J1 Visa Tax Refund Calculator

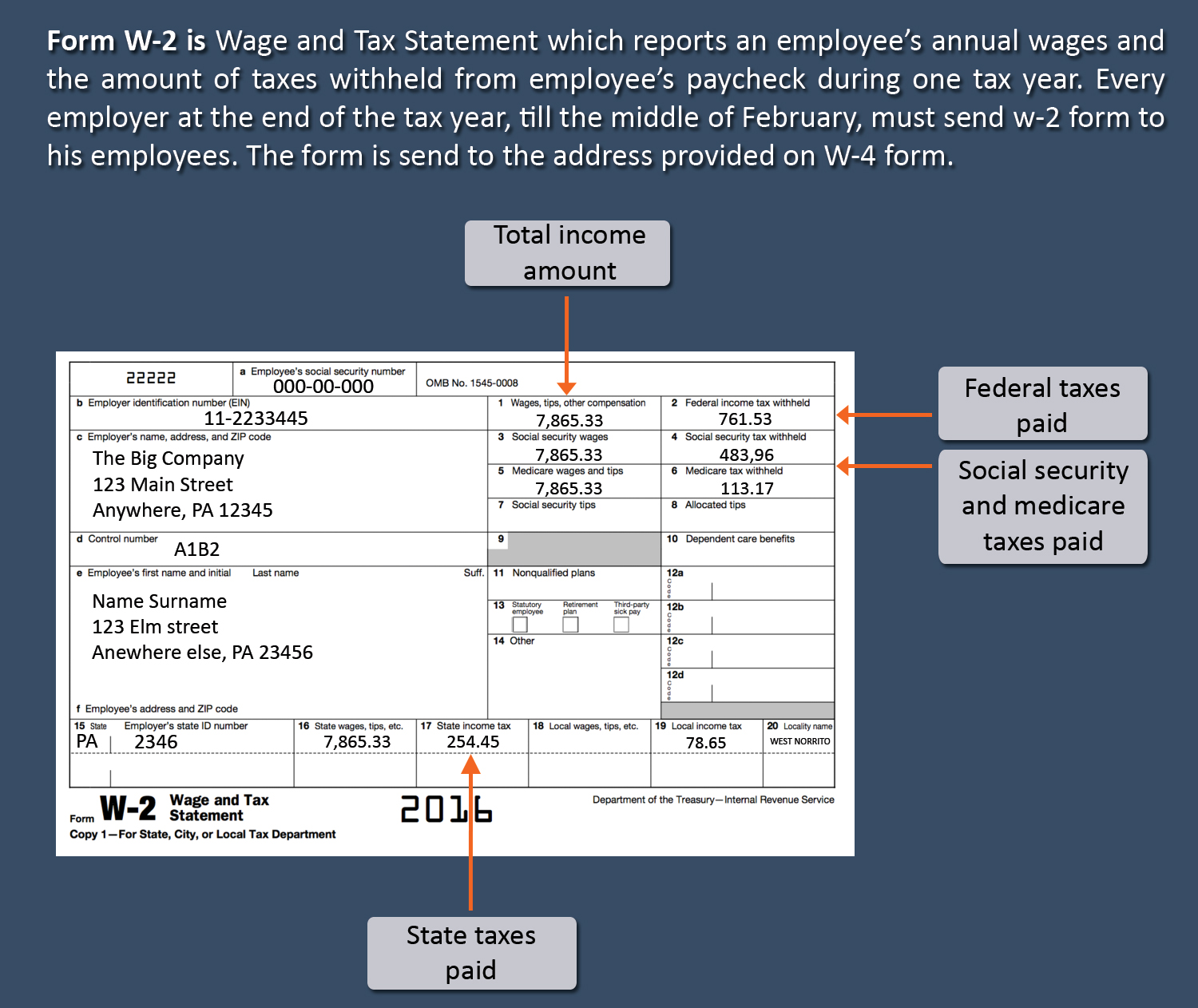

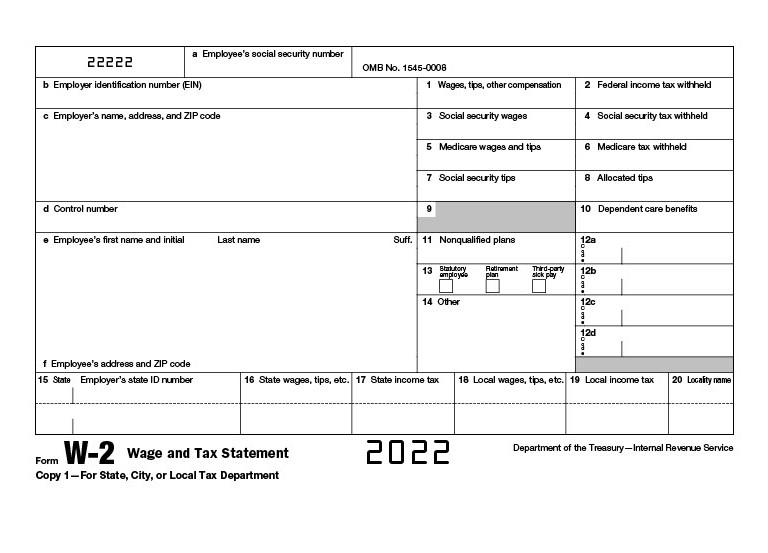

J1 Visa Tax Refund Calculator - This is a summary of what taxes you paid during your time in the usa. The average j1 tax refund is $800, so it is worth checking what you're owed. But there’s one responsibility that comes with this. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. It’s also no obligation so if you don’t have to continue.

Immigration law is different from u.s. It’s also no obligation so if you don’t have to continue. Web sprintax can help you determine if you are due a tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Tax