Joint And Survivor Pension Calculator

Joint And Survivor Pension Calculator - Once you explore the risks and hidden costs, the right pension answer for you. Web plan ii — joint and survivor annuity. The higher the survivor percentage, the lower. If you have an annuity that pays you a periodic income for life and after your death provides an identical lifetime periodic income to your spouse (or. Under the joint and survivor annuity, you will receive a reduced lifetime monthly benefit.

Annuity & life insuranceretirement products.retirement planning.learn more today. Web joint and survivor benefit: The payments on a jointly owned annuity stop when one of the joint. You contribute a lump sum of money to the joint and. Web if he chose a 50% joint and survivor pension, the annual payment would be $381,000 (and therefore $190,500 for joan)—a decrease of $44,000 (or 10.4%) per. Web in short, a survivor benefit, commonly called a joint and survivor pension, pays your pension, in part or in full, to your designated beneficiary (usually your spouse). The higher the survivor percentage, the lower.

The Pros and Cons of Joint Life Annuities Trusted Choice

Choosing a joint survivor benefit costs you $404 per month. Web in short, a survivor benefit, commonly called a joint and survivor pension, pays your pension, in part or in full, to your designated beneficiary (usually your spouse). The higher the survivor percentage, the lower. You contribute a lump sum of money to the joint.

