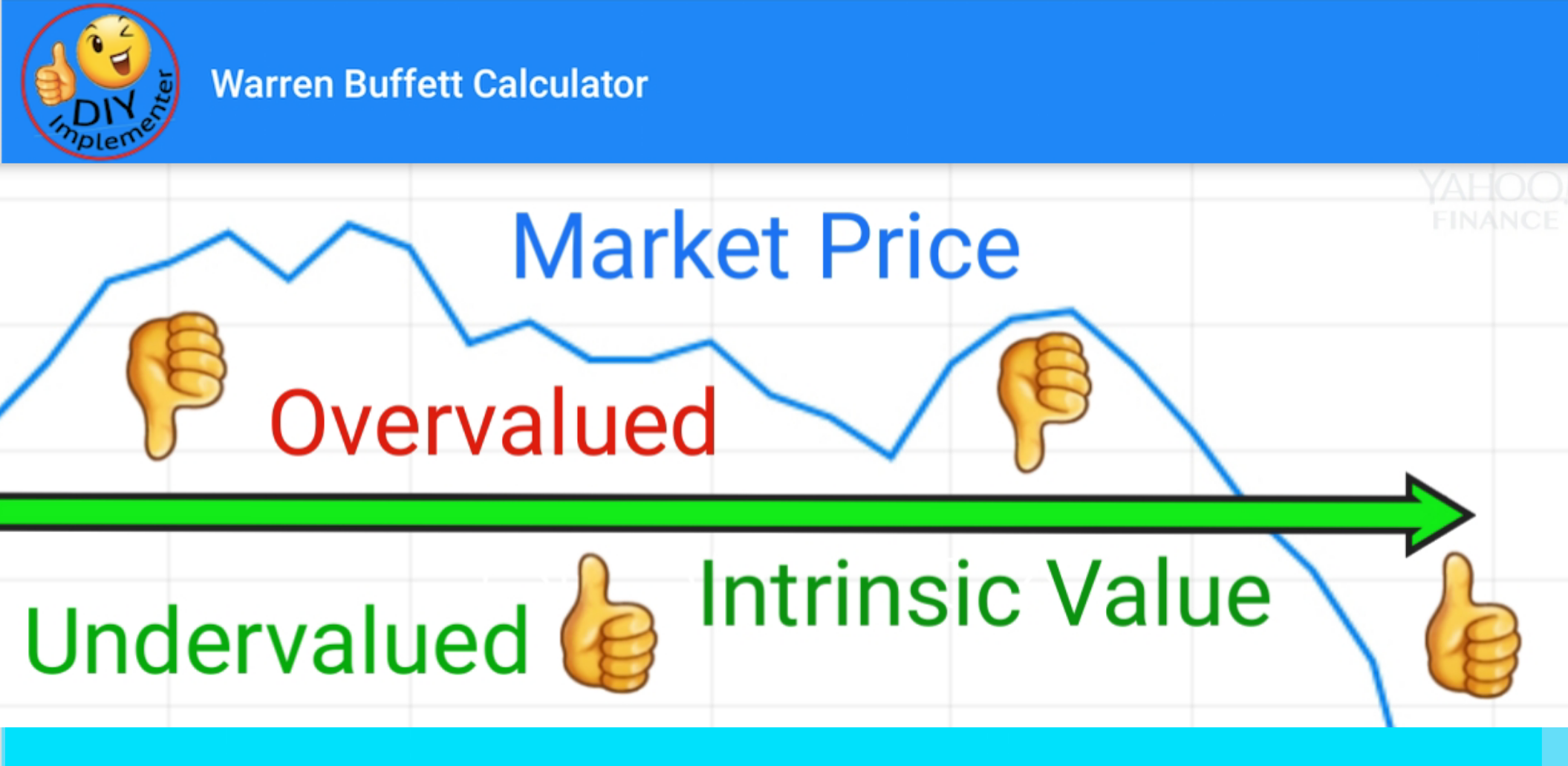

Fvx = net cash flow (inflow or. Web this comparison helps you understand if the stock is undervalued (intrinsic value > current stock price) or overvalued (intrinsic value < current stock price). Learn how to use it. It reflects the business’s true worth and potential profit. Instructions please enter the following details regarding the stock.