residents or change their visa status to other work visa types (other than f, m or q visa) are subject to social security and medicare. Intuit.com has been visited by 1m+ users in the past month Web calculate your us j1 tax refund for free.

J1 Visa Outsourcing Processing

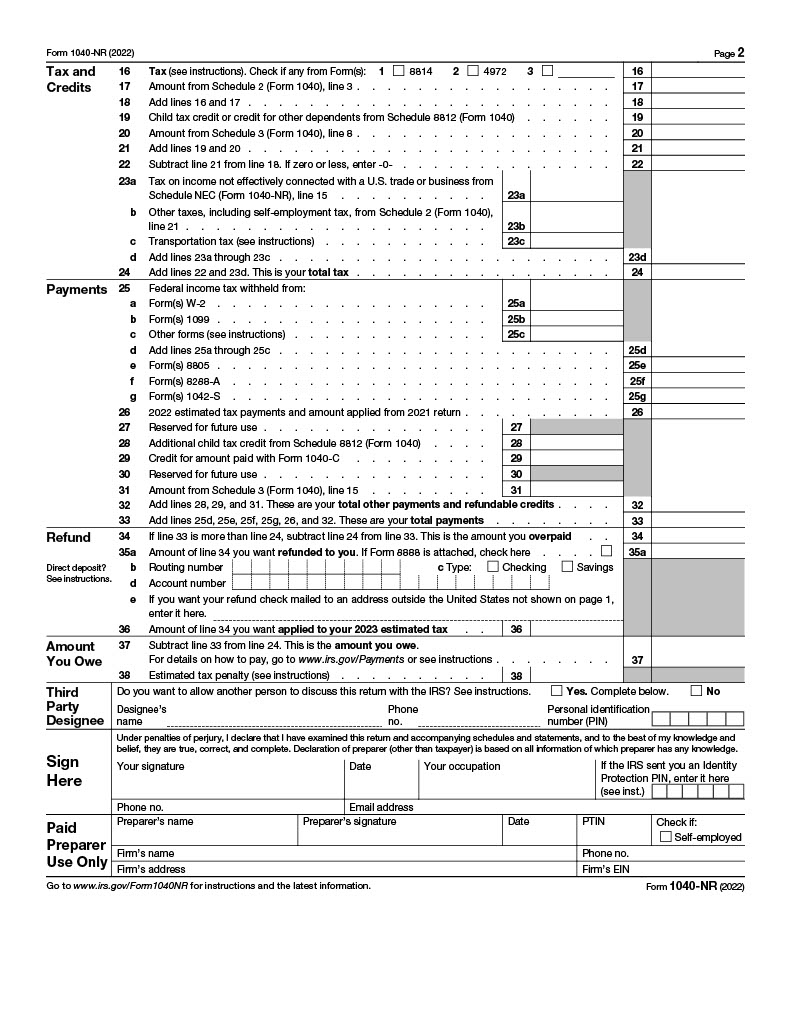

Web filing is required by nonresident alien students and scholars who have: Tax residents or change their visa status to other work visa types (other than f, m or q visa) are subject to social security and medicare. This is a summary of what taxes you paid during your time in the usa. Intuit.com has.

