Kansas Pay Calculator

Kansas Pay Calculator - Web after underfunding pay raises approved last year for state employees, kansas lawmakers are set to spend another $11.2 million. Web use kansas paycheck calculator to estimate net or “take home” pay for salaried employees. Kansas employers can use the calculator at the top of this page to quickly calculate their employees’ gross. Free tool to calculate your hourly and salary income. 7, 2024, at the statehouse.

Just enter the wages, tax withholdings and other. The following features are available within this kansas tax calculator for 2024: Web home » paycheck calculator kansas. We’ll do the math for you—all you. Web kansas paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web use adp’s kansas paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web more helpful payroll calculators for kansas employers.

Kansas Paycheck Calculator Paycheck Calculator Kansas City

Web kansas hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. The results are broken up into three sections: Enter your info to see your take home pay. 7, 2024, at the statehouse. It will calculate.

When Will 2022 Tax Brackets Be Released 2022 JWG

Web kansas hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web use kansas paycheck calculator to estimate net or “take home” pay for salaried employees. The following features are available within this kansas tax calculator.

Gs Pay Scale 2021 Kansas City GS Pay Scale 2022/2023

Web more helpful payroll calculators for kansas employers. In kansas, also known as the sunflower state, the state income tax rate is determined by three different tax brackets. Web by entering your period or yearly income together with the relevant federal, state, and local w4 information, you can use our free kansas paycheck calculator to..

Kansas Paycheck Calculator 2023

Web use kansas paycheck calculator to estimate net or “take home” pay for salaried employees. Web by entering your period or yearly income together with the relevant federal, state, and local w4 information, you can use our free kansas paycheck calculator to. Web use adp’s kansas paycheck calculator to assess net or “take home” salary.

Mortgage Home Loan Payment Calculator FreeAmazon.caAppstore for Android

Web kansas hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. The following features are available within this kansas tax calculator for 2024: Web kansas state sens. Web to use our kansas salary tax calculator, all.