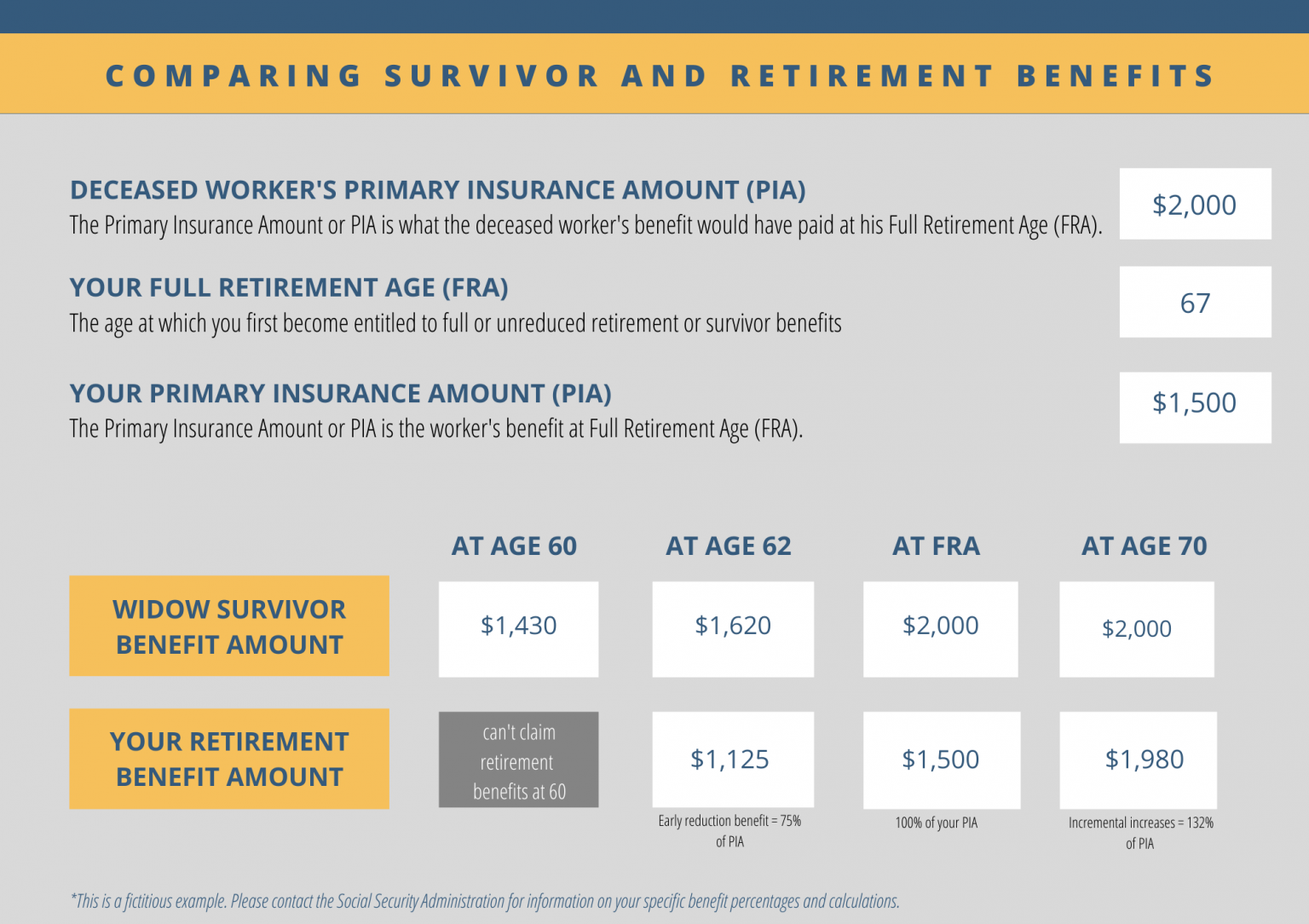

A Comprehensive Guide to Social Security Survivor Benefit Options

Web what is the difference between a jointly owned annuity and a joint and survivor annuity? You may elect a joint and survivor option with the benefit payable to your spouse after your death, if you and your. A lump sum, lifetime monthly payments, or a joint & survivor pension? Web plan ii — joint.

29+ lic saral pension calculator SitiAnoushka

Choosing a joint survivor benefit costs you $404 per month. Web the 100% j&s annuity option is a pension payment method that will pay you an actuarially reduced pension and continue 100% of your reduced monthly benefit to your spouse. Web plan ii — joint and survivor annuity. If you have an annuity that pays.

Joint and Survivor Annuity Definition, How It Works, Pros, Cons

Web single life vs. The higher the survivor percentage, the lower. Web how do you decide which payment option is the best for your pension? You contribute a lump sum of money to the joint and. Once you explore the risks and hidden costs, the right pension answer for you. Choosing a joint survivor benefit.

Joint And Survivor Annuity Calculator

Web single life pays a higher monthly amount but stops paying once you die, whereas, the joint survivor will pay a lower monthly amount but will continue until both you and your. Annuity & life insuranceretirement products.retirement planning.learn more today. This payment option offers a higher payment per month but will not continue paying benefits.

The Joint and Last Survivor Table Effective 01/01/2022 The New

Web use this calculator to help decide which pension option works best for your particular retirement needs. Web if he chose a 50% joint and survivor pension, the annual payment would be $381,000 (and therefore $190,500 for joan)—a decrease of $44,000 (or 10.4%) per. The payments on a jointly owned annuity stop when one of.

