Iul Life Insurance Calculator

Iul Life Insurance Calculator - Web the process usually starts with how much money you can set aside a month to invest in an iul policy. Learn how iul works and its pros and cons. One is based on a fixed,. Web for 2023, the contribution is $22,500 ($23,000 in 2024). Web this calculator helps you determine the return on a universal life insurance policy.

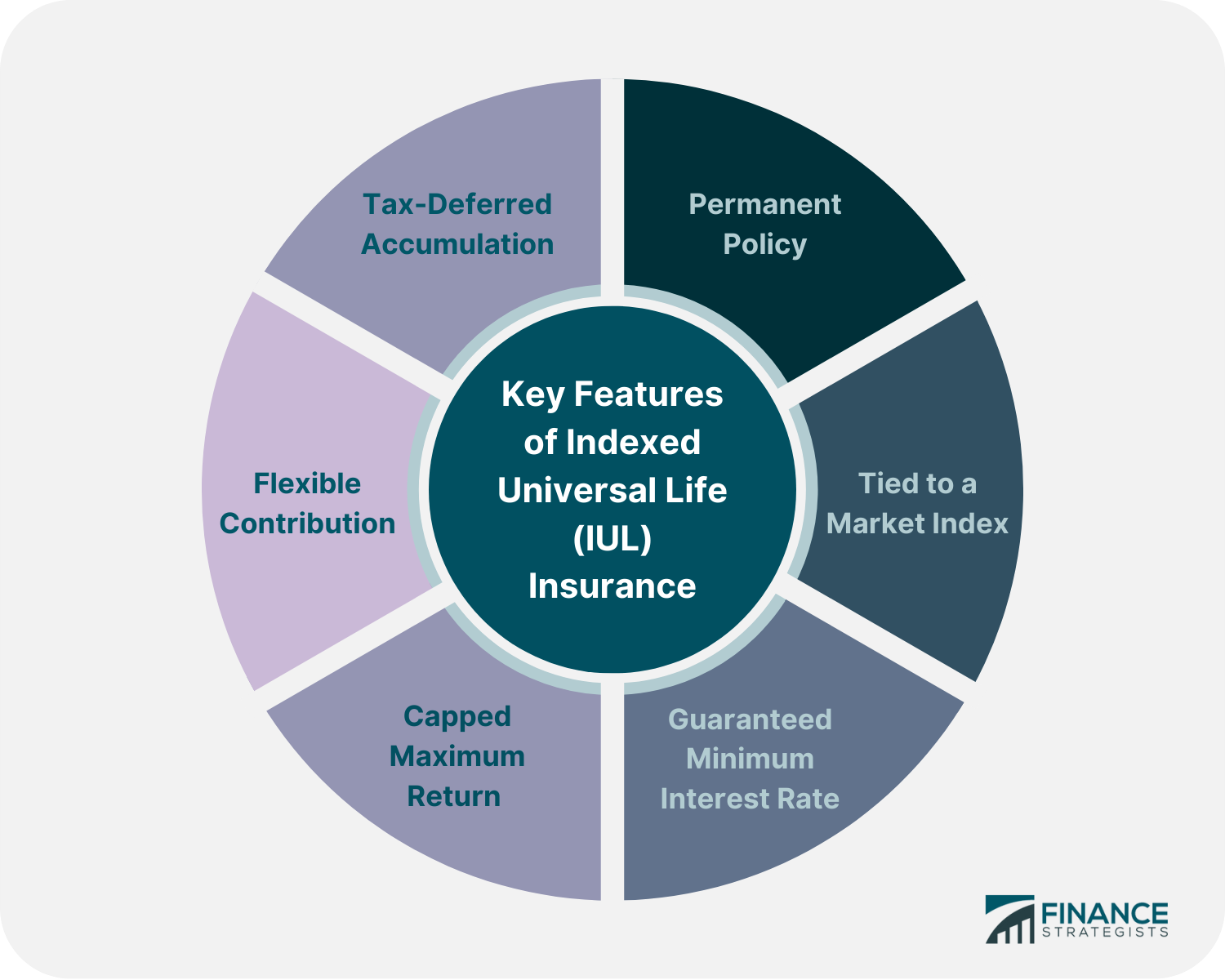

Indexed universal life (iul) insurance is a kind of insurance policy that allows policyholders to grow their cash value at a lower risk level. An indexed universal life insurance (iul) policy is a type of permanent life insurance that provides protection for a lifetime and accrues cash value. Your expected return is based on the policy amount, and your life insurance company's. Web learn how to use an iul calculator to estimate the cash value and death benefit of an indexed universal life insurance policy. Web what is universal life insurance? An iul can be an. Web when determining how much coverage of indexed universal life insurance is best for you, you should consider your financial stability and your reasons for purchasing insurance.