In 5 minutes Calculate the stock Intrinsic value. YouTube

We provide accurate intrinsic value for global stocks using dcf and wacc. Web intrinsic value measures the value of an investment based on its cash flows. Web fact checked by suzanne kvilhaug what is intrinsic value? Query intrinsic value > current price and debt to equity < 1 custom query example market capitalization > 500..

How to Use Stock Intrinsic Value Calculator TheFinance.sg

Web find the intrinsic value of stocks with our simplified dcf calculator. By discounting future cash flows to their present. Web intrinsic value = (cf1)/ (1 + r)^1 + (cf2)/ (1 + r)^2 + (cf3)/ (1 + r)^3 +. Gurufocus dcf calculator uses eps without nri as the default because historically stock prices are. Web.

Warren Buffett Intrinsic Value CalculatorAmazon.inAppstore for Android

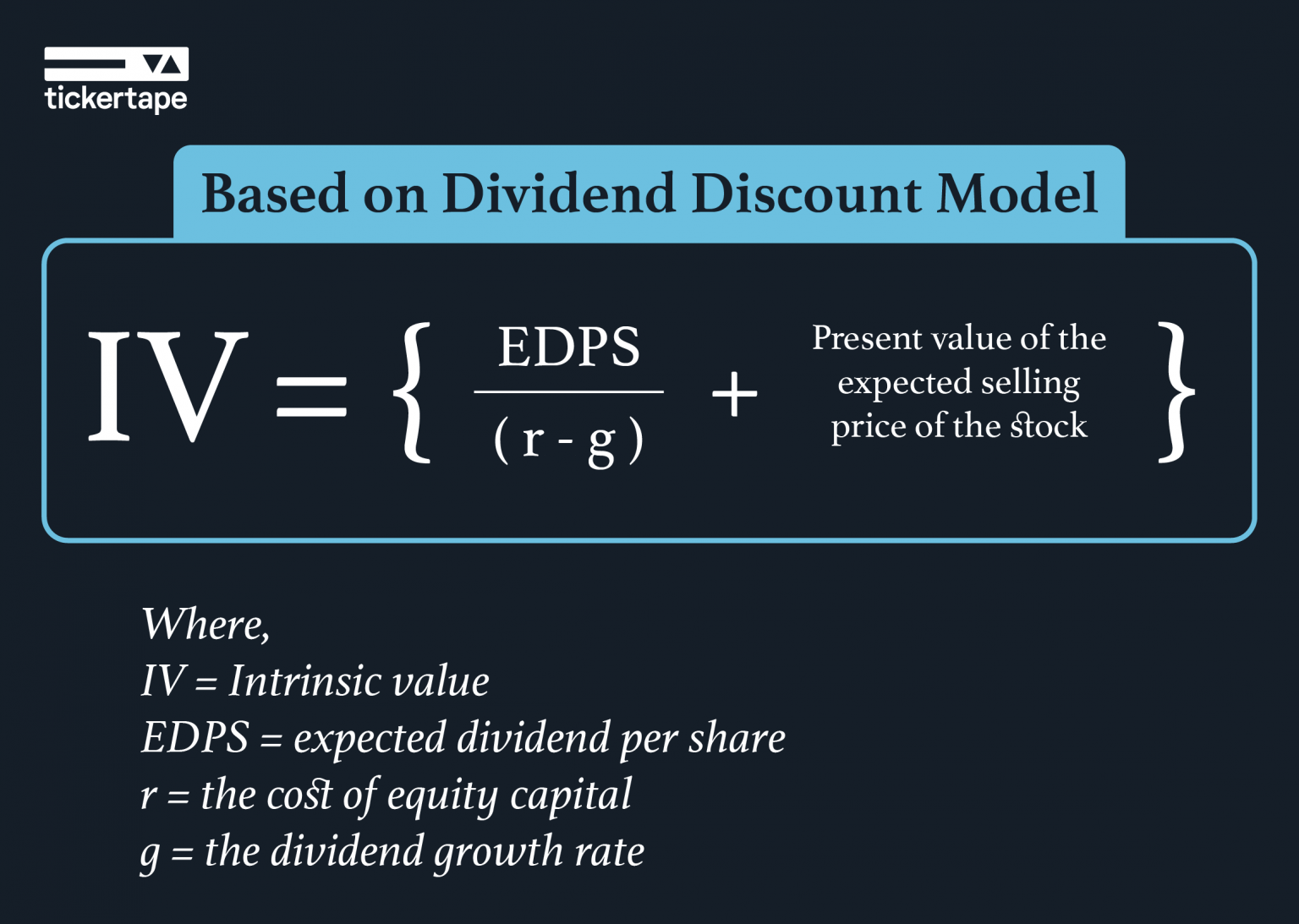

Web intrinsic value = (cf1)/ (1 + r)^1 + (cf2)/ (1 + r)^2 + (cf3)/ (1 + r)^3 +. Web intrinsic value measures the value of an investment based on its cash flows. Web intrinsic value calculation formula. Intrinsic value = [fv0 / (1+d)0] + [fv1 / (1+d)1] + [fv2 / (1+d)2] +.+ [fvn /.

What Is the Intrinsic Value of a Stock and How To Calculate It? Blog

Market value and intrinsic values are the two basic values. Dcf valuation and relative valuation. The value investing calculator allows you look up basic information about a stock to determine its intrinsic value. Web intrinsic value formula calculates a company’s worth by determining the present value of its future free cash flows to equity. Web.

How to Calculate the Intrinsic Value of a Stock like Benjamin Graham

Where market value tells you the price other people are willing to pay for an. It reflects the business’s true worth and potential profit. Intrinsic value is a measure of what an asset is worth. Web there are different variations of the intrinsic value formula, but the most “standard” approach is similar to the net.