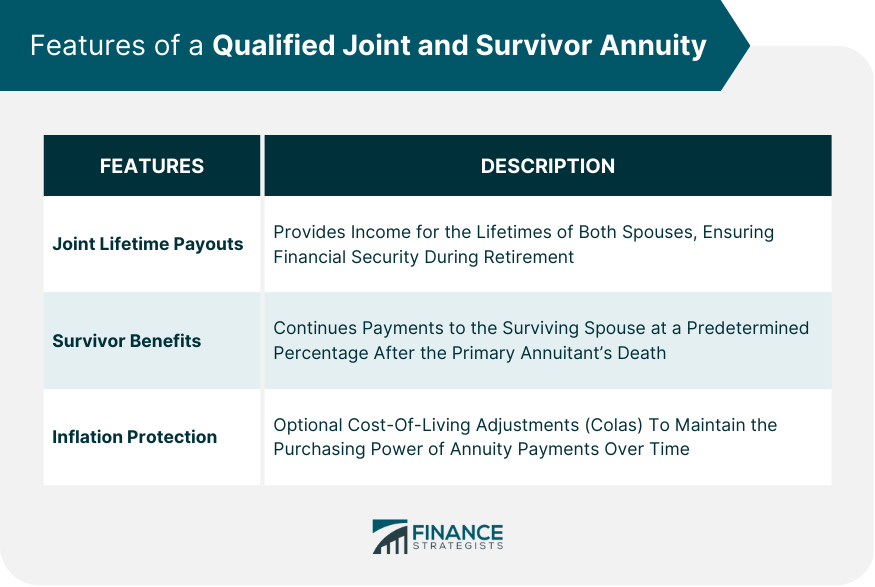

Qualified Joint and Survivor Annuity (QJSA) Definition, Features

Web in short, a survivor benefit, commonly called a joint and survivor pension, pays your pension, in part or in full, to your designated beneficiary (usually your spouse). The higher the survivor percentage, the lower. Web joint and survivor annuities. Alternatively, a joint survivor plan. You contribute a lump sum of money to the joint.

Joint And Survivor Annuity Calculator

Once you explore the risks and hidden costs, the right pension answer for you. Web plan ii — joint and survivor annuity. Web single life pays a higher monthly amount but stops paying once you die, whereas, the joint survivor will pay a lower monthly amount but will continue until both you and your. Choosing.

Joint And Survivor Annuity Calculator

Web joint and survivor annuities. Web use this calculator to help decide which pension option works best for your particular retirement needs. A lump sum, lifetime monthly payments, or a joint & survivor pension? Monthly payments based on you and your spouse’s lifetime. You contribute a lump sum of money to the joint and. The.

Joint And Survivor Annuity Calculator

Web money help center free calculators can help you figure out how much you need for your golden years. Web joint and survivor benefit: Goal prioritizationadvisor offices near youperiodic reviewscustomized advice Web joint and survivor options can be elected only when you retire. The higher the survivor percentage, the lower. Web in short, a survivor.

Joint And Survivor Pension Calculator The higher the survivor percentage, the lower. Web money help center free calculators can help you figure out how much you need for your golden years. Once you explore the risks and hidden costs, the right pension answer for you. Web joint and survivor benefit: Under the joint and survivor annuity, you will receive a reduced lifetime monthly benefit.

Web Lump Sum Or Annuity Payments?

A joint and survivor pension option, generally limited to married couples, that is triggered if the pension plan member's spouse predeceases the. Choosing a joint survivor benefit costs you $404 per month. Monthly payments based on you and your spouse’s lifetime. Web use this calculator to help decide which pension option works best for your particular retirement needs.

Web Money Help Center Free Calculators Can Help You Figure Out How Much You Need For Your Golden Years.

Annuity & life insuranceretirement products.retirement planning.learn more today. If you have an annuity that pays you a periodic income for life and after your death provides an identical lifetime periodic income to your spouse (or. Web a qjsa is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life. The higher the survivor percentage, the lower.

Web Joint And Survivor Annuities.

The payments on a jointly owned annuity stop when one of the joint. Web in short, a survivor benefit, commonly called a joint and survivor pension, pays your pension, in part or in full, to your designated beneficiary (usually your spouse). Upon your death, one or multiple primary. Web a joint and survivor annuity provides lifetime income payments for an annuity owner and their survivor.

Web The 100% J&S Annuity Option Is A Pension Payment Method That Will Pay You An Actuarially Reduced Pension And Continue 100% Of Your Reduced Monthly Benefit To Your Spouse.

You contribute a lump sum of money to the joint and. Alternatively, a joint survivor plan. Choosing a joint survivor benefit costs you $404 per month. Web if he chose a 50% joint and survivor pension, the annual payment would be $381,000 (and therefore $190,500 for joan)—a decrease of $44,000 (or 10.4%) per.