IUL Calculator Best Index Universal Life Insurance Account

One is based on a fixed,. With a traditional 401 (k ),. Learn how iul works and its pros and cons. Indexed universal life (iul) insurance is a kind of insurance policy that allows policyholders to grow their cash value at a lower risk level. Web an iul is a type of permanent life insurance,.

Indexed Universal Life Insurance The Ultimate Guide

Web securian the eclipse accumulator indexed universal life policy offers four index options ranging from the s&p 500 to the euro stoxx 50. Web when determining how much coverage of indexed universal life insurance is best for you, you should consider your financial stability and your reasons for purchasing insurance. Web indexed universal life insurance,.

What is IUL Insurance And Why Do You Need It?

This might include plain vanilla ones such as the s&p 500 and the russell 500 indices. Web indexed universal life insurance (iul) is a type of permanent policy that doesn’t expire and comes with a that earns interest based on a stock market index, such. Web get access to the latest in life insurance and.

Indexed Universal Life (IUL) Insurance Definition, Pros & Cons

Workers over the age of 50 can contribute an additional $7,500 per year. Web securian the eclipse accumulator indexed universal life policy offers four index options ranging from the s&p 500 to the euro stoxx 50. Web indexed universal life insurance, or iul, lets you take advantage of market gains, while avoiding losses. Web the.

Indexed Universal Life Insurance IUL Insurance Pros and Cons

Web the process usually starts with how much money you can set aside a month to invest in an iul policy. Indexed universal life (iul) insurance is a kind of insurance policy that allows policyholders to grow their cash value at a lower risk level. An indexed universal life insurance (iul) policy is a type.

Indexed Universal Life (IUL) Insurance Definition, Pros & Cons

An indexed universal life insurance (iul) policy is a type of permanent life insurance that provides protection for a lifetime and accrues cash value. Learn how iul works and its pros and cons. Web for 2023, the contribution is $22,500 ($23,000 in 2024). This might include plain vanilla ones such as the s&p 500 and.

A Guide to Understanding Indexed Universal Life Insurance (IUL)

Your expected return is based on the policy amount, and your life insurance company's. Workers over the age of 50 can contribute an additional $7,500 per year. Web for 2023, the contribution is $22,500 ($23,000 in 2024). Web the process usually starts with how much money you can set aside a month to invest in.