How to File J1 Visa Tax Return 101 TFX US Expat Tax Service

Simply create an account to get started with your us nonresident tax return. How much tax refund will. Web all the latest tax tips and updates. Tax residents or change their visa status to other work visa types (other than f, m or q visa) are subject to social security and medicare. Web all j.

J1 Visa Tips How to File your U.S. Tax Return YouTube

This is a summary of what taxes you paid during your time in the usa. The j1 tax calculator is a great way to get a refund estimation without having to do the maths yourself. Web filing is required by nonresident alien students and scholars who have: All right are reserved © j1 summer tax.

J1 Visa And Tax Return QATAX

Estimate your federal tax refund for free. Tax residents or change their visa status to other work visa types (other than f, m or q visa) are subject to social security and medicare. Web social security and medicare are generally mandatory for anyone who works and earns an income in the u.s. The total taxable.

The Complete J1 Student Guide to Tax in the US

This is a summary of what taxes you paid during your time in the usa. Immigration law is different from u.s. Web all the latest tax tips and updates. It’s also no obligation so if you don’t have to continue. Web social security and medicare are generally mandatory for anyone who works and earns an.

The Complete J1 Student Guide to Tax in the US

Web generally, for u.s. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Tax residents or change their visa status to other work visa types (other than f, m or q visa) are subject to social security and medicare. Web sprintax can help you determine if you are due a tax refund..

How to file a J1 Visa Tax Return J1 visa taxes explained [2023]

If money has been earned, then also file either the 1040nr or 1040nr. Web sprintax can help you determine if you are due a tax refund. The amount of taxes to pay will depend on the amount you. Easy access to tax help and information. This is a summary of what taxes you paid during.

AmberTax USA Tax Refund for J1, H2B and other temporary visitors

It is not your tax refund. Web all the latest tax tips and updates. Web j1 summer tax back. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. The total taxable amount is 15.3% of the employee’s. Web calculate your us j1 tax refund for free. Tax purpose, a nonimmigrant or immigrant.

HOW TO FILE TAX RETURN FOR J1 STUDENTS 2020 J1VISA EPISODE 21

Tax residency status under u.s. Intuit.com has been visited by 1m+ users in the past month The j1 tax calculator is a great way to get a refund estimation without having to do the maths yourself. Simply create an account to get started with your us nonresident tax return. Get your j1 tax refund estimation.

