Kaiser Pension Plan Calculator

Kaiser Pension Plan Calculator - We’ve prepared this calculator to help you estimate the difference between nuhw’s proposal vs kaiser’s. It provides employees with a platform to save for their future after retirement. Web kaiser permanente southern california employees pension plan supplement to the kaiser permanente retirement plan. To log in, you need your kaiser permanente member id and a password. Web with this calculator, you can enter your income, age, and family size to estimate your eligibility for subsidies and how much you could spend on health insurance.

At the retirement group, we can help you understand how your kaiser permanente retirement scheme fits into your overall financial picture, and how to make that plan work for you. Periodic reviews14,000 financial advisorsgoal prioritizationcustomized advice Web kaiser foundation health plan (kfhp) kfhp coverage for retirees is comprehensive and includes basic and major medical care, durable medical equipment and emergency care. Rounded service to next full year. So after 30 years, the pension would be 50% of salary per year. Visit kp cares for volunteer opportunities. Comparing apples to apples, would mean the private practice equivalent would be a $448k salary + $56k contributed annually to 401k for a total of $504k.

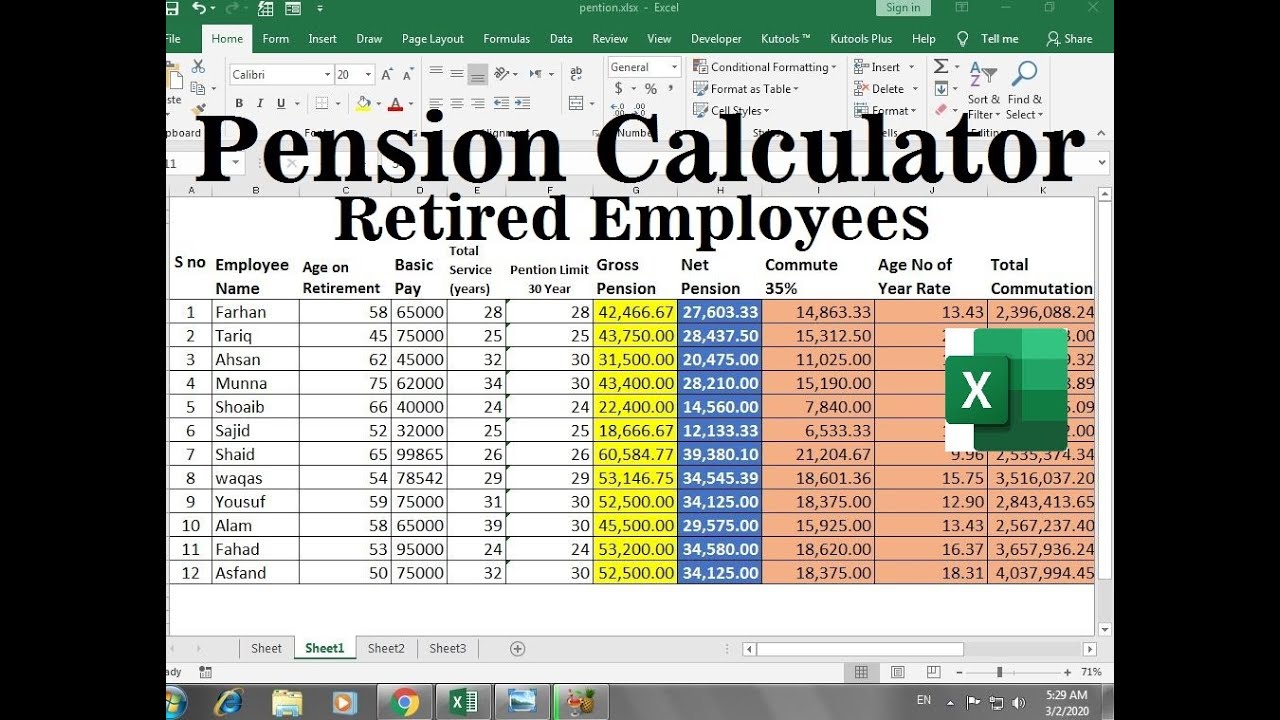

Pension and commutation Calculator in Excel For Retired Employees YouTube

The program is offered in multiple variations, such as a defined benefit plan, a defined contribution plan, or a combination of both. Enter years of actual kpers service credit at retirement. Connect with other retirees while creating positive change. Your cost per visit or prescription is shown below. Kaiser permanente makes all contributions to this.

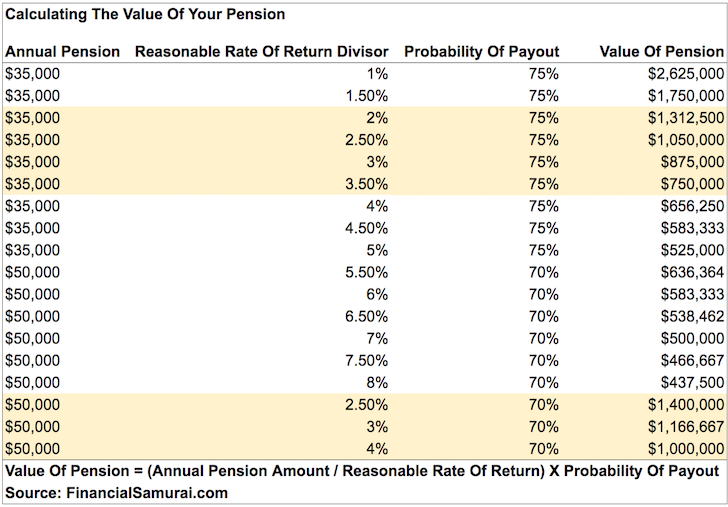

How Do I Calculate The Value Of My Pension? Financial Samurai

Web kaiser 401 (k) vs. Retirement benefits are one of the unresolved issues in our contract negotiations with kaiser. This could take up to 4 weeks. Take advantage of the programs, tools, and classes kaiser permanente offers. Chiropractic and acupuncture evidence of coverage. Comparing apples to apples, would mean the private practice equivalent would be.