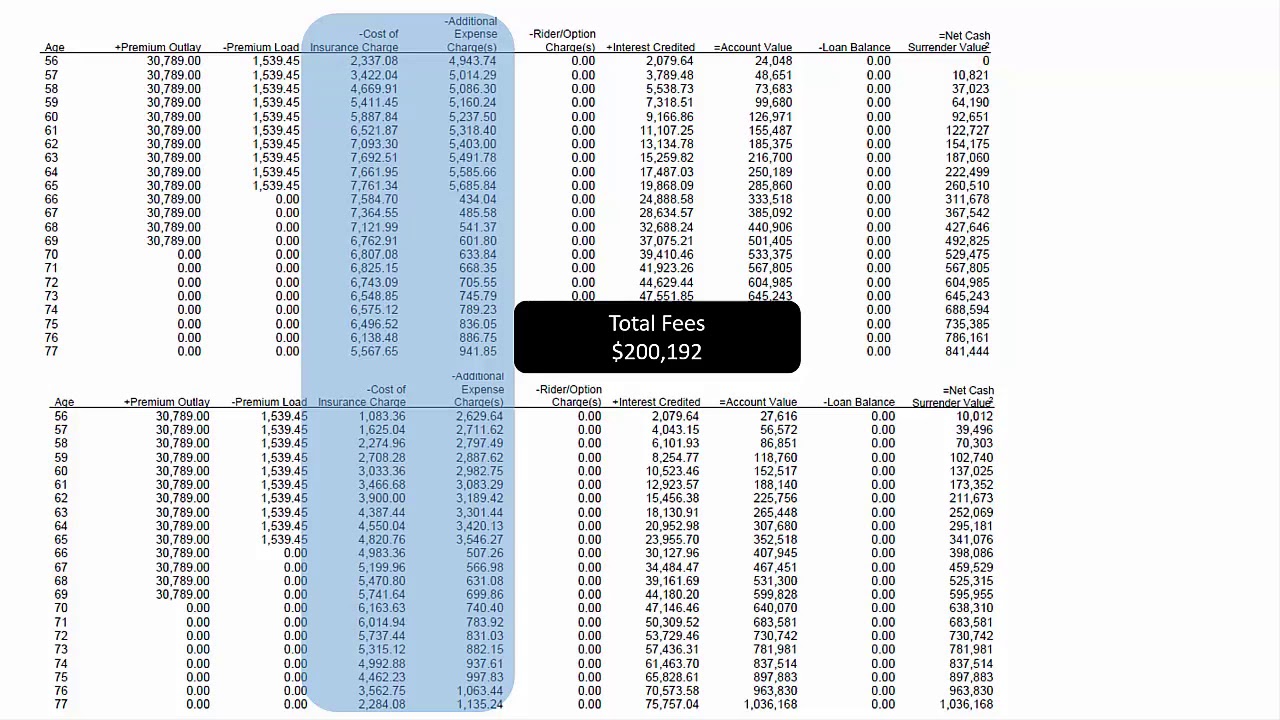

Indexed Universal Life (IUL) Insurance Fees Explained YouTube

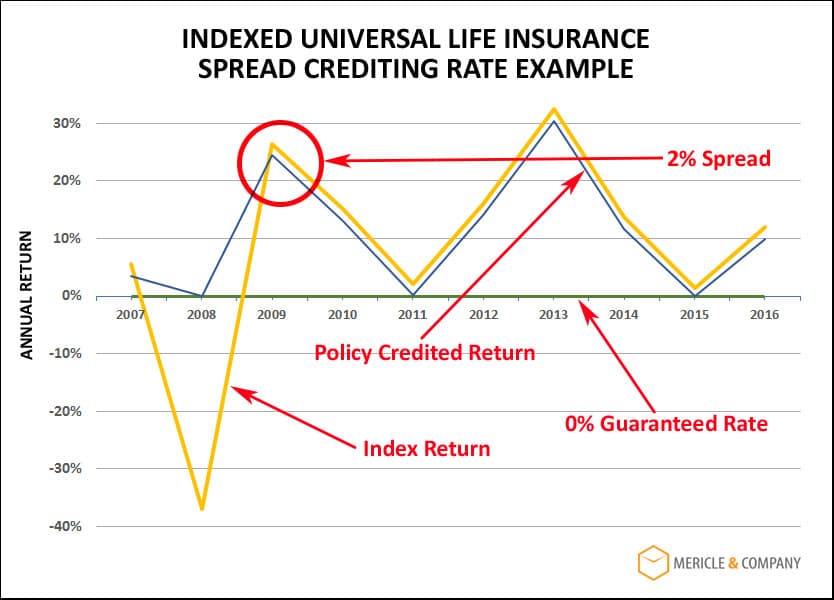

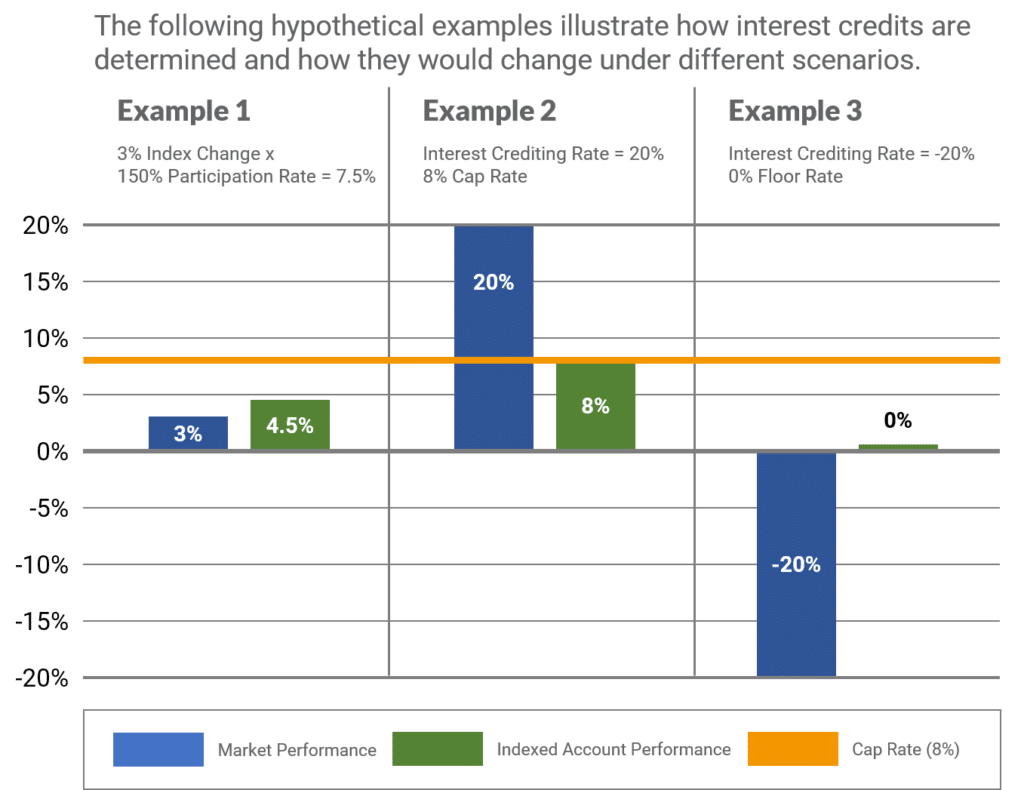

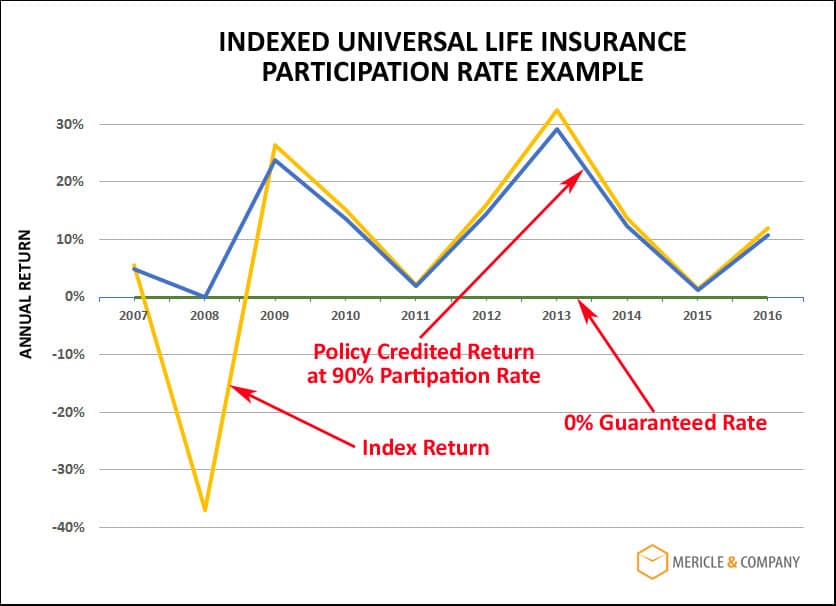

From that, insurance companies will calculate how much. Web riding an index the cash value within an iul policy is tied to an index. Web securian the eclipse accumulator indexed universal life policy offers four index options ranging from the s&p 500 to the euro stoxx 50. With a traditional 401 (k ),. One is.

Indexed Universal Life Insurance 2022 Definitive Guide

Web an iul is a type of permanent life insurance, meaning it can accumulate cash value and provide a death benefit. Workers over the age of 50 can contribute an additional $7,500 per year. Indexed universal life (iul) insurance is a kind of insurance policy that allows policyholders to grow their cash value at a.

Indexed Universal Life Insurance The Ultimate Guide

Workers over the age of 50 can contribute an additional $7,500 per year. One is based on a fixed,. Universal life insurance gives you lifelong protection and cash value you can use for anything, anytime, plus the flexibility to adjust your policy. Web riding an index the cash value within an iul policy is tied.

Iul Life Insurance Calculator An indexed universal life insurance (iul) policy is a type of permanent life insurance that provides protection for a lifetime and accrues cash value. Web this calculator helps you determine the return on a universal life insurance policy. Universal life insurance gives you lifelong protection and cash value you can use for anything, anytime, plus the flexibility to adjust your policy. With a traditional 401 (k ),. Learn how iul works and its pros and cons.