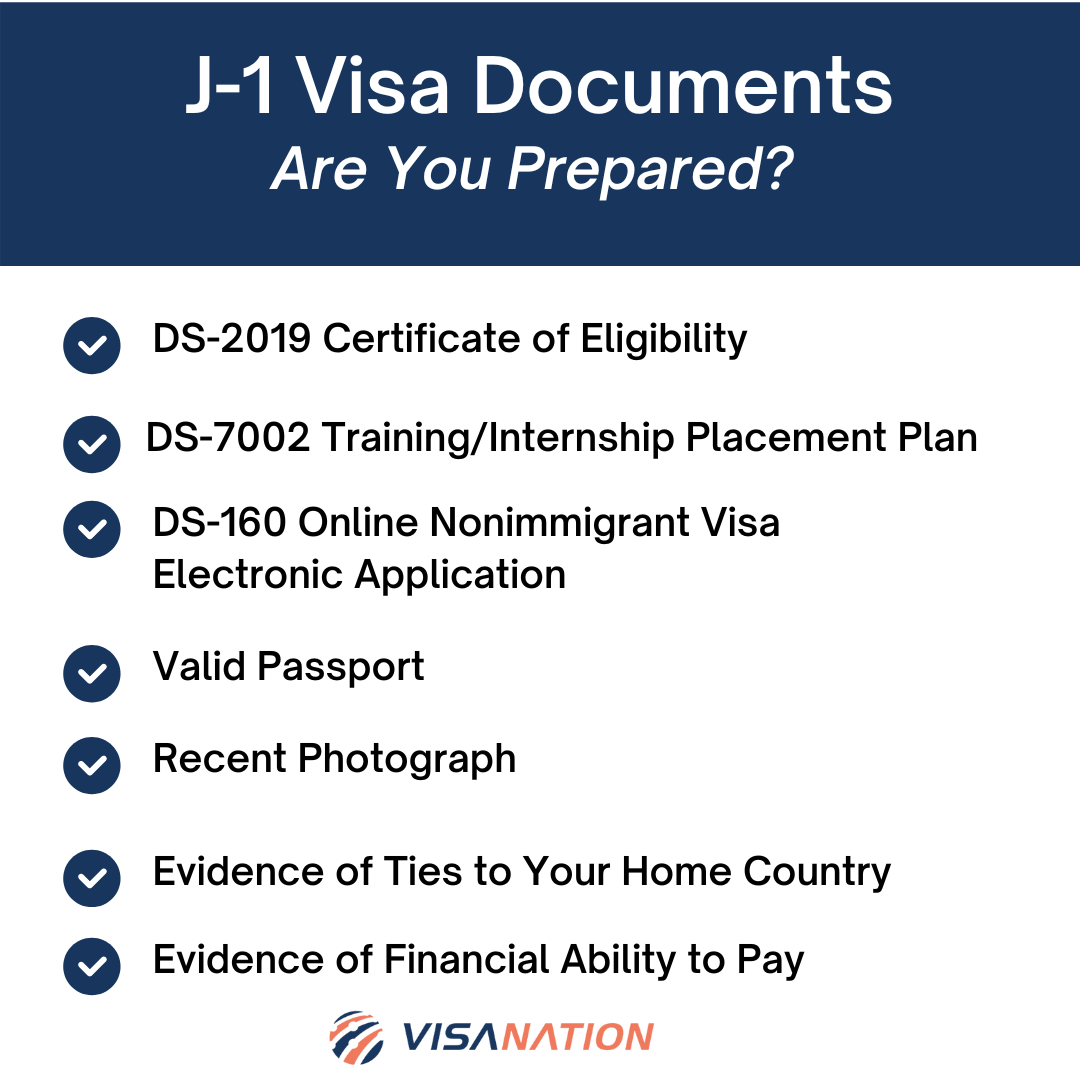

J1 Visa Documents 2023 Checklist The Only Guide You Need

A taxable scholarship or fellowship grant, as described in chapter 1 of publication 970, tax. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Tax purpose, a nonimmigrant or immigrant visa status under u.s. Web j1 summer tax back. Web generally, for u.s. Estimate your federal tax refund for free. The amount.

J1 Visa Tax Refund Calculator Web generally, for u.s. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. The amount of taxes to pay will depend on the amount you. Intuit.com has been visited by 1m+ users in the past month How much tax refund will.

Web Social Security And Medicare Are Generally Mandatory For Anyone Who Works And Earns An Income In The U.s.

All right are reserved © j1 summer tax back inc. The average j1 tax refund is $800, so it is worth checking what you're owed. Immigration law is different from u.s. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500.

The Total Taxable Amount Is 15.3% Of The Employee’s.

How much tax refund will. It is not your tax refund. Web sprintax can help you determine if you are due a tax refund. Tax purpose, a nonimmigrant or immigrant visa status under u.s.

Web J1 Summer Tax Back.

This is a summary of what taxes you paid during your time in the usa. Intuit.com has been visited by 1m+ users in the past month But there’s one responsibility that comes with this. Web filing is required by nonresident alien students and scholars who have:

It’s Also No Obligation So If You Don’t Have To Continue.

Web generally, for u.s. Tax residency status under u.s. Web all the latest tax tips and updates. Simply create an account to get started with your us nonresident tax return.

![How to file a J1 Visa Tax Return J1 visa taxes explained [2023]](https://blog.sprintax.com/wp-content/uploads/2020/03/J1-visa-tax-return-guide-2022.jpg)