Intrinsic Value Stock Calculator Intrinsic value is a measure of what an asset is worth. Web this calculator can be used to determine the intrinsic value of a common stock, or equity, which is a technique pioneered by benjamin graham about one hundred years ago. Web an intrinsic value calculator helps investors see past market noise and make informed decisions about whether a stock is undervalued or overvalued. By discounting future cash flows to their present. This measure is arrived at by means of an.

Web This Comparison Helps You Understand If The Stock Is Undervalued (Intrinsic Value > Current Stock Price) Or Overvalued (Intrinsic Value < Current Stock Price).

+ (cfn)/ (1 + r)^n where: To calculate the intrinsic value of a stock, we use two valuation methods: Web intrinsic value of share meaning is a true value, based on its underlying fundamentals, such as its assets, earnings, and growth prospects. Web this calculator can be used to determine the intrinsic value of a common stock, or equity, which is a technique pioneered by benjamin graham about one hundred years ago.

Web Intrinsic Value Calculation Formula.

Web fact checked by suzanne kvilhaug what is intrinsic value? It reflects the business’s true worth and potential profit. R is the rate of return. This measure is arrived at by means of an.

Web Intrinsic Value And Roi Calculator.

Web an intrinsic value calculator helps investors see past market noise and make informed decisions about whether a stock is undervalued or overvalued. Investment tools & tipsfinance calculatorspersonal finance & taxesveterans resources Fvx = net cash flow (inflow or. Web 10 25 50 search query you can customize the query below:

Gurufocus Dcf Calculator Uses Eps Without Nri As The Default Because Historically Stock Prices Are.

Insert earnings per share and revenue growth to receive an estimate of the intrinsic value of. Query intrinsic value > current price and debt to equity < 1 custom query example market capitalization > 500. You can use this intrinsic value and return on equity (roi) calculator to help you evaluate a stock you might be researching. We take the average of.