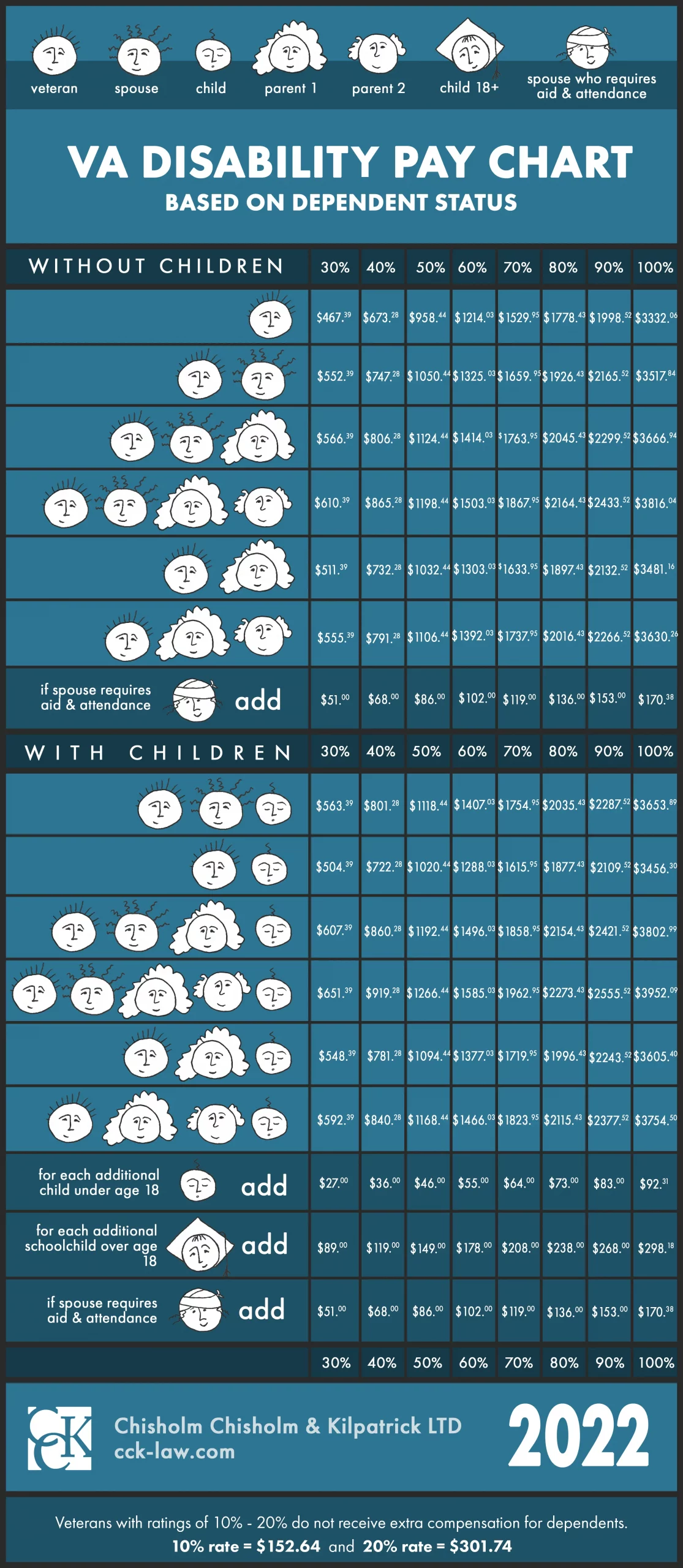

Va retirement calculator SadafLosana

Updated on dec 05 2023. The results are broken up into three sections: Web the state income tax rate in kansas is progressive and ranges from 3.1% to 5.7% while federal income tax rates range from 10% to 37% depending on your income. In kansas, also known as the sunflower state, the state income tax.

Kansas Tax Calculator 2023 2024

Web smartasset's kansas paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web kansas salary and tax calculator features. Web kansas paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web kansas hourly paycheck calculator take home pay.

Kansas Paycheck Calculator 2022 2023

The following features are available within this kansas tax calculator for 2024: Enter your info to see your take home pay. Web kansas paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web smartasset's kansas paycheck calculator shows your hourly and salary income.

Toll 49 and ETHG NETRMA

Web kansas salary and tax calculator features. Web kansas paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web use kansas paycheck calculator to estimate net or “take home” pay for salaried employees. Free tool to calculate your hourly and salary income. Web.

Tax withholding estimator 2022 ConaireRainn

These kansas state government jobs pay around or more than the median household income in sedgwick county. After a few seconds, you will be provided with a full. Just enter the wages, tax withholdings and other. Web kansas hourly paycheck calculator results. Web smartasset's kansas paycheck calculator shows your hourly and salary income after federal,.

Kansas Pay Calculator Web the irs has developed a calculator, called the tax withholding estimator, that accurately predicts how much federal taxes you will need to pay each year, based. Web after underfunding pay raises approved last year for state employees, kansas lawmakers are set to spend another $11.2 million. Enter your info to see your take home pay. We’ll do the math for you—all you. Payroll check calculator is updated for payroll year 2024 and new w4.

Web More Helpful Payroll Calculators For Kansas Employers.

Web after underfunding pay raises approved last year for state employees, kansas lawmakers are set to spend another $11.2 million. Web kansas salary and tax calculator features. The results are broken up into three sections: Web smartasset's kansas paycheck calculator shows your hourly and salary income after federal, state and local taxes.

Web The State Income Tax Rate In Kansas Is Progressive And Ranges From 3.1% To 5.7% While Federal Income Tax Rates Range From 10% To 37% Depending On Your Income.

We’ll do the math for you—all you. These kansas state government jobs pay around or more than the median household income in sedgwick county. Just enter the salaries and a few basic data. After a few seconds, you will be provided with a full.

The Following Features Are Available Within This Kansas Tax Calculator For 2024:

Enter your info to see your take home pay. Kansas employers can use the calculator at the top of this page to quickly calculate their employees’ gross. Web kansas hourly paycheck calculator results. Web the irs has developed a calculator, called the tax withholding estimator, that accurately predicts how much federal taxes you will need to pay each year, based.

Web Use Kansas Paycheck Calculator To Estimate Net Or “Take Home” Pay For Salaried Employees.

Web kansas hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web home » paycheck calculator kansas. Simply input salary details, benefits and deductions, and any other. Web use adp’s kansas paycheck calculator to assess net or “take home” salary for either hourly or salaried employees.