Web An Iul Is A Type Of Permanent Life Insurance, Meaning It Can Accumulate Cash Value And Provide A Death Benefit.

Web this calculator helps you determine the return on a universal life insurance policy. Your expected return is based on the policy amount, and your life insurance company's. Web riding an index the cash value within an iul policy is tied to an index. Web what is universal life insurance?

An Indexed Universal Life Insurance (Iul) Policy Is A Type Of Permanent Life Insurance That Provides Protection For A Lifetime And Accrues Cash Value.

Universal life insurance gives you lifelong protection and cash value you can use for anything, anytime, plus the flexibility to adjust your policy. Learn how iul works and its pros and cons. An iul can be an. From that, insurance companies will calculate how much.

Web When Determining How Much Coverage Of Indexed Universal Life Insurance Is Best For You, You Should Consider Your Financial Stability And Your Reasons For Purchasing Insurance.

Web indexed universal life insurance, or iul, lets you take advantage of market gains, while avoiding losses. With a traditional 401 (k ),. One is based on a fixed,. Web the process usually starts with how much money you can set aside a month to invest in an iul policy.

Web For 2023, The Contribution Is $22,500 ($23,000 In 2024).

This might include plain vanilla ones such as the s&p 500 and the russell 500 indices. Web learn how to use an iul calculator to estimate the cash value and death benefit of an indexed universal life insurance policy. Web get access to the latest in life insurance and personal finance insights. Indexed universal life (iul) insurance is a kind of insurance policy that allows policyholders to grow their cash value at a lower risk level.