Basic Pension Calculator Find Out Your Retirement

To be eligible for kfhp in retirement, you must reside within the kfhp california service area, and: Web the kaiser pension plan is a retirement savings program offered by kaiser permanente. To log in, you need your kaiser permanente member id and a password. Inside, the benefit calculator uses your account data to create a.

EXCEL of Retirement Calculator for HR.xlsx WPS Free Templates

Retiree benefits you may be eligible for retiree health benefits when you. So after 30 years, the pension would be 50% of salary per year. The program is offered in multiple variations, such as a defined benefit plan, a defined contribution plan, or a combination of both. To view or download plan details click the.

A Deep Dive Into Kaiser Permanente's Pension Plan TechStaffer

Service prior to january 1, 2014, and most purchased service is included in this category. Nephew, fred, who starts him at $40,000 a year but gives a 3 percent annual raise each year. Enter years of actual kpers service credit at retirement. Web what pension plan benefit do kaiser permanente employees get? Take advantage of.

Kaiser Pension Plan Calculator Online CalculatorsHub

Visit kp cares for volunteer opportunities. Web if i made $250k for 4 years, then $350k for 3 years followed by $200k the next 3 years, the 45% would be calculated off of the $350k for 3 years… it’s a bit convoluted but there is a very intelligent reason for this (benefiting the medical group).

A Deep Dive Into Kaiser Permanente’s Pension Plan TechStaffer

1 business day turnaround unlimited revisions until the qdro is accepted by the plan administrator and the court step by step instructions for how to file the qdro with the plan and the court cover letters for: Your cost per visit or prescription is shown below. Login to your kpers account. Newyorklife.com has been visited.

A Deep Dive Into Kaiser Permanente’s Pension Plan TechStaffer

Retiree benefits you may be eligible for retiree health benefits when you. Service high plan mid plan basic plan office visits $10 $20 $30 preventive care $10 $20 $30 Web calculate how much retirement income you need from your savings, 401(k), social security benefits and more for financial security. Web kaiser 401 (k) vs. Web.

KAISER PLANS & PRICES

Login to your kpers account. Web calpers plans for retirees (medicare). Nephew, fred, who starts him at $40,000 a year but gives a 3 percent annual raise each year. Web kaiser's plan earns 2% of salary x 20 years, then 1% thereafter. Web kaiser permanente retirement plan this defined benefit pension plan provides retirement income.

A Deep Dive Into Kaiser Permanente's Pension Plan TechStaffer

Web in summary, the kaiser pension plan calculator is a vital tool for anyone associated with kaiser permanente. Rounded service to next full year. It provides employees with a platform to save for their future after retirement. It simplifies the complex task of pension calculation, offering clarity and aiding. Web increasing your investment balance and.

Kaiser Pension Plan Calculator Kaiser permanente pension plan, reported anonymously by kaiser permanente employees. All plans come with vision care and an allowance for frames or lenses. Comparing apples to apples, would mean the private practice equivalent would be a $448k salary + $56k contributed annually to 401k for a total of $504k. Web what pension plan benefit do kaiser permanente employees get? Annuity & life insuranceretirement products.annuity & life insurance.learn more today.

Visit Kp Cares For Volunteer Opportunities.

Your cost per visit or prescription is shown below. Web increasing your investment balance and reducing taxes is the key to a successful retirement plan spending strategy. Web free calculator to help optimize pension payout or planning. To log in, you need your kaiser permanente member id and a password.

Reach Age 55 With 15 Or More Years Of Common Plan Qualifying Service, Or

You are vested in the plan after. Web if i made $250k for 4 years, then $350k for 3 years followed by $200k the next 3 years, the 45% would be calculated off of the $350k for 3 years… it’s a bit convoluted but there is a very intelligent reason for this (benefiting the medical group) which i won’t get into. Kaiser permanente makes all contributions to this plan. Comparing apples to apples, would mean the private practice equivalent would be a $448k salary + $56k contributed annually to 401k for a total of $504k.

Web Myplansconnect Is A Secure Online Portal That Allows You To Manage Your Health Plan Benefits, View Your Claims History, And Access Wellness Resources.

It simplifies the complex task of pension calculation, offering clarity and aiding. Periodic reviews14,000 financial advisorsgoal prioritizationcustomized advice Web calpers plans for retirees (medicare). Newyorklife.com has been visited by 100k+ users in the past month

Service High Plan Mid Plan Basic Plan Office Visits $10 $20 $30 Preventive Care $10 $20 $30

Enter years of actual kpers service credit at retirement. Annuity & life insuranceretirement products.annuity & life insurance.learn more today. You are vested in the plan after 5 years of service. Also, fred’s 401(k) plan matches 50 percent of tim’s contribution, to